Tax Units (thousands) CURRENT LAW

advertisement

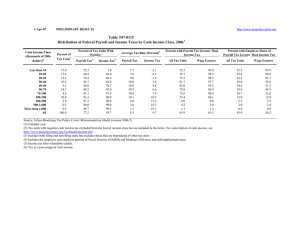

1-Jul-09 PRELIMINARY RESULTS http://www.taxpolicycenter.org Table T09-0333 Tax Units with Zero or Negative Tax Liability, 2009-20191 Tax Units (thousands) 2 Calendar Year 2013 2014 2009 2010 2011 2012 2015 2016 2017 2018 2019 151.5 153.5 155.4 157.3 159.7 161.8 164.0 166.0 168.0 170.0 171.9 68.9 44.9 56.9 36.6 53.5 34.0 53.8 33.7 54.2 33.5 55.1 33.6 55.9 33.6 56.7 33.7 57.5 33.8 58.4 33.9 34.9 22.8 30.2 19.4 29.0 18.4 29.6 18.5 30.3 18.7 31.4 19.1 32.2 19.4 33.2 19.7 34.1 20.1 35.0 20.4 20.3 13.4 20.3 13.2 19.9 12.8 19.8 12.6 20.5 12.9 21.5 13.3 22.8 13.9 23.8 14.4 24.9 14.8 25.9 15.2 27.0 15.7 71.0 46.9 69.2 45.1 62.6 40.3 59.3 37.7 59.5 37.3 60.0 37.1 60.7 37.0 61.5 37.1 62.3 37.1 63.2 37.2 64.1 37.3 35.0 22.8 32.9 21.2 31.7 20.2 32.2 20.2 32.9 20.4 33.9 20.7 34.7 20.9 35.6 21.2 36.6 21.5 37.5 21.8 20.3 13.4 20.3 13.2 20.4 13.2 20.4 13.0 21.1 13.2 22.1 13.7 23.4 14.3 24.4 14.7 25.5 15.2 26.5 15.6 27.6 16.0 71.0 46.9 69.2 45.1 71.0 45.7 67.8 43.1 68.0 42.6 68.4 42.3 69.3 42.2 69.8 42.1 70.4 41.9 71.2 41.9 71.9 41.8 35.0 22.8 35.9 23.1 34.6 22.0 35.0 21.9 35.6 22.0 36.6 22.3 37.5 22.6 38.3 22.8 39.2 23.1 40.1 23.3 20.3 13.2 20.5 13.2 20.4 13.0 21.1 13.2 22.2 13.7 23.5 14.3 24.5 14.7 25.5 15.2 26.6 15.6 27.6 16.0 CURRENT LAW Tax Units with Zero or Negative Individual Income Tax Number (millions) As percent of all tax units 71.0 46.9 Tax Units with Zero or Negative Sum of Income and Payroll Taxes Number (millions) As percent of all tax units 36.2 23.9 Tax Units with Zero or Negative Income and Payroll Tax Number (millions) As percent of all tax units ADMINISTRATION BASELINE 3 Tax Units with Zero or Negative Individual Income Tax Number (millions) As percent of all tax units Tax Units with Zero or Negative Sum of Income and Payroll Taxes Number (millions) As percent of all tax units 36.2 23.9 Tax Units with Zero or Negative Income and Payroll Tax Number (millions) As percent of all tax units ADMINISTRATION BUDGET PROPOSAL 4 Tax Units with Zero or Negative Individual Income Tax Number (millions) As percent of all tax units Tax Units with Zero or Negative Sum of Income and Payroll Taxes Number (millions) As percent of all tax units 36.2 23.9 Tax Units with Zero or Negative Income and Payroll Tax Number (millions) As percent of all tax units 20.3 13.4 Source: Urban-Brookings Tax Policy Center Microsimulation Model (version 0309-2) (1) Calendar year. (2) Excludes those that are dependents of other tax units. (3) The Administration baseline extends all provisions in the 2001 and 2003 tax acts that are currently scheduled to sunset on 12/31/10 (the estate tax is retained at its 2009 levels). The 2009 AMT patch is extended and the exemption, phaseout bracket threshold, and tax bracket threshold are indexed for inflation after 2009. (4) Proposal extends the Making Work Pay Credit, the Earned Income Tax Credit expansion; the Saver's credit expansion; creates automatic 401(k)s and IRAs; and extends the American Opportunity Tax Credit; reinstates the 36 percent and 39.6 percent rates; reinstates the personal exemption phaseout and limitation on itemized deductions for those taxpayers with AGI over $250,000 (married) and $200,000 (single); imposes a 20 percent rate on capital gains and qualified dividends for those taxpayers with AGI over $250,000 (married) and $200,000 (single); and limits the tax rate at which itemized deductions reduce tax liability to 28 percent.