14-Aug-08 PRELIMINARY RESULTS

advertisement

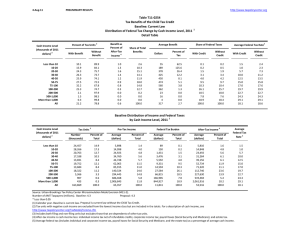

14-Aug-08 PRELIMINARY RESULTS http://www.taxpolicycenter.org Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. Table T08-0202 Senator Obama's Tax Proposals of August 14, 2008: Economic Advisers' Version (No Payroll Surtax) 1 Distribution of Federal Tax Change by Cash Income Level, 2009 Summary Table Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units With Tax Cut 67.1 69.1 85.1 90.6 93.0 91.8 86.9 83.6 75.0 11.6 4.2 81.3 3 With Tax Increase 6.5 9.0 8.7 6.9 5.6 7.5 11.8 14.4 24.8 88.3 95.8 10.4 Percent Change in After-Tax Income 4 8.2 4.6 3.8 3.2 2.9 2.2 1.7 2.0 0.7 -3.9 -7.9 0.6 Share of Total Federal Tax Change 15.4 32.4 33.8 28.9 26.0 48.6 35.1 84.4 18.1 -39.3 -183.1 100.0 Average Federal Tax Change ($) -444 -668 -860 -997 -1,098 -1,114 -1,236 -2,125 -1,591 19,745 175,117 -331 Average Federal Tax Rate 5 Change (% Points) -7.8 -4.4 -3.4 -2.8 -2.4 -1.8 -1.4 -1.5 -0.5 2.8 5.5 -0.4 Under the Proposal -2.8 0.2 6.0 10.5 13.6 16.3 18.4 21.3 25.5 29.7 35.8 21.3 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-6). Number of AMT Taxpayers (millions). Baseline: 29.9 Proposal: 4.0 (1) Calendar year. Baseline is current law. For a detailed description of the proposals see Tables T08-0192 and T08-0193. Assumes all provisions are fully phased in. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 14-Aug-08 PRELIMINARY RESULTS Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. http://www.taxpolicycenter.org Table T08-0202 Senator Obama's Tax Proposals of August 14, 2008: Economic Advisers' Version (No Payroll Surtax) 1 Distribution of Federal Tax Change by Cash Income Level, 2009 Detail Table Cash Income Level (thousands of 2008 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 67.1 69.1 85.1 90.6 93.0 91.8 86.9 83.6 75.0 11.6 4.2 81.3 6.5 9.0 8.7 6.9 5.6 7.5 11.8 14.4 24.8 88.3 95.8 10.4 Percent Change in After-Tax 4 Income 8.2 4.6 3.8 3.2 2.9 2.2 1.7 2.0 0.7 -3.9 -7.9 0.6 Share of Total Federal Tax Change 15.4 32.4 33.8 28.9 26.0 48.6 35.1 84.4 18.1 -39.3 -183.1 100.0 Average Federal Tax Change Dollars -444 -668 -860 -997 -1,098 -1,114 -1,236 -2,125 -1,591 19,745 175,117 -331 Percent -156.8 -95.3 -36.3 -21.0 -15.0 -9.8 -7.0 -6.7 -2.1 10.6 18.0 -2.0 Share of Federal Taxes Change (% Points) -0.3 -0.7 -0.7 -0.5 -0.5 -0.8 -0.5 -1.2 0.0 1.0 4.2 0.0 Under the Proposal -0.1 0.0 1.2 2.2 3.0 9.2 9.6 24.1 17.4 8.5 24.7 100.0 5 Average Federal Tax Rate Change (% Points) -7.8 -4.4 -3.4 -2.8 -2.4 -1.8 -1.4 -1.5 -0.5 2.8 5.5 -0.4 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2009 Cash Income Level (thousands of 2008 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) 17,204 24,101 19,493 14,384 11,749 21,662 14,107 19,712 5,636 989 519 150,241 Percent of Total 11.5 16.0 13.0 9.6 7.8 14.4 9.4 13.1 3.8 0.7 0.4 100.0 Average Income (Dollars) 5,704 15,181 25,314 35,555 45,838 63,039 88,790 138,154 291,886 695,069 3,199,967 75,289 Average Federal Tax Burden (Dollars) 283 702 2,368 4,744 7,317 11,364 17,553 31,521 76,093 186,664 970,835 16,358 Average After4 Tax Income (Dollars) 5,421 14,479 22,947 30,811 38,521 51,674 71,236 106,633 215,793 508,405 2,229,132 58,930 Average Federal Tax 5 Rate 5.0 4.6 9.4 13.3 16.0 18.0 19.8 22.8 26.1 26.9 30.3 21.7 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.9 3.2 4.4 4.5 4.8 12.1 11.1 24.1 14.5 6.1 14.7 100.0 1.1 3.9 5.1 5.0 5.1 12.6 11.4 23.7 13.7 5.7 13.1 100.0 0.2 0.7 1.9 2.8 3.5 10.0 10.1 25.3 17.5 7.5 20.5 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-6). Number of AMT Taxpayers (millions). Baseline: 29.9 Proposal: 4.0 (1) Calendar year. Baseline is current law. For a detailed description of the proposals, see tables T08-0192 and T08-0193. Assumes all proposals are fully phased in. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal -2.8 0.2 6.0 10.5 13.6 16.3 18.4 21.3 25.5 29.7 35.8 21.3 14-Aug-08 PRELIMINARY RESULTS Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. http://www.taxpolicycenter.org Table T08-0202 Senator Obama's Tax Proposals of August 14, 2008: Economic Advisers' Version (No Payroll Surtax) 1 Distribution of Federal Tax Change by Cash Income Level, 2009 Detail Table - Single Tax Units Cash Income Level (thousands of 2008 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 64.6 60.1 81.5 90.8 94.4 90.1 71.5 38.2 35.0 6.0 1.2 73.0 6.7 11.7 11.4 7.5 4.7 9.1 24.2 49.7 63.8 93.8 98.7 12.6 Percent Change in After-Tax 4 Income 7.8 3.9 3.2 2.8 2.5 1.6 0.4 -0.3 -2.0 -5.3 -8.8 0.8 Share of Total Federal Tax Change 30.0 46.7 39.0 30.7 28.3 37.6 4.4 -5.9 -18.0 -19.9 -73.0 100.0 Average Federal Tax Change Dollars -413 -542 -683 -812 -902 -796 -235 347 4,253 26,392 183,620 -266 Percent -96.2 -43.4 -18.8 -12.6 -10.0 -5.9 -1.1 1.1 5.4 13.4 17.1 -3.0 Share of Federal Taxes Change (% Points) -0.9 -1.3 -1.0 -0.7 -0.6 -0.6 0.2 0.7 0.8 0.7 2.6 0.0 Under the Proposal 0.0 1.9 5.2 6.5 7.7 18.4 11.9 17.4 10.6 5.1 15.2 100.0 5 Average Federal Tax Rate Change (% Points) -7.2 -3.6 -2.7 -2.3 -2.0 -1.3 -0.3 0.3 1.4 3.8 5.8 -0.6 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2009 Cash Income Level (thousands of 2008 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 12,556 14,909 9,879 6,530 5,421 8,162 3,264 2,958 730 130 69 64,958 19.3 23.0 15.2 10.1 8.4 12.6 5.0 4.6 1.1 0.2 0.1 100.0 Average Income (Dollars) 5,704 15,017 25,243 35,566 45,797 62,150 87,974 134,418 295,280 694,203 3,156,727 42,053 Average Federal Tax Burden (Dollars) 429 1,248 3,641 6,474 8,980 13,567 20,907 33,072 78,380 197,611 1,074,908 9,009 Average After4 Tax Income (Dollars) 5,275 13,769 21,602 29,093 36,817 48,582 67,067 101,346 216,900 496,592 2,081,819 33,043 Average Federal Tax 5 Rate 7.5 8.3 14.4 18.2 19.6 21.8 23.8 24.6 26.5 28.5 34.1 21.4 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 2.6 8.2 9.1 8.5 9.1 18.6 10.5 14.6 7.9 3.3 7.9 100.0 3.1 9.6 9.9 8.9 9.3 18.5 10.2 14.0 7.4 3.0 6.7 100.0 0.9 3.2 6.2 7.2 8.3 18.9 11.7 16.7 9.8 4.4 12.6 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-6). Number of AMT Taxpayers (millions). Baseline: 29.9 Proposal: 4.0 (1) Calendar year. Baseline is current law. For a detailed description of the proposals, see tables T08-0192 and T08-0193. Assumes all proposals are fully phased in. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal 0.3 4.7 11.7 15.9 17.6 20.6 23.5 24.9 28.0 32.3 39.9 20.8 14-Aug-08 PRELIMINARY RESULTS Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. http://www.taxpolicycenter.org Table T08-0202 Senator Obama's Tax Proposals of August 14, 2008: Economic Advisers' Version (No Payroll Surtax) 1 Distribution of Federal Tax Change by Cash Income Level, 2009 Detail Table - Married Tax Units Filing Jointly Cash Income Level (thousands of 2008 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 66.1 74.8 80.8 82.8 87.5 90.8 91.1 91.8 81.8 12.8 4.7 85.1 9.6 8.4 10.3 11.7 9.7 8.5 8.6 8.1 18.2 87.1 95.2 11.4 Percent Change in After-Tax 4 Income 8.3 4.6 4.1 3.5 3.4 2.4 2.1 2.4 1.2 -3.6 -7.7 0.2 Share of Total Federal Tax Change 7.7 26.5 44.9 43.6 48.0 122.2 138.7 396.1 120.2 -147.3 -700.0 100.0 Average Federal Tax Change Dollars -384 -701 -984 -1,151 -1,367 -1,316 -1,548 -2,611 -2,652 18,572 169,894 -175 Percent -154.5 -155.5 -79.1 -40.1 -26.3 -13.9 -9.6 -8.4 -3.5 10.1 18.1 -0.6 Share of Federal Taxes Change (% Points) -0.1 -0.2 -0.3 -0.3 -0.3 -0.7 -0.8 -2.3 -0.6 1.0 4.5 0.0 Under the Proposal 0.0 -0.1 0.1 0.4 0.8 4.7 8.1 26.9 20.6 10.0 28.3 100.0 5 Average Federal Tax Rate Change (% Points) -7.8 -4.5 -3.9 -3.2 -3.0 -2.1 -1.7 -1.9 -0.9 2.7 5.4 -0.1 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2009 Cash Income Level (thousands of 2008 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,093 3,937 4,757 3,946 3,659 9,688 9,341 15,817 4,725 827 430 59,479 3.5 6.6 8.0 6.6 6.2 16.3 15.7 26.6 7.9 1.4 0.7 100.0 Average Income (Dollars) 4,904 15,709 25,357 35,641 45,966 64,204 89,292 139,272 291,151 695,396 3,148,057 125,155 Average Federal Tax Burden (Dollars) 249 451 1,245 2,874 5,207 9,479 16,147 31,189 75,739 184,872 936,517 28,407 Average After4 Tax Income (Dollars) 4,655 15,258 24,112 32,767 40,759 54,725 73,145 108,083 215,412 510,524 2,211,540 96,748 Average Federal Tax 5 Rate 5.1 2.9 4.9 8.1 11.3 14.8 18.1 22.4 26.0 26.6 29.8 22.7 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.1 0.8 1.6 1.9 2.3 8.4 11.2 29.6 18.5 7.7 18.2 100.0 0.2 1.0 2.0 2.3 2.6 9.2 11.9 29.7 17.7 7.3 16.5 100.0 0.0 0.1 0.4 0.7 1.1 5.4 8.9 29.2 21.2 9.1 23.8 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-6). Number of AMT Taxpayers (millions). Baseline: 29.9 Proposal: 4.0 (1) Calendar year. Baseline is current law. For a detailed description of the proposals, see tables T08-0192 and T08-0193. Assumes all proposals are fully phased in. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal -2.8 -1.6 1.0 4.8 8.4 12.7 16.4 20.5 25.1 29.3 35.2 22.6 14-Aug-08 PRELIMINARY RESULTS Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. http://www.taxpolicycenter.org Table T08-0202 Senator Obama's Tax Proposals of August 14, 2008: Economic Advisers' Version (No Payroll Surtax) 1 Distribution of Federal Tax Change by Cash Income Level, 2009 Detail Table - Head of Household Tax Units Cash Income Level (thousands of 2008 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 79.8 90.1 96.5 98.0 97.9 97.9 94.1 89.4 64.6 2.9 0.8 93.2 3.1 1.4 1.5 0.9 1.8 1.7 4.8 8.2 35.1 95.7 98.7 2.4 Percent Change in After-Tax 4 Income 9.8 6.4 4.6 3.7 2.8 2.4 2.1 1.8 -0.7 -4.0 -8.0 2.9 Share of Total Federal Tax Change 6.9 21.9 21.9 18.0 11.1 17.4 7.7 5.9 -0.9 -1.8 -8.1 100.0 Average Federal Tax Change Dollars -671 -1,030 -1,132 -1,187 -1,117 -1,238 -1,437 -1,739 1,601 19,914 171,856 -1,004 Percent 144.7 124.1 -187.2 -34.5 -17.2 -11.2 -7.7 -5.5 2.2 10.9 18.4 -17.6 Share of Federal Taxes Change (% Points) 5 Average Federal Tax Rate Under the Proposal Change (% Points) Under the Proposal -2.5 -8.4 -2.2 7.3 11.3 29.4 19.6 21.3 9.2 3.8 11.1 100.0 -10.5 -6.8 -4.5 -3.4 -2.4 -2.0 -1.6 -1.3 0.5 2.9 5.6 -2.5 -17.7 -12.2 -2.1 6.4 11.7 15.9 19.6 22.8 25.6 29.6 36.0 11.7 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 1.6 8.1 12.2 13.4 11.3 21.7 11.7 10.9 4.2 1.5 3.6 100.0 2.1 9.9 13.9 14.1 11.3 20.8 10.7 9.7 3.7 1.3 2.9 100.0 -0.8 -3.1 2.1 9.2 11.3 27.3 17.5 18.6 7.4 2.8 7.7 100.0 -1.7 -5.3 -4.2 -1.9 0.0 2.1 2.1 2.7 1.8 1.0 3.4 0.0 Baseline Distribution of Income and Federal Taxes 1 by Cash Income Level, 2009 Cash Income Level (thousands of 2008 2 dollars) Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,406 4,961 4,512 3,554 2,315 3,290 1,254 786 132 21 11 23,292 10.3 21.3 19.4 15.3 9.9 14.1 5.4 3.4 0.6 0.1 0.1 100.0 Average Income (Dollars) 6,412 15,257 25,403 35,401 45,811 61,934 87,576 130,519 298,070 683,864 3,070,023 40,351 Average Federal Tax Burden (Dollars) -464 -830 605 3,438 6,485 11,052 18,587 31,457 74,573 182,579 932,865 5,718 Average After4 Tax Income (Dollars) 6,876 16,087 24,799 31,963 39,326 50,882 68,989 99,062 223,497 501,285 2,137,158 34,633 Average Federal Tax 5 Rate -7.2 -5.4 2.4 9.7 14.2 17.9 21.2 24.1 25.0 26.7 30.4 14.2 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-6). Number of AMT Taxpayers (millions). Baseline: 29.9 Proposal: 4.0 (1) Calendar year. Baseline is current law. For a detailed description of the proposals, see tables T08-0192 and T08-0193. Assumes all proposals are fully phased in. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 14-Aug-08 PRELIMINARY RESULTS Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. http://www.taxpolicycenter.org Table T08-0202 Senator Obama's Tax Proposals of August 14, 2008: Economic Advisers' Version (No Payroll Surtax) Distribution of Federal Tax Change by Cash Income Level, 2009 1 Detail Table - Tax Units with Children Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 83.6 97.0 99.0 99.1 99.1 98.6 97.9 97.3 88.3 9.8 1.5 95.5 1.1 0.6 0.7 0.7 0.8 1.2 1.9 2.4 11.7 90.0 98.5 3.2 Percent Change in After-Tax Income 4 11.8 6.6 5.2 4.5 3.8 2.9 2.8 3.3 1.8 -3.5 -7.8 1.4 Share of Total Federal Tax Change 4.3 12.3 15.0 13.8 11.5 23.2 23.6 65.0 20.4 -15.5 -73.4 100.0 Average Federal Tax Change Dollars -784 -1,113 -1,331 -1,459 -1,523 -1,560 -2,010 -3,559 -3,784 17,501 172,560 -1,036 Percent 115.0 79.0 1,379.5 -51.8 -26.2 -15.4 -11.9 -11.2 -4.9 9.2 17.8 -5.1 Share of Federal Taxes Change (% Points) Average Federal Tax Rate 5 Under the Proposal Change (% Points) Under the Proposal -0.4 -1.5 -0.9 0.7 1.7 6.8 9.3 27.5 21.0 9.8 25.9 100.0 -13.1 -7.2 -5.2 -4.1 -3.3 -2.5 -2.3 -2.6 -1.3 2.5 5.4 -1.1 -24.5 -16.3 -5.6 3.8 9.4 13.6 16.7 20.3 25.3 30.0 35.9 20.4 -0.2 -0.7 -0.8 -0.7 -0.5 -0.8 -0.7 -1.9 0.0 1.3 5.0 0.0 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2009 1 Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,701 5,494 5,603 4,726 3,756 7,394 5,839 9,103 2,690 442 212 48,094 5.6 11.4 11.7 9.8 7.8 15.4 12.1 18.9 5.6 0.9 0.4 100.0 Average Income (Dollars) 5,981 15,478 25,399 35,550 45,850 63,220 89,123 139,015 288,713 693,043 3,179,388 95,281 Average Federal Tax Burden (Dollars) -682 -1,408 -97 2,818 5,815 10,145 16,866 31,823 76,858 190,429 970,051 20,498 Average AfterTax Income 4 (Dollars) 6,663 16,886 25,495 32,732 40,036 53,076 72,257 107,192 211,855 502,614 2,209,337 74,782 Average Federal Tax Rate 5 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total -11.4 -9.1 -0.4 7.9 12.7 16.1 18.9 22.9 26.6 27.5 30.5 21.5 0.4 1.9 3.1 3.7 3.8 10.2 11.4 27.6 17.0 6.7 14.7 100.0 0.5 2.6 4.0 4.3 4.2 10.9 11.7 27.1 15.8 6.2 13.0 100.0 -0.2 -0.8 -0.1 1.4 2.2 7.6 10.0 29.4 21.0 8.6 20.9 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-6). Number of AMT Taxpayers (millions). Baseline: 29.9 Proposal: 4.0 Note: Tax units with children are those claiming an exemption for children at home or away from home. (1) Calendar year. Baseline is current law. For a detailed description of the proposals, see tables T08-0192 and T08-0193. Assumes all proposals are fully phased in. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. 14-Aug-08 PRELIMINARY RESULTS Click on PDF or Excel link above for additional tables containing more detail and breakdowns by filing status and demographic groups. http://www.taxpolicycenter.org Table T08-0202 Senator Obama's Tax Proposals of August 14, 2008: Economic Advisers' Version (No Payroll Surtax) Distribution of Federal Tax Change by Cash Income Level, 2009 1 Detail Table - Elderly Tax Units Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Percent of Tax Units 3 With Tax Cut With Tax Increase 19.7 24.7 49.8 59.5 70.5 68.2 54.4 52.1 43.7 10.2 4.9 45.5 19.8 23.5 29.7 30.7 24.2 29.5 43.1 46.5 56.2 89.6 95.0 31.9 Percent Change in After-Tax Income 4 0.8 0.6 1.1 1.4 2.9 1.4 0.1 -0.2 -1.4 -5.2 -8.4 -1.4 Share of Total Federal Tax Change -0.6 -2.2 -4.4 -4.0 -8.7 -13.2 -0.7 3.0 13.8 23.9 92.9 100.0 Average Federal Tax Change Dollars -53 -82 -268 -452 -1,236 -789 -71 230 3,125 26,568 180,545 856 Percent -29.9 -20.4 -21.0 -21.3 -34.7 -10.8 -0.6 0.9 4.4 14.1 18.5 6.0 Share of Federal Taxes Change (% Points) Under the Proposal 0.0 -0.2 -0.3 -0.3 -0.6 -1.2 -0.5 -1.0 -0.3 0.8 3.6 0.0 0.1 0.5 1.0 0.8 0.9 6.2 7.6 19.4 18.7 11.0 33.8 100.0 Average Federal Tax Rate 5 Change (% Points) -0.8 -0.5 -1.1 -1.3 -2.7 -1.2 -0.1 0.2 1.1 3.8 5.8 1.1 Baseline Distribution of Income and Federal Taxes by Cash Income Level, 2009 1 Cash Income Level (thousands of 2008 dollars) 2 Less than 10 10-20 20-30 30-40 40-50 50-75 75-100 100-200 200-500 500-1,000 More than 1,000 All Tax Units 3 Number (thousands) Percent of Total 2,765 6,689 4,053 2,142 1,714 4,095 2,542 3,191 1,082 221 126 28,639 9.7 23.4 14.2 7.5 6.0 14.3 8.9 11.1 3.8 0.8 0.4 100.0 Average Income (Dollars) 6,577 15,129 24,891 35,242 46,021 63,445 88,251 137,801 298,445 696,175 3,134,426 75,721 Average Federal Tax Burden (Dollars) 177 399 1,275 2,124 3,564 7,324 12,934 26,024 71,553 188,080 974,466 14,211 Average AfterTax Income 4 (Dollars) 6,400 14,730 23,616 33,118 42,457 56,122 75,317 111,776 226,893 508,095 2,159,960 61,511 Average Federal Tax Rate 5 2.7 2.6 5.1 6.0 7.7 11.5 14.7 18.9 24.0 27.0 31.1 18.8 Share of PreTax Income Percent of Total Share of PostTax Income Percent of Total Share of Federal Taxes Percent of Total 0.8 4.7 4.7 3.5 3.6 12.0 10.3 20.3 14.9 7.1 18.2 100.0 1.0 5.6 5.4 4.0 4.1 13.1 10.9 20.3 13.9 6.4 15.5 100.0 0.1 0.7 1.3 1.1 1.5 7.4 8.1 20.4 19.0 10.2 30.2 100.0 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0308-6). Number of AMT Taxpayers (millions). Baseline: 29.9 Proposal: 4.0 Note: Elderly tax units are those with either head or spouse (if filing jointly) age 65 or older. (1) Calendar year. Baseline is current law. For a detailed description of the proposals, see tables T08-0192 and T08-0193. Assumes all proposals are fully phased in. (2) Tax units with negative cash income are excluded from the lowest income class but are included in the totals. For a description of cash income, see http://www.taxpolicycenter.org/TaxModel/income.cfm (3) Includes both filing and non-filing units but excludes those that are dependents of other tax units. (4) After-tax income is cash income less: individual income tax net of refundable credits; corporate income tax; payroll taxes (Social Security and Medicare); and estate tax. (5) Average federal tax (includes individual and corporate income tax, payroll taxes for Social Security and Medicare, and the estate tax) as a percentage of average cash income. Under the Proposal 1.9 2.1 4.1 4.8 5.1 10.3 14.6 19.1 25.0 30.8 36.9 19.9