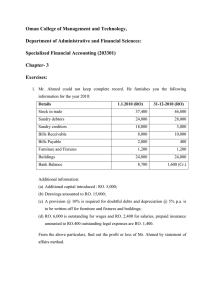

Professor Vipin 2014 Unit 9 Accounts from Incomplete Records

advertisement

Professor Vipin 2014 Unit 9 Accounts from Incomplete Records Meaning Accounting records which are not prepared in accordance with double entry system method are described as accounts for incomplete records. Salient Features 1. 2. 3. 4. Apply of personal accounts only (ignores nominal and real accounts) Maintenance of cash book. (Cash book is prepared) Based on original vouchers. (Collection of data is made with original vouchers) Lack of Similarity. (Method of preparation of books differs from firm to firm, it prepared as per the need of the business. 5. Preparation of final accounts. (After converting the information into double entry system final accounts are prepared. Due to this Statement of affairs is prepared instead of Balance sheet) Uses 1. 2. 3. 4. 5. Easy method (Not requires any specific knowledge) Economical (Can be prepared by without having more staff) Suitable for small concerns (Few assets and liabilities are to be recorded) Not – rigid (Can be modified/changed as per requirement of business) Easy finding of profit & losses. (Only opening and Closing capital is required) Limitations 1. 2. 3. 4. 5. Impossible to find fraud (As Trial balance is ignored) Incomplete system (No set rules are followed) Unable to find adequate profit & losses. (Ignorance of nominal accounts) Difficulty in preparation of balance sheet.(Lack of valuation of goodwill) Unable to retain full control on asserts. (Real accounts are ignored, it is difficult to make full control on assets) 6. Unsuitable for planning in control(Lack of reliable figure) 7. Lack of internal checking(Fails to adopt double entry system) 8. Improper evaluation of asserts (Ignorance of certain information like depreciation etc.) www.VipinMKS.com Page 1 Professor Vipin 2014 Difference Between Double Entry System and Accounts from Incomplete Records 1. Recording of both aspects (Double entry records every transaction and incomplete records few transactions) 1. Type of accounts (All accounts are considered in double entry only personal account are considered in incomplete records) 2. Trial balance (Trial balance is prepared in double entry system, trial balance is not prepared in incomplete record ) 3. Net profit/ loss (Profit/Loss is calculated by preparing trading and profit &loss a/c in double entry system, Statement of profit is prepared in incomplete records to find the same. 4. Financial position (Balance sheet is prepared in double entry and statement of affairs is prepared in incomplete records) 5. Adjustment (Adjustment are considered in double entry, while adjustments are not considered in incomplete records) Ascertainment of Profit and Loss under Incomplete Records Liabilities Bank Overdraft Bills payable Sundry Creditors Outstanding expenses Income received in advance Capital (Bal Fig) Amount Assets Cash in Hand Cash in Bank Bills receivable Sundry debtors Stock Prepaid expenses Accrued income Furniture Plant and Machinery etc Amount Format of Statement of Profit Closing Capital Add: Drawings Less: Opening Capital Additional capital introduced Profit during the year www.VipinMKS.com Page 2 Professor Vipin 2014 Example 1 Mr. Ramesh, the owner of a mobile shop maintains incomplete records of his business. He wants to know the result of the business in 31/12/98 and for that the following information are available: Particulars Cash in hand Bank Balance Furniture Stock Creditors Debtors 1-Jan-98 300 1500 200 1000 700 500 31-Dec-98 350 1600 200 1300 800 600 During the year he had withdrawn Rs. 1000 for his personal use and invested Rs. 500 as additional capital. Calculate his profit on 31/12/98 Statement of Affairs as on 1/01/98 Liabilities Creditors Capital (Bal Fig) - Opening Amount Assets 700 Cash in Hand Bank Balance Debtors Stock Furniture 3500 Amount 3 15 5 10 2 35 Statement of Affairs as on 31/12/98 Liabilities Creditors Capital (Bal Fig) - Closing www.VipinMKS.com Amount Assets 800 Cash in Hand 3250 Bank Balance Debtors Stock Furniture 4050 Amount 3 16 6 13 2 40 Page 3 Professor Vipin 2014 Statement of Profit as on 31/12/98 Particulars Closing Capital Add: Drawings Amount 3250 1000 4250 500 3750 2800 950 Less: Addl Capital Introduced Less: Opening capital on 1/1/98 Profit Note: If opening capital is given but not closing capital, only one statement of affairs will be prepared to find closing capital. Example 2 Ravi keeps incomplete records of his business. The following information is available: Particulars Bank Stock in Trade Sundry Debtors Furniture Investment Cash in Hand Sundry Creditors Bills Payable Loan 31/12/11 4200 (cr) 31/12/12 11200 (dr) 30000 60000 10000 10000 1000 50000 2000 40000 57000 10000 10000 4000 54000 1000 6000 1. Ravi withdrew Rs. 500 each month during first half of the year and Rs. 400 each for the remaining period of the year. 2. He withdrew Rs. 10000 for his daughter’s fees and Rs. 2000 for his son’s fees. 3. He also used goods worth Rs. 3000 for domestic purposes 4. In October 2010 he received a lottery prize of Rs. 10000 of which Rs. 8000 was invested in the business 5. He sold his scooter for Rs. 7000 and proceeds were utilized for the business. 6. Furniture is to be depreciated at 10% p.a and provision for doubtful debts is to be created at 5%. 7. He has not paid salary of Rs. 600 and Rent of Rs. 400 was due. 8. Commission earned but not received was Rs. 4800. Find the profit and redraft statement of affairs. www.VipinMKS.com Page 4 Professor Vipin 2014 Combined Statement of Affairs as on 01/01/12 and 31/12/12 Liabilities Bank OD Sundry Creditors Bills Payable Loan Borrowed Capital (Bal Fig) 1/1/2012 31/12/2012 4200 50000 54000 2000 1000 6000 54800 71200 111000 Assets Bank Stock in Trade Sundry Debtors Furniture Investment Cash 1/1/2012 31/12/2012 11200 30000 40000 60000 57000 10000 10000 10000 10000 1000 4000 111000 111000 111000 Statement of P&L as on 31/12/12 Particulars Closing Capital Add: Drawings Made Cash: Jan to Jun 500x6 Jul to Dec 400x6 Daughter Fees Son Fees Goods Less: Additional Capital Introduced Lottery Sale Proceeds of Scooter Amount Amount 71200 3000 2400 10000 2000 17400 3000 8000 7000 Adjusted Closing Capital Less: Opening Capital Gross Profit Less: Expenses and Losses Provision for doubtful debts (57000x5%) Depreciation on Furniture (10000x10) Outstanding salary Outstanding rent Add: Incomes and Gains Commission earned but not received Net Profit www.VipinMKS.com 20400 91600 15000 76600 54800 21800 2850 1000 600 400 4800 4850 16950 4800 21750 Page 5 Professor Vipin 2014 Revised Statement of Affairs as on 31/12/2012 Liabilities Creditors Bills Payable Loan Outstanding Salary Capital: Add: Addl Capital Net Profit Less: Drawings www.VipinMKS.com Amount 54800 15000 21750 91550 20400 Amount 54000 1000 6000 Assets Bank Stock Sundry Debtors 600 Less: Prov 400 Furniture Less: Depreciation Investments Cash Commission earned not 71150 received 133150 Amount Amount 57000 2850 10000 1000 54150 9000 10000 4000 4800 133150 Page 6