Document 14545005

advertisement

The SIJ Transactions on Industrial, Financial & Business Management (IFBM), Vol. 3, No. 8, October 2015

Stockholders’ Special Benefit System

and Shop Events in Japan:

An Event Study Analysis

Michiko Miyamoto*

*Department of Management Science and Engineering, Akita Prefectural University, Yurihonjo, Akita, JAPAN.

E-Mail: miyamoto{at}ism{at}ac{at}jp

Abstract—Stock prices are affected by a number of factors and events. Marketing strategies based on

increasing customer lifetime value can have a positive impact on shareholder value and influence stock prices

in a predictable manner [Kumar & Denish, 12]. A system called “kabunushi-yutai” in Japan, which translated

means “a shareholders' special benefit plan,” is a gift that a growing number of Japanese companies send to

stockholders as a courtesy, to show their appreciation for the support of their stockholders. The purpose of this

study is to compare the impact of shareholders’ special benefit plan and the impact of sales promotion of the

worldwide recognized ice cream scoop shop have on its daily stock returns. An event study method is applied

to isolate the events and measure the abnormal returns of this shop for 2011 and 2012 in terms of the

shareholders' special benefit plan and sales campaign activities. The empirical results suggest that the averaged

abnormal returns and cumulative abnormal returns are increased toward the date of allotment in order to

capture shareholders’ special benefit. It implies that the shareholders’ special benefit successfully attract

investors, particularly individual ones. The results also show that each sales campaign affects the stock price in

some extent.

Keywords—Averaged Abnormal Returns; Cumulative Abnormal Returns; Event Study; Dividend;

Shareholders’ Special Benefit; Sales Promotion.

Abbreviations—Abnormal Returns (AR); Average Abnormal Returns (AAR); Cumulative Abnormal Return

(CAR); Cumulative Averaged Abnormal Returns (CAAR); Japan Air Lines (JAL); Tokyo Stock Price Index

(TOPIX).

I.

S

INTRODUCTION

TOCK prices are affected by a number of factors and

events, some of which influence stock prices directly

and others that do so indirectly. One of factors which

affect stock prices is announced earnings (e.g., Ball &

Brown, [2], Joy et al., [10], Watts [25], Rendleman et al.,

[20], and Foster et al., [8]). Knowledge of the contents of the

forthcoming earnings announcement is known to yield an

abnormal return. Many firms conduct marketing activities to

promote products, brands or stores as such are one way to

increase sales, and profit margin. Srinivasan & Hanssens [21]

explore marketing concepts such as brand equity, customer

equity, customer satisfaction, product quality, marketing-mix

actions, and research and development, and establish the links

among marketing actions, value creation, and observed

market values.

Dividends are treated as a proxy for estimated future

earnings. The dividends increase will send a message to the

market that the future earnings will increase, and vice versa

ISSN: 2321-242X

[Miller & Modigliani, 14]. Using the event study on event

window surrounding the day of dividend announcement, a

significant positive reaction between stock dividend

announcement and stock return have found, but it was a

significant negative relation between cash dividend

announcement and the stock return [Wang, 24].

A system called “kabunushi-yutai” in Japan, which

translated means “a shareholders' special benefit plan,” is a

gift that a growing number of Japanese companies send to

stockholders as a courtesy, to show their appreciation for the

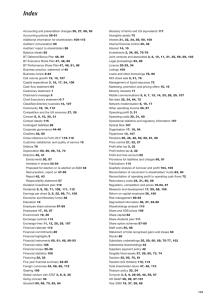

support of their stockholders. According to Daiwa Investor

Relations [7], number of companies which conduct

shareholders' special benefit plans in 1992 was 247, has

grown to 1,150, about 30% of entire Tokyo Stock Exchange

listed companies of 3,600, at the end of September, 2014 (see

figure 1).

“A shareholders' special benefit plan” is non-taxable

gifts, which give away “kabununi-yutai-ken,” i.e., “the

stockholders complimentary tickets.” The practice seems to

be unique to Japanese corporations, which give special

© 2015 | Published by The Standard International Journals (The SIJ)

123

The SIJ Transactions on Industrial, Financial & Business Management (IFBM), Vol. 3, No. 8, October 2015

treatment to shareholders when there are no dividends to

distribute. If the company is a manufacturer, it may actually

give away its products or discounts on its products. In the

case of Japan Air Lines (JAL), shareholders received coupons

that could be used for discounts of up to 50 percent on air

fares, tours, hotels and other JAL-related services [Brasor &

Tsubuku, 5].

dividend, sales promotions and event study, and the

hypotheses are stated. Section 3 describes data. Section 4

presents the methodology. Section 5 presents the results of

the event studies. The results are discussed in Section 6.

II.

LITERATURE

2.1. The Stock Price, Dividend and An Event Study

1,200

1,000

800

600

400

200

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

0

Figure 1: Number of Companies Conduct Shareholders' Special

Benefits Plans

Source: Daiwa Investor Relation [7]

The stockholders complimentary tickets system works

like those of dividends. In order to receive these tickets,

shareholders have to be in the shareholder list of a certain

day. The Oriental Land group, the operator of Tokyo Disney

Resort, for example, provides complimentary passports twice

a year to the Oriental Land stockholders whose names are

listed on the registered and/or beneficial stockholders' lists as

of September 30 and March 31, in proportion to the number

of stocks held. In addition to the current stockholder benefit

program, Oriental Land will distribute a complimentary

passport ticket for stockholders for Tokyo Disney Resort’s

Anniversaries, held every five years [OLC Group, 17]. The

shareholders' special benefit plan seems to attract many

individual investors to the stock market.

The purpose of this study is to compare the impact of

shareholders’ special benefit plan and the impact of sales

promotion at one of the worldwide recognized ice cream

scoop shop have on the its daily stock returns. The shop is

one of the affiliates of a Japan-based company mainly

engaged in the operation of ice cream store chains, as well as

the manufacture and sale of ice cream products. The shop

offers various kinds of ice cream, sherbet and specialty

desert. In order to boost sales, the shop holds several price

related and seasonal promotions. The stock of the shop’s

parent company is listed on the Tokyo Stock Exchange.

The author applies an event study method to isolate the

events and measure the abnormal returns of this shop for

2011 and 2012 in terms of the shareholders' special benefit

plan and sales campaign activities.

The rest of the paper is organized as follows. Section 2

introduces previous research using the stock price and

ISSN: 2321-242X

How dividend policy decisions affect a firm’s stock price

have been studies for many years by scholars using data of

the stock exchanges around the globe. Charest [6] selected

dividend information from the 1947-67 period of the New

York Stock Exchange, and analysed the risk and return

behaviour of common stocks around dividend changes. He

found that stocks’ residuals after dividend changes tend to be

anomalous as if the Exchange was slow in digesting dividend

information.

Liu & Hu [13] summarize literatures in dividend

payment policy in China. Wei Chen et al., [23] analyses the

dividend policy of Shanghai stock market and study the

existence and character of the signalling effect of dividend

policy in this market. This study showed that the degree of

Cumulative Abnormal Return (CAR) was very different from

different dividend policy. Wang (2014)’s result of 4,586

stocks listed on the Shanghai and Shenzhen Stock Exchange

for the period of 2006 to 2012 indicates that dividend

announcement depicts positive impact on stock return at the

time of announcement as well as immediately after such

announcements. There was a positive reaction after the

dividend announcement; however, there was a significant

negative relation between dividend announcement and the

stock return in cash dividend. Qiao & Yin Chen [26] found

that there was significantly positive statistical relationship

between the dividends and mix dividend policies of firms on

the stock market. But their study showed that the market was

not sensitive with cash dividends. Kumar et al., [11] found

that not only do stock returns reflect the firm’s dividend data

when published but they also anticipate future dividend

growth to some extent, based calendar year from January

2009 to December 2009. Patel & Prajapati [18] find the

empirical evidences of stock dividend announcement on

selected 20 companies of the Bombay Stock Exchange in

India, and try to investigate the existence of abnormal returns.

Their sample data was drawn from companies listed on the

Bombay Stock Exchange that have announced dividend over

the period of January 2008 through December 2011. They

found that Abnormal Returns on event day during any period

of dividend announcement, whereas Cumulative Average

Abnormal Returns has been found significant on event period

57 times positive move, 49 times negative move and 64 times

constant or near to zero volatility.

As for “kabunushi yutai” in Japan, Nose [16]

hypothesizes that stock prices would increase toward the date

of allotment for “Kabunushi Yutai” by using data samples of

624 companies. His empirical result shows that positive dairy

abnormal returns (AR) are observed three months prior to the

© 2015 | Published by The Standard International Journals (The SIJ)

124

The SIJ Transactions on Industrial, Financial & Business Management (IFBM), Vol. 3, No. 8, October 2015

event day, i.e., the allotment day for “kabunushi yutai.” AR

and raw return (RR) at the right allotment day (the event day)

are negative and statistically significant; however only

marginal share drops are observed. Isagawa & Suzuki [9] test

liquidities and prices of 187 companies which have

introduced “kabunushi yutai” systems for the period of 1998

and 2005. Their empirical findings include the liquidity ratio

of those companies increased after the introduction of the

system, since they could attract more individual investors. As

liquidity improves, their stock prices are increased as well.

2.2. Sales Promotion and An Event Study

Blattberg & Neslin [3] define a sales promotion as “an actionfocused marketing event whose purpose is to have a direct

impact on the behavior of the firm’s customer.” Sales

promotions are temporary and a “call-to-action.” If customers

do not take advantage of promotions within specified time

frames, they will lose the benefit offered by the promotions.

Sales promotions are almost always combined with some

type of communication (e.g., TV commercials or a retailer

advertisement) that the price is reduced and that the time

period is limited (price is reduced only up to some point in

time). Among different types of promotion defined by

Blattberg & Briesch [4], the shop in this study has employed

price reduction, free goods promotions, and constantly

offering free trials. This ice cream shop offers over 1,000

flavors of ice cream including frozen yogurt, beverages,

cakes and sundaes. According to Peopalove [19], the parent

company of this ice cream shop has various brand

promotions, among which is the Pink Day where customers

have to show up in pink on a Wednesday to savor double

scoop for a single scoop price. The 31% discount at every

31st of the month is well known. Their customers always

come back for more. Eventually, the brand promotions

created brand visibility and brand awareness for this ice

cream shop and they have been able to engage more exciting

ideas in future for their target audiences. As for brand

promotion, not only discounts and free gifts, but the parent

company of this ice cream shop has used celebrity

endorsements all over the world. An idle group, SHINee, in

Korea, Drew Barrymore and Sean "Diddy" Combs, in the

U.S. were chosen as the advertisement models for this brand.

In Japan, Tina Tamashiro, a fashion model who is popular

among teenagers, has recently been chosen in their

commercials. The parent company also partnered with a nonprofit group that donates books to low income families in the

US to hold an annual ‘Free Scoop Night’ to thank their

customers who help curb illiteracy. Other means of brand

promotion that was carried out by this company includes road

shows as well as seasonal brand promotions on Valentine’s

Day, Mother’s Day and Father’s Day.

There are several studies have examined consumers’

response to celebrity endorsement in advertising. Agrawal &

Kamakura [1] assess the impact of celebrity endorsement

contracts on the expected profitability of a firm by using

event study methodology. They defined the event day as the

date when the announcement of a contract or a forthcoming

ISSN: 2321-242X

contract between a firm and a celebrity first appeared in the

print media. They included 110 cases for a period of January

1980 and December 1992. They found that the market reacted

both positively and negatively to the announcement of

different celebrity endorsement contracts, which was

reflected in both positive and negative abnormal returns on

the event day. However, investors seem to value positively

the use of celebrities in advertisements on average. Recently,

social networking services have been used as promotional

platforms. Todri & Adamopoulos [22] studied the long-term

effectiveness of promotional events in social media

platforms, such as Twitter, by employing an event study

methodology. They found that the cumulative abnormal

returns are positive and statistically significant for brands

which participate in promotional events with explicit and/or

implicit advocacy are more likely to attract more followers

and expand their fan base.

The author has formed two hypotheses based on the

previous researches as follows;

Hypothesis 1: Kabunushi Yutai allotments are expected

to generate a significant positive market reaction.

Hypothesis 2: Sales campaigns are expected to be

associated with a significantly positive share market reaction.

III.

DATA

The actual sales data used in this study were obtained from an

ice cream shop in a large shopping mall located in Akita, a

northern part of Japan, by the courtesy of a shop owner. This

shop mainly sells ice cream as well as crepes and ice cakes.

Based on the historical records from 1979 to 2012 reported

by Japan Meteorological Agency, the weather condition in

Akita throughout the year is reported as follows; the warm

season lasts from June to September with an average daily

high temperature above 23°C (73°F). The hottest day of the

year is August, with an average high of 28°C (83°F) and low

of 22°C (71°F). The cold season lasts from December to

March with an average daily high temperature below 6°C

(43°F). The coldest day of the year is the end of January, with

an average low of -3°C (26°F) and high of 1°C (33°F). This

shop is one of franchisees of the world’s largest chain of ice

cream specialty shops. Ice cream and frozen desserts’ sales

data available from this source included daily and hourly

sales from January 2011 to December 2012. The sales data

were primarily recorded at the checkout counter. Figure 2

shows sales by month.

The shop offers seasonal events along with calendar

events; January (New Year), February (St. St. Valentine’s

Day), March (Easter), October (Halloween), and December

(Christmas). It also announces the addition of a new flavour

every month, e.g. Oreo Chocolate Mint in May. In April, the

shop’s parent company has been hosting a charitable event,

and any customer, who contributes, can receive a free scoop

of ice cream.

During the Golden Week, a collection of four national

holidays within seven days in Japan, starts on April 27 and

lasts until May 9, the shop’s official campaign offers

© 2015 | Published by The Standard International Journals (The SIJ)

125

The SIJ Transactions on Industrial, Financial & Business Management (IFBM), Vol. 3, No. 8, October 2015

customers with a double scoop, can order at more than 30

percent off the regular price. Their parent company launches

nationwide summer advertising campaign, using a popular

young male idle group to attract teenagers in Japan. The shop

continuously offers various campaigns to boost sales; these

events certainly help boosting sales, not only for summer, but

for cold winter season. Fig. 2 shows sales revenue by each

month at the shop, and Fig.3 shows sales revenue by each

campaign during 2012. Table 1 shows a list of major

campaign periods for 2011 and 2012.

As for the shareholders' special benefit plan, the parent

company provides complimentary coupons that could be

exchanged to their ice cream products twice a year to their

stockholders whose names are listed on the registered and/or

beneficial stockholders' lists as of June 30 and December 31,

in proportion to the number of stocks held.

1,00,00,000

30

25

80,00,000

20

60,00,000

15

10

40,00,000

5

20,00,000

0

Ave. Sales (yen)

DEC

NOV

SEP

OCT

JUL

AUG

JUN

MAY

APR

MAR

JAN

-5

FEB

0

Ave. temperature (°C)

Figure 2: Average Ice Cream Sales and Average Temperature by

Month

6,00,000

4,00,000

3,00,000

Valentine's Day 1st week

Easter 1st week

Tripple 1st week

Snowman 1st week

Halloween 1st week

Christmas 1st week

Valentine's Day 1st week

Valentine's Day Last Week

Easter 1st week

Easter last week

Tripple 1st week

Tripple last week

Snowman 1st week

Snowman last week

Halloween 1st week

Halloween last week

Christmas 1st week

Christmas last week

2,00,000

0

IV.

EVENT STUDY METHODOLOGY AND

TESTING FOR SIGNIFICANCE

4.1. Event Study

The event study methodology is the appropriate tool to

investigate the relation among a right allotment for

“shareholders' special benefit”, sales campaigns, and a stock

price reaction. Event studies yield as an outcome abnormal

returns (ARs), which are cumulated over time to cumulative

abnormal returns (CARs) and then averaged over several

observations of identical events to averaged abnormal returns

(AARs) and cumulative averaged abnormal returns CAARs.

These event study results are then oftentimes used as

dependent variables in regression analyses. Returns of day t20 to day t-20 were used to estimate the parameters of the

market model, where the Tokyo Stock Price Index (TOPIX)

is a proxy of market index. Then a market model is estimated

for each firm during this period by regression firm-specific

returns on TOPIX returns. The abnormal return of the i th

stock, is obtained by subtracting the normal or expected

return in the absence of the event, from the actual return in

the event period. For any security i the market model

equation is expressed as follows:

Rit i i Rmt it

(1)

Determine Abnormal Return (AR) in event windows and

post-event windows using the estimated result of estimated

market model as follows:

ARit Rit (i i Rmt )

(2)

5,00,000

1,00,000

Table 1: A List of Major Campaign Periods

2011

2012

Jan. 23-Feb.14

Jan. 24-Feb.14

Valentine’s Day Campaign

Mar. 24-Apr.22

Mar. 26-Apr.24

Easter Campaign

Jun.1-Jul.16

Jun.1-Jul.18

Triple Campaign

Jul.21-Sep.9

Jul.23-Sep.4

Snowman Campaign

Sep.29-Oct.31

Oct.1-Oct.31

Halloween Campaign

Nov.16-Dec.25

Nov.16-Dec.25

Christmas Campaign

Valentine's Day Last Week

Easter last week

Tripple last week

Snowman last week

Halloween last week

Christmas last week

where t=-t1,...,+tn,

CAR for the event period from is obtained as follows:

t2

CARi ARik

(3)

k t1

4.2. Testing for Significance

A test statistic is computed to check whether the average

abnormal return for each stock is statistically different from

zero as follows.

t

AR

SD AR

where

return, and

N

(4)

is standard deviation,

is average abnormal

is the number of companies.

Figure 3: Sales Revenue by Different Campaign Events during 2012

ISSN: 2321-242X

© 2015 | Published by The Standard International Journals (The SIJ)

126

The SIJ Transactions on Industrial, Financial & Business Management (IFBM), Vol. 3, No. 8, October 2015

RESULTS

20

5.1. The Shareholders’ Special Benefit

15

First, average abnormal returns (AAR), cumulative average

abnormal returns (CAAR) for the period from 17 days before

to 19 days after the event days (a right allotment day for the

shareholders' special benefit) of the end of June and the end

of December, 2011 and 2012 are calculated (see fig. 6 ~fig.

9). Just like the previous study [Nose, 16], the stock price

increased toward the date of allotment for “the shareholders'

special benefit” in order to capture it. Especially, in June,

2011, the stock price was almost unchanged for an entire

month except just before the last day when the investor can

obtain the right of allotment for the shareholders' special

benefit (see fig. 8). AAR and CAAR are popped up, which

imply that investor bought shares in order to obtain the right.

10

5.2. The Effects of Campaigns Events

-0.2

Next, average abnormal returns (AAR), cumulative average

abnormal returns (CAAR) during beginning and ending days

of sales campaigns for 2011 and 2012 are calculated (see fig.

10~fig.15). The event days are set for the actual event days,

for example, if it is Valentine’s Day, the event day would be

February 14. AAR and CAAR are calculated in order to

observe the stock movement for particular sales promotional

campaigns. As for the various sales campaigns, the stock

price tends to increase during the campaigns periods.

However, AAR and CAAR are almost unchanged in

February, even before the St. Valentine’s Day (see fig.10). It

is common for Japanese women to give chocolates to men,

not ice creams on Valentine's Day. The benign ice cream

sales may affect the stock price during the Valentine's Day

campaigns. As far as other campaigns concerned, after the

triple campaign, AAR and CAAR drop and then become

benign. After the Christmas day, AAR and CAAR drop

sharply and bounce back (see fig.15).

-0.4

5

-19

-17

-15

-13

-11

-9

-7

-5

-3

-1

1

3

5

7

9

11

13

15

0

-5

AAR

CAAR

Figure 6: The End of June, 2012 Kabunushi Yutai Day

0.4

0.2

0

-17

-15

-13

-11

-9

-7

-5

-3

-1

1

3

5

7

9

11

13

15

17

19

AAR

CAAR

Figure 7: The End of December, 2012 Kabunushi Yutai Day

0.2

-28

-25

-22

-19

-16

-13

-10

-7

-4

-1

2

5

8

0

-12

-9

-6

V.

-0.2

-0.4

-0.6

AR-2011

CAR-2011

AR-2012

CAR-2012

Figure 8: Valentine’s Day Campaign

3

2

1

0.1

0

0

-20 -17 -14 -11 -8 -5 -2 1

4

7 10 13 16 19

-0.1

-1 -14 -11 -8 -5 -2 1 4 7 10 13 16 19 22 25 28 31

-2

-0.2

AAR

AR-2011

AR-2012

CAAR

CAR-2011

CAR-2012

Figure 9: Easter Campaign

Figure 4: The End of June, 2011 Kabunushi Yutai Day

1

0.1

0.5

0

-19 -16 -13 -10 -7 -4 -1 2

5

8 11 14 17

-0.1

0

-14 -11 -8 -5 -2 1 4 7 10 13 16 19 22

-8 -5

-0.5

-0.2

AAR

CAAR

Figure 5: The End of December, 2011 Kabunushi Yutai Day

ISSN: 2321-242X

AR-2011

AR-2012

CAR-2011

CAR-2012

Figure 10: Triple Campaign

© 2015 | Published by The Standard International Journals (The SIJ)

127

The SIJ Transactions on Industrial, Financial & Business Management (IFBM), Vol. 3, No. 8, October 2015

promotion, coordinating all media used in the most effective

manner as a means of support for the campaign.

4

2

REFERENCES

0

-10 -8 -6 -4 -2 0 2 4 6 8 10 12 14 16 18 20

-2

AR-2011

AR-2012

CAR-2011

CAR-2012

Figure 11: Snowman Campaign

[1]

[2]

[3]

0.6

0.4

[4]

0.2

-0.2

-21

-19

-17

-15

-13

-11

-9

-7

-5

-3

-1

1

3

5

7

9

0

AR-2011

AR-2012

CAR-2011

CAR-2012

[5]

[6]

Figure 12: Halloween Campaign

[7]

0.5

[8]

0

-15 -13 -11 -9 -7 -5 -3 -1 1 3 5 7 9 11 13

[9]

-0.5

AR-2011

AR-2012

CAR-2011

CAR-2012

[10]

Figure 13: Christmas Campaign

[11]

VI.

CONCLUSION

The purpose of this study is to compare the impact of

shareholders’ special benefit plan and the impact of sales

promotion of the worldwide recognized ice cream scoop shop

have on the its daily stock returns. The empirical results

suggest that the AAR and CAAR are increased toward the

date of allotment for “kabunushi yutai” in order to capture

shareholders’ special benefit, which supports the hypothesis

1. It implies that the shareholders’ special benefit

successfully attract investors, particularly individual ones.

The mixed results are obtained for the hypothesis 2. Each

sales campaign affects the stock price in some extent.

However, there are some campaigns do not have impact on

the stock price. The ice cream has a high seasonality, but that

sales themselves are becoming more prevalent as a means of

promotion at the shop like this company tries to achieve.

Managerially implication for a seasonally uncertain retail

environment; there should be a focus on objectives such as

the movement of stock and maintenance of traditional

seasonal sales that consumers may have come to expect. To

achieve these objectives, retailers in highly seasonal

industries should concentrate on carefully planning the

ISSN: 2321-242X

[12]

[13]

[14]

[15]

[16]

[17]

[18]

J. Agrawal & W.A. Kamakura (1995), “The Economic Worth

of Celebrity Endorsers: An Event Study Analysis”, Journal of

Marketing, Vol. 59, No. 3, Pp. 56–62.

R. Ball & P. Brown (1968), “An Empirical Evaluation of

Accounting Income Numbers”, Journal of Accounting

Research, Vol. 6, Pp. 159–178.

R.C. Blattberg & R.A. Briesch (2012), “Sales Promotions”,

Chapter in “The Oxford Handbook of Pricing Management”,

Editors: O. Özer R R. Phillips, Oxford: Oxford University

Press.

R.C. Blattberg & S.A. Neslin (1990), “Sales Promotions:

Concepts, Methods and Strategies”, Englewood Cliffs, N.J.:

Prentice Hall.

P. Brasor & M. Tsubuku (2010), “Stockholder Coupons Bite

JAL in the Butt, Yen for Living”, The Japan Times, Jan. 17th.

http://blog.japantimes.co.jp/yen-for-living/stockholdercoupons-bite-jal-in-the-butt/, Date of access. May 6, 2015.

G. Charest (1978), “Dividend information, Stock Returns, and

Market Efficiency II”, Journal of Financial Economics, Vol. 6,

No. 2/3, Pp. 297–330.

Daiwa Investor Relations (2015), Kabunushi Yutai Guide (in

Japanese), Tokyo.

G. Foster, C. Olsen & T. Shevlin (1984), “Earnings Releases,

Anomalies, and the Behavior of Security Returns”, The

Accounting Review, Vol. 59, Pp. 574–603.

N. Isagawa & K. Suzuki (2008), “Effects of Introduction of

Kabunushi Yutai on Stock Prices”, Graduate School of

Business Administration, Kobe University Discussion Paper

Series.

O.M. Joy, R. Litzenberger & R. McEnally (1977), “The

Adjustment of Stock Prices to Announcements of

Unanticipated Changes in Quarterly Earnings”, Journal of

Accounting Research, Vol. 15, Pp. 207–225.

S. Kumar, A. Mahadevan & S. Gunasekar (2012), “Market

Reaction to Dividend Announcement: An Empirical Study

using Event Study Technique”, Prestige International Journal

of Management & IT-Sanchayan, Vol. 1, No. 1, Pp. 141–153.

V. Kumar & S. Denish (2011), “Can Marketing Lift Stock

Prices?”, MIT Sloan Management Review, 52.4, Summer: 24–

26.

S. Liu & Y. Hu (2005), “Empirical Analysis of Cash Dividend

Payment in Chinese Listed Companies”, Nature and Science,

Vol. 3, No. 1, Pp. 65–70

M.H. Miller & F. Modigliani (1961), “Dividend Policy,

Growth, and the Valuation of Shares”, Journal of Business,

Vol. 34, No. 411–433.

M. Miyamoto (2015), “Event Study of a Stockholders' Special

Benefit System and Shop Events in Japan”, Proceedings of

Annual Symposium on Management and Social Sciences

(ASMSS), Pp. 536–545.

Y. Nose (2015), “Stock Performance of Companies which

Implement Shareholders' Special Benefit Plan”, The Economic

Studies of Securities, 49, 1-8-1-1-8-13. (in Japanese).

OLC Group (2015), “Stockholder Benefit Program”,

http://www.olc.co.jp/en/ir/ benefit.html, Date of access, May 6,

2015

N. Patel & K. Prajapati (2014), “Impact of Dividend

Announcement on the Stock Prices of Indian Companies: An

Empirical Evidence”, ELK Asia Pacific Journals, Vol. 5, No. 2.

© 2015 | Published by The Standard International Journals (The SIJ)

128

The SIJ Transactions on Industrial, Financial & Business Management (IFBM), Vol. 3, No. 8, October 2015

[19]

[20]

[21]

[22]

[23]

Peopalove (2011), “Brand Promotion Leads the Way”,

Brandtalk,

http://www.peopalove.com/brandtalk/2011/

feb/wanted.html, retrieved on October 23, 2015.

R.J. Rendleman, C.P. Jones & H.A. Latane (1987), “Further

Insight into the Standardized Unexpected Earnings Anomaly:

Size and Serial Correlation Effects”, The Financial Review,

Vol. 22, Pp. 131–144., Article first published online: 9 MAR

2005.

S. Srinivasan & D.M. Hanssens (2009), “Marketing and Firm

Value: Metrics, Methods, Findings and Future Directions”,

Journal of Marketing Research, XLVI, Pp. 293–312.

V. Todri & P. Adamopoulos (2014), “Social Commerce: An

Empirical Examination of the Antecedents and Consequences

of Commerce in Social Network Platforms”, Proceedings of the

35th International Conference on Information Systems.

Wei Chen, Xing Liu & Yuanxin Yang (1999), “An Empirical

Study on the Signaling Effect of Dividend Policy in Shanghai

Stock Market”, Chinese Journal of Management Science, Vol.

7, No. 3 (in Chinese).

ISSN: 2321-242X

C.P. Wang (2014), “The Effect of Dividend Announcement:

Evidence from the Emerging Market”, Proceeding of European

Financial Management Association 2014 Annual Meetings, Pp.

1–21.

[25] R.L. Watts (1978), “Systematic ‘Abnormal’ Returns after

Quarterly Earnings Announcements”, Journal of Financial

Economics, Vol. 6, Pp. 127–150.

[26] Yu Qiao & Yin Chen (2001), “Dividend Policy and Fluctuation

of Stock Market in Chinese Companies”, Economic Research,

4 (in Chinese).

Michiko Miyamoto studied at the State

University of New York College at Buffalo,

where she received her Bachelor of Science

degree (magna cum laude). She received her

MBA from the University of California at Los

Angeles. After a 7-year career with Goldman

Sachs and Company, obtained her PhD further

to a thesis about Econometrical Approaches to

Economic and Strategic Management Studies

at the University of Tsukuba, Graduate School of Systems

Management. In 2008, she joined the Department of Management

Science and Engineering at the Akita Prefectural University.

[24]

© 2015 | Published by The Standard International Journals (The SIJ)

129