The Impact of State Tax Subsidies for Private Long-Term Care... on Coverage and Medicaid Expenditures

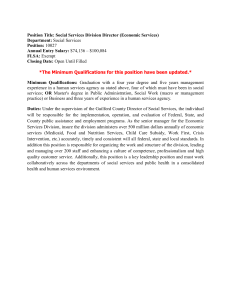

advertisement