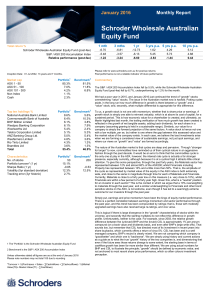

1 mth 3 mths 1 yr 3 yrs p.a. 5 yrs p.a.

advertisement

December 2015

Quarterly Report

Schroder Wholesale Australian

Equity Fund

Total return %

8

Schroder Wholesale Australian Equity Fund (post-fee)

S&P / ASX 200 Accumulation Index

Relative performance (post-fee)

1 mth

3 mths

1 yr

2.80

2.73

0.07

3.66

6.48

-2.82

-4.25

2.56

-6.81

3 yrs p.a. 5 yrs p.a.

5.88

9.19

-3.31

5.80

6.97

-1.17

10 yrs p.a.

6.09

5.63

0.46

Please refer to www.schroders.com.au for post-tax returns

Past performance is not a reliable indicator of future performance

Inception Date: 01 Jul 2002, 13 years and 6 months.

Market cap

ASX 1 - 50

ASX 51 - 100

ASX 101 - 300

Non Index

Cash

Portfolio1

85.3%

7.1%

4.2%

1.0%

2.4%

Benchmark2

81.7%

11.5%

6.8%

Top ten holdings %

National Australia Bank Limited

Commonwealth Bank of Australia

BHP Billiton Limited

Westpac Banking Corporation

Woolworths Ltd

ANZ Banking Group Ltd.

Telstra Corporation Limited

Wesfarmers Limited

Rio Tinto Limited

Brambles Ltd

Total

Portfolio1

8.7%

6.4%

6.4%

6.1%

5.0%

4.8%

4.7%

4.4%

4.4%

3.8%

54.7%

Benchmark2

5.8%

10.6%

4.1%

8.1%

2.3%

5.9%

5.0%

3.4%

1.4%

1.3%

47.9%

Characteristics

No. of stocks

Portfolio turnover* (1 yr)

Sharpe Ratio (1 yr)

Volatility (5yr standard deviation)

Tracking error (3yr historic)

Portfolio

49

13.1%

-0.35

11.9%

2.7%

1

Benchmark

200

2

0.03

12.2%

Commentary

The S&P / ASX 200 Accumulation Index rose by 6.5%, while the Schroder Wholesale

Australian Equity Fund (post-fee) rose by 3.7%, underperforming by 2.8% for the quarter.

Much as we might prefer otherwise, the market price of every listed equity investment is an

amorphous blend of human behaviour, macroeconomic and corporate fundamentals. Share

prices do not conform to a precise mathematical theorem. Investment returns over any period

will comprise an element which reflects investors’ assessment of the short and longer term

earnings power of a business and an element which reflects the equity market popularity

contest. The separation of luck and skill in the process of investing will remain arbitrary, and

anyone suggesting luck does not play a significant part is either disingenuous or delusional. If

all securities moved by the change in book value per share plus dividends every year,

dispersion of returns would bear no resemblance to the scorecard which also incorporates

human behaviour. The gaps are often large. Blackmores grew book value plus dividends by

around $55m between June 2014 and June 2015, a strong result and a very solid return on

capital. Based on equity market capitalisation of a little under $500m at June 2014, this

represented a solid return of around 12%. Market capitalisation rose by $830m during the

same time frame. Between June and December this year it rose a further $2.4bn, with book

value growth and dividends probably accounting for another $50m. Chinese proclivity for

western vitamins aside (they liked iron ore for a while too), when market capitalisation shifts

by more than 50 times the change in book value, it is fair to say that human behaviour is

having a reasonable impact on the returns of investors. Even if book value growth doubles to

$110m annually, the return on the current equity market value ($3.75bn) is now below 3%.

Emotion (or share price momentum) can be extremely powerful in both directions. This will not

dissuade commentators, including us, from providing narratives which support their

prescience in cases of success and portray the path and quantum of returns as eminently

foreseeable. They are not. The assassination of Archduke Franz Ferdinand in Sarajevo has

become widely accepted as the trigger for the chain of events which incited World War I and

would feature in almost every retrospective. If one were to have conducted a survey on the

day of the assassination as to whether and why the event would trigger a World War, I

suspect things would not have been as obvious as historians now convey. Harry Hindsight

has always been a successful investor!

As always, we have sought to position the portfolio to take advantage of what we believe is

fundamental mispricing based on our expectation of the longer term earnings power of

businesses. This has been roundly unsuccessful of recent times. Rightly or wrongly, we

believe that returns in the longer run should remain driven by changes in economic value

through time, whilst behavioural elements will oscillate. Returns in the past year have been

disproportionately driven by behavioural factors, with momentum as powerful as almost any

time in history. Nearly all resource and energy stocks have seen large percentages of their

market capitalisation erode over recent years. Whilst there has been some economic value

erosion from poor investment, the vast bulk is behavioural. Reasons for this momentum will

always be debatable; however, it is almost certain that several factors are contributing

disproportionately. These factors are inter-related and represent a far from exhaustive list.

1 The 'Portfolio' is the Schroder Wholesale Australian Equity Fund

2 Benchmark is the S&P / ASX 200 Accumulation Index

Unless otherwise stated all figures are as at the end of December 2015

Please note numbers may not total 100 due to rounding

*Turnover = ½(Purchases + Sales - ∑Cashinflows + ∑Cashoutflows) / ½(Market

Value(T0)+ Market Value(T1) - ∑Cashflows)

Economic growth – acceptance of the inevitability of low levels of economic growth moving

forward has become almost universal. If central bankers, the IMF and politicians reinforce it

with sufficient regularity, it becomes the accepted wisdom. The reasons for low growth get

less attention. The ability of individuals and businesses to harness resources to improve

productivity and improve quality of life is unlikely to have changed significantly. The

slowdown in reported growth is almost solely the result of an extended period of borrowing

from the future through aggressive credit growth. Pulling forward consumption, encouraging

population growth and deferring repayment has been the global recipe. They are the problem

and they have a cost.

Interest rates – Albert Edwards, Global Strategist at Societe Generale dubbed Alan

Greenspan and his central banker successors Ben Bernanke and Janet Yellen “economic war

criminals”. Whilst obvious hyperbole, his point is correct.

Schroder Wholesale Australian Equity Fund

Quarterly contributors %

Position *

Brambles Ltd

Chorus Limited

Westfield Corporation

Aurizon Holdings Ltd.

Spotless Group Holdings Ltd

Overweight

Overweight

Underweight

Underweight

Underweight

Quarterly detractors %

BHP Billiton Limited

Rio Tinto Limited

Commonwealth Bank of Australia

South32 Ltd.

Woolworths Ltd

Position *

Attribution

0.26

0.18

0.15

0.15

0.10

Attribution

Overweight

Overweight

Underweight

Overweight

Overweight

-0.54

-0.43

-0.41

-0.21

-0.21

* Portfolio weights versus benchmark are average weights over the quarter

Distribution details for the financial year ended 30 June

Total CPU (i)

Capital gains (ii)

Discount capital

gains

Non discount

capital gains

Franking % (iii)

Growth

component (iv)

Distribution

component (v)

Return

(post-fee)

Benchmark (vi)

2013

2014

2015

3.44

3.57

4.24

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

90.37

95.25

102.00

21.29%

12.47%

-1.04%

4.34%

3.58%

3.82%

25.63%

16.05%

2.78%

22.75%

17.43%

5.68%

i) CPU: Cents Per Unit.

ii) Annual cash distribution represented by capital gains.

iii) Franking for financial year ending 30 June. Franking Levels Per

FSC calculation being franking credits as % of cash distribution

multiplied by (1-tax rate) divided by the tax rate.

iv) Growth return is the price to price return excluding distributions.

v) Distribution return includes both income and realised capital

gains where applicable.

(vi) Benchmark is the S&P / ASX 200 Accumulation Index

Quarterly Report

December 2015

Commentary continued

What began as the ‘Greenspan put’, an expectation by financial market participants that any

corrections in asset prices which threatened the inexorable rise in credit would always be

met with further accommodation, has proven correct. It has permeated behaviour globally

to a desperately unhealthy degree and has significantly altered the apportionment of

economic value throughout the economy. The one thing financial markets are good at is

arbitrage. If you bail them out every time they cry wolf, they’ll call your bluff. Buybacks,

merger and acquisition activity and real estate bubbles are behavioural outcomes of an

ingrained expectation of bail outs. On no planet is it rational to suggest that those with the

discipline to save should have these savings forcibly removed through negative interest

rates such that the more profligate should be permitted to bring forward yet more

consumption. Things are surreal.

Relative size of financial assets versus the real economy – the obvious corollary of low

interest rates is that assets and liabilities have become far larger relative to revenues and

incomes. This creates the mathematical certainty of hypersensitivity. The race to zero

interest rates and the exorbitant asset revaluations thereby induced has seen wealth

transfers of stratospheric proportions. The theoretically infinite valuations which become

justifiable at negligible discount rates can dwarf history. We could halve mortgage rates

again and justify another doubling in Sydney house prices. An average home might sell for

$2m. The gain triggered would be more in absolute terms than over the rest of history. You

wouldn’t even need any more income as long as credit is made freely available. These are

the maths currently permeating equity markets, making those invested in the market

darlings look like geniuses and the contrarians (us) look like dunces.

The rise of the machines – the days of equity markets functioning primarily to facilitate

exchange of ownership between investors are long gone. It is now a database of

microsecond price histories, earnings revisions and correlation matrices. There is little

doubt that behaviour of fundamental investors with more malleable belief sets can become

reflexive in response. The correlation of price moves with changes in earnings per share is

heightening and in 2015 was alarming. Upgrades are good; downgrades are bad.

Importantly, in combination with the above issue on financial market size, share prices are

set at the margin. Volatility is heightened, market efficiency and reliability of valuations, not

so much!

Given the above dynamics, the winners and losers over the final quarter looked like a copy

of the past year, 2 years and 3 years. Blackmores (+49.4%), Domino’s Pizza (+43.5%),

Magellan Financial (43.4%) and Fisher & Paykel Healthcare (+29.6%) were near the top,

Sims Metal (-23.7%), South32 (-22.0%), Worley Parsons (-21.7%) and BHP Billiton (19.6%) were near the bottom. Moves are becoming more extreme. South32’s balance

sheet shows $US11bn of equity value supporting its $A5.7bn market capitalisation.

Blackmores shows $A133m supporting its $A3.75bn. We have no issue with the ability to

create highly valuable businesses without the need for tangible capital, however, the

frequency and extent to which this polarisation is becoming commonplace is alarming.

Strange days indeed.

Contributors

Chorus (o/w, +56.4%) Seemingly interminable interactions with the NZ Commerce

Commission to determine the fair price for retail service providers to access the Chorus

network saw prices finalised at a level above the interim determination and at a level far

more likely to provide an adequate return for Chorus shareholders. Significant financial

leverage has heightened the reaction of the stock to these regulatory fluctuations.

Crown Resorts (o/w, +26.3%) A major shareholder seemingly determined to pursue

significant incremental investment despite signs of excessive capacity addition in most

markets outside Australia, has created a significant conundrum. A valuation which has

increasingly reflected expected value destruction offers shareholders significant scope for

gains should this destruction not eventuate, however, indications of either the Board or

management listening or acquiescing to views other than those of the major shareholder

are indiscernible.

Brambles (o/w, +18.8%) Although value creation at Brambles remains solid and business

quality strong, share price gains are undoubtedly reflective of an ongoing exodus from

materials and energy stocks rather than evidence of any change in the longer term potential

of the business. Additionally, as a beneficiary of lower fuel prices, the current environment

should assist short term earnings.

Navitas (o/w, +17.6%) As a lower currency restores Australia’s competitive position in

offering education services in a global environment, Navitas remains well positioned to

assist universities in maximising the opportunity. Evidence remains overwhelmingly

supportive of partnerships between universities and Navitas delivering far superior

outcomes to universities in their own right.

Detractors

BHP Billiton (o/w, -19.6%) The Samarco disaster combined with further commodity price

declines to provide fuel for investors to imagine ever more bearish scenarios for BHP

Billiton. Reductions in equity value over the quarter were multiples of the entire book value

of the Samarco JV. Despite remaining profitable at commodity prices where most producers

are struggling for oxygen, momentum in commodity markets continues to overwhelm

valuation. If the company were to halve the dividend it would still leave the company

offering a fully franked yield of close to 5%.

Schroder Wholesale Australian Equity Fund

Fund objective

Quarterly Report

December 2015

Commentary Continued

To outperform the S&P/ASX 200 Accumulation Index after fees over the

medium to long term by investing in a broad range of companies from

Australia and New Zealand.

Primary Healthcare (o/w, -38.3%) Significant financial leverage has amplified the pain for

shareholders as the freezing of Medicare indexation for GP’s and further efforts to stem

government outlays in pathology and radiology pressure earnings. Although portfolio

exposure is small, we feel this pricing paradigm may become a greater issue for the

healthcare sector in the future as constrained government budgets call into question the

sustainability of assured price and volume growth for businesses delivering little in the way

of productivity gain.

Investment style

Schroders is a bottom-up, fundamental, active growth manager of

Australian equities, with an emphasis on stocks that are able to grow

shareholder value in the long term.

Fund details

APIR code

Fund size (AUD)

Redemption unit price

Fund inception date

Buy / sell spread

Minimum investment

Distribution frequency

Management costs (p.a.)

SCH0101AU

$1,964,215,660

$1.0221

July 2002

0.25%/0.25%

$25,000

Normally twice yearly - June and Dec

0.92%

Sector exposure versus the benchmark %

-6.0

-4.0

-2.0

0.0

2.0

Energy

4.0

6.0

8.0

0.0

Materials

Chemicals

2.7

Construction Materials

Commonwealth Bank (u/w, +17.6%) Two and half decades of uninterrupted credit explosion

have provided the fuel for banks to become the engine of both the economy and the equity

market. As valuation levels return to around 3 times net tangible assets, the expectation of

banks continuing to provide a steady stream of ever growing dividends without hiccup is

clear. If ever there was clear evidence of the behavioural outcomes induced by an

expectation of central bank protection, this is it.

Outlook

None of the above is intended to distract attention from the poor results we have delivered

over the past year. It is intended as a reminder that risks remain elevated (an

understatement) and conditions are far from normal. Current corporate bond market

activity should heighten concerns. US corporate debt has risen significantly over the past

couple of years whereas ungeared earnings have barely moved. Widening spreads

indicate a degree of discomfort from debt investors not currently shared by equity

counterparts. The view that plummeting oil and commodity prices should be seen as boost

for economic activity seems a touch ironic in light of the rationale for low interest rates being

part of an ongoing battle against deflation. Obviously the falling prices central bankers are

worried about don’t include these. The complacency evident in financials (particularly in

Australia) rests significantly on the extremely benign bad debt experience of recent months

and quarters. This was also the case months before the global financial crisis and may not

be the data point on which to anchor a benign forecast.

0.3

Containers & Packaging

-1.4

Metals & Mining

8.5

Paper & Forest Products

0.0

Industrials

1.2

Consumer Discretionary

-1.5

Consumer Staples

3.4

Health Care -4.4

Information Technology

0.5

Telecommunication Services

-0.3

Our focus on economic value necessitates an acknowledgement that this process is most

commonly slow and steady, particularly when accompanied by sensible levels of financial

leverage. As behaviour continues to wildly overshadow fundamentals, the lure of outsized

gains causes investors to forget totally about a margin of safety. If the share price of BHP

Billiton or Rio Tinto continues to decline when the business is not making losses and asset

values are already reflecting an exceptionally tough operating environment, the margin of

safety is improving. When share price gains are wildly outpacing the rate of value creation,

margin of safety is declining sharply. These rules are simple, but behaviour is powerful.

FoMO (Fear of Missing Out) can, and has, overshadowed economic value for some time as

momentum has ruled. It will not always be this way.

0.1

Utilities

Capital Markets

-1.0

Financials

Martin Conlon

Consumer banks-5.0

Diversified Fin Services

Insurance

10.0

1.6

Building Products

Rio Tinto (o/w, -8.0%) As for BHP, downward earnings revisions from commodity price

declines continue to overwhelm all other valuation metrics as momentum investment

continues to rule. Strong cost reduction efforts allowing the company to maintain its

advantageous position on the cost curve count for little.

1.0

-3.3

Real Estate Mgmt & Dev

0.1

Property Trusts -4.9

Unless otherwise stated all figures are as at the end of December 2015

Benchmark is the S&P / ASX 200 Accumulation Index

Contact

www.schroders.com.au

E-mail: simal@schroders.com

Schroder Investment Management Australia Limited

ABN 22 000 443 274 Australian Financial Services Licence 226473

Level 20 Angel Place, 123 Pitt Street, Sydney NSW 2000

Phone: 1300 136 471 Fax: (02) 9231 1119

Investment in the Schroder Wholesale Australian Equity Fund ('the Fund') may be made on an application form accompanying the current Product Disclosure Statement available from

the Manager, Schroder Investment Management Australia Limited (ABN 22 000 443 274 AFSL 226473) (“Schroders”).

This Report is intended solely for the information of the person to whom it is provided by Schroders. It should not be relied on by any person for the purposes of making investment

decisions. Total returns are calculated using exit price to exit price, after fees and expenses, and assuming reinvestment of income. Gross returns are calculated using exit price to exit

price and are gross of fees and expenses. The repayment of capital and performance of the Fund is not guaranteed by Schroders or any company in the Schroders Group. Past

performance is not a reliable indicator of future performance. Unless otherwise stated the source for all graphs and tables contained in this report is Schroders. Opinions constitute our

judgment at the time of issue and are subject to change. This report does not contain and is not to be taken as containing any financial product advice or financial product

recommendation. For security reasons telephone calls may be recorded.