Lat18 Pan Corporation acquired a controlling ...

advertisement

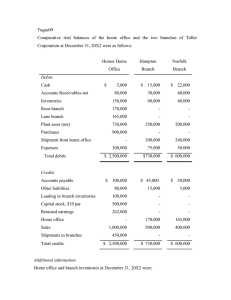

Lat18 Pan Corporation acquired a controlling interest in Saf Corporation on January 1, 20X2. Financial statements of Pan and Saf corporations for the year 20X2 are as follows : Pan Saf $400,000 $100,000 Combined Income and Retained Earnings Statements for the Year Ended December 31, 20X2 Sales Income from Saf Cost of sales 17,000 - (250,000) (50,000) (97,000) (26,000) 70,000 24,000 Add : Retained earnings January 1, 20X2 180,000 34,000 Deduct : Dividends (50,000) (16,000) $200,000 $ 42,000 $ 61,000 $ 15,000 80,000 20,000 Other expenses Net income Retained earnings December 31, 20X2 Balance Sheet at December 31, 20X2 Cash Accounts receivable-net Dividends receivable from Saf Inventories Note receivable from Pan Land 6,000 95,000 - 10,000 5,000 65,000 30,000 Buildings-net 170,000 80,000 Equipment-net 130,000 50,000 Investment in Saf 183,000 - $790,000 $210,000 $ 85,000 $ 10,000 Total assets Accounts payable Note payable to Saf Dividends payable Capital stock, $10 par 5,000 500,000 8,000 150,000 Retained earnings Total equities 200,000 42,000 $790,000 $210,000 Required : Prepare consolidation working papers for Pan Corporation and Subsidiary for the year ended December 31, 20X2. Only the information provided in the financial statements is available, and accordingly, your solution will require some standard assumptions. (Hint : Determine Pan’s interest in Saf as a first step.)