7 Inventories Click to edit Master title style 1

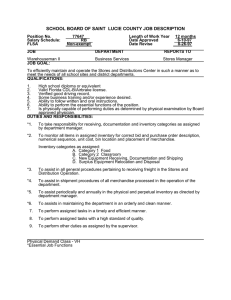

advertisement

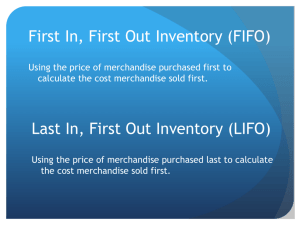

1 Click to edit Master title style 7 Inventories 1 2 Click to edit Master title style After studying this chapter, you should be able to: 1. Describe the importance of control over inventory. 2. Describe three inventory cost flow assumptions and how they impact the income statement and balance sheet. 2 3 Click to edit Master title style After studying this chapter, you should be able to: 3. Determine the cost of inventory under the perpetual system, using the FIFO, LIFO, and average cost methods. 4. Determine the cost of inventory under the periodic system, using the FIFO, LIFO, and average cost methods. 5. Compare and contrast the use of the three inventory costing methods. 3 4 Click to edit Master title style After studying this chapter, you should be able to: 6. Describe and illustrate the reporting of merchandise inventory in the financial statement. 7. Estimate the cost of inventory using the retail method and the gross profit method. 4 5 Click to edit Master title style 7-1 Objective 1 Describe the importance of control over inventory. 5 6 Click to edit Master title style 7-1 Two primary objectives of control over inventory are: 1) Safeguarding the inventory, and 2) Properly reporting it in the financial statements. 6 7 Click to edit Master title style 7-1 Controls over inventory include developing and using security measures to prevent inventory damage or customer or employee theft. 7 8 Click to edit Master title style 7-1 To ensure the accuracy of the amount of inventory reported in the financial statements, a merchandising business should take a physical inventory. 8 9 Click to edit Master title style 7-2 Objective 2 Describe three inventory cost flow assumptions and how they impact the income statement and balance sheet. 9 10 Inventory Costing Methods Click to edit Master title style 7-2 10 10 11 Click to edit Master title style 7-2 (Continued) 11 11 12 Click to edit Master title style 7-2 (Continued) 12 12 13 Click to edit Master title style (Concluded) 7-2 13 13 14 Click to edit Master title style Inventory Costing Methods In Indonesia 7-2 250 200 150 100 50 0 FIFO Average Specific Indentification 14 15 Inventory Costing Methods In USA Click to edit Master title style 400 7-2 371 299 300 Number of firms 200 (> $1B Sales) 130 100 0 FIFO LIFO Average cost 15 14 16 7-2 Example Exercise 7-1 Click to edit Master title style The three identical units of Item QBM are purchased during February, as shown below. Item QBM Units Cost Feb. 8 Purchase 1 Rp45,000 15 Purchase 1 48,000 26 Purchase 1 51,000 Total 3 Rp144,000 Average cost per unit Rp48,000 (Rp144,000 ÷ 3 units) Assume that one unit is sold on February 27 for Rp70,000. Determine the gross profit for February and ending inventory on February 28 using (a) first-in, first-out (FIFO); (b) last-in, first-out (LIFO); and (c) average cost methods. 16 15 17 7-2 Click to edit Master title style Follow My Example 7-1 Gross Profit Ending Inventory (a) First-in, first-out (FIFO): Rp25,000 (Rp70,000 – Rp45,000) Rp99,000 (Rp48,000 – Rp51,000) (b) Last-in, first-out (LIFO): Rp19,000 (Rp70,000 – Rp51,000) Rp93,000 (Rp45,000 + Rp48,000) (c) Average cost: Rp22,000 (Rp70,000 – Rp48,000) Rp96,000 (Rp48,000 x 2) $144/3 units For Practice: PE 7-1A, PE 7-1B 16 17 18 Click to edit Master title style Objective 3 7-3 Determine the cost of inventory under the perpetual inventory system, using FIFO, LIFO, and average cost methods. 18 19 FIFO Perpetual Click to edit Master title style 7-3 On January 1, the firm had 100 units of Item 127B that cost Rp20,000 per unit. Item 127B Units Jan. 1 Inventory Cost 100 Rp20,000 19 18 20 FIFO Perpetual Click to edit Master title style 7-3 On January 4, the firm sold 70 units of 127B at Rp30,000 each. Item 127B Units Jan. 1 4 Inventory Sale Cost 100 Rp20,000 70 20 19 21 FIFO Perpetual Click to edit Master title style 7-3 On January 4, the firm sold 70 units of 127B at Rp30,000 each. 4 Accounts Receivable Sales 2 100 000 2 100 000 On4 January 22, the firm sold1 twenty Cost of Merchandise Sold 400 000 1 400 000 units atMerchandise $30. Inventory 21 20 22 FIFO Perpetual Click to edit Master title style 7-3 Item 127B Purchases Date Jan. 1 4 Qty. Unit Cost Total Cost Cost of Mdse. Sold Inventory Balance Unit Cost Total Cost 2,000 600 Qty. 70 20 Total Cost Qty. Unit Cost 1,400 100 30 20 20 22 21 The cost was in Rp000 23 FIFO Perpetual Click to edit Master title style 7-3 On January 10, the firm purchased 80 units at Rp21,000 each. Item 127B Units Jan. 1 4 10 Inventory Sale Purchase Cost 100 Rp20,000 70 80 21,000 23 22 24 7-3 FIFO Perpetual Click to edit Master title style On January 10, the firm purchased 80 units at Rp21,000 each. 10 Merchandise Inventory Accounts Payable 1 680 000 1 680 000 24 23 25 FIFO Perpetual Click to edit Master title style 7-3 Item 127B Purchases Date Jan. 1 4 10 Qty. Unit Cost Total Cost Cost of Mdse. Sold Inventory Balance Unit Cost Qty. Unit Cost Total Cost 100 30 30 80 20 20 20 21 2,000 600 600 1,680 Qty. 70 80 21 1,680 20 Total Cost 1,400 25 24 The cost was in Rp000 26 FIFO Perpetual Click to edit Master title style 7-3 On January 22, the firm sold 40 units for Rp30,000 each. Item 127B Units Jan. 1 4 10 22 Inventory Sale Purchase Sale Cost 100 Rp20,000 70 80 21,000 40 26 25 27 FIFO Perpetual Click to edit Master title style 7-3 On January 22, the firm sold 40 units for Rp30,000 each. 22 Accounts Receivable Sales 1 200 000 On 22, theSoldfirm sold twenty 22 January Cost of Merchandise 810 000 units atMerchandise $30. Inventory 1 200 000 810 000 27 26 28 FIFO Perpetual Click to edit Master title style 7-3 Item 127B Purchases Date Jan. 1 4 10 22 Qty. 80 Unit Cost 21 Total Cost Cost of Mdse. Sold Inventory Balance Unit Cost Qty. Unit Cost Total Cost 100 30 30 80 20 20 20 21 2,000 600 600 1,680 70 21 1,470 Qty. Total Cost 70 20 1,400 30 10 20 21 600 210 1,680 Of the forty sold, thirty are considered to be from those acquired at Rp20,000 each. The other ten are considered to be from the January 10 purchase. The cost was in Rp000 28 27 29 FIFO Perpetual Click to edit Master title style 7-3 On January 28, the firm sold 20 units at Rp30,000 each. Item 127B Units Jan. 1 4 10 22 28 Inventory Sale Purchase Sale Sale Cost 100 Rp20,000 70 80 21,000 40 20 29 28 30 7-3 FIFO Perpetual Click to edit Master title style On January 28, the firm sold 20 units at Rp30,000 each. 28 Accounts Receivable Sales 600 000 28 Cost of Merchandise Sold Merchandise Inventory 420 000 600 000 420 000 30 29 31 FIFO Perpetual Click to edit Master title style 7-3 Item 127B Purchases Date Jan. 1 4 10 22 28 Qty. 80 Unit Cost 21 Total Cost Cost of Mdse. Sold Inventory Balance Unit Cost Qty. Unit Cost Total Cost 100 30 30 80 20 20 20 21 2,000 600 600 1,680 70 50 21 21 1,470 1,050 Qty. Total Cost 70 20 1,400 30 10 20 20 21 21 600 210 420 1,680 31 30 Unit Cost and Total Cost is in Rp000 32 FIFO Perpetual Click to edit Master title style 7-3 On January 30, purchased ten additional units of Item 127B at Rp22,000 each. Item 127B Units Jan. 1 4 10 22 28 30 Inventory Sale Purchase Sale Sale Purchase Cost 100 Rp20,000 70 80 21,000 40 20 100 22,000 32 31 33 7-3 FIFO Perpetual Click to edit Master title style On January 30, purchased ten additional units of Item 127B at Rp22,000 each. 30 Merchandise Inventory Accounts Payable 2 200 000 2 200 000 33 32 34 FIFO Perpetual Click to edit Master title style 7-3 Item 127B Purchases Date Jan. 1 4 10 Qty. 80 Unit Cost 21 Total Cost 22 Inventory Balance Unit Cost Qty. Unit Cost Total Cost 100 30 30 80 20 20 20 21 2,000 600 600 1,680 70 50 50 21 21 21 100 1,470 1,050 1,050 22 Qty. Total Cost 70 20 1,400 30 10 20 20 21 21 600 210 420 1,680 22 28 30 100 Cost of Mdse. Sold 2,200 2,200 34 33 Unit Cost and Total Cost is in Rp000 35 FIFO Perpetual Click to edit Master title style 7-3 Item 127B Purchases Date Jan. 1 4 10 Qty. 80 Unit Cost 21 Total Cost 22 Inventory Balance Unit Cost Qty. Unit Cost Total Cost 100 30 30 80 20 20 20 21 2,000 600 600 1,680 70 50 50 21 21 21 100 1,470 1,050 1,050 22 Qty. Total Cost 70 20 1,400 30 10 20 20 21 21 600 210 420 1,680 22 28 30 100 Cost of Mdse. Sold 2,200 2,200 Unit Cost and Total Cost is in Rp000 Cost of merchandise sold for January is Rp2,630,000. 35 34 36 FIFO Perpetual Click to edit Master title style 7-3 Item 127B Purchases Date Jan. 1 4 10 Qty. 80 Unit Cost 21 Total Cost 22 Inventory Balance Unit Cost Qty. Unit Cost Total Cost 100 30 30 80 20 20 20 21 2,000 600 600 1,680 70 50 50 21 21 21 100 1,470 1,050 1,050 22 Qty. Total Cost 70 20 1,400 30 10 20 20 21 21 600 210 420 1,680 22 28 30 100 Cost of Mdse. Sold 2,200 2,200 The cost was in Rp000 January 31, inventory is Rp3,250,000 36 35 (Rp1,050,000 + Rp2,200,000) 37 7-3 - Click to edit Master title style Example Exercise 7-2 Beginning inventory, purchases, and sales for Item ER27 are as follows: Nov. 1 Inventory 40 units at Rp5,000 5 Sale 32 units 11 Purchase 60 units at Rp7,000 21 Sale 45 units Assuming a perpetual inventory system and the first-in, first-out (FIFO) method, determine (a) the cost of the merchandise sold for the November 21 sale and (b) the inventory on November 30. 37 36 38 7-3 Click to edit Master title style Follow My Example 7-2 a) Cost of merchandise sold: 8 units @ Rp5,000 Rp40,000 37 units @ Rp7,000 259,000 45 units Rp299,000 b) Inventory, November 30: Rp161,000 = (23 units x Rp7,000) For Practice: PE 7-2A, PE 7-2B 37 38 39 LIFO Perpetual Click to edit Master title style 7-3 On January 1, the firm had 100 units of Item 127B that cost Rp20,000 per unit. Item 127B Units Jan. 1 Inventory Cost 100 Rp20,000 39 38 40 LIFO Perpetual Click to edit Master title style 7-3 On January 4, the firm sold 70 units of 127B at Rp30,000 each. Item 127B Units Jan. 1 4 Inventory Sale Cost 100 Rp20,000 70 40 39 41 LIFO Perpetual Click to edit Master title style 7-3 On January 4, the firm sold 70 units of 127B at Rp30,000 each. 4 Accounts Receivable Sales 2 100 000 2 100 000 On4 January 22, theSoldfirm sold1 400 twenty Cost of Merchandise 000 1 400 000 units atMerchandise $30. Inventory 41 40 42 LIFO Perpetual Click to edit Master title style 7-3 Item 127B Purchases Date Jan. 1 4 Qty. Unit Cost Total Cost Cost of Mdse. Sold Inventory Balance Unit Cost Total Cost 2,000 600 Qty. 70 20 Total Cost Qty. Unit Cost 1,400 100 30 20 20 42 41 The unit cost and total cost is in Rp000 43 LIFO Perpetual Click to edit Master title style 7-3 On January 10, the firm purchased 80 units at Rp21,000 each. Item 127B Units Jan. 1 4 10 Inventory Sale Purchase Cost 100 Rp20,000 70 80 21,000 43 42 44 7-3 LIFO Perpetual Click to edit Master title style On January 10, the firm purchased 80 units at Rp21,000 each. 10 Merchandise Inventory Accounts Payable 1 680 000 1 680 000 44 43 45 LIFO Perpetual Click to edit Master title style 7-3 Item 127B Purchases Date Jan. 1 4 10 Qty. Unit Cost Total Cost Cost of Mdse. Sold Inventory Balance Unit Cost Qty. Unit Cost Total Cost 100 30 30 80 20 20 20 21 2,000 600 600 1,680 Qty. 70 80 21 1,680 20 Total Cost 1,400 45 44 The unit cost and total cost is in Rp000 46 LIFO Perpetual Click to edit Master title style 7-3 On January 22, the firm sold 40 units for Rp30,000 each. Item 127B Units Jan. 1 4 10 22 Inventory Sale Purchase Sale Cost 100 Rp20,000 70 80 21,000 40 46 45 47 LIFO Perpetual Click to edit Master title style 7-3 On January 22, the firm sold 40 units for Rp30,000 each. 22 Accounts Receivable Sales 1 200 000 1 200 000 On 22, theSoldfirm sold twenty 22 January Cost of Merchandise 840 000 840 000 units atMerchandise $30. Inventory 47 46 48 LIFO Perpetual Click to edit Master title style 7-3 Item 127B Purchases Date Jan. 1 4 10 22 Qty. 80 Unit Cost 21 Total Cost Cost of Mdse. Sold Inventory Balance Unit Cost Qty. Unit Cost Total Cost 100 30 30 80 30 40 20 20 20 21 20 21 2,000 600 600 1,680 600 840 Qty. Total Cost 70 20 1,400 40 21 840 1,680 All of the 40 sold are considered to be from the January 10 purchase. 48 47 The unit cost and total cost is in Rp000 49 LIFO Perpetual Click to edit Master title style 7-3 On January 28, the firm sold 20 units at Rp30,000 each. Item 127B Units Jan. 1 4 10 22 28 Inventory Sale Purchase Sale Sale Cost 100 Rp20,000 70 80 21,000 40 20 49 48 50 7-3 LIFO Perpetual Click to edit Master title style On January 28, the firm sold 20 units at Rp30,000 each. 28 Accounts Receivable Sales 600 000 28 Cost of Merchandise Sold Merchandise Inventory 420 000 600 000 420 000 50 49 51 LIFO Perpetual Click to edit Master title style 7-3 Item 127B Purchases Date Jan. 1 4 10 Qty. Unit Cost Total Cost Cost of Mdse. Sold Inventory Balance Unit Cost Qty. Unit Cost Total Cost 100 30 30 80 30 40 30 20 20 20 20 21 20 21 20 21 2,000 600 600 1,680 600 840 600 420 Qty. Total Cost 70 20 1,400 22 40 21 840 28 20 21 420 80 21 1,680 All of the 20 sold are considered to be from the January 22 purchase. The unit cost and total cost is in Rp000 51 50 52 LIFO Perpetual Click to edit Master title style 7-3 On January 30, the firm purchased one hundred additional units of Item 127B at Rp22,000 each. Item 127B Units Jan. 1 4 10 22 28 30 Inventory Sale Purchase Sale Sale Purchase Cost 100 Rp20,000 70 80 21,000 40 20 100 22,000 52 51 53 7-3 LIFO Perpetual Click to edit Master title style On January 30, the firm purchased one hundred additional units of Item 127B at Rp22,000 each. 30 Merchandise Inventory Accounts Payable 2 200 000 2 200 000 53 52 54 LIFO Perpetual Click to edit Master title style 7-3 Item 127B Purchases Date Jan. 1 4 10 Qty. Unit Cost Total Cost Cost of Mdse. Sold Inventory Balance Unit Cost Qty. Unit Cost Total Cost 100 30 30 80 30 40 30 20 30 20 100 20 20 20 21 20 21 20 21 20 21 22 2,000 600 600 1,680 600 840 600 420 600 420 2,200 Qty. Total Cost 70 20 1,400 22 40 21 840 28 20 21 420 80 30 100 21 22 1,680 2,200 The unit cost and total cost is in Rp000 54 33 53 55 LIFO Perpetual Click to edit Master title style 7-3 Item 127B Purchases Date Jan. 1 4 10 Qty. Unit Cost Total Cost Cost of Mdse. Sold Inventory Balance Unit Cost Qty. Unit Cost Total Cost 100 30 30 80 30 40 30 20 30 20 100 20 20 20 21 20 21 20 21 20 21 22 2,000 600 600 1,680 600 840 600 420 600 420 2,200 Qty. Total Cost 70 20 1,400 22 40 21 840 28 20 21 420 80 30 100 21 22 1,680 2,200 Cost of merchandise sold Rp2,660,000 The unit cost and total cost is in Rp000 55 33 54 56 LIFO Perpetual Click to edit Master title style 7-3 Item 127B Purchases Date Jan. 1 4 10 Qty. Unit Cost Total Cost Cost of Mdse. Sold Inventory Balance Unit Cost Qty. Unit Cost Total Cost 100 30 30 80 30 40 30 20 30 20 100 20 20 20 21 20 21 20 21 20 21 22 2,000 600 600 1,680 600 840 600 420 600 420 2,200 Qty. Total Cost 70 20 1,400 22 40 21 840 28 20 21 420 80 30 100 21 22 1,680 2,200 January 31, inventory…..Rp3,220,000 The unit cost and total cost is in Rp000 56 33 55 57 7-3 - Click to edit Master title style Example Exercise 7-3 Beginning inventory, purchases, and sales for Item ER27 are as follows: Nov. 1 Inventory 40 units at Rp5,000 5 Sale 32 units 11 Purchase 60 units at Rp7,000 21 Sale 45 units Assuming a perpetual inventory system and the last-in, first-out (LIFO) method, determine (a) the cost of the merchandise sold for the November 21 sale and (b) the inventory on November 30. 57 56 58 7-3 Click to edit Master title style Follow My Example 7-3 a) Cost of merchandise sold: Rp315,000 = (45 units x Rp7,000) b) Inventory, November 30: 8 units @ Rp5,000 Rp 40,000 15 units @ Rp7,000 105,000 23 Rp145,000 For Practice: PE 7-3A, PE 7-3B 57 58 59 Click to edit Master title style Objective 4 7-4 Determine the cost of inventory under the periodic inventory system, using FIFO, LIFO, and average cost methods. 59 60 FIFO Periodic Click to edit Master title style 7-4 Using FIFO, the earliest batch purchased is considered the first batch of merchandise sold. The physical flow does not have to match the accounting method chosen. 60 61 FIFO Periodic Click to edit Master title style Jan. 1 100 units @ Rp20,000 =Rp2,000,000 Jan. 10 80 units @ Rp21,000 = 1,680,000 Jan. 30 100 units @ Rp22,000 = 2,200,000 7-4 280 units available Rp5,880,000 for sale during year Cost of merchandise available for sale 61 60 62 FIFO Periodic Click to edit Master title style 7-4 The physical count on January 31 shows that 150 units are on hand (conclusion: 130 units were sold). What is the cost of the ending inventory? = Rp Jan. 1 100 Sold unitsthese @ $20 Jan. 10 Sold 30 of these 80 units @ $21 50 units @ Rp21,000 = 1,050,000 Jan. 30 100 units @ Rp22,000 100 units @ $22 = 2,200,000 0 Ending inventory Rp3,250,000 62 61 63 FIFO Periodic Click to edit Master title style 7-4 Now we can calculate the cost of goods sold as follows: Beginning inventory, January 1 (Slide 60) Purchases (Rp1,680,000 + Rp2,200,000) Cost of merchandise available for sale Ending inventory, January 31(Slide 61) Cost of merchandise sold Rp2,000,000 3,880,000 Rp5,880,000 3,250,000 Rp2,630,000 63 62 64 7-4 LIFO Periodic Click to edit Master title style Using LIFO, the most recent batch purchased is considered the first batch of merchandise sold. The actual flow of goods does not have to be LIFO. For example, a store selling fresh fish would want to sell the oldest fish first (which is FIFO) even though LIFO is used for accounting purposes. 64 65 LIFO Periodic Click to edit Master title style Jan. 1 100 units @ Rp20,000 =Rp2,000,000 Jan. 10 80 units @ Rp21,000 = 1,680,000 Jan. 30 100 units @ Rp22,000 = 2,200,000 7-4 280 units available Rp5,880,000 for sale during year Cost of merchandise available for sale 65 64 66 LIFO Periodic Click to edit Master title style 7-4 Assume again that the physical count on January 31 is 150 units (and that 130 units were sold). What is the cost of the ending inventory? Jan. 1 100 units @ Rp20,000 =Rp2,000,000 Jan. 10 50 units @ Rp21,000 80 units @ $21 Sold 30 of these = Jan. 30 100 Sold unitsthese @ $22 = 1,050,000 1, 680 2,2000 Ending inventory Rp3,050,000 66 65 67 LIFO Periodic Click to edit Master title style 7-4 Now we can calculate the cost of goods sold as follows: Beginning inventory, January 1 (Slide 64) Purchases (Rp1,680,000 + Rp2,200,000) Cost of merchandise available for sale Ending inventory, January 31(Slide 65) Cost of merchandise sold Rp2,000,000 3,880,000 Rp5,880,000 3,050,000 Rp2,830,000 67 66 68 Average Cost Click to edit Master title style 7-4 The weighted average unit cost method is based on the average cost of identical units. The total cost of merchandise available for sale is divided by the related number of units of that item. 68 69 Average Cost Click to edit Master title style Jan. 1 100 units @ Rp20,000 =Rp2,000,000 Jan. 10 80 units @ Rp21,000 = 1,680,000 Jan. 30 100units units @ $22 100 @ Rp22,000 = 2,200,000 280 7-4 Rp5,880,000 Average unit cost: Rp5,880,000 ÷ 280 = Rp21,000 Cost of merchandise sold: 130 units at Rp21,000 = Rp2,730,000 69 68 Ending merchandise inventory: 150 units at Rp21,000= Rp3,150,000 70 Average Cost Click to edit Master title style 7-4 Now we can calculate the cost of goods sold as follows: Beginning inventory, January 1 (Slide 68) Purchases (Rp1,680,000 + Rp2,200,000) Cost of merchandise available for sale Ending inventory, January 31(Slide 68) Cost of merchandise sold Rp2,000,000 3,880,000 Rp5,880,000 3,150,000 Rp2,730,000 70 69 71 7-4 - Click to edit Master title style Example Exercise 7-4 The units of an item available for sale during the year were as follows: Jan. 1 Inventory Mar. 20 Purchase Oct. 30 Purchase Available for sale 6 units @ Rp50,000 Rp 300,000 14 units @ Rp55,000 770,000 20 units @ Rp62,000 1,240,000 40 units Rp 2,310,000 There are 16 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost by (a) the first-in, first-out (FIFO) method, (b) the last-in, first-out (LIFO) method, and (c) the average cost method. 71 70 72 7-4 Click to edit Master title style Follow My Example 7-4 a) First-in, first-out (FIFO) method: Rp992,000 (16 units x Rp62,000) b) Last-in, first-out (LIFO) method: Rp850,000 (6 units x Rp50,000) + (10 units x Rp55,000) c) Average method: Rp924,000 (16 units x Rp57,750) where average cost = Rp57,750 (Rp2,310,000 ÷ 40 units) For Practice: PE 7-4A, PE 7-4B 71 72 73 Click to edit Master title style 7-5 Objective 5 Compare and contrast the use of the three inventory costing methods. 73 74 7-5 Partial Income Statements Click to edit Master title style First-In, First-Out Net sales Rp3,900,000 Cost of merchandise sold: Beginning inventory Rp2,000,000 Purchases 3,880,000 Merchandise available for sale Rp5,880,000 Less ending inventory 3,250,000 Cost of merchandise sold 2,630,000 Gross profit Rp1,270,000 74 73 75 7-5 Partial Income Statements Click to edit Master title style Average Cost Net sales Cost of merchandise sold: Beginning inventory Purchases Merchandise available for sale Less ending inventory Cost of merchandise sold Gross profit Rp3,900,000 Rp2,000,000 3,880,000 Rp5,880,000 3,150,000 2,730,000 Rp1,170,000 75 74 76 Partial Income Statements Click to edit Master title style 7-5 Last-In, First-Out Net sales Cost of merchandise sold: Beginning inventory Purchases Merchandise available for sale Less ending inventory Cost of merchandise sold Gross profit Rp3,900,000 Rp2,000,000 3,880,000 Rp5,880,000 3,050,000 2,830,000 Rp1,070,000 76 75 77 Recap Click to edit Master title style FIFO LIFO 7-5 Weighted Average Ending inventory Rp3,250,000 Rp3,150,000 Rp3,050,000 Cost of merchandise sold Rp2,630,000 Rp2,730,000 Rp2,830,000 Gross profit Rp1,270,000 Rp1,170,000 Rp1,070,000 77 78 Click to edit Master title style 7-6 Objective 6 Describe and illustrate the reporting of merchandise inventory in the financial statements. 78 79 Lower-of-Cost-or-Market Method Click to edit Master title style 7-6 If the cost of replacing an item in inventory is lower than the original purchase cost, the lower-of-cost-ormarket (LCM) method is used to value the inventory. 79 80 Click to edit Master title style 7-6 Market, as used in lower of cost or market, is the cost to replace the merchandise on the inventory date. 80 81 Click to edit Master title style 7-6 Cost and replacement cost can be determined for— 1) each item in the inventory, 2) major classes or categories of inventory, or 3) the inventory as a whole. 81 82 Click to edit Master title style Determining Inventory at Lower-of-Cost-or-Market Method A Commodity 1A 2B 3C 4D 5 Total B Inventory Quantity 400 120 600 280 C Unit Cost Price Rp10,250 22,500 8,000 14,000 D E F G Unit Total Market Lower Price Cost Market of C or M Rp 9,500 Rp4,100,000 Rp3,800,000 Rp3,800,000 24,100 2,700,000 2,892,000 2,700,000 7,750 4,800,000 4,650,000 4,650,000 14,750 3,920,000 4,130,000 3,920,000 Rp15,520,000 Rp15,472,000 Rp15,070,000 7-6 1 2 3 4 5 82 83 Click to edit Master title style 7-6 Merchandise that is out of date, spoiled, or damaged should be written down to its net realizable value. This is the estimated selling price less any direct cost of disposal, such as sales commissions. 83 84 Merchandise Inventory on the Balance Sheet Click to edit Master title style 7-6 Merchandise inventory is usually presented in the Current Assets section of the balance sheet, following receivables. 84 85 Click to edit Master title style 7-6 The method of determining the cost of inventory (FIFO, LIFO, or weighted average) should be shown. 85 86 7-6 - Click to edit Master title style Example Exercise 7-5 On the basis of the following data, determine the value of the inventory at the lower of cost or market. Apply lower of cost or market to each inventory item as shown in Exhibit 7. Inventory Unit Unit Commodity Quantity Cost Price Market Price C17Y 10 Rp 39,000 Rp 40,000 B563 7 Rp 110,000 98,000 86 85 87 7-6 - Click to edit Master title style Follow My Example 7-5 Unit Unit Commodity Qty Cost Price Market Price C17Y B563 Total 10 7 Rp 39,000 110,000 Rp 40,000 98,000 For Practice: PE 7-5A, PE 7-5B Cost Market Lower of C or M Rp 390,000 Rp 400,000 Rp 390,000 770,000 686,000 686,000 Rp1,160,000 Rp1,086,000 Rp1,076,000 86 87 88 7-6 - Click to edit Master title style Example Exercise 7-6 Agung Jaya Motor Shop incorrectly counted its December 31, 2008 inventory as Rp250,000,000 instead of the correct amount of Rp220,000,000. Indicate the effect of the misstatement on Agung Jaya Motor Shop December 31, 2008 balance sheet and income statement for the year ended December 31, 2008. 88 87 89 7-6 - Click to edit Master title style Follow My Example 7-6 Amount of Misstatement Overstatement (Understatement) Balance Sheet: Merchandise inventory overstated Current assets overstated Total assets overstated Owner’s equity overstated Income Statement: Cost of merchandise sold understated Gross profit overstated Net income overstated For Practice: PE 7-6A, PE 7-6B Rp 30,000,000 30,000,000 30,000,000 30,000,000 Rp(30,000,000) 30,000,000 30,000,000 88 89 90 Click to edit Master title style 7-7 Objective 7 Estimate the cost of inventory, using the retail method and the gross profit method. 90 91 Retail Inventory Method Click to edit Master title style 7-7 The retail inventory method of estimating inventory cost is based on the relationship of the cost of merchandise available for sale to the retail price of the same merchandise. 91 92 Determining Inventory by the Retail Method Click to edit Master title style A 1 Merchandise inventory, January 1 2 Purchases in January (net) 3 Merchandise available for sale Ratio of cost to retail price: (Rp 62,000,000:Rp 4 100,000,000) = 62% 5 Sales for January (net) 6 Merchandise inventory, January 31, at retail 7 Merchandise inventory, January 31, at estimated cost 8 (Rp30,000,000 x 62%) B C Cost Retail Rp19,400,000 Rp36,000,000 42,600,000 64,000,000 Rp62,000,000 Rp100,000,000 7-7 1 2 3 4 70,000,000 Rp30,000,000 Rp18,600,000 5 6 7 8 92 93 7-7 Click to edit Master title style Example Exercise 7-7 A business using the retail method of inventory costing determines that merchandise inventory at retail is Rp900,000,000. If the ratio of cost to retail price is 70%, what is the amount of inventory to be reported on the financial statements? Follow My Example 7-7 Rp630,000,000 (Rp900,000,000 x 70%) For Practice: PE 7-7A, PE 7-7B 93 92 94 61 Gross Profit Method Click to edit Master title style 7-7 The gross profit method uses the estimated gross profit for the period to estimate the inventory at the end of the period. 94 95 7-7 Estimating Inventory by Gross Profit Method Click to edit Master title style A 1 2 3 4 5 6 7 B Cost C Retail Rp 57,000,000 180,000,000 Rp 237,000,000 Merchandise inventory January 1 Purchases in January (net) Merchandise available for sale Sales for January (net) Rp 250,000,000 Less estimated gross profit (Rp250,000 x 30%) 75,000,000 Estimated cost of merchandise sold 175,000,000 Estimated merchandise inventory, January 31 Rp 62,000,000 1 2 3 4 5 6 7 95 96 Click to edit Master title style 7-7 The gross profit method is useful for estimating inventories for monthly or quarterly financial statements in a periodic inventory system. 96 97 7-7 Click to edit Master title style Example Exercise 7-8 Based on the following data, estimate the cost of ending merchandise inventory: Sales (net) Estimated gross profit rate Rp1,250,000,000 40% Beginning merchandise inventory Rp100,000,000 Purchases (net) 800,000,000 Merchandise available for sale Rp900,000,000 97 96 98 7-7 Click to edit Master title style Follow My Example 7-8 Merchandise available for sale Rp900,000,000 Less cost of merchandise sold [Rp1,250,000,000 x (100% – 40%)] 750,000,000 Estimated ending merchandise inventory Rp150,000,000 For Practice: PE 7-8A, PE 7-8B 97 98 99 Click to edit Master title style 7-7 Inventory turnover measures the relationship between the volume of goods (merchandise) sold and the amount of inventory carried during the period. Cost of merchandise sold Inventory turnover = Average inventory 99 100 7-7 Click to edit Master title style Cost Of Merchandise Sold Inventories Beginning Of Year End Of Year Average Inventory Turnover HERO Rp4,035,116,000,000 RIMO Rp87,696,796,439 Rp427,941,000,000 Rp494,919,000,000 Rp461,430,000,000 Rp24,907,993,901 Rp28,537,693,305 Rp26,722,843,603 8.74 times 3.28 times 100 101 Click to edit Master title style 7-7 Generally, the larger the inventory turnover, the more efficient and effective the management of inventory. 101 102 Click to edit Master title style 7-7 The number of days’ sales in inventory is a rough measure of the length of time it takes to acquire, sell, and replace the inventory. Number of days’ sales in inventory = Average inventory Average daily cost of merchandise sold 102 103 7-7 Click to edit Master title style HERO Average Daily Cost Of Merchandise Sold Rp16,681,472,000/365 Rp11,055,112,328.77 Rp1,157,226,000/365 Average Inventory Rp461,430,000,000 Number Of Days' Sales in Inventory 41.74 days RIMO Rp240,265,196 Rp26,722,843,603 111.22 days 103