LESSON 5 INCOME TAX

advertisement

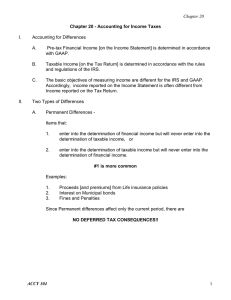

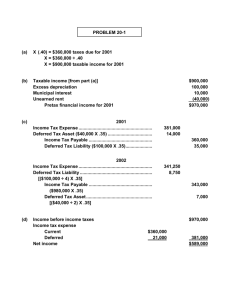

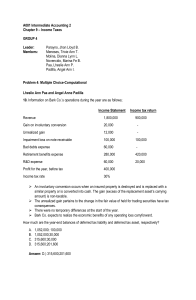

ACCOUNTING FOR INCOME TAXES CHAPTER 16 INCOME TAXES Learning Objectives The concept of deferred taxes Permanent differences: Temporary differences. Apply the concept & compute: Changes in Enacted Tax rates Use of Valuation Allowance The Provisions of Tax loss carry-backs/forwards Financial statement presentation and disclosure 2 FUNDAMENTAL REPORTING Financial & Tax Reporting FINANCIAL REPORTING - Useful Information INCOME TAX SYSTEM: Equitable collection of revenue 3 Fundamentals of Accounting for Income Taxes FINANCIAL REPORTING TAX REPORTING vs. SEC Investors and Creditors Pretax Financial Income GAAP Income Tax Expense Taxable Income Tax Code Income Tax Payable INCOME COMPUTATION: Two sets of rules Pretax Financial (Accounting) Income: – according to GAAP (FASB 109) is income before income taxes for financial reporting purposes Taxable Income: - according to IRS rules is the amount of income on which the income tax is based Therefore the above two income differ 5 DIFFERENT TAXABLE Depreciation GAAP: (based on estimated amount) IRS: The Modified Accelerated Cost Recovery System (MACRS) Page 6 Temporary Differences TIMMING DIFFERENCES A temporary difference corporation’s pretax financial income & taxable income that “originates” in one or more years and “reverses” in later years. 7 HOW IS ADVANCED SUBSCRIPTION RECORDING ACCORDING TO: GAAP? IRS? For recording expense we need GAAP reporting For Income tax payment we need IRS rule STOP & THINK! Is it possible for a company to have both deferred tax assets and deferred tax liability at the same time? If so, How? Give Example! Let’s Illustrate Examples: Types of Temporary Differences Deferred tax assets result in deductible amounts in the future. Deferred tax liabilities result in taxable amounts in the future. Permanent Differences Some items of revenue and expense that a corporation reports for financial accounting purposes are never reported for income tax purposes. These permanent differences never reverse in a later accounting period. 11 Book-Tax Differences – Permanent Examples of permanent book-tax differences Tax-exempt state and local bond interest income Nondeductible expenses incurred to generate state and local bond interest income Life insurance proceeds (death benefits) 50% of meals and entertainment Political contributions Fines and penalties Bribes, kickbacks and illegal payments Dividends-received deduction: Certain deductions Professor Vedd CONT… PART II CHANGES IN TAX RATES ACCOUNTING FOR INCOME TAXES CHAPTER 16 PART II INCOME TAXES DEFERED TAX: WITH CHANGES IN ENACTED TAX RATES Professor Vedd Tax Rate Considerations Deferred tax assets and liabilities should be determined using the future tax rates, if known. The deferred tax asset or liability must be adjusted if a change in a tax law or rate occurs. Revision of Future Tax Rates When a change in tax rate is enacted, its effect should be recorded immediately The effect is reported as an adjustment to tax expense in the period of change Changes in tax rates are treated just like any other change in estimate, prospectively See example following slide 16 Net Operating Losses (NOL) Tax laws often allow a company to use tax NOLs to offset taxable income in earlier or subsequent periods. When used to offset earlier taxable income: Called: operating loss carryback. Result: tax refund. When used to offset future taxable income: Called: operating loss carryforward. Result: reduced tax payable. Accounting for Net Operating Losses Loss Carryback Back 2 years and forward 20 years Losses must be applied to earliest year first Loss Carryforward May elect to forgo loss carryback and Carryforward losses 20 years A company would most likely choose the carry-forward option for a net operating loss if the company expected higher tax rates in the future compared to the past 18 Balance Sheet Classification Deferred tax assets/liabilities are classified as current or noncurrent based on the classification of the related asset or liability. Disclose the following: Total of all deferred tax liabilities. Total of all deferred tax assets. Total valuation allowance recognized. Net change in valuation account. Approximate tax effect of each type of temporary difference (and carryforward). INTERPERIOD/INTRAPERIOD INCOME TAX ALLOCATION INTERPERIOD: is to recognize an asset or liability for the tax consequences of temporary differences that exist at the balance sheet date. INTRAPERIOD: The total income tax expense for a reporting period is allocated among the financial statement items that gave rise to the income tax expense. The following items should be reported net of their respective income tax effects: • Income (or loss) from continuing operations • Discontinued operations • Extraordinary items • Changes in accounting principle • Prior period adjustments (to the beginning retained earnings balance) 20