Brandeis University Exclusive Provider Organization Description of Benefits

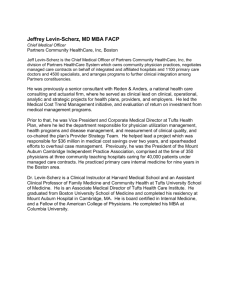

advertisement