Unit 2 Capital of a Company

advertisement

Unit 2

Capital of a Company

Share Capital – Meaning of Shares

Share capital denotes the amount of capital raised by the issue of shares, by a company. It is

collected through the issue of shares and remains with the company till its liquidation.

Share capital is owned capital of the company, since it is the money of the shareholder and

the shareholder are the owners of the company. The total share capital is divided into small

parts and each part is called a share. Share is the smallest part of the total capital of a

company.

Types of Shares

The capital of the company can be divided into different units with definite value called

shares. Holders of these shares are called shareholders or members of the company. There

are two types of shares which a company may issue (1) Preference Shares (2) Equality

Shares.

1. Preferences Shares: Shares which enjoy the preferential rights as to dividend and

repayment of capital in the event of winding up of the company over the equity

shares are called preference shares. The holder of preference shares will get a fixed

rate of dividend. Preference shares may be

a) Cumulative Preference Share: If the company does not earn adequate profit in any

year, dividends on preference shares may not be paid for that year. But if the

preference shares are cumulative such unpaid dividends on these shares go on

accumulating and become payable out of the profits of the company, in subsequent

years. Only after such arrears have been paid off, any dividend can be paid to the

holder of quality shares. Thus a cumulative preference shareholder is sure to receive

dividend on his shares for all the years out of the earnings of the company.

b) Non-cumulative Preference Shares: The holders of non-cumulative preference shares

no doubt will get a preferential right in getting a fixed dividend it is distributed to

quality shareholders. The fixed dividend is to be paid only out of the divisible profits

but if in a particular year there is no profit as to distribute it among the shareholders,

the non-cumulative preference shareholders, will not get any dividend for that year

and they cannot claim it in the next year during which period there might be profits.

If it is not paid, it cannot be carried forward. These shares will be treated on the

same footing as other preference shareholders as regards payment of capital in

concerned.

c) Redeemable Preference Shares: Capital raised by issuing shares, is not to be repaid

to the shareholders (except buy back of shares in certain conditions) but capital

raised through the issue of redeemable preference shares is to be paid back by the

raised thought the issue of redeemable preference shares is to be paid back to the

company to such shareholders after the expiry of a stipulated period, whether the

company is wound up or not. As per section (80) 5a, a company after the

commencement of the Companies (Amendment) Act, 1988 cannot issue any

preference shares which are irredeemable or redeemable after the expiry of a period

of 10 years from the date of its issue. It means a company can issue redeemable

preference share which are redeemable within 10 years from the date of their issue.

d) Participating or Non-participating Preference Shares: The preference shares which

are entitled to a share in the surplus profit of the company in addition to the fixed

rate of preference dividend are known as participating preference shares. After the

payment of the dividend a part of surplus is distributed as dividend among the

quality shareholders at a particulate rate. The balance may be shared both by equity

shareholders at a particular rate. The balance may be shared both by equity and

participating preference shares. Thus participating preference shareholders obtain

return on their capital in two forms (i) fixed dividend (ii) share in excess of profits.

Those preference shares which do not carry the right of share in excess profits are

known as non-participating preference shares.

2. Equity Shares: Equity shares will get dividend and repayment of capital after meeting

the claims of preference shareholders. There will be no fixed rate of dividend to be

paid to the equity shareholders and this rate may vary form year to year. This rate of

dividend is determined by directors and in case of larger profits, it may even be more

than the rate attached to preference shares. Such shareholders may go without any

dividend if no profit is made.

Difference between Equity and Preference Shares

Equity Shares

Preference Shares

Equity shares are those shares that do not Preference shares are those shares which

enjoy any preference as regards payment of enjoy preference as regards payment of

dividend and repayment of capital

dividend and repayment of capital

The rate of dividend is not fixed. It depends The rate of dividend on preference shares is

on the profits made by a company i.e. higher fixed

the profits, higher the dividend, lower the

profits, lower the dividend.

Equity shareholders are paid their capital Preference shareholders are paid their

after the preference shareholders are paid.

capital first

They have normal voting rights.

Preference shareholders do not have normal

voting rights

Equity shares have no classification.

Preference shares are classified into many

types like cumulative preference shares,

non-cumulative,

convertible

preference

shares, non-convertible preference shares,

participating

preference

shares,

non-

participating preference shares, redeemable

preference

shares

and

irredeemable

preference shares.

Equity shares receive dividend after it is paid These shareholders receives dividend first.

to preference shares

Debentures – Meaning

A Debenture is a debt security issued by a company (called the Issuer), which offers to pay

interest in lieu of the money borrowed for a certain period. In essence it represents a loan

taken by the issuer who pays an agreed rate of interest during the lifetime of the instrument

and repays the principal normally, unless otherwise agreed, on maturity.

These are long-term debt instruments issued by private sector companies. These are issued

in denominations as low as Rs 1000 and have maturities ranging between one and ten years.

Long maturity debentures are rarely issued, as investors are not comfortable with such

maturities

Features of Debentures

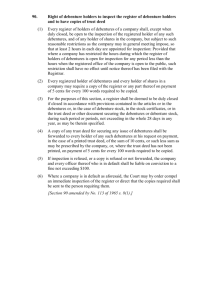

1. Debenture holders are not the owners of the company. They are considered the

creditors of the corporation or in other words, the company borrow money from

them through issuing debenture.

2. No voting rights. The debenture-holder is not a shareholder and cannot vote in the

company's general meetings.

3. Fixed rate of interest. A debenture with a fixed charge has a fixed rate of interest. It

can be presented as "10% Debenture". They are always unsecured and earns a fixed

rate of interest but has no share of the profit.

4. Compulsory payment of interest. The interest on debenture is payable irrespective

of whether there are profits made or not.

5. Redeemable and Irredeemable. A redeemable debenture is the one which is to be

repaid within a maturity period, while Irredeemable or Non-redeemable debentures

cannot be redeemed in the life time of the company and only repayable upon the

liquidation of the corporation.

Types of Debentures

Security

Secured/Mortgage Debentures: Debentures secured against assets of the company

.i.e. if the company is winding up, assets will be sold and debent

ure holders will be paid back. The charge/mortgage may be fixed or a floating

charge. If it is fixed, charge is on a specific asset say plant, machinery etc. If it is

floating charge, it means it is on general assets of the company.

Which assets are charged: The ones available with the company presently and also

assets in future

Mortgage deed: Includes nature/value of the security, date of interest payment, and

rate of interest, repayment terms, and rights of the debenture holders if the

company defaults. In the event of default of company to pay interest or principal

installment, they can recover their money via the assets mortgaged.

Unsecured/Naked Debentures: Debentures not secured against assets of the

company .i.e. if the company is winding up, assets will be not be sold in order to pay

the debenture holders. In other words, no charge is created on the assets of the

company which means that there is no security of interest and principal payment.

The creditworthiness and soundness of the company serves as a security.

Tenure

Redeemable Debentures: Debentures which have to be repaid within a certain

specified period. Eg: 5% 2 years Rs. 1000 debenture means redeemable period is 2

years(5%:interest/coupon payment). After redemption, they can be reissued.

Irredeemable/Perpetual Debentures: These can be paid back at any time during the

life of the company .i.e. there is no specified period for redemption. Hence they are

also called Perpetual Debentures. Nonetheless if the company has to wind up, then

they have to repay the debenture holders.

Registration

Registered Debentures: As the name suggested, these are debentures that are

registered with the company. It records all details of debenture holdings such as

name, address, particulars of holding etc. Interest shall be paid only to the registered

holder (treated as a non-negotiable instrument). They can be transferred by a

transfer deed.

Bearer Debentures: These can be transferred by mere delivery. Company does not

hold records for the debenture holder. Interest will be paid to the one who displays

the interest coupon attached to the debenture.

Coupon

Zero Coupon Debentures: Does not have a specified interest rate, thereby to

compensate, they are issued at a substantial discount. Interest: Difference in face

value and issue price.

Specific Coupon rate Debentures: Debentures are normally issued with an interest

rate which is nothing but the coupon rate. It can be fixed or floating. Floating is

associated with the bank rates.

Convertibility

Convertible Debentures (Fully/ Partly convertible): Debentures which can be

converted to either equity shares or preference shares by the company or debenture

holders at a specified rate after a certain period. A company can also issue Partly

Convertible Debentures whereby only a part of the amount can be converted to

equity/preference shares.

Non Convertible Debentures (NCDs): These can’t be converted into

equity/preference shares.

Advantages/Merits of Debentures

a) It enables a company to raise funds for a specific period.

b) No dilution of control as debenture holders don’t possess voting rights

c) Debenture (debt) enables the company to Trade on equity. It can pay dividend to

equity shareholders at a rate higher than overall ROI.

d) Debenture holders entitled to a fixed rate of interest. Eg: 10% debenture

e) They enjoy priority over other unsecured creditors with respect to debt repayment.

f) Suitable for conservative investors who seek steady ROI with little or no risk.

g) Interest on debentures is treated as expense and is tax deductible.

h) Company can adjust its gearing in accordance to its financial plan.

i) Debenture holders are regarded as creditors of the company and they receive

preference over equity shareholders and preference share holders.

Disadvantages/Demerits of Debentures

a) They have a fixed maturity; hence provision has to be made for repayment.

b) There is a limit to which funds can be raised through debentures.

c) It is risky if the company fails to pay interest or principal installment on time, as

debenture holders can file petition for winding up the company.

d) It is not suitable for a company with fluctuating earnings as it may also lead to

fluctuations in payment of dividend payable to equity shareholders.

e) With more risk, you get more return. Debentures being secure investments, returns

are less.

f) Like ordinary shares, debenture holders will not be regarded as owners of the

company and have no voting rights.

SEBI Guidelines for Equity Issue

1) Eligibility of Issuer: The company shall meet the following requirements –

Net Tangible Assets ≥ ` 3 crores (for 3 full years)

Should have track record of profitability in 3 out of previous years

Net worth ≥ ` 1 crore in three years

If change in name, at least 50% revenue for preceding 1 year should be from the

activity under new name

2) Size of the Public Issue:

Issue of shares to public ≥ 25% of the total issue,

The issue size should not be more that five

times the pre-issue net wort

3) Promoter Contribution:

Minimum Promoters contribution is 20-25% of the public issue.

Minimum Lock in period for promoters contribution is 5 years

4) Prospectus:

Abridged prospectus must be attached with every application form.

Risk factors must be highlighted

Objectives of the issue and the cost of the project should be disclosed

Company’s management, past history and present

business of the firm should be disclosed

Particulars of the company and other listed companies under the same

management who have made public issues during the past 3 years are to be

disclosed

5) IPO Grading:

A company which has filed the draft offer document for its IPO with SEBI is

required to obtain a grade from at least one CRA registered with SEBI like CARE,

ICRA, CRISIL and FITCH Ratings.

A company can appeal once if it is not satisfied with the rating it has been given.

However, it can assign a the task of IPO grading to more than one credit rating

company and choose the best rating.

IPO grades indicate how strong the company is with its fundamentals.

6) Timeframes for the Issue and Post- Issue formalities:

The min. period = 3 working days and the max. = 10 working days.

In case of over-subscription the company may have the right to retain the excess

application money and allot shares more than the proposed issue, which is

referred to as the ‘green-shoe’ option.

7) Dispatch of Refund Orders:

Refund orders have to be dispatched within 30 days of the closure of the Public

Issue.

8) Other regulations pertaining to IPO:

Underwriting is not mandatory but 90% subscription is mandatory for each issue

of capital to public except in disinvestment.

If the issue is undersubscribed then the collected amount should be returned

back (not valid for disinvestment issues).

If the issue size is more than ` 500 Crores , voluntary disclosures should be made

regarding the deployment of the funds and an adequate monitoring mechanism

to be put in place to ensure compliance.

Code of advertisement specified by SEBI should be adhered to.

SEBI Guidelines for Debenture Issue

a) Appointment and Duties of Debenture Trustees

In terms of Section 117 B, it has been made mandatory for any company making a

public/rights issue of debentures to appoint one or more debenture trustees before

issuing the prospectus or letter of offer and to obtain their consent which shall be

mentioned in the offer document. The Debenture Trustees shall not:

I.

Beneficially hold shares in a company.

II.

Beneficially entitled to monies which are to be paid by the company to the

debenture trustees.

III.

Enter into any guarantee in respect of principal debt secured by the

debentures or interest thereon.

This section also lists the functions that shall be performed by the Trustees. These

include:

I.

Protecting the interests of the debenture holders by addressing their

grievances.

II.

Ensuring that the assets of the company issuing debentures are sufficient to

discharge the principal amount.

III.

To ensure that the offer document does not contain any clause this is

inconsistent with the terms of the debentures or the Trust Deed.

IV.

To ensure that the company does not commit any breach of the provisions of

the Trust Deed.

V.

To take reasonable steps as may be necessary to undertake remedy in the

event of breach of any covenant in the Trust Deed.

VI.

To convene a meeting of the debenture holders as and when required.

If the debenture trustees are of the opinion that the assets of the company are

insufficient to discharge the principal amount, they shall file a petition before the

Central Government and the latter may after hearing the parties pass such orders as

is necessary in the interests of the debenture holders. As per the SEBI (Debenture

Trustees) Regulations, 1993, {hereinafter referred to as the 'Regulations'} a

Debenture Trustee can be a scheduled bank, an insurance company, a body

corporate or a public financial institution.

b) Debenture Trust Deed: A Debenture Trust Deed shall, interalia, include the following:

I.

An undertaking by the company to pay the Debenture holders, principal and

interest.

II.

Clauses giving the Trustees the legal mortgages over the company's freehold

and leasehold property.

III.

Clauses that may make the security enforceable in the event of default in

payment of principal or interest i.e. appointment of receiver, foreclosure,

sale of assets etc.

IV.

A clause giving the Trustees the power to take possession of the property

charged when security becomes enforceable.

V.

Register of Debenture holders, meeting of all debenture holders and other

administrative matters may be included in the Deed.

In addition thereto, the SEBI regulations have laid format of the Trust Deed in

Schedule IV to the regulations. Some of the important provisions would include

I.

Time limit of creation of security for issue of debentures.

II.

Obligations of the body corporate towards the debenture holders.

III.

Obligations towards the debenture holders - equity ratio and debt service

coverage ratio.

IV.

Procedure for the inspection of charged assets by the Trustees.

c) Creation of debenture Redemption Reserve: Section 117 C of the Act casts an

obligation on the company to create a Debenture Redemption Reserve. This account

will be credited with proceeds from the profits of the company arrived at every year

till redemption of the debentures. The Act, however, does not stipulate the time

period for creation of security. SEBI regulations provides for creation of security

within six months from the date of issue of debentures and if a company fails to

create the security within 12 months, it shall be liable to pay 2% penal interest to the

debenture holders. If the security is not created even after 18 months, a meeting of

the debenture holders will have to be called to explain the reasons thereof. Further,

the issue proceeds will be kept in escrow account until the documents for creation of

securities are executed between the Trustees and the company.

d) Default: In the event of failure on the part of the company to redeem the

debentures on the date of maturity, the Company Law Tribunal may, on the

application of any debenture holder, direct redemption of debentures forthwith by

payment of principal and interest due thereon. If a default is made in complying with

the orders of the Tribunal, every officer of the company who is in default shall be

punishable with imprisonment for a term which may extend to three years and shall

also be liable to fine of not less than Rs.500/- for every day during which the default

continues. (Section 117C) Further this offence is not compoundable under section

621A of the Act.

There are contradictions between the Companies Act and the SEBI regulations on

issues relating to:

I.

Utilisation of Debenture Redemption Reserves. The Act provides that the

Debenture Redemption Reserve will be used towards redemption of

debentures only whereas the SEBI regulation states that these will be a part

of the General Reserves, which can be utilised for the purpose of bonus

issues.

II.

Any debentures issued with a maturity period of 18 months or less is

exempted from the creation of Debenture Redemption Reserve Account,

whereas no such exemption is provided under the Companies Act.

III.

No Public Issue/Rights Issue of Debentures shall be made by a company

unless it has appointed one or more Debenture Trustees for such debentures

whereas under SEBI guidelines, appointment of Debenture Trustees is

compulsory only in case of debentures with maturity of 18 months or more.