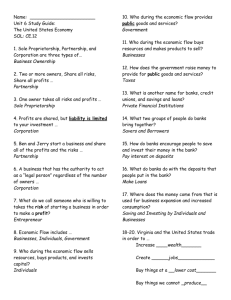

Journal #4: “We’ll all pay a steep price for... Summary Reckless behaviour of bankers threatens us with a...

advertisement

Journal #4: “We’ll all pay a steep price for greed of bankers” (December 2, ’07) Summary Reckless behaviour of bankers threatens us with a credit crunch and recession Governments support banks by giving them ready access to loans from central banks to balance their own books and insuring the public’s deposits at banks Major banks assume gov’ts can’t afford to let them fail because of the negative economic consequences therefore their profit driven top executives take unnecessary risks to increase profits U.S. banks made hundreds of billions of dollars of imprudent subprime loans to homebuyers who were a bad credit risk Now many borrowers cannot maintain payments causing housing prices to steeply decline as foreclosures increase U. S. banks deceived foreigners by packaging these risky mortgages as triple A investments, so now the greed of U.S. bankers will hurt foreigners including Cdns Larry Summers former U.S. Secretary of Treasury warns, “the capacity of the financial system to provide credit in support of new investment on the scale necessary to maintain economic expansion is increasingly in doubt.” This will mean that many people will not be able to borrow money for a house or car and others will lose their jobs therefore regulation is needed Cause – Effect Predictions 1. If bankers are allowed to continue to put profits ahead of prudence then further financial crises will occur in the future costing middle class Cdns their jobs as investment slows & the ability to be homeowners as loans become difficult. 2. If bankers are regulated more to prevent putting profits ahead of prudence then business will have access to sufficient funds for capital investment which increases productivity and workers’ pay and improves product quality. 3. If there is more of an educational emphasis placed on positive business ethics at university then bank executives will potentially make decisions that benefit Canadian society more than themselves (e.g. less loans for less short term profit, but less bad loans lead to long term stability creating jobs) Opinion 1. The government should penalize bank executives who engage in risky loan schemes to ensure that they will not be rewarded for such behaviour and continue to put millions of consumers at risk of financial hardship. 2. Business programs at universities should have a mandatory course on positive business ethics to encourage more bank executives and business leaders to behave in a more unselfish and caring manner. Questions 1. What are the major causes & effects of the present credit crunch in the world? 2. What are the most effective methods of dealing with the credit crunch problem?