Quantity of Repo Funding Repo Terms During the Financial Crisis

advertisement

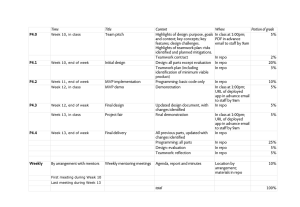

Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Sizing Up Repo Arvind Krishnamurthy1 Stefan Nagel2 1 Northwestern 2 Stanford University University March 2012 Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Dmitry Orlov2 Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Funding Flows in Shadow Banking System !"&% =&+12) !&%7/+/(2# -(./(# "01.2# !"&% 345# !"&% Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov $6,+7(%+,# 8(9&# $%&'(%) *(+,(%# :$;4# <&1.067# '()*+,(-.% /0+1% !!"# !"#$% Sizing Up Repo >*(9&2672?# @AB#C:5D# ;+2F# 3(<0%6E(2# ;&,,+7(%+,## ,(1.(%# Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Tri-Party Repo 2345# 2345# $%&'()%*+# ,-.)%&/0# 10./*# ;%6<.%= >.)-.%# ,6--)*.%)-# 76%*8 29::5# !!"# ,6--)*.%)-# 76%*8 29::5# Haircut: 5% in this example Repo rate: Interest paid by borrower on loan amount ($95m) Maturity: Varies from overnight to weeks or months. Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs How did Repo contribute to the Crisis? ”Run on repo” by repo ”depositors” lead to collapse of shadow banking (Gorton and Metrick) Repo as the “deposit” in a shadow banking sector that holds non-Agency MBS/ABS Run of repo depositors created funding squeeze for shadow banking system (GM: haircuts from 0% to 20% w/ $10 trillion repo ≈ $2 trillion funding shortfall) Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs How did Repo contribute to the Crisis? ”Run on repo” by repo ”depositors” lead to collapse of shadow banking (Gorton and Metrick) Repo as the “deposit” in a shadow banking sector that holds non-Agency MBS/ABS Run of repo depositors created funding squeeze for shadow banking system (GM: haircuts from 0% to 20% w/ $10 trillion repo ≈ $2 trillion funding shortfall) Data on repo GM have haircut data, but for interdealer/dealer-hedge fund repo, not for net cash investors. Estimates of size (i.e. $10 tn) subject to serious double counting problems. We collect a new data set on repo, based on MMF and sec lenders. Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Findings and Lessons – Preview Repo much less important than ABCP in terms of funding non-Agency MBS/ABS pre-crisis and contraction during crisis Replace word repo with “ABCP plus repo” in Gorton-Metrick. Run on ABCP is a (solvency) problem for regulated banking sector (w/ regular access to Fed), not for broker/dealer sector Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Findings and Lessons – Preview Repo much less important than ABCP in terms of funding non-Agency MBS/ABS pre-crisis and contraction during crisis Replace word repo with “ABCP plus repo” in Gorton-Metrick. Run on ABCP is a (solvency) problem for regulated banking sector (w/ regular access to Fed), not for broker/dealer sector Repo run limited to repo with non-govt. collateral Funding problems more significant for subset of dealer banks that are heavy users of non-govt. collateral Haircuts of MMF-to-dealer repo increase much less than those of the dealer-to-dealer repo in Gorton-Metrick Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Findings and Lessons – Preview Repo much less important than ABCP in terms of funding non-Agency MBS/ABS pre-crisis and contraction during crisis Replace word repo with “ABCP plus repo” in Gorton-Metrick. Run on ABCP is a (solvency) problem for regulated banking sector (w/ regular access to Fed), not for broker/dealer sector Repo run limited to repo with non-govt. collateral Funding problems more significant for subset of dealer banks that are heavy users of non-govt. collateral Haircuts of MMF-to-dealer repo increase much less than those of the dealer-to-dealer repo in Gorton-Metrick Less a run of “depositors” than an “interbank” credit crunch (due to capital concerns, liquidity hoarding?) Here interbank means broker/dealers in making repo loans to e.g., hedge funds, rather than commercial banks in making loans to corporates. Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Rehypothecation Problem in Existing Repo Data *+,1-# !23# 4%56%# "785# *+,,-# *+,,-# *+,,-# $%&'%(#)# $%&'%(#2# ./''&0%(&'# ./''&0%(&'# !!"# ./''&0%(&'# In this example, amount of funding for MBS purchase provided to shadow banking system via repo is $100m, but total volume of repo oustanding is $300m. Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Rehypothecation Problem in Existing Repo Data *+,1-# !23# 4%56%# "785# *+,,-# *+,,-# *+,,-# $%&'%(#)# $%&'%(#2# ./''&0%(&'# ./''&0%(&'# !!"# ./''&0%(&'# In this example, amount of funding for MBS purchase provided to shadow banking system via repo is $100m, but total volume of repo oustanding is $300m. Fed Primary Dealer Repo Data ($4.1 trillion Dec. 2007) includes inter-dealer repo. Fed Tri-Party Repo Data ($2.5 trillion Dec. 2007) includes inter-dealer GCF repo. Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Rehypothecation Problem in Existing Repo Data *+,1-# !23# 4%56%# "785# *+,,-# *+,,-# *+,,-# $%&'%(#)# $%&'%(#2# ./''&0%(&'# ./''&0%(&'# !!"# ./''&0%(&'# In this example, amount of funding for MBS purchase provided to shadow banking system via repo is $100m, but total volume of repo oustanding is $300m. Fed Primary Dealer Repo Data ($4.1 trillion Dec. 2007) includes inter-dealer repo. Fed Tri-Party Repo Data ($2.5 trillion Dec. 2007) includes inter-dealer GCF repo. Analogy: Exclusion of inter-bank deposits in calculation of M2 money stock Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Data Data (micro) on MMF repos from quarterly SEC filings of MMF We collect repos for 20 biggest MMF families from end of 2006 to mid-2010 (top 20 covers 80%+ of total MMF assets under management) ≈ 16,000 repo agreements Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Data Data (micro) on MMF repos from quarterly SEC filings of MMF We collect repos for 20 biggest MMF families from end of 2006 to mid-2010 (top 20 covers 80%+ of total MMF assets under management) ≈ 16,000 repo agreements Quarterly survey of major securities lenders conducted by Risk Management Association (RMA), including the big securities lenders (AIG, BNY Mellon, State Street, ...) Data (aggregate) on cash collateral reinvestment, incl. repos, Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Data Data (micro) on MMF repos from quarterly SEC filings of MMF We collect repos for 20 biggest MMF families from end of 2006 to mid-2010 (top 20 covers 80%+ of total MMF assets under management) ≈ 16,000 repo agreements Quarterly survey of major securities lenders conducted by Risk Management Association (RMA), including the big securities lenders (AIG, BNY Mellon, State Street, ...) Data (aggregate) on cash collateral reinvestment, incl. repos, Transactions data on emergency lending programs of the Federal Reserve Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs MMF Data Example: Reserve Fund – Primary Fund February 29, 2008 Repurchase Agreements Notional Counterparty Rate Init. Rep. Collateral Coll. mkt.val. 1,000,000,000 450,000,000 500,000,000 140,000,000 1,000,000,000 ... Bear Stearns Bear Stearns Citigroup Merrill Lynch Morgan Stanley 3.28% 3.33% 3.23% 3.43% 3.29% 2/29/08, 2/29/08 2/29/08 2/29/08 2/29/08 3/3/08 3/3/08 3/3/08 3/3/08 3/3/08 ABS, CMO, TRR, TR3 ABS, CMO MNI, TRR WLR WLR 1,048,922,871 472,500,201 556,131,379 146,599,193 1,020,794,540 Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Collateral in Tri-Party Repo Short-term funding of private debt instruments Demand or Supply? Summary of MMF and Securities Lender Repo ($bn) Quarter 2006Q4 2007Q1 2007Q2 2007Q3 2007Q4 2008Q1 2008Q2 2008Q3 2008Q4 2009Q1 2009Q2 2009Q3 2009Q4 2010Q1 1 2 3 Money Market Funds Collected Total Total Repo Repo2 Assets2 2431 395 2312 324 387 2372 331 426 2466 412 528 2780 483 606 3033 501 592 3383 466 518 3318 433 592 3355 479 542 3757 546 562 3739 507 488 3585 495 495 3363 472 480 3259 427 440 2931 Securities Lenders Cash Repo Collateral 431 1594 527 1834 504 1902 522 1754 478 1712 467 1537 509 1790 490 1519 228 954 212 779 257 882 244 865 229 850 263 837 Incomplete coverage of funds in MMF sample in 2006Q4. Source: Flow of Funds Accounts. Source: Federal Reserve Bank of New York Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Primary Dealer Repo3 3442 3619 3889 3886 4106 4278 4222 3989 3208 2743 2582 2499 2469 2477 Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Collateral in Tri-Party Repo Short-term funding of private debt instruments Demand or Supply? How much of Total Repo Funding Do We Capture? 2007Q4, about $1.1 trillion repo lending in total from MMF and securities lenders Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Collateral in Tri-Party Repo Short-term funding of private debt instruments Demand or Supply? How much of Total Repo Funding Do We Capture? 2007Q4, about $1.1 trillion repo lending in total from MMF and securities lenders Tri-party repo of $2.5tn, but includes interdealer repo (∼$500bn?). Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Collateral in Tri-Party Repo Short-term funding of private debt instruments Demand or Supply? How much of Total Repo Funding Do We Capture? 2007Q4, about $1.1 trillion repo lending in total from MMF and securities lenders Tri-party repo of $2.5tn, but includes interdealer repo (∼$500bn?). Other repo lenders according to Flow of Funds Accounts, 2007Q4 (December 2010 release): State and local governments $163.3bn Government sponsored enterprises $142.7bn Rest of the world $338.4bn Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Collateral in Tri-Party Repo Short-term funding of private debt instruments Demand or Supply? How much of Total Repo Funding Do We Capture? 2007Q4, about $1.1 trillion repo lending in total from MMF and securities lenders Tri-party repo of $2.5tn, but includes interdealer repo (∼$500bn?). Other repo lenders according to Flow of Funds Accounts, 2007Q4 (December 2010 release): State and local governments $163.3bn Government sponsored enterprises $142.7bn Rest of the world $338.4bn Who else: Corporations (appear to go through MMFs). Foreign Central Banks (DVP, tri-party, $100 to $200bn). Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Collateral in Tri-Party Repo Short-term funding of private debt instruments Demand or Supply? Share .5 .6 .7 .8 .9 1 MMF: Share of Collateral by Type (by value) 2007q1 2008q1 2009q1 2010q1 Quarter U.S. Treasury Corporate Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Agency Other Sizing Up Repo Priv. ABS Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Collateral in Tri-Party Repo Short-term funding of private debt instruments Demand or Supply? 0 .2 .4 Share .6 .8 1 Securities Lenders: Share of Collateral by Type (by value) 2007q1 2008q1 2009q1 2010q1 Quarter U.S. Treasury Corporate Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Agency Other Sizing Up Repo Priv. ABS Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Collateral in Tri-Party Repo Short-term funding of private debt instruments Demand or Supply? Repo versus ABCP Repo of ABS Bank holds ABS on balance sheet. Issues short-term debt, overcollateralized, against ABS. Typically overnight, so lenders can redeem the debt at par. ABCP Bank takes loans/securities, places them in SPV. Issues short-term (ofter overnight) debt against loans. Buyers of debt can sell the debt back to banks at par. Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Collateral in Tri-Party Repo Short-term funding of private debt instruments Demand or Supply? Short-term Funding Pre-Crisis 2007Q2 Non-agency MBS/ABS Amount % Total outstanding1 Short-term funding ABCP2 Direct holdings3 MMF Securities lenders Repo4 MMF Securities lenders Total short-term 5275 100% 1173 22% 243 502 31 120 2069 Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Corporate Bonds Amount % 5591 100% 5% 10% 179 369 3% 7% 1% 2% 40% 42 166 755 1% 3% 14% Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Collateral in Tri-Party Repo Short-term funding of private debt instruments Demand or Supply? Contraction in Short-term Funding Non-Agency MBS/ABS ABCP1 Direct holdings MMF3 Securities lenders2 Repo MMF Securities lenders4 Total Corporate bonds Direct holdings MMF3 Securities lenders Repo MMF Securities lenders4 Total 2007Q2 2009Q1 Contraction 1173.2 511.0 -662.2 243.3 501.6 59.4 116.0 -183.9 -385.6 30.5 120.1 0.3 1.6 -30.2 -118.5 -1380.4 178.9 368.7 158.4 309.1 -20.5 -59.6 42.1 165.6 9.7 49.3 -32.4 -116.3 -228.8 Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Collateral in Tri-Party Repo Short-term funding of private debt instruments Demand or Supply? 0 300 50 100 150 Repo w/ non−agency MBS/ABS ABCP outstanding 600 900 1200 200 1500 Comparison of repo and ABCP contraction 2006q3 2007q3 ABCP outstanding 2008q3 Quarter 2009q3 2010q3 Repo w/ non−agency MBS/ABS ABCP outstanding net of amount funded through Fed CPFF program Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Collateral in Tri-Party Repo Short-term funding of private debt instruments Demand or Supply? Demand or Supply? Repo demand contraction: MMF and securities lenders refuse to lend against non-agency MBS/ABS collateral? Repo supply contraction: Hedge funds and dealer banks scale back investments in MBS/ABS and have lower MBS/ABS funding needs? Indication that largely demand driven Quantity going to zero suggests demand effect Price terms rise Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Maturity Haircuts Repo Rates 0 50 Maturity (business days) 100 150 200 250 Maturity Compression (vw.) 2006q3 2007q3 99th Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov 2008q3 Quarter 98th 2009q3 95th Sizing Up Repo 2010q3 90th Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Maturity Haircuts Repo Rates 0 Maturity (business days) 50 100 150 Maturity Compression (ew.) 2006q3 2007q3 90th Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov 2008q3 Quarter 80th 2009q3 70th Sizing Up Repo 2010q3 60th Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Maturity Haircuts Repo Rates 2 3 Percent 4 5 6 7 Haircuts by Collateral Type (vw.) 2006m7 2007m7 2008m7 Month U.S. Treasury Priv. ABS Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov 2009m7 Agency Corporate Sizing Up Repo 2010m7 Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Maturity Haircuts Repo Rates 0 2 Percent 4 6 Average Overnight Treasury Repo Rate (vw.) and Fed Funds Rate 2006m7 2007m7 Fed Funds Rate Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov 2008m7 Month 2009m7 Treasury Repo Rate (vw.) Sizing Up Repo 2010m7 Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Maturity Haircuts Repo Rates 0 1 2 Percent 3 4 5 Average Overnight Repo Rate (vw.) in Excess of Fed Funds Rate 2006m7 2007m7 2008m7 Month Agency Corporate Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov 2009m7 Priv. ABS Sizing Up Repo 2010m7 Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Maturity Haircuts Repo Rates Limited Run on Repo Increase in price terms on non-agency MBS/ABS (repo rate, haircut, decrease in maturity) suggest “run on repo”. Haircuts for Treasury and agency always stayed between 2-3%. Tri-party repo haircuts increased much less during crisis than the bi-lateral repo haircuts reported in Gorton and Metrick (2011b) Gorton and Metrick report haircuts > 50% for several categories of securitized products Why the difference? Their data: dealer to dealer. Credit crunch from dealers, given capital concerns? Defensive actions of dealers, liquidity hoarding? Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Changes in Repo Quantities by Counterparty Repo Terms by Counterparty on September 30, 2008 Cross-Sectional Patterns by Repo Counterparty Evidence for “run” on repo with private collateral, especially non-agency MBS/ABS, but channel for collapse of shadow banking is unclear. Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Changes in Repo Quantities by Counterparty Repo Terms by Counterparty on September 30, 2008 Cross-Sectional Patterns by Repo Counterparty Evidence for “run” on repo with private collateral, especially non-agency MBS/ABS, but channel for collapse of shadow banking is unclear. We examine effects on dealer banks: Dealer banks with higher exposure to private debt instruments? “Run” on specific dealer banks irrespective of type of collateral offered? Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Changes in Repo Quantities by Counterparty Repo Terms by Counterparty on September 30, 2008 Cross-Sectional Patterns by Repo Counterparty Evidence for “run” on repo with private collateral, especially non-agency MBS/ABS, but channel for collapse of shadow banking is unclear. We examine effects on dealer banks: Dealer banks with higher exposure to private debt instruments? “Run” on specific dealer banks irrespective of type of collateral offered? Analysis based on MMF repo data, focused on periods Pre-Bear Stearns (BSC): Dec. ’07 - Feb ’08 Post-Lehman (LEH): Sep. ’08 - Nov. ’08 Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Changes in Repo Quantities by Counterparty Repo Terms by Counterparty on September 30, 2008 Change Pre−BSC to Post−LEH −.5 0 .5 1 1.5 Contraction/Expansion in Total MMF Repo Total Repo mfg bcs jpm bnpqy hbc bac scgly drb ms ing db rbs cs ubs mer c gs wb 0 .1 .2 .3 .4 .5 .6 .7 .8 Private Collateral Share Pre−BSC Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo .9 Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Changes in Repo Quantities by Counterparty Repo Terms by Counterparty on September 30, 2008 Contraction Pre−BSC to Post−LEH −.5 0 .5 1 1.5 Contraction/Expansion in MMF Repo w/ Private Collateral Repo w/ Private Collateral bcs bnpqy mfg scgly rbs ing hbc jpmdb bac cs ubs drb ms mer cgs wb 0 .1 .2 .3 .4 .5 .6 .7 .8 Private Collateral Share Pre−BSC Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo .9 Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Changes in Repo Quantities by Counterparty Repo Terms by Counterparty on September 30, 2008 1500 Private Collateral Share and Post-Lehman CDS Rates wb Maximum 5−yr Senior CDS Rate 500 1000 ms bsc leh hbc gs mer rbs bcs bac cs ing jpm db drb bnpqy 0 scgly c ubs 0 .2 .4 .6 Private Collateral Share Pre−BSC Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo .8 Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Changes in Repo Quantities by Counterparty Repo Terms by Counterparty on September 30, 2008 Trading Assets (preliminary) Change from pre-BSC to post-LEH: Dealer banks with high private collateral shares: GS = -32% MS = -37% MerLynch = -20% Citi = -23% Dealer banks with low private collateral share: JPM = +10% BAC = -10% Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Changes in Repo Quantities by Counterparty Repo Terms by Counterparty on September 30, 2008 Haircuts by Counterparty 1 2 Haircut 3 4 5 Haircuts 0 200 400 600 5−yr Senior CDS Rate 9/30/2008 Treasury Agency Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Treasury/Agency Private Sizing Up Repo 800 1000 Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Changes in Repo Quantities by Counterparty Repo Terms by Counterparty on September 30, 2008 Repo Rates by Counterparty 0 2 Repo Rate 4 6 8 Repo Rates 0 200 400 600 5−yr Senior CDS Rate 9/30/2008 Treasury Agency Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Treasury/Agency Private Sizing Up Repo 800 1000 Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Changes in Repo Quantities by Counterparty Repo Terms by Counterparty on September 30, 2008 Cross-Sectional Patterns by Repo Counterparty Dealer banks with highest private collateral funding needs appear to run into trouble. We do not see “runs” on high-risk dealer banks: financing with high-quality collateral still available at normal terms. But our data is not high frequency ... Some money market investors stopped rolling over Lehman Brothers repos, irrespective of collateral, only in the last few days before bankruptcy (Copeland, Martin, and Walker (2010)) Concern existed that tri-party agents (JPMC and BNYM) could cut off access to tri-party repo for high-risk dealer banks Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Quantity of Fed Funding Fed Program Participation, by Dealer Bank Federal Reserve Programs We focus on four principal programs: 1 PDCF (Primary Dealer Credit Facility), March 2008: Loan facility that provided funding to primary dealers in exchange for any tri-party-eligible collateral. Loans were overnight, and made at the primary credit discount rate. Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Quantity of Fed Funding Fed Program Participation, by Dealer Bank Federal Reserve Programs We focus on four principal programs: 1 PDCF (Primary Dealer Credit Facility), March 2008: Loan facility that provided funding to primary dealers in exchange for any tri-party-eligible collateral. Loans were overnight, and made at the primary credit discount rate. 2 TSLF (Term Securities Lending Facility), March 2008: Facility to loan Treasuries from the Fed’s portfolio in exchange for any investment-grade collateral. Loans were 28-day, and rates were set in an auction. Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Quantity of Fed Funding Fed Program Participation, by Dealer Bank Federal Reserve Programs We focus on four principal programs: 1 PDCF (Primary Dealer Credit Facility), March 2008: Loan facility that provided funding to primary dealers in exchange for any tri-party-eligible collateral. Loans were overnight, and made at the primary credit discount rate. 2 TSLF (Term Securities Lending Facility), March 2008: Facility to loan Treasuries from the Fed’s portfolio in exchange for any investment-grade collateral. Loans were 28-day, and rates were set in an auction. 3 Maiden Lane, 2 facilities, various dates: Fed made loans to SPVs that held non-agency ABS. Facilities were set up in conjunction with interventions in Bear Stearns and AIG. Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Quantity of Fed Funding Fed Program Participation, by Dealer Bank Federal Reserve Programs We focus on four principal programs: 1 PDCF (Primary Dealer Credit Facility), March 2008: Loan facility that provided funding to primary dealers in exchange for any tri-party-eligible collateral. Loans were overnight, and made at the primary credit discount rate. 2 TSLF (Term Securities Lending Facility), March 2008: Facility to loan Treasuries from the Fed’s portfolio in exchange for any investment-grade collateral. Loans were 28-day, and rates were set in an auction. 3 Maiden Lane, 2 facilities, various dates: Fed made loans to SPVs that held non-agency ABS. Facilities were set up in conjunction with interventions in Bear Stearns and AIG. 4 CPFF (Commercial Paper Funding Facility), October 2008: Fed made loans to an SPV to purchase 3-month ABCP. Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Quantity of Fed Funding Fed Program Participation, by Dealer Bank 0 50 Amount ($bn.) 100 150 200 Repo and Federal Reserve Funding of Non-Agency MBS/ABS 2006q3 2007q3 2008q3 Quarter Repo TSLF Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov 2009q3 Maiden Lane PDCF Sizing Up Repo 2010q3 Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Quantity of Fed Funding Fed Program Participation, by Dealer Bank 50 Amount ($bn.) 100 150 200 250 300 Repo and Federal Reserve Funding of Corporate Debt Securities 2006q3 2007q3 2008q3 Quarter Repo PDCF Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov 2009q3 TSLF Sizing Up Repo 2010q3 Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Quantity of Fed Funding Fed Program Participation, by Dealer Bank Amount ($bn.) 400 600 800 1000 1200 ABCP Oustanding (ex CPFF) and CPFF Funding 2006q3 2007q3 2008q3 Date ABCP ex CPFF Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov 2009q3 ABCP in CPFF Sizing Up Repo 2010q3 Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Quantity of Fed Funding Fed Program Participation, by Dealer Bank Federal Reserve Programs: Terms We focus on Fed Program Utilization around Sep. 30, 2008 TSLF looks attractive relative to market rates on Sep. 30, 2008 Schedule 2 auction on 10/1/08 yielded a (uniform) loan fee of 1.51%, compared private collateral repo rate spread to Treasury repo on 9/30/08 of 7%. Schedule 1 auction on 10/1/08 yielded a (uniform) loan fee of 0.42%, which is lower than many observed agency repo spreads on 9/30/2008. PDCF funding rates attractive for private collateral (2.25% on 9/30/2008). Both must have carried stigma similar to discount window borrowing for commercial banks. Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Quantity of Fed Funding Fed Program Participation, by Dealer Bank Fed Program Utilization by Primary Dealers in Sep ’08 maxout1 (1) TSLF maxout2 (2) Total (3) PDCF Total (4) Agency Share pre-BSC 1.43 (2.21) 0.77 (1.58) 46.16 (2.31) 9.34 (0.62) Private Share pre-BSC -0.36 (-0.48) 1.10 (1.92) 39.33 (1.66) 57.85 (3.26) 15 0.17 15 0.28 15 0.36 15 0.42 Observations Adjusted R 2 Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Discussion: Repo and contraction of shadow banking Gorton-Metrick broadbrush picture: Run on repo by “depositors” created big aggregate funding shortfall Evaluation based on our evidence: Repo w/ non-Agency MBS/ABS collateral too small to fit that picture Run by repo “depositors” confined to risky/illiquid collateral, relatively insignificant in terms of aggregate funding needs of shadow banking system. Contraction in ABCP and direct ABS/MBS investments of short-term investors an order of magnitude bigger Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo Quantity of Repo Funding Repo Terms During the Financial Crisis Cross-Sectional Patterns by Repo Counterparty Federal Reserve Programs Discussion: Repo and contraction of shadow banking Emerging picture: Funding squeeze for some dealer banks Run may have played a significant role for dealer banks with high risky/illiquid collateral funding needs. Many of these dealer banks almost failed (caveat: capital depletion, loss of brokerage business, etc. could be correlated with collateral composition). Gorton-Metrick dealer-to-dealer repo haircut data indicates dealer banks then raised cost of repo credit to each other and to hedge funds in interbank repo (“credit crunch”) Arvind Krishnamurthy, Stefan Nagel, Dmitry Orlov Sizing Up Repo