Table T10-0168

advertisement

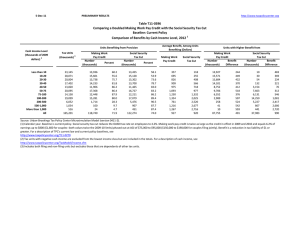

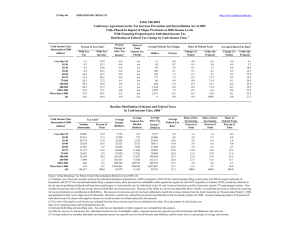

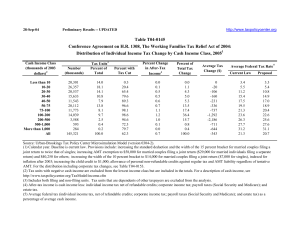

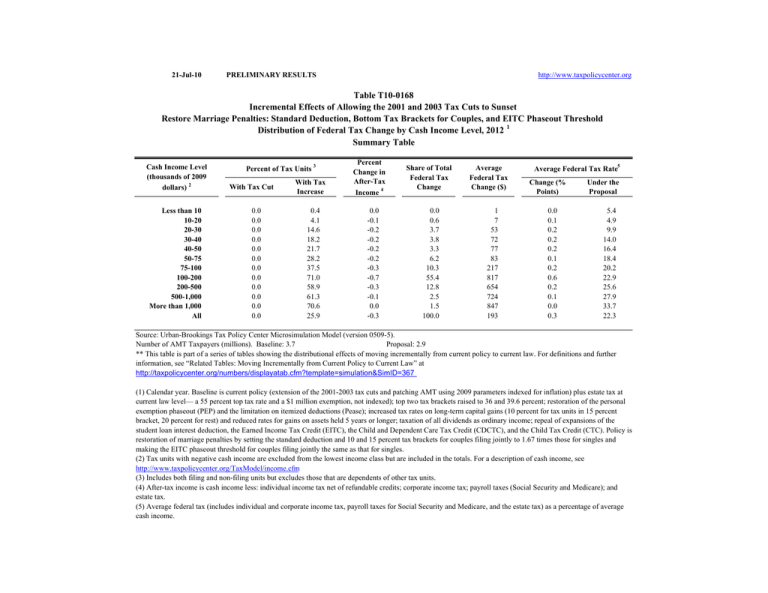

21-Jul-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0168 Incremental Effects of Allowing the 2001 and 2003 Tax Cuts to Sunset Restore Marriage Penalties: Standard Deduction, Bottom Tax Brackets for Couples, and EITC Phaseout Threshold Distribution of Federal Tax Change by Cash Income Level, 2012 1 Summary Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 With Tax Increase 0.4 4.1 14.6 18.2 21.7 28.2 37.5 71.0 58.9 61.3 70.6 25.9 Percent Change in After-Tax 4 Income 0.0 -0.1 -0.2 -0.2 -0.2 -0.2 -0.3 -0.7 -0.3 -0.1 0.0 -0.3 Share of Total Federal Tax Change 0.0 0.6 3.7 3.8 3.3 6.2 10.3 55.4 12.8 2.5 1.5 100.0 Average Federal Tax Change ($) 1 7 53 72 77 83 217 817 654 724 847 193 Average Federal Tax Rate5 Change (% Points) 0.0 0.1 0.2 0.2 0.2 0.1 0.2 0.6 0.2 0.1 0.0 0.3 Under the Proposal 5.4 4.9 9.9 14.0 16.4 18.4 20.2 22.9 25.6 27.9 33.7 22.3 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-5). Number of AMT Taxpayers (millions). Baseline: 3.7 Proposal: 2.9 ** This table is part of a series of tables showing the distributional effects of moving incrementally from current policy to current law. For definitions and further information, see “Related Tables: Moving Incrementally from Current Policy to Current Law” at http://taxpolicycenter.org/numbers/displayatab.cfm?template=simulation&SimID=367 (1) Calendar year. Baseline is current policy (extension of the 2001-2003 tax cuts and patching AMT using 2009 parameters indexed for inflation) plus estate tax at current law level— a 55 percent top tax rate and a $1 million exemption, not indexed); top two tax brackets raised to 36 and 39.6 percent; restoration of the personal exemption phaseout (PEP) and the limitation on itemized deductions (Pease); increased tax rates on long-term capital gains (10 percent for tax units in 15 percent bracket, 20 percent for rest) and reduced rates for gains on assets held 5 years or longer; taxation of all dividends as ordinary income; repeal of expansions of the student loan interest deduction, the Earned Income Tax Credit (EITC), the Child and Dependent Care Tax Credit (CDCTC), and the Child Tax Credit (CTC). Policy is restoration of marriage penalties by setting the standard deduction and 10 and 15 percent tax brackets for couples filing jointly to 1.67 times those for singles and making the EITC phaseout threshold for couples filing jointly the same as that for singles. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 21-Jul-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0168 Incremental Effects of Allowing the 2001 and 2003 Tax Cuts to Sunset Restore Marriage Penalties: Standard Deduction, Bottom Tax Brackets for Couples, and EITC Phaseout Threshold Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Increase With Tax Cut 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.4 4.1 14.6 18.2 21.7 28.2 37.5 71.0 58.9 61.3 70.6 25.9 Percent Change in After-Tax Income 4 Share of Total Federal Tax Change 0.0 -0.1 -0.2 -0.2 -0.2 -0.2 -0.3 -0.7 -0.3 -0.1 0.0 -0.3 0.0 0.6 3.7 3.8 3.3 6.2 10.3 55.4 12.8 2.5 1.5 100.0 Average Federal Tax Change Dollars 1 7 53 72 77 83 217 817 654 724 847 193 Percent 0.2 1.0 2.1 1.4 1.0 0.7 1.2 2.6 0.9 0.4 0.1 1.2 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.4 -0.1 -0.1 -0.2 0.0 Under the Proposal 0.2 0.7 2.0 3.1 3.7 10.0 9.8 24.9 16.8 7.7 20.9 100.0 5 Average Federal Tax Rate Change (% Points) 0.0 0.1 0.2 0.2 0.2 0.1 0.2 0.6 0.2 0.1 0.0 0.3 Under the Proposal 5.4 4.9 9.9 14.0 16.4 18.4 20.2 22.9 25.6 27.9 33.7 22.3 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units Number (thousands) 16,958 24,305 21,133 16,074 12,909 22,702 14,431 20,606 5,930 1,048 531 157,348 3 Percent of Total 10.8 15.5 13.4 10.2 8.2 14.4 9.2 13.1 3.8 0.7 0.3 100.0 Average Income (Dollars) 5,723 15,533 25,808 36,190 46,615 64,099 90,195 141,257 296,062 704,969 3,114,004 76,169 Average Federal Tax Burden (Dollars) 308 755 2,512 4,990 7,578 11,700 17,988 31,494 74,989 196,006 1,048,648 16,773 Average AfterTax Income 4 (Dollars) 5,415 14,778 23,295 31,200 39,038 52,400 72,207 109,762 221,073 508,963 2,065,356 59,395 Average Federal Tax Rate 5 5.4 4.9 9.7 13.8 16.3 18.3 19.9 22.3 25.3 27.8 33.7 22.0 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.8 3.2 4.6 4.9 5.0 12.1 10.9 24.3 14.7 6.2 13.8 100.0 1.0 3.8 5.3 5.4 5.4 12.7 11.2 24.2 14.0 5.7 11.7 100.0 0.2 0.7 2.0 3.0 3.7 10.1 9.8 24.6 16.9 7.8 21.1 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-5). Number of AMT Taxpayers (millions). Baseline: 3.7 Proposal: 2.9 (1) Calendar year. Baseline is current policy (extension of the 2001-2003 tax cuts and patching AMT using 2009 parameters indexed for inflation) plus estate tax at current law level— a 55 percent top tax rate and a $1 million exemption, not indexed); top two tax brackets raised to 36 and 39.6 percent; restoration of the personal exemption phaseout (PEP) and the limitation on itemized deductions (Pease); increased tax rates on long-term capital gains (10 percent for tax units in 15 percent bracket, 20 percent for rest) and reduced rates for gains on assets held 5 years or longer; taxation of all dividends as ordinary income; repeal of expansions of the student loan interest deduction, the Earned Income Tax Credit (EITC), the Child and Dependent Care Tax Credit (CDCTC), and the Child Tax Credit (CTC). Policy is restoration of marriage penalties by setting the standard deduction and 10 and 15 percent tax brackets for couples filing jointly to 1.67 times those for singles and making the EITC phaseout threshold for couples filing jointly the same as that for singles. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 21-Jul-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0168 Incremental Effects of Allowing the 2001 and 2003 Tax Cuts to Sunset Restore Marriage Penalties: Standard Deduction, Bottom Tax Brackets for Couples, and EITC Phaseout Threshold Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Single Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After-Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Share of Total Federal Tax Change 1.2 -3.0 -5.3 6.5 0.3 -5.0 8.8 15.0 0.0 -1.3 2.5 100.0 Average Federal Tax Change Dollars 0 0 0 0 0 0 0 0 0 0 0 0 Percent 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Under the Proposal 0.9 2.9 5.8 7.2 8.3 18.4 11.8 17.9 9.9 4.5 12.2 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Under the Proposal 8.5 8.5 13.5 17.6 19.8 22.1 24.4 25.6 27.9 31.2 36.6 22.0 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 12,161 14,889 11,204 7,555 6,018 8,766 3,599 3,384 787 138 75 68,932 17.6 21.6 16.3 11.0 8.7 12.7 5.2 4.9 1.1 0.2 0.1 100.0 Average Income (Dollars) 5,710 15,384 25,667 36,120 46,555 63,234 89,193 137,406 300,163 697,814 2,972,435 43,878 Average Federal Tax Burden (Dollars) 484 1,301 3,460 6,356 9,204 13,948 21,755 35,106 83,874 218,009 1,087,577 9,646 Average AfterTax Income 4 (Dollars) 5,227 14,083 22,208 29,764 37,351 49,286 67,439 102,300 216,289 479,804 1,884,858 34,232 Average Federal Tax Rate 5 8.5 8.5 13.5 17.6 19.8 22.1 24.4 25.6 27.9 31.2 36.6 22.0 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 2.3 7.6 9.5 9.0 9.3 18.3 10.6 15.4 7.8 3.2 7.3 100.0 2.7 8.9 10.5 9.5 9.5 18.3 10.3 14.7 7.2 2.8 6.0 100.0 0.9 2.9 5.8 7.2 8.3 18.4 11.8 17.9 9.9 4.5 12.2 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-5). (1) Calendar year. Baseline is current policy (extension of the 2001-2003 tax cuts and patching AMT using 2009 parameters indexed for inflation) plus estate tax at current law level— a 55 percent top tax rate and a $1 million exemption, not indexed); top two tax brackets raised to 36 and 39.6 percent; restoration of the personal exemption phaseout (PEP) and the limitation on itemized deductions (Pease); increased tax rates on long-term capital gains (10 percent for tax units in 15 percent bracket, 20 percent for rest) and reduced rates for gains on assets held 5 years or longer; taxation of all dividends as ordinary income; repeal of expansions of the student loan interest deduction, the Earned Income Tax Credit (EITC), the Child and Dependent Care Tax Credit (CDCTC), and the Child Tax Credit (CTC). Policy is restoration of marriage penalties by setting the standard deduction and 10 and 15 percent tax brackets for couples filing jointly to 1.67 times those for singles and making the EITC phaseout threshold for couples filing jointly the same as that for singles. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 21-Jul-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0168 Incremental Effects of Allowing the 2001 and 2003 Tax Cuts to Sunset Restore Marriage Penalties: Standard Deduction, Bottom Tax Brackets for Couples, and EITC Phaseout Threshold Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Married Tax Units Filing Jointly Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 2.6 19.0 57.9 60.9 62.5 60.7 56.3 89.8 70.1 72.5 84.3 63.6 Percent Change in After-Tax Income 4 -0.1 -0.2 -0.9 -0.8 -0.5 -0.3 -0.4 -0.9 -0.4 -0.2 -0.1 -0.5 Share of Total Federal Tax Change 0.0 0.5 3.6 3.8 3.1 5.5 10.0 56.5 13.0 2.5 1.5 100.0 Average Federal Tax Change Dollars 5 38 222 255 223 164 325 1,036 782 860 1,022 484 Percent 2.0 7.4 14.9 8.0 4.2 1.7 2.0 3.4 1.1 0.5 0.1 1.7 Share of Federal Taxes Change (% Points) 0.0 0.0 0.1 0.1 0.0 0.0 0.0 0.5 -0.1 -0.1 -0.4 0.0 Under the Proposal 0.0 0.1 0.5 0.8 1.3 5.4 8.5 28.6 20.4 9.4 24.7 100.0 Average Federal Tax Rate5 Change (% Points) 0.1 0.2 0.9 0.7 0.5 0.3 0.4 0.7 0.3 0.1 0.0 0.4 Under the Proposal 5.3 3.4 6.6 9.5 11.8 15.1 18.4 22.3 25.2 27.4 33.2 23.2 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,172 4,097 4,842 4,391 4,095 9,883 9,149 16,193 4,941 876 435 61,357 3.5 6.7 7.9 7.2 6.7 16.1 14.9 26.4 8.1 1.4 0.7 100.0 Average Income (Dollars) 4,766 16,031 25,959 36,302 46,760 65,241 90,792 142,545 295,420 706,519 3,075,014 126,020 Average Federal Tax Burden (Dollars) 246 509 1,493 3,189 5,313 9,701 16,338 30,750 73,538 192,717 1,019,650 28,804 Average AfterTax Income 4 (Dollars) 4,521 15,522 24,466 33,113 41,447 55,540 74,454 111,795 221,882 513,802 2,055,364 97,216 Average Federal Tax Rate 5 5.2 3.2 5.8 8.8 11.4 14.9 18.0 21.6 24.9 27.3 33.2 22.9 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.1 0.9 1.6 2.1 2.5 8.3 10.7 29.9 18.9 8.0 17.3 100.0 0.2 1.1 2.0 2.4 2.9 9.2 11.4 30.4 18.4 7.5 15.0 100.0 0.0 0.1 0.4 0.8 1.2 5.4 8.5 28.2 20.6 9.6 25.1 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-5). (1) Calendar year. Baseline is current policy (extension of the 2001-2003 tax cuts and patching AMT using 2009 parameters indexed for inflation) plus estate tax at current law level— a 55 percent top tax rate and a $1 million exemption, not indexed); top two tax brackets raised to 36 and 39.6 percent; restoration of the personal exemption phaseout (PEP) and the limitation on itemized deductions (Pease); increased tax rates on long-term capital gains (10 percent for tax units in 15 percent bracket, 20 percent for rest) and reduced rates for gains on assets held 5 years or longer; taxation of all dividends as ordinary income; repeal of expansions of the student loan interest deduction, the Earned Income Tax Credit (EITC), the Child and Dependent Care Tax Credit (CDCTC), and the Child Tax Credit (CTC). Policy is restoration of marriage penalties by setting the standard deduction and 10 and 15 percent tax brackets for couples filing jointly to 1.67 times those for singles and making the EITC phaseout threshold for couples filing jointly the same as that for singles. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 21-Jul-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0168 Incremental Effects of Allowing the 2001 and 2003 Tax Cuts to Sunset Restore Marriage Penalties: Standard Deduction, Bottom Tax Brackets for Couples, and EITC Phaseout Threshold Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Head of Household Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Percent Change in After-Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Share of Total Federal Tax Change 0.2 -1.1 -1.1 4.2 2.1 -22.1 7.6 -7.2 -3.8 2.2 6.0 100.0 Average Federal Tax Change Dollars 0 0 0 0 0 0 0 0 0 0 0 0 Percent 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Under the Proposal -0.8 -2.4 3.7 10.2 11.4 26.5 16.8 17.6 7.1 2.8 7.2 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Under the Proposal -7.7 -4.8 4.5 11.5 15.3 18.2 20.8 23.1 24.7 26.2 34.1 15.0 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,483 5,029 4,757 3,767 2,449 3,559 1,389 877 150 24 11 24,547 10.1 20.5 19.4 15.4 10.0 14.5 5.7 3.6 0.6 0.1 0.0 100.0 Average Income (Dollars) 6,647 15,579 25,971 36,157 46,569 63,082 89,214 132,993 294,130 686,382 2,985,055 41,760 Average Federal Tax Burden (Dollars) -514 -745 1,180 4,158 7,126 11,448 18,575 30,738 72,680 180,096 1,016,347 6,255 Average AfterTax Income 4 (Dollars) 7,161 16,325 24,791 31,999 39,444 51,634 70,639 102,256 221,450 506,286 1,968,708 35,505 Average Federal Tax Rate 5 -7.7 -4.8 4.5 11.5 15.3 18.2 20.8 23.1 24.7 26.2 34.1 15.0 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 1.6 7.6 12.1 13.3 11.1 21.9 12.1 11.4 4.3 1.6 3.2 100.0 2.0 9.4 13.5 13.8 11.1 21.1 11.3 10.3 3.8 1.4 2.5 100.0 -0.8 -2.4 3.7 10.2 11.4 26.5 16.8 17.6 7.1 2.8 7.2 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-5). (1) Calendar year. Baseline is current policy (extension of the 2001-2003 tax cuts and patching AMT using 2009 parameters indexed for inflation) plus estate tax at current law level— a 55 percent top tax rate and a $1 million exemption, not indexed); top two tax brackets raised to 36 and 39.6 percent; restoration of the personal exemption phaseout (PEP) and the limitation on itemized deductions (Pease); increased tax rates on long-term capital gains (10 percent for tax units in 15 percent bracket, 20 percent for rest) and reduced rates for gains on assets held 5 years or longer; taxation of all dividends as ordinary income; repeal of expansions of the student loan interest deduction, the Earned Income Tax Credit (EITC), the Child and Dependent Care Tax Credit (CDCTC), and the Child Tax Credit (CTC). Policy is restoration of marriage penalties by setting the standard deduction and 10 and 15 percent tax brackets for couples filing jointly to 1.67 times those for singles and making the EITC phaseout threshold for couples filing jointly the same as that for singles. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 21-Jul-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0168 Incremental Effects of Allowing the 2001 and 2003 Tax Cuts to Sunset Restore Marriage Penalties: Standard Deduction, Bottom Tax Brackets for Couples, and EITC Phaseout Threshold Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Tax Units with Children Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Increase With Tax Cut 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.4 5.7 24.0 30.0 36.6 35.0 36.4 79.7 58.5 72.8 84.7 38.3 Percent Change in After-Tax Income 4 0.0 -0.1 -0.6 -0.6 -0.4 -0.2 -0.2 -0.8 -0.3 -0.2 -0.1 -0.4 Share of Total Federal Tax Change 0.0 0.6 5.5 6.0 4.4 5.2 6.9 55.9 11.5 2.6 1.4 100.0 Average Federal Tax Change Dollars 2 15 142 179 167 103 174 881 614 850 1,015 299 Percent -0.3 -1.2 23.8 4.9 2.5 0.9 1.0 2.8 0.8 0.4 0.1 1.4 Share of Federal Taxes Change (% Points) 0.0 0.0 0.1 0.1 0.0 0.0 0.0 0.4 -0.1 -0.1 -0.3 0.0 Under the Proposal -0.2 -0.7 0.4 1.8 2.5 7.9 9.9 28.6 19.9 8.7 21.2 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.1 0.6 0.5 0.4 0.2 0.2 0.6 0.2 0.1 0.0 0.3 Under the Proposal -11.3 -8.2 2.9 10.7 14.6 17.2 19.4 22.5 25.6 29.1 34.6 22.2 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,968 5,639 5,683 4,891 3,849 7,425 5,841 9,319 2,750 441 206 49,155 6.0 11.5 11.6 10.0 7.8 15.1 11.9 19.0 5.6 0.9 0.4 100.0 Average Income (Dollars) 6,252 15,769 25,918 36,161 46,701 64,368 90,740 142,137 293,742 705,334 3,105,769 95,419 Average Federal Tax Burden (Dollars) -708 -1,306 598 3,673 6,654 10,976 17,438 31,121 74,668 204,144 1,072,221 20,923 Average AfterTax Income 4 (Dollars) 6,961 17,075 25,320 32,488 40,046 53,392 73,302 111,016 219,074 501,190 2,033,547 74,496 Average Federal Tax Rate 5 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -11.3 -8.3 2.3 10.2 14.3 17.1 19.2 21.9 25.4 28.9 34.5 21.9 0.4 1.9 3.1 3.8 3.8 10.2 11.3 28.2 17.2 6.6 13.7 100.0 0.6 2.6 3.9 4.3 4.2 10.8 11.7 28.3 16.5 6.0 11.4 100.0 -0.2 -0.7 0.3 1.8 2.5 7.9 9.9 28.2 20.0 8.8 21.5 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-5). Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current policy (extension of the 2001-2003 tax cuts and patching AMT using 2009 parameters indexed for inflation) plus estate tax at current law level— a 55 percent top tax rate and a $1 million exemption, not indexed); top two tax brackets raised to 36 and 39.6 percent; restoration of the personal exemption phaseout (PEP) and the limitation on itemized deductions (Pease); increased tax rates on long-term capital gains (10 percent for tax units in 15 percent bracket, 20 percent for rest) and reduced rates for gains on assets held 5 years or longer; taxation of all dividends as ordinary income; repeal of expansions of the student loan interest deduction, the Earned Income Tax Credit (EITC), the Child and Dependent Care Tax Credit (CDCTC), and the Child Tax Credit (CTC). Policy is restoration of marriage penalties by setting the standard deduction and 10 and 15 percent tax brackets for couples filing jointly to 1.67 times those for singles and making the EITC phaseout threshold for couples filing jointly the same as that for singles. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 21-Jul-10 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0168 Incremental Effects of Allowing the 2001 and 2003 Tax Cuts to Sunset Restore Marriage Penalties: Standard Deduction, Bottom Tax Brackets for Couples, and EITC Phaseout Threshold Distribution of Federal Tax Change by Cash Income Level, 2012 1 Detail Table - Elderly Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Increase With Tax Cut 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.2 1.4 13.5 18.0 18.9 38.9 47.7 65.6 61.2 47.2 58.3 24.5 Percent Change in After-Tax Income 4 Share of Total Federal Tax Change 0.0 0.0 -0.1 -0.1 -0.1 -0.2 -0.3 -0.7 -0.3 -0.1 0.0 -0.3 0.0 0.2 2.8 2.3 1.9 9.1 12.9 49.0 17.0 2.9 1.9 100.0 Average Federal Tax Change Dollars 0 2 27 37 42 101 252 806 742 574 705 161 Percent 0.1 0.4 2.3 1.7 1.2 1.5 2.0 2.9 1.0 0.3 0.1 1.1 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.3 0.0 -0.1 -0.3 0.0 Under the Proposal 0.1 0.6 1.4 1.5 1.8 7.0 7.3 18.9 19.2 10.7 31.4 100.0 Average Federal Tax Rate5 Change (% Points) 0.0 0.0 0.1 0.1 0.1 0.2 0.3 0.6 0.2 0.1 0.0 0.2 Under the Proposal 3.2 2.6 4.7 6.2 7.7 11.0 14.6 19.9 25.0 27.4 34.2 19.3 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2012 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,305 6,471 5,084 2,999 2,259 4,405 2,504 2,986 1,128 245 132 30,543 7.6 21.2 16.7 9.8 7.4 14.4 8.2 9.8 3.7 0.8 0.4 100.0 Average Income (Dollars) 6,366 15,655 25,560 36,054 46,537 64,489 89,136 141,589 304,121 709,954 3,095,895 75,737 Average Federal Tax Burden (Dollars) 200 405 1,171 2,192 3,556 6,997 12,778 27,383 75,149 194,182 1,058,280 14,429 Average AfterTax Income 4 (Dollars) 6,166 15,249 24,389 33,863 42,981 57,492 76,357 114,207 228,972 515,772 2,037,615 61,309 Average Federal Tax Rate 5 3.2 2.6 4.6 6.1 7.6 10.9 14.3 19.3 24.7 27.4 34.2 19.1 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.6 4.4 5.6 4.7 4.5 12.3 9.7 18.3 14.8 7.5 17.7 100.0 0.8 5.3 6.6 5.4 5.2 13.5 10.2 18.2 13.8 6.8 14.4 100.0 0.1 0.6 1.4 1.5 1.8 7.0 7.3 18.6 19.2 10.8 31.7 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-5). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current policy (extension of the 2001-2003 tax cuts and patching AMT using 2009 parameters indexed for inflation) plus estate tax at current law level— a 55 percent top tax rate and a $1 million exemption, not indexed); top two tax brackets raised to 36 and 39.6 percent; restoration of the personal exemption phaseout (PEP) and the limitation on itemized deductions (Pease); increased tax rates on long-term capital gains (10 percent for tax units in 15 percent bracket, 20 percent for rest) and reduced rates for gains on assets held 5 years or longer; taxation of all dividends as ordinary income; repeal of expansions of the student loan interest deduction, the Earned Income Tax Credit (EITC), the Child and Dependent Care Tax Credit (CDCTC), and the Child Tax Credit (CTC). Policy is restoration of marriage penalties by setting the standard deduction and 10 and 15 percent tax brackets for couples filing jointly to 1.67 times those for singles and making the EITC phaseout threshold for couples filing jointly the same as that for singles. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income.