Chapter 20 I. Accounting for Differences A.

advertisement

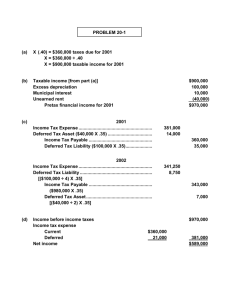

Chapter 20 Chapter 20 - Accounting for Income Taxes I. II. Accounting for Differences A. Pre-tax Financial Income [on the Income Statement] is determined in accordance with GAAP. B. Taxable Income [on the Tax Return] is determined in accordance with the rules and regulations of the IRS. C. The basic objectives of measuring income are different for the IRS and GAAP. Accordingly, income reported on the Income Statement is often different from Income reported on the Tax Return. Two Types of Differences A. Permanent Differences Items that: 1. enter into the determination of financial income but will never enter into the determination of taxable income, or 2. enter into the determination of taxable income but will never enter into the determination of financial income. #1 is more common Examples: 1. 2. 3. Proceeds [and premiums] from Life insurance policies Interest on Municipal bonds Fines and Penalties Since Permanent differences affect only the current period, there are NO DEFERRED TAX CONSEQUENCES!! ACCY 304 1 Chapter 20 B. Temporary [Timing] Differences Textbook definition - Temporary differences arise when the Tax Basis of an asset or liability differs from the reported amounts in the financial statements. My definition - When an income or expense item is recognized in one year on the income statement and another year on the tax return. Examples: 1. 2. 3. 4. 5. 6. Accelerated vs. straight-line depreciation Unearned Rent or Subscription Income Warranty Costs Installment Sales Use of the Equity method in accounting for investments Prepaid Insurance and other contracts Since these items ORIGINATE in one period and REVERSE in another, the tax consequences are DEFERRED, and result in deferred income taxes. C. Types of Deferrals 1. When the differences result in FUTURE TAXABLE AMOUNTS: When Current Taxable Income < Current Financial Income A. B. Higher Income Amounts [on the tax return] in future periods, or Lower Expense Amounts [on the tax return] in future periods This results in a DEFERRED TAX LIABILITY Sample journal entry: Income Tax Expense [based on Income Statement] Deferred Tax Liability [Deferred income x Tax rate] Income Tax Payable [based on the Tax Return] 2. When the differences result in FUTURE DEDUCTIBLE AMOUNTS: When Current Taxable Income > Current Financial Income A. B. Lower Income Amounts [on the tax return] in future periods, or Higher Expense Amounts [on the tax return] in future periods This results in a DEFERRED TAX ASSET ACCY 304 2 Chapter 20 Sample journal entry: Income Tax Expense [based on Income Statement] Deferred Tax Asset [Deferred income x Tax rate] Income Tax Payable [based on the Tax Return] III. Tax Rates A. Deferred income tax assets and liabilities are recorded at RECOVERABLE amounts. This means that they are recorded using the tax rates that will be in effect when the temporary difference reverses. B. Tax rates other than the current tax rate should be used if the future tax rates have been enacted into law. If the future tax rate has not yet been enacted, the current tax rate should be used. C. When a tax rate change is enacted, and deferred tax assets and liabilities exist, the effect of the change in tax rate is recorded immediately in the deferred account and the income tax expense account. SEE EXAMPLE ON PAGES 1040 - 1041 D. V. The appropriate enacted tax rate is the AVERAGE tax rate when graduated tax rates exist. Net Operating Loss Carryback and Carryforward A. Tax laws permit a corporation that experiences alternate periods of income and losses to equalize their tax burdens by matching loss periods against income periods. 1. NOL Carryback If a loss is suffered in the current period, the corporation is permitted to offset the loss against the previous three years' income. This would necessitate filing amended tax returns for the three previous years and claiming a tax refund. For book purposes, the income tax effect is recognized in the year of the loss, since the loss gives rise to a refund that is both measurable and currently realizable. 2. NOL Carryforward If the NOL is not fully absorbed through the Carryback, OR the corporation decides not to carry the loss back, the NOL can be carried forward for 15 years. Because carryforwards are used to offset future taxable income, the tax effect of a loss carryforward is a Deferred Tax Asset. SEE EXAMPLES ON PAGES 1042-1043 ACCY 304 3