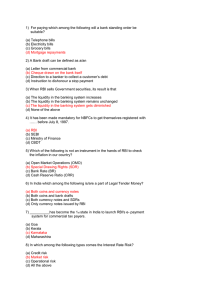

Professor Vipin 2014 Unit 4 Regulatory Institutions

advertisement

Professor Vipin 2014 Unit 4 Regulatory Institutions Reserve Bank of India The Reserve Bank of India i.e RBI is the central bank of our country. It was established in the year 1935, under the Reserve Bank of India Act, 1934. Being a central bank, RBI has control over the entire currency and banking system in India. It acts as a banker to both the state and the central government in India. It has the exclusive right to issue currency, notes in the country. RBI – Organization The Reserve Bank of India is managed by well-structured administrative machinery. The organization structure of the RBI can be easily understood with the help of the follow-ing chart: The management of the RBI is entrusted to the central and local boards. The Central in 1927 Board consists of the following members: We can observe from the table that all members of Central Board are appointed by the Central Government. The Governor and the Deputy Governors are appointed as execu-tives in the bank and by virtue of their position in the bank; they become members of the Central Board. The other directors of Central Board are appointed for a four year term (excepting the official of Government of India) by Government under RBI Act, 1934. The present Governor of RBI is Raghuram Rajan. The Governor is assisted in the perfor-mance of his duties by the Deputy Governors and the Executive Directors. The Governor and Deputy Governors hold office as per their terms of appointment and eligible for reap-pointment. The executive directors are whole time officials of the bank, with salaries. They are however not members of Central Board. Appointment of members of Central Board are so made that two directors retire every year. A retiring director is eligible for reappoint-ment. The local Boards consist of 5 members appointed by the Central Government. The appointment will be made so as to secure adequate representation of regional and eco-nomic interest of the areas concerned. The local Board will have a Chairman elected from amongst the members of the local Board. The members of the local Board hold office for a period of 4 years and are eligible for reappointment. www.VipinMKS.com Page 1 Professor Vipin 2014 No person may be a director if: a) He is a salaried officer of the Government b) If he is insolvent, of unsound mind or c) If he is an officer or employee of any bank or a director of a bank other than co-operative bank. The Governor or Deputy Governor or a Director may be removed from office by the Central Government. A Director ceases to hold office if he is absent for 3 consecutive meetings of the Board. (This provision does not apply in the case of the Governor, Deputy Governor or the official Director). A member of the Parliament or of a State Legislature cannot be a Director unless he ceases to be member of the Parliament or State Legislative within two months from the date of being appointed as director of the bank. At least six meetings of the Cen-tral Board must be held every year. Any three directors can require the Governor to convene a meeting of the Board. The Governor and, in his absence, the Deputy Governor presides over such meetings. The organizational structure of RBI is divided into two parts, the Internal Organization and the External Organisation. The internal structure includes the central office of the bank. The central office consists of various departments for the efficient discharge of its functions. The external structure includes its local offices, situated at important metropolitan cities of India. In other places where the RBI does not have its offices, the State Bank of India and its subsidiaries act as its agents. Objectives of RBI 1. 2. 3. 4. 5. 6. 7. 8. To manage the monetary and credit system of the country. To stabilizes internal and external value of rupee. For balanced and systematic development of banking in the country. For the development of organized money market in the country. For proper arrangement of agriculture finance. For proper arrangement of industrial finance. For proper management of public debts. To establish monetary relations with other countries of the world and international financial institutions. 9. For centralization of cash reserves of commercial banks. 10. To maintain balance between the demand and supply of currency. www.VipinMKS.com Page 2 Professor Vipin 2014 Functions of Reserve Bank of India Traditional Functions of RBI 1. Issue of Currency Notes: The RBI has the sole right or authority or monopoly of issuing currency notes except one rupee note and coins of smaller denomination. These currency notes are legal tender issued by the RBI. Currently it is in denominations of Rs. 2, 5, 10, 20, 50, 100, 500, and 1,000. The RBI has powers not only to issue and withdraw but even to exchange these currency notes for other denominations. It issues these notes against the security of gold bullion, foreign securities, rupee coins, exchange bills and promissory notes and government of India bonds. 2. Banker to other Banks: The RBI being an apex monitory institution has obligatory powers to guide, help and direct other commercial banks in the country. The RBI can control the volumes of banks reserves and allow other banks to create credit in that proportion. Every commercial bank has to maintain a part of their reserves with its parent's viz. the RBI. Similarly in need or in urgency these banks approach the RBI for fund. Thus it is called as the lender of the last resort. 3. Banker to the Government: The RBI being the apex monitory body has to work as an agent of the central and state governments. It performs various banking function such as to accept deposits, taxes and make payments on behalf of the government. It works as a representative of the government even at the international level. It maintains government accounts, provides financial advice to the government. It manages government public debts and maintains foreign exchange reserves on behalf of the government. It provides overdraft facility to the government when it faces financial crunch. 4. Exchange Rate Management: It is an essential function of the RBI. In order to maintain stability in the external value of rupee, it has to prepare domestic policies in that direction. Also it needs to prepare and implement the foreign exchange rate policy which will help in attaining the exchange rate stability. In order to maintain the exchange rate stability it has to bring demand and supply of the foreign currency (U.S Dollar) close to each other. 5. Credit Control Function: Commercial bank in the country creates credit according to the demand in the economy. But if this credit creation is unchecked or unregulated then it leads the economy into inflationary cycles. On the other credit creation is below the required limit then it harms the growth of the economy. As a central bank of the nation the RBI has to look for growth with price stability. Thus it regulates the credit creation capacity of commercial banks by using various credit control tools. 6. Supervisory Function: The RBI has been endowed with vast powers for supervising the banking system in the country. It has powers to issue license for setting up new banks, to open new branches, to decide minimum reserves, to inspect functioning of commercial banks in India and abroad, and to guide and direct the commercial banks in India. It can have periodical inspections an audit of the commercial banks in India. www.VipinMKS.com Page 3 Professor Vipin 2014 Developmental / Promotional Functions of RBI 1. Development of the Financial System: The financial system comprises the financial institutions, financial markets and financial instruments. The sound and efficient financial system is a precondition of the rapid economic development of the nation. The RBI has encouraged establishment of main banking and non-banking institutions to cater to the credit requirements of diverse sectors of the economy. 2. Development of Agriculture: In an agrarian economy like ours, the RBI has to provide special attention for the credit need of agriculture and allied activities. It has successfully rendered service in this direction by increasing the flow of credit to this sector. It has earlier the Agriculture Refinance and Development Corporation (ARDC) to look after the credit, National Bank for Agriculture and Rural Development (NABARD) and Regional Rural Banks (RRBs). 3. Provision of Industrial Finance: Rapid industrial growth is the key to faster economic development. In this regard, the adequate and timely availability of credit to small, medium and large industry is very significant. In this regard the RBI has always been instrumental in setting up special financial institutions such as ICICI Ltd. IDBI, SIDBI and EXIM BANK etc. 4. Provisions of Training: The RBI has always tried to provide essential training to the staff of the banking industry. The RBI has set up the bankers' training colleges at several places. National Institute of Bank Management i.e. NIBM, Bankers Staff College i.e. BSC and College of Agriculture Banking i.e. CAB is few to mention. 5. Collection of Data: Being the apex monetary authority of the country, the RBI collects process and disseminates statistical data on several topics. It includes interest rate, inflation, savings and investments etc. This data proves to be quite useful for researchers and policy makers. 6. Publication of the Reports: The Reserve Bank has its separate publication division. This division collects and publishes data on several sectors of the economy. The reports and bulletins are regularly published by the RBI. It includes RBI weekly reports, RBI Annual Report, Report on Trend and Progress of Commercial Banks India., etc. This information is made available to the public also at cheaper rates. 7. Promotion of Banking Habits: As an apex organization, the RBI always tries to promote the banking habits in the country. It institutionalizes savings and takes measures for an expansion of the banking network. It has set up many institutions such as the Deposit Insurance Corporation1962, UTI-1964, IDBI-1964, NABARD-1982, NHB-1988, etc. These organizations develop and promote banking habits among the people. During economic reforms it has taken many initiatives for encouraging and promoting banking in India. 8. Promotion of Export through Refinance: The RBI always tries to encourage the facilities for providing finance for foreign trade especially exports from India. The Export-Import Bank of India (EXIM Bank India) and the Export Credit Guarantee Corporation of India (ECGC) are supported by refinancing their lending for export purpose. www.VipinMKS.com Page 4 Professor Vipin 2014 Supervisory Functions of RBI 1. Granting license to banks: The RBI grants license to banks for carrying its business. License is also given for opening extension counters, new branches, even to close down existing branches. 2. Bank Inspection: The RBI grants license to banks working as per the directives and in a prudent manner without undue risk. In addition to this it can ask for periodical information from banks on various components of assets and liabilities. 3. Control over NBFIs: The Non-Bank Financial Institutions are not influenced by the working of a monitory policy. However RBI has a right to issue directives to the NBFIs from time to time regarding their functioning. Through periodic inspection, it can control the NBFIs. 4. Implementation of the Deposit Insurance Scheme: The RBI has set up the Deposit Insurance Guarantee Corporation in order to protect the deposits of small depositors. All bank deposits below Rs. One lakh are insured with this corporation. The RBI work to implement the Deposit Insurance Scheme in case of a bank failure. SEBI Securities and Exchange Board of India (SEBI) is an apex body for overall development and regulation of the securities market. It was set up on April 12, 1988. To start with, SEBI was set up as a non-statutory body. Later on it became a statutory body under the Securities Exchange Board of India Act, 1992. The Act entrusted SEBI with comprehensive powers over practically all the aspects of capital market operations. Objectives of SEBI 1. Regulation of Stock Exchanges: The first objective of SEBI is to regulate stock exchanges so that efficient services may be provided to all the parties operating there. 2. Protection to the Investors: The capital market is meaningless in the absence of the investors. Therefore, it is important to protect the interests of the investors. The protection of the interests of the investors means protecting them from the wrong information given by the companies in their prospectus, reducing the risk of delivery and payment, etc. Hence, the foremost objective of the SEBI is to provide security to the investors. 3. Checking the Insider Trading: Insider trading means the buying and selling of securities by those people’s directors Promoters, etc. who have some secret information about the company and who wish to take advantage of this secret information. This hurts the interests of the general investors. It was very essential to check this tendency. Many steps have been taken to check inside trading through the medium of the SEBI. 4. Control over Brokers: It is important to keep an eye on the activities of the brokers and other middlemen in order to control the capital market. To have a control over them, it was necessary to establish the SEBI. www.VipinMKS.com Page 5 Professor Vipin 2014 The Organizational Structure of SEBI 1. SEBI is working as a corporate sector. 2. Its activities are divided into five departments. Each department is headed by an executive director. 3. The head office of SEBI is in Mumbai and it has branch office in Kolkata, Chennai and Delhi. 4. SEBI has formed two advisory committees to deal with primary and secondary markets. 5. These committees consist of market players, investors associations and eminent persons. Functions of SEBI Protective Functions 1. It Checks Price Rigging: Price rigging refers to manipulating the prices of securities with the main objective of inflating or depressing the market price of securities. SEBI prohibits such practice because this can defraud and cheat the investors. 2. It Prohibits Insider trading:Insider is any person connected with the company such as directors, promoters etc. These insiders have sensitive information which affects the prices of the securities. This information is not available to people at large but the insiders get this privileged information by working inside the company and if they use this information to make profit, then it is known as insider trading, e.g., the directors of a company may know that company will issue Bonus shares to its shareholders at the end of year and they purchase shares from market to make profit with bonus issue. This is known as insider trading. SEBI keeps a strict check when insiders are buying securities of the company and takes strict action on insider trading. 3. SEBI prohibits fraudulent and Unfair Trade Practices: SEBI does not allow the companies to make misleading statements which are likely to induce the sale or purchase of securities by any other person. 4. SEBI undertakes steps to educate investors so that they are able to evaluate the securities of various companies and select the most profitable securities. 5. SEBI promotes fair practices and code of conduct in security market by taking following steps: a) SEBI has issued guidelines to protect the interest of debenture-holders wherein companies cannot change terms in midterm. b) SEBI is empowered to investigate cases of insider trading and has provisions for stiff fine and imprisonment. c) SEBI has stopped the practice of making preferential allotment of shares unrelated to market prices. Developmental Functions www.VipinMKS.com Page 6 Professor Vipin 2014 1. SEBI promotes training of intermediaries of the securities market. 2. SEBI tries to promote activities of stock exchange by adopting flexible and adoptable approach in following way: a) SEBI has permitted internet trading through registered stock brokers. b) SEBI has made underwriting optional to reduce the cost of issue. c) Even initial public offer of primary market is permitted through stock exchange. Regulatory Functions 1. SEBI has framed rules and regulations and a code of conduct to regulate the intermediaries such as merchant bankers, brokers, underwriters, etc. 2. These intermediaries have been brought under the regulatory purview and private placement has been made more restrictive. 3. SEBI registers and regulates the working of stock brokers, sub-brokers, share transfer agents, trustees, merchant bankers and all those who are associated with stock exchange in any manner. 4. SEBI registers and regulates the working of mutual funds etc. 5. SEBI regulates takeover of the companies. 6. SEBI conducts inquiries and audit of stock exchanges. www.VipinMKS.com Page 7