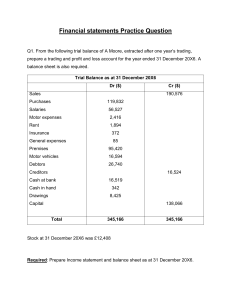

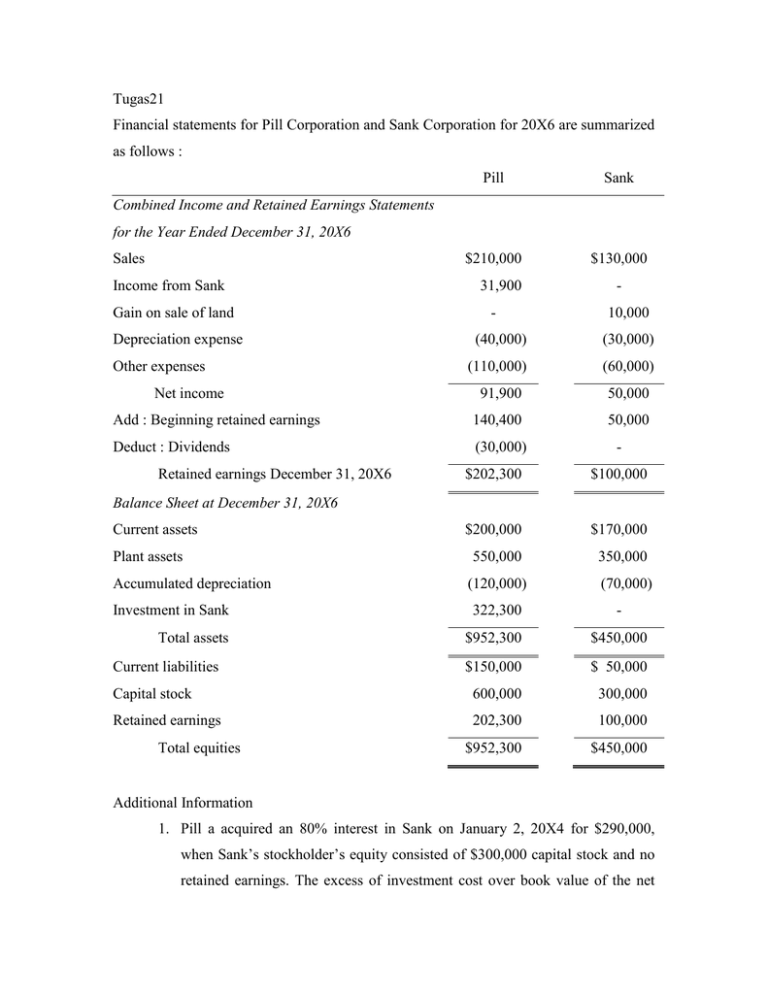

Tugas21 Financial statements for Pill Corporation and Sank Corporation for 20X6... as follows :

advertisement

Tugas21 Financial statements for Pill Corporation and Sank Corporation for 20X6 are summarized as follows : Pill Sank $210,000 $130,000 Combined Income and Retained Earnings Statements for the Year Ended December 31, 20X6 Sales Income from Sank Gain on sale of land Depreciation expense 31,900 - 10,000 (40,000) (30,000) (110,000) (60,000) 91,900 50,000 Add : Beginning retained earnings 140,400 50,000 Deduct : Dividends (30,000) Other expenses Net income Retained earnings December 31, 20X6 - $202,300 $100,000 $200,000 $170,000 550,000 350,000 (120,000) (70,000) Balance Sheet at December 31, 20X6 Current assets Plant assets Accumulated depreciation Investment in Sank 322,300 - Total assets $952,300 $450,000 $150,000 $ 50,000 Capital stock 600,000 300,000 Retained earnings 202,300 100,000 $952,300 $450,000 Current liabilities Total equities Additional Information 1. Pill a acquired an 80% interest in Sank on January 2, 20X4 for $290,000, when Sank’s stockholder’s equity consisted of $300,000 capital stock and no retained earnings. The excess of investment cost over book value of the net assets acquired related 50% to undervalued inventories (subsequently sold in 20X4) and 50% to goodwill with a 10-year amortization period. 2. Sank sold equipment to Pill for $25,000 on January 1, 20X5, at which time the equipment had a book value of $10,000 and a five-year remaining useful life. (Included in plant assets in the financial statements.) 3. During 20X6 Sank sold land to Pill at a profit of $10,000. (Included in plant assets in the financial statements.) 4. Plier uses the equity method in accounting for its investment in Sank. Required : Prepare consolidation working papers for Pill Corporation and Subsidiary for the year ended December 31, 20X6.