1-Mar-10 REVISED PRELIMINARY RESULTS

advertisement

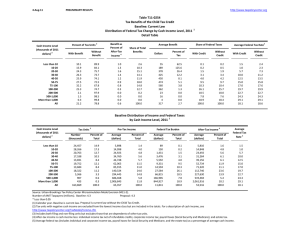

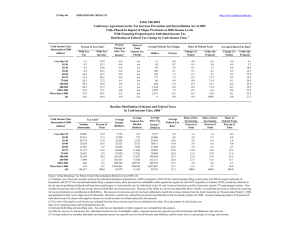

1-Mar-10 REVISED PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T10-0084 Proposal to Broaden the Medicare Hospital Insurance Tax Base Distribution of Federal Tax Change by Cash Income Level, 2013 1 Summary Table Cash Income Level (thousands of 2009 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Cut 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 3 With Tax Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.3 44.2 85.7 92.5 2.7 Percent Change in After-Tax 4 Income 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 -0.2 -0.8 -1.7 -0.3 Share of Total Federal Tax Change Average Federal Tax Change ($) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.1 10.1 16.3 73.5 100.0 0 0 0 0 0 0 0 1 467 4,235 36,310 180 Average Federal Tax Rate Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.2 0.6 1.2 0.2 5 Under the Proposal 5.7 5.2 10.5 14.6 17.3 19.5 21.5 24.6 27.6 29.1 34.4 23.7 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Number of AMT Taxpayers (millions). Baseline: 21.0 Proposal: 21.0 (1) Calendar year. Baseline is current law. Proposal would impose an additional 0.9% tax on earnings for single filers in excess of $200,000 ($250,000 for married couples filing a joint return) as defined for purposes of the Hospital Insurance Tax. An additional tax of 2.9% would be imposed on investment income. Investment income would include taxable interest, dividends, net positive capital gains, net positive income from rents, net positive income from royalties, and net positive passive income from partnerships and S corporations. The unearned income surtax would not exceed 2.9% of a single filer's adjusted gross income in excess of $200,000 ($250,000 for married couples filing a joint return). The thresholds would be indexed for inflation. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 1-Mar-10 REVISED PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0084 Proposal to Broaden the Medicare Hospital Insurance Tax Base Distribution of Federal Tax Change by Cash Income Level, 2013 1 Detail Table Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.3 44.2 85.7 92.5 2.7 Percent Change in After-Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 -0.2 -0.8 -1.7 -0.3 Share of Total Federal Tax Change 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.1 10.1 16.3 73.5 100.0 Average Federal Tax Change Dollars 0 0 0 0 0 0 0 1 467 4,235 36,310 180 Percent 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.6 2.1 3.5 1.0 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 -0.1 -0.1 -0.3 -0.1 0.1 0.5 0.0 Under the Proposal 0.2 0.7 2.0 2.9 3.6 9.7 9.6 25.5 17.1 7.7 21.0 100.0 Average Federal Tax Rate 5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.2 0.6 1.2 0.2 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2013 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 16,502 24,782 21,396 16,376 13,031 22,841 14,549 21,632 6,214 1,106 582 159,683 Percent of Total 10.3 15.5 13.4 10.3 8.2 14.3 9.1 13.6 3.9 0.7 0.4 100.0 Average Income (Dollars) 5,707 15,704 26,108 36,546 47,119 64,835 91,193 142,825 298,823 714,908 3,132,936 78,831 Average Federal Tax Burden (Dollars) 323 819 2,746 5,349 8,168 12,651 19,591 35,139 81,891 203,500 1,042,101 18,515 Average AfterTax Income 4 (Dollars) 5,384 14,886 23,361 31,196 38,951 52,184 71,602 107,686 216,932 511,408 2,090,835 60,316 Average Federal Tax Rate 5 5.7 5.2 10.5 14.6 17.3 19.5 21.5 24.6 27.4 28.5 33.3 23.5 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.8 3.1 4.4 4.8 4.9 11.8 10.5 24.5 14.8 6.3 14.5 100.0 0.9 3.8 5.2 5.3 5.3 12.4 10.8 24.2 14.0 5.9 12.6 100.0 0.2 0.7 2.0 3.0 3.6 9.8 9.6 25.7 17.2 7.6 20.5 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Number of AMT Taxpayers (millions). Baseline: 21.0 Proposal: 21.0 (1) Calendar year. Baseline is current law. Proposal would impose an additional 0.9% tax on earnings for single filers in excess of $200,000 ($250,000 for married couples filing a joint return) as defined for purposes of the Hospital Insurance Tax. An additional tax of 2.9% would be imposed on investment income. Investment income would include taxable interest, dividends, net positive capital gains, net positive income from rents, net positive income from royalties, and net positive passive income from partnerships and S corporations. The unearned income surtax would not exceed 2.9% of a single filer's adjusted gross income in excess of $200,000 ($250,000 for married couples filing a joint return). The thresholds would be indexed for inflation. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal 5.7 5.2 10.5 14.6 17.3 19.5 21.5 24.6 27.6 29.1 34.4 23.7 1-Mar-10 REVISED PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0084 Proposal to Broaden the Medicare Hospital Insurance Tax Base Distribution of Federal Tax Change by Cash Income Level, 2013 1 Detail Table - Single Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.1 64.7 83.2 89.4 1.0 Percent Change in After-Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 -0.4 -1.0 -1.9 -0.2 Share of Total Federal Tax Change 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 15.1 16.5 68.4 100.0 Average Federal Tax Change Dollars 0 0 0 0 0 0 0 0 818 5,057 36,758 63 Percent 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.9 2.3 3.4 0.6 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 -0.1 -0.1 -0.1 -0.1 0.0 0.1 0.3 0.0 Under the Proposal 0.8 2.9 5.7 7.0 8.0 18.2 11.6 18.9 9.9 4.4 12.4 100.0 Average Federal Tax Rate 5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.3 0.7 1.2 0.1 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2013 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 11,828 15,407 11,555 7,794 6,086 9,075 3,687 3,717 813 144 82 70,516 16.8 21.9 16.4 11.1 8.6 12.9 5.2 5.3 1.2 0.2 0.1 100.0 Average Income (Dollars) 5,698 15,564 25,975 36,476 47,085 63,999 89,906 138,527 304,431 705,182 2,967,927 45,222 Average Federal Tax Burden (Dollars) 496 1,371 3,649 6,595 9,655 14,755 23,167 37,361 88,842 218,505 1,069,744 10,352 Average AfterTax Income 4 (Dollars) 5,203 14,193 22,326 29,881 37,429 49,244 66,739 101,165 215,589 486,677 1,898,183 34,870 Average Federal Tax Rate 5 8.7 8.8 14.1 18.1 20.5 23.1 25.8 27.0 29.2 31.0 36.0 22.9 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 2.1 7.5 9.4 8.9 9.0 18.2 10.4 16.2 7.8 3.2 7.7 100.0 2.5 8.9 10.5 9.5 9.3 18.2 10.0 15.3 7.1 2.9 6.4 100.0 0.8 2.9 5.8 7.0 8.1 18.3 11.7 19.0 9.9 4.3 12.1 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). (1) Calendar year. Baseline is current law. Proposal would impose an additional 0.9% tax on earnings for single filers in excess of $200,000 ($250,000 for married couples filing a joint return) as defined for purposes of the Hospital Insurance Tax. An additional tax of 2.9% would be imposed on investment income. Investment income would include taxable interest, dividends, net positive capital gains, net positive income from rents, net positive income from royalties, and net positive passive income from partnerships and S corporations. The unearned income surtax would not exceed 2.9% of a single filer's adjusted gross income in excess of $200,000 ($250,000 for married couples filing a joint return). The thresholds would be indexed for inflation. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal 8.7 8.8 14.1 18.1 20.5 23.1 25.8 27.0 29.5 31.7 37.3 23.0 1-Mar-10 REVISED PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0084 Proposal to Broaden the Medicare Hospital Insurance Tax Base Distribution of Federal Tax Change by Cash Income Level, 2013 1 Detail Table - Married Tax Units Filing Jointly Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 39.5 86.0 92.8 5.4 Percent Change in After-Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 -0.2 -0.8 -1.7 -0.4 Share of Total Federal Tax Change 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 9.0 16.7 74.2 100.0 Average Federal Tax Change Dollars 0 0 0 0 0 0 0 0 392 4,081 35,172 367 Percent 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.5 2.0 3.5 1.1 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 -0.1 -0.1 -0.3 -0.1 0.1 0.6 0.0 Under the Proposal 0.0 0.1 0.4 0.8 1.2 5.0 8.1 29.0 21.0 9.5 24.9 100.0 Average Federal Tax Rate 5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.6 1.1 0.3 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2013 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,146 3,927 4,789 4,393 4,045 9,552 9,065 16,793 5,188 925 476 61,567 3.5 6.4 7.8 7.1 6.6 15.5 14.7 27.3 8.4 1.5 0.8 100.0 Average Income (Dollars) 4,820 16,283 26,261 36,653 47,276 65,950 91,849 144,302 298,013 717,165 3,098,035 131,596 Average Federal Tax Burden (Dollars) 271 551 1,850 3,667 6,016 10,504 17,861 34,686 80,901 201,629 1,015,333 32,310 Average AfterTax Income 4 (Dollars) 4,549 15,732 24,411 32,986 41,260 55,446 73,987 109,617 217,112 515,536 2,082,702 99,285 Average Federal Tax Rate 5 5.6 3.4 7.1 10.0 12.7 15.9 19.5 24.0 27.2 28.1 32.8 24.6 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.1 0.8 1.6 2.0 2.4 7.8 10.3 29.9 19.1 8.2 18.2 100.0 0.2 1.0 1.9 2.4 2.7 8.7 11.0 30.1 18.4 7.8 16.2 100.0 0.0 0.1 0.5 0.8 1.2 5.0 8.1 29.3 21.1 9.4 24.3 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). (1) Calendar year. Baseline is current law. Proposal would impose an additional 0.9% tax on earnings for single filers in excess of $200,000 ($250,000 for married couples filing a joint return) as defined for purposes of the Hospital Insurance Tax. An additional tax of 2.9% would be imposed on investment income. Investment income would include taxable interest, dividends, net positive capital gains, net positive income from rents, net positive income from royalties, and net positive passive income from partnerships and S corporations. The unearned income surtax would not exceed 2.9% of a single filer's adjusted gross income in excess of $200,000 ($250,000 for married couples filing a joint return). The thresholds would be indexed for inflation. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal 5.6 3.4 7.1 10.0 12.7 15.9 19.5 24.0 27.3 28.7 33.9 24.8 1-Mar-10 REVISED PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0084 Proposal to Broaden the Medicare Hospital Insurance Tax Base Distribution of Federal Tax Change by Cash Income Level, 2013 1 Detail Table - Head of Household Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 79.2 83.2 95.8 0.6 Percent Change in After-Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 -0.3 -0.8 -1.7 -0.1 Share of Total Federal Tax Change 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 17.7 17.4 64.9 100.0 Average Federal Tax Change Dollars 0 0 0 0 0 0 0 0 697 4,107 34,155 25 Percent 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.9 2.3 3.4 0.4 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 -0.1 -0.1 -0.1 0.0 0.1 0.2 0.0 Under the Proposal -0.7 -2.1 3.5 9.8 11.1 26.2 17.2 18.3 7.0 2.8 7.0 100.0 Average Federal Tax Rate 5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.2 0.6 1.2 0.1 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2013 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,384 5,169 4,739 3,847 2,550 3,705 1,493 962 161 27 12 25,098 9.5 20.6 18.9 15.3 10.2 14.8 6.0 3.8 0.6 0.1 0.1 100.0 Average Income (Dollars) 6,553 15,681 26,253 36,526 46,982 63,981 90,488 134,401 295,681 691,245 2,963,152 43,145 Average Federal Tax Burden (Dollars) -508 -722 1,302 4,543 7,728 12,614 20,535 33,897 76,748 182,247 997,637 7,081 Average AfterTax Income 4 (Dollars) 7,061 16,402 24,951 31,983 39,253 51,368 69,953 100,504 218,933 508,999 1,965,515 36,064 Average Federal Tax Rate 5 -7.8 -4.6 5.0 12.4 16.5 19.7 22.7 25.2 26.0 26.4 33.7 16.4 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 1.4 7.5 11.5 13.0 11.1 21.9 12.5 11.9 4.4 1.7 3.3 100.0 1.9 9.4 13.1 13.6 11.1 21.0 11.5 10.7 3.9 1.5 2.6 100.0 -0.7 -2.1 3.5 9.8 11.1 26.3 17.3 18.4 6.9 2.7 6.8 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). (1) Calendar year. Baseline is current law. Proposal would impose an additional 0.9% tax on earnings for single filers in excess of $200,000 ($250,000 for married couples filing a joint return) as defined for purposes of the Hospital Insurance Tax. An additional tax of 2.9% would be imposed on investment income. Investment income would include taxable interest, dividends, net positive capital gains, net positive income from rents, net positive income from royalties, and net positive passive income from partnerships and S corporations. The unearned income surtax would not exceed 2.9% of a single filer's adjusted gross income in excess of $200,000 ($250,000 for married couples filing a joint return). The thresholds would be indexed for inflation. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal -7.8 -4.6 5.0 12.4 16.5 19.7 22.7 25.2 26.2 27.0 34.8 16.5 1-Mar-10 REVISED PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0084 Proposal to Broaden the Medicare Hospital Insurance Tax Base Distribution of Federal Tax Change by Cash Income Level, 2013 1 Detail Table - Tax Units with Children Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.2 44.4 93.6 97.9 4.0 Percent Change in After-Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 -0.2 -0.8 -1.7 -0.3 Share of Total Federal Tax Change 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 10.8 17.3 71.8 100.0 Average Federal Tax Change Dollars 0 0 0 0 0 0 0 0 405 3,932 34,611 219 Percent 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.5 1.9 3.2 0.9 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 -0.1 -0.1 -0.3 -0.1 0.1 0.5 0.0 Under the Proposal -0.2 -0.6 0.4 1.8 2.5 7.6 9.4 28.7 20.4 8.8 21.1 100.0 Average Federal Tax Rate 5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.1 0.6 1.1 0.2 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2013 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,857 5,609 5,655 4,911 3,915 7,394 5,702 9,573 2,895 477 224 49,348 5.8 11.4 11.5 10.0 7.9 15.0 11.6 19.4 5.9 1.0 0.5 100.0 Average Income (Dollars) 6,247 15,929 26,192 36,543 47,207 65,203 91,892 143,664 297,024 715,114 3,119,255 99,072 Average Federal Tax Burden (Dollars) -693 -1,298 844 4,177 7,404 12,113 19,395 35,273 82,458 213,067 1,069,109 23,595 Average AfterTax Income 4 (Dollars) 6,941 17,227 25,347 32,366 39,803 53,090 72,497 108,391 214,566 502,047 2,050,145 75,477 Average Federal Tax Rate 5 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -11.1 -8.2 3.2 11.4 15.7 18.6 21.1 24.6 27.8 29.8 34.3 23.8 0.4 1.8 3.0 3.7 3.8 9.9 10.7 28.1 17.6 7.0 14.3 100.0 0.5 2.6 3.9 4.3 4.2 10.5 11.1 27.9 16.7 6.4 12.4 100.0 -0.2 -0.6 0.4 1.8 2.5 7.7 9.5 29.0 20.5 8.7 20.6 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law. Proposal would impose an additional 0.9% tax on earnings for single filers in excess of $200,000 ($250,000 for married couples filing a joint return) as defined for purposes of the Hospital Insurance Tax. An additional tax of 2.9% would be imposed on investment income. Investment income would include taxable interest, dividends, net positive capital gains, net positive income from rents, net positive income from royalties, and net positive passive income from partnerships and S corporations. The unearned income surtax would not exceed 2.9% of a single filer's adjusted gross income in excess of $200,000 ($250,000 for married couples filing a joint return). The thresholds would be indexed for inflation. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal -11.1 -8.2 3.2 11.4 15.7 18.6 21.1 24.6 27.9 30.3 35.4 24.0 1-Mar-10 REVISED PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T10-0084 Proposal to Broaden the Medicare Hospital Insurance Tax Base Distribution of Federal Tax Change by Cash Income Level, 2013 1 Detail Table - Elderly Tax Units Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.2 37.3 77.9 92.2 2.3 Percent Change in After-Tax Income 4 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 -0.3 -1.0 -2.0 -0.4 Share of Total Federal Tax Change 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.1 7.9 15.7 76.3 100.0 Average Federal Tax Change Dollars 0 0 0 0 0 0 0 1 574 5,220 42,305 253 Percent 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.7 2.6 4.0 1.7 Share of Federal Taxes Change (% Points) 0.0 0.0 0.0 0.0 0.0 -0.1 -0.1 -0.3 -0.2 0.1 0.7 0.0 Under the Proposal 0.1 0.6 1.4 1.6 1.9 6.7 7.4 19.3 18.2 10.1 32.7 100.0 Average Federal Tax Rate 5 Change (% Points) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.2 0.7 1.3 0.3 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2013 1 Cash Income Level (thousands of 2009 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,172 6,748 5,361 3,209 2,230 4,305 2,610 3,192 1,097 238 143 31,333 6.9 21.5 17.1 10.2 7.1 13.7 8.3 10.2 3.5 0.8 0.5 100.0 Average Income (Dollars) 6,172 15,836 25,861 36,417 47,022 65,349 90,205 143,246 306,015 718,754 3,171,919 77,032 Average Federal Tax Burden (Dollars) 211 412 1,260 2,446 4,069 7,533 13,715 29,445 80,095 200,351 1,067,486 15,256 Average AfterTax Income 4 (Dollars) 5,961 15,424 24,602 33,971 42,953 57,817 76,490 113,801 225,920 518,403 2,104,433 61,775 Average Federal Tax Rate 5 3.4 2.6 4.9 6.7 8.7 11.5 15.2 20.6 26.2 27.9 33.7 19.8 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.6 4.4 5.7 4.8 4.3 11.7 9.8 18.9 13.9 7.1 18.8 100.0 0.7 5.4 6.8 5.6 5.0 12.9 10.3 18.8 12.8 6.4 15.6 100.0 0.1 0.6 1.4 1.6 1.9 6.8 7.5 19.7 18.4 10.0 32.0 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0509-4). Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law. Proposal would impose an additional 0.9% tax on earnings for single filers in excess of $200,000 ($250,000 for married couples filing a joint return) as defined for purposes of the Hospital Insurance Tax. An additional tax of 2.9% would be imposed on investment income. Investment income would include taxable interest, dividends, net positive capital gains, net positive income from rents, net positive income from royalties, and net positive passive income from partnerships and S corporations. The unearned income surtax would not exceed 2.9% of a single filer's adjusted gross income in excess of $200,000 ($250,000 for married couples filing a joint return). The thresholds would be indexed for inflation. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal 3.4 2.6 4.9 6.7 8.7 11.5 15.2 20.6 26.4 28.6 35.0 20.1