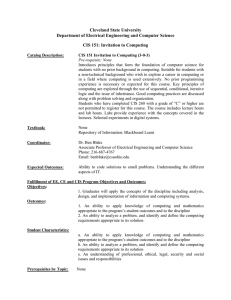

CIS September 2013 Exam Diet Examination Paper 1.4:

advertisement

CIS September 2013 Exam Diet Examination Paper 1.4: Ethics and Professional Standards Law relating to Securities and Investments Regulations of Securities and Corporate Finance Level 1 MULTI CHOICE QUESTIONS Ethics and Professional Standards (1 - 35) 1. According to the CIS Code and Standards, which of the following statements about fair dealing is least accurate? The Standard related to fair dealing __________ A. Imposes a duty with respect to both clients and prospective clients. B. Pertains to both investment recommendations and investment actions. C. Requires Members to compete fairly in the market. D. States that members should treat all clients equally. 2. Which of the following sanctions may not be imposed by the Board of the Nigerian Stock Exchange for contravening provisions of the Code of Conduct by dealing members? A. Restitution. B. Suspension C. Expulsion. D. Imprisonment. 3. Which of the following constitute(s) unethical behavior in the capital market? A. Speculation. B. Pegging of securities. C. Insider trading. D. (B) and (C) above. 4. Paul Aruta (ACS) has been hired by First Pensions Fund Administrators Limited to manage its pension funds. Paul’s fiduciary duty is owed primarily to ________ A. The management of First PFA Limited. B. The shareholders of First PFA Limited. C. The beneficiaries of First PFA Limited. D. All of the above. 5. A CIS member approves the circulation of information that promises a guaranteed minimum annual return of 25% to his clients. Which CIS Code and Standards has he most likely violated? A. None. B. Prohibition against guarantees. C. Competency. D. Conflict of interest. 6. According to the CIS Code and Standards, a supervisor establishing procedures to eliminate conflicts of interest relating to personal trading would least likely recommend requiring ___________ A. Disclosures of beneficial ownerships. B. Duplicate confirmations of employee transactions. C. Trading consistently with their firm’s published recommendation. D. A ban on employee investments. 7. According to the CIS Code and Standards, members are least likely required to disclose to clients their __________ A. Firm’s market-making activities. B. Beneficial ownership of shares. C. Responsibilities as CIS members. D. Service as Directors. 2 8. According to the CIS Code and Standards, a member with supervisory responsibilities violates the Code and Standards if the member fails to ___________ A. Prevent violations of the law. B. Prevent violations of the CIS Code and Standards. C. Detect fraud and prevent it. D. Establish and implement written compliance procedures. 9. Which of the following is not one of the fundamental Principles of the Association of Certified International Financial Analyst (ACIIA)? A. Honesty, integrity and fairness. B. Awareness and creativity. C. Independence and objectivity. D. Professional competence. 10. If a CIS member or registered student gains access to material non-public information as a result of a fiduciary, special or confidential relationship, which of these represents the appropriate action he should take in line with specific key principles of ACIIA? A. He should not communicate the information to other parties. B. He should not take investment action on the basis of such information. C. He should give a report on such information to his supervisor immediately. D. (A) and (B) above. 11. Sade Olambo (ACS) is a financial analyst with Happy-End Stockbrokers Ltd. She is preparing a purchase recommendation on Pilot Nig. Plc stocks. Which of the following situations is least likely to represent a conflict of interest for Sade that would have to be disclosed? A. Sade is a part-time consultant to Pilot Nig. Plc. B. Happy-End Stockbrokers Ltd holds for its own accounts a substantial ordinary shares position in Pilot Nig. Plc. C. Sade’s cousin is a supplier to Pilot Nig. Plc. D. Sade has material beneficial ownership of Pilot Nig. Plc through a family trust. 12. For the past decade, Uduak Okon, ACS, has managed the account of Mary Odion and in that time developed a close relationship with his client. During Christmas, Mary sent a 15 inch LG Television to Uduak as a reward for the excellent returns generated in her account. Uduak was excited about the gift and told nobody about it. By accepting Mary’s gift, Uduak least likely violates the CIS Code and Standards relating to __________ A. Loyalty to employer. B. Conflict of interest. C. Independence and objectivity. D. None of the above. 13. Abdullahi, a CIS student works as a Research Assistant for Top Investments. He is able to access Top Investment’s purchase list and immediately purchases several of the recommended stocks. Abdullahi most likely violates the CIS Code and Standards relating to ____________ A. Market manipulation. B. Priority of transactions. C. Diligence and reasonable care. D. Competency. 14. The SEC Code of Ethics for Investment Advisers/Portfolio Managers provides that an investment adviser shall do which of the following? 3 I. Display impartiality and objectivity in his relationship with his clients. II. Disclose to clients when giving investment advice whether the advice is based on facts or opinion. III. Send annual statements to clients showing their investment position during the period. A. B. C. D. I and II only. I and III only. II and III only. All of the above. 15. According to the SEC Code of Conduct for Capital Market Operators and their employees, the names of staff dismissed for any fraudulent act, dishonesty, misbehavior or any other misconduct should be communicated to which of the following? A. SROs. B. SEC, SROs and EFCC. C. SEC and SROs. D. EFCC. 16. Which of the following is correct in respect of a CIS member who is involved in preparing investment reports? A. When using materials prepared by others, he should write and obtain approval from the Nigerian Copyright Commission. B. He may not use, without acknowledgement, factual information published by recognized financial and statistical reporting services or similar services. C. He is not allowed to use materials prepared by others, otherwise he will be guilty of plagiarism. D. None of the above. 17. According to the Code of Corporate Governance issued by SEC, whose responsibility is it to implement and establish a whistle-blowing mechanism in quoted companies in Nigeria? A. Executive Management. B. Shareholders. C. Managing Director. D. None of the above. 18. A stock broking firm which is a subsidiary of an investment bank whose shares are quoted on the Nigerian Stock Exchange often receives non-public information considered to be material and could have considerable value if used in advising the firm’s clients. Which of the following is the best options for the firm to conform to CIS Code and Standards? A. Ensure appropriate monitoring of the exchange of information between the Bank and its stock broking subsidiary. B. Advise all clients of the firms to sell off their current holdings in the bank. C. The firm should never issue a sell or buy recommendation of the stocks of the bank. D. Establish informational barriers within the group to prevent the exchange of such information (non-public) between the Bank and its subsidiary stockbroking firm. 19. A CIS member runs a small investment management firm. The firm subscribes to a service from a large investment research firm that provides research reports that can be repackaged as in-house research by smaller firms. The firm distributes these reports to clients without reference to their source and author. Has the CIS member violated CIS Code and Standards related to plagiarism? 4 A. B. No. Yes, because she distributed materials prepared by another without acknowledging and identifying the author and publisher. C. Yes, because she misrepresented her firm’s services. D. Yes because she distributes the reports to clients. 20. What is conflict of interest? A. Not to worry about someone else’s interest if it competes with your own B. A tension between two employees of the same organization. C. You have the same obligations and responsibilities as another party. D. A tension between competing obligations and responsibilities. 21. Danladi Aminu became an Associate member of CIS in 2002. He recently retired from active service as CEO of Platinum Investments, and started an agro-allied processing company. However, he still attends CIS meetings and events, and remains a financial member of the Institute. According to the CIS Code and Standards, how should Danladi use his professional qualification? A. Danladi Aminu, FCS. B. Danladi Aminu, FCS (retired). C. Danladi Aminu, ACS (retired). D. Danladi Aminu, ACS. 22. Shina Maikudi, ACS produces an electronic newsletter where he comments and makes recommendations on listed stocks. He normally sends the Newsletter to interested persons free of charge. Shina bases his recommendations on thorough fundamental analysis, and makes reference to the write-ups of Professor Sagay, a well-respected finance expert. He duly acknowledges Professor Sagay’s materials. Which of the following CIS Code and Standards is he likely to violate? A. Fair dealing. B. Pagiarism. C. Duty to clients and prospective clients. D. None of the above. 23. Which of the following is not applicable when Members and Registered Students are in an advisory relationship with a client? They should ________ A. Take action on the appropriateness and suitability of an investment based purely on client’s instruction. B. Make a reasonable inquiry into a client’s investment experience, risk and return objectives and financial constraints prior to making any investment recommendation. C. Determine that the recommendation or action is suitable to the client’s financial situation, investment experience, risk and objectives. D. Assess the appropriateness and suitability of an investment in the context of the client’s total portfolio. 24. According to the CIS Code and Standards, a broker should update his knowledge about a client’s circumstances at least _________ A. Monthly. B. Quarterly. C. Half-yearly. D. Annually. 25. Ambrose Chikeze, a CIS student working as an analyst for an investment bank, recently suspected that one of his co-workers, Tayo Lawal, in the mergers and acquisitions department, has been illegally tipping off his brother-in-law about upcoming mergers. Ambrose should _________ A. Report to EFCC. 5 B. Inform the SEC. C. Inform the NSE. D. None of the above. 26. Deola, a CIS member took a bet with her colleague about the future direction of the stock market in the foreseeable future. According to the CIS Code and Standards, Deola __________ A. Had violated the Code and Standards by taking a bet on the market. B. Had done nothing wrong since she took a bet with a professional colleague. C. Had not violated the code because there was no monetary reward associated with the bet. D. Had violated the code because her supervisor was not aware of the bet. 27. According to the CIS Code and Standards, which of the following is a breach of duty to a client? A. Having a reasonable basis for investment research and recommendation. B. Non-disclosure of basic principles and methods used for valuation of securities. C. Exercising diligence and thoroughness in investment analysis. D. Making reasonable effort to avoid material misrepresentation. 28. Julius is a portfolio manager. One of his firm’s clients has told Julius that he will compensate him beyond what is provided by his firm on the basis of the capital appreciation of his portfolio each year. Julius should ____________ A. Turn down the additional compensation because it will result in conflict of interest with other clients accounts. B. Receive permission from CIS to accept the compensation arrangement. C. Obtain permission from his employer and clients prior to accepting the compensation arrangement. D. Turn down the additional compensation because it will create undue pressure on him to achieve strong short-term performance. 29. Which of the following is most likely to conflict with the CIS Code and Standards? A. Analyst may change their investment recommendations without obtaining approval from their supervisors. B. The confidentiality of personal account transactions by brokers should always be guaranteed. C. A portfolio manager should conduct a fact-finding about a new customer before undertaking investment action on the customer’s behalf. D. An analyst shall not engage in any transaction with a client when acting as a principal or agent for an associate without the knowledge and consent of the client. 30. Baba Ado, FCS, is a stockbroker with Alltrades Limited, a broker/dealer firm. He has orders to sell 500,000 units of FBNH shares for his clients, and would like to dispose 300,000 units of the same shares on his own account. In order not to violate CIS Codes and Standards what is the most appropriate action to take? A. Sell the 500,000 units of his clients before his own. B. Sell his 300,000 units before the 500,000 units for his clients. C. Stop the sale of his own 300,000 units outright. D. He can sell in any order without violating CIS Codes and Standards. 31. Chume Abdullahi, FCS is a Fund Manager at Moneygrows Investment Limited where he supervises 10 back-office staff who are neither CIS students nor members. In line with CIS Code and Standards, which of the following is/are expected of him in his supervisory capacity? 6 I. He should ensure that staff under his supervision undertake jobs for which they are competent. II. He should train them and help to build their capacity. III. He should ensure that adequate structures and controls are in place to monitor their activities. A. B. C. D. I only. I and II only. II and III only. All of the above. 32. The Board of Directors of a quoted company is expected to meet at least ___________ A. Once every quarter. B. Once every month. C. Once every six months. D. Once in a year. 33. John Mark, ACS, is an investment Adviser. He read in Business Day a proposed merger between ABC Limited and XYZ Limited which has reached an advanced stage. On the basis of this information and further analysis, he traded on the shares of ABC Limited and recommended the stock to some of his clients to whom he felt it was appropriate. Which of these statements is most likely correct? A. John Mark has violated the CIS Code and Standards by trading on the merger information. B. John Mark has violated the CIS Code and Standards by recommending the shares of ABC Limited to his clients. C. John Mark has not violated the CIS Code and Standards in any way. D. (A) and (B) above. 34. Jide, a CIS member is a research analyst with Downtown Securities Limited. He holds 100,000 units of NBC Ltd shares, and recently issues a “buy” report on the shares of the company. Meanwhile, he notes in his report that he holds units of the company’s shares. Which of the following statements is most likely correct? A. Jide has not violated CIS Code and Standards. B. Jide has violated CIS Code and Standards by giving a “buy” rating on a stock in which he has beneficial interest. C. Jide has violated CIS Code and Standards because he did not sell his shares before issuing the report. D. Jide has violated CIS Code and Standards by researching a stock in which he holds beneficial interest. 35. Mohammed is the Chief Executive of a large stock broking firm. He supervises many brokers and analysts, some of whom are subject to the CIS Code and Standards. He frequently delegates some of his supervisory duties. Which statement best describes his responsibility under the Code and Standards? A. CIS Code and Standards discourages delegation of supervisory responsibilities by Mohammed. B. Mohammed’s supervisory responsibilities do not apply to those subordinates who are not subject to the Code and Standards. C. Mohammed no longer has supervisory responsibilities for those duties delegated to his subordinates. D. Mohammed retains supervisory responsibility for all subordinates despite his delegation of some duties. 7 Law Relating to Securities and Investments (36 - 65) 36. Which of the following courts do not have coordinate jurisdiction? I. II. III. IV. Customary Court and Magistrates Court. High Court of a State and Federal High Court. Coroners Court and National Industrial Court. Sharia Court of Appeal of the FCT and Customary Court of Appeal of a State. A. B. C. D. I and II only. I and III only. II and IV only. II, III and IV only. 37. Which of the following types of law have the major aim of compensating the victim? A. Criminal law. B. Civil law. C. Statute law. D. Case law. 38. The words in a trust which express the desire, belief, recommendation or hope of the person creating the trust are called __________ A. Discretionary words. B. Precatory words. C. Testamentary words. D. Conceptual words. 39. Which of the following principles of the law of contract makes an agreement between a husband and his wife not enforceable under normal circumstances? A. Intention to create legal relations. B. Past consideration. C. Insufficiency of consideration. D. Non-acceptance. 40. Which of the following are remedies available for breach of contract? I. II. III. IV. Detention. Specific performance. Injunction. Repudiation. A. B. C. D. I and II only. III and IV only. I, II and III only. II, III and IV only. 41. An A. B. C. D. agency can be terminated by which of the following? Ratification. Obligation. Necessity. Acceptance. 42. Which of the following is not a general defence in the law of tort? A. Quantum meruit. B. Volenti non fit injuria. C. Inevitable accident. 8 D. Self-defence. 43. Which type of agency may be created where it is impossible to get the principal’s instruction? A. Agency by ratification. B. Agency by default. C. Agency by conduct. D. Agency by necessity. 44. Which of the following are the duties of an agent? I. II. III. IV. To render account when required. To exercise due diligence in the performance of his duties. To ensure that the business of his principal makes substantial profit yearly. Not to make secret profit. A. B. C. D. I and II only. II and III only. I, II and III only. I, II and IV only. 45. Which of the following is an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand, or at a fixed or determinable future time a sum certain in money to or to the order of a specified person or to bearer? A. Bill of lading. B. Bill of sale. C. Bill of exchange. D. Bill of order. 46. Which of the following situations will not affect a banker’s duty to honour the cheques of his customer? A. Upon having notice of the divorce of the customer. B. Upon a countermand by the customer. C. Upon having notice of the death of the customer. D. Upon having notice of the insanity of the customer. 47. Which of the following rules guide the declaration and payment of dividends by a company? A. Dividends can be paid out of profit and capital. B. A shareholder can compel his company to pay dividends upon failure to do so after ten years. C. The shareholders may reduce the amount recommended by the directors but they cannot increase it. D. (A) and (C) above. 48. Which of the following are jointly referred to as the securities of a company? A. The number of buildings owned by the company. B. The shares and debentures. C. The amount of money in its various bank accounts. D. The paid–up and unpaid capital of the company. 49. How many days are required for a special notice with regard to an issue which is proposed to be raised at a general meeting of a company? A. 7 days. B. 21 days. C. 28 days. D. 42 days. 9 50. Which of the following persons are referred to as the personal representatives of a deceased person? I. Wives and children. II. Executors and administrators. III. Fathers and mothers. IV. Members of the immediate and extended families. A. B. C. D. I only. II only. I, II and III only. II, III and IV only. 51. Which of the following is any supplementary clause attached to or referring to a Will with the purpose of adding, cancelling or altering the provisions of the Will? A. Addendum. B. Supplement. C. Codicil. D. Probate. 52. Which of the following trusts is created for the benefit of an individual or a defined number of persons? A. Personal Trust. B. Private Trust. C. Resulting Trust. D. Express Trust. 53. A trust created by Will must comply with which of the following conditions? I. II. III. IV. It It It It must be in writing. must be signed by the testator. may also be signed by another person in his presence or by his direction. must be witnessed by his wife and one of his children. A. B. C. D. I and II only. III and IV only. I, II and III only. II, III and IV only. 54. Which of the following orders of a court extinguishes the equity of redemption of a mortgagor and transfers ownership of his property to the mortgagee? A. Order of foreclosure. B. Order of attachment. C. Order of execution. D. Order of injunction. 55. Which of the following persons is not a “capital market dealer” under the Investments and Securities Act (ISA) 2007? A. Rating agency. B. Broker/Dealer. C. Registrar to an issue and underwriters. D. Portfolio managers and investment advisers. 56. What is the penalty for including a statement purportedly made by an expert in a prospectus which invites the public to subscribe for securities without the consent of the expert? A. N50,000 fine. 10 B. C. D. N100,000 fine. N1 million fine. N5 million fine. 57. What is the acquisition by one company of sufficient shares in another company to give the acquiring company control over that other company? A. Reconstruction. B. Diversification. C. Merger. D. Take-over. 58. Which of the following are sources of foreign currency which may be sold in the Autonomous Foreign Exchange market? I. II. III. IV. 59. Foreign Foreign Foreign Foreign currency currency currency currency held by Nigerian citizens resident abroad. imported by tourists into Nigeria. provided by the Central Bank. imported for direct investment in Nigeria. A. I and II only. B. III and IV only. C. I, II and III only. D. II, III and IV only. Which of the following is not an attribute of the Nigerian Investment Promotion Commission? A. It is a body corporate. B. It has the power to prosecute violators of the Nigerian Investment Promotion Commission Act. C. It has perpetual succession. D. It can sue and be sued in its corporate name. 60. A resolution shall be a special resolution when it has been passed by __________ A. Simple majority. B. 95% of votes cast by members of the company. C. Three-fourth of the votes cast by members of the company. D. 50% of votes cast by members of the company. 61. What is the principle of the law of contract which states that a person who is not a party to a contract cannot enforce it? A. Privity of contract. B. Private contract. C. Residual contract. D. Contract witness. 62. Who is the person to whom a dishonoured foreign bill of exchange must be delivered for noting? A. Banker. B. Notary public. C. Exchange officer. D. Dealer. 63. What is the legal term by which the shares of a deceased person are vested in his personal representatives who may be executors or administrators? A. Beneficial. B. Transistor. C. Will transfer. D. Transmission of shares. 11 64. 65. A shareholder of a limited liability company has the following rights under the Companies and Allied Matters Act 1990 except __________ I. II. III. IV. The The The The right right right right to to to to attend any General Meeting of the company. speak and vote on any resolution before the meetings. demand for bonus shares in place of dividends. the payment of dividends where such has been declared. A. B. C. D. I, II and III only. II and III only. III only. None of the above. In law “Nemo dat quod non habet” means ___________ A. You caused your own misfortune. B. You cannot give that which you do not possess. C. Justice and equity. D. Contractual relationship. Regulations of Securities and Corporate Finance (66 - 100) 66. The provision of Section 154 of the investment and Securities Act 2007 states that the Commission may approve a collective investment scheme which is administered as _________ I. Real Estate Investment Company or Trust (REIT). II. Unit Trust Scheme (UTS). III. Open ended Investment Company. A. B. C. D. I only. III only. All of the above. None of the above. 67. An agent who maintains an inventory from which he or she buys and sells securities is called a __________ A. Trader. B. Capitalist. C. Principal. D. Dealer. 68. The owner of a trading licence on the NSE is called a __________ A. Broker. B. Member. C. Agent. D. Specialist. 69. Who A. B. C. D. 70. Which of the following is not a primary responsibility of an Issuing House in respect of a new issue of securities? A. Co-ordinating the activities of all parties to the issue. B. Sponsoring the issue. C. Preparing application to SEC. determines the price of securities in the secondary market of the NSE? Forces of demand and supply. The SEC. The NSE. (B) and (C) above. 12 D. Advising on underwriting. 71. A ____________ is an offer document that contains the relevant information necessary to guide an investor to make an informed investment decision when accessing the capital market to raise funds. A. Memorandum of understanding . B. Prospectus. C. Memorandum of association. D. Certificate of incorporation. 72. 'Securities Exchange' as stipulated in the SEC rules and regulations shall include among others ___________ A. Options, Futures and Exchange . B. Petroleum Exchange. C. Metal Exchange. D. All of the above. 73. The application for registration as a Securities Exchange shall be filled on _____________ as provided in ____________ of the SEC rules and regulations. A. Form SEC 5, Schedule 3 B. Form SEC 7, Schedule 3 C. Form NSE 5, Schedule 5 D. None of the above. 74. _____________ occurs in a market where stock certificates are no longer issued by the company registrars, rather electronic records are kept. A. Depository notes . B. Settlement. C. Dematerialization. D. Custodianship. 75. A shareholder who has received a right circular can do which of the following on the NSE? A. Take up the right. B. Renounce the right. C. Take part of the right and sell the rest. D. All of the above. 76. Which of the following is not correct in respect of the Securities & Exchange Commission (SEC)? A. It provides regulatory oversight over only corporate bodies in the Nigerian Capital Market. B. It is the apex regulator in the Nigerian Capital Market. C. Its activities are guided by the Investment and Securities Act 2007. D. None of the above. 77. The following are the responsibilities of Stockbrokers to the Chartered Institute of Stockbrokers except __________ A. Obedience of the rules and regulations of the Institute as well as the code of conduct. B. Attendance of the mandatory continuing professional development programme. C. Not exposing other members when they commit infractions. D. Promoting the image of the Institute. 78. The court that has exclusive jurisdiction on capital market affairs is _________ 13 A. B. C. D. 79. Supreme Court. Investment and Securities Tribunal. CIS disciplinary Tribunal. Capital Market Court. The SEC post registration requirements for listed companies include __________ I. II. III. IV. Furnish SEC with quarterly accounts. Payment of approved listing fee. Notify the Exchange about changes in the composition of company's staff. Notify the Exchange immediately with respect to dividend announcement. A. B. C. D. I only. III only. I, II and III only. I, II and IV only. 80. Which of the following is not correct in respect of trading on the NSE? A. Delivery and settlement is done on a T+3 cycle. B. Only authorised clerks can trade on the NSE. C. All stockbroking firms are members of the NSE. D. The NSE is the only recognized securities trading platform in Nigeria. 81. An Exchange may delist any security in accordance with its rules and regulations but the company shall give notice of _______ to the Commission prior to taking such action. A. 7 days. B. 1 month. C. 14 days. D. 3 month. 82. The benefits derived by companies for being quoted on the floor of the NSE does not include _________ A. Free advertisement and publicity. B. Improved and better corporate performance. C. Obtaining free funds. D. Liquidity of shares. 83. The Investment and Securities Act 2007, does not provide for _________ A. The establishment of Securities and Exchange Commission. B. The repeal of the Investment and Securities Act, 1999. C. Registration and regulation of real estate companies. D. The enlarged powers and functions of the Commission over the capital market. 84. Which of the following types of underwriting is currently allowed in Nigeria in connection with new issue of shares? A. Firm. B. Best effort. C. Stand-by. D. All of the above. 85. The listing of a Stock Exchange on itself is known as _________ A. Dematerialization. B. Deregulation. C. De-Exchange. D. Demutualization. 14 86. Buy-in market is ____________ A. A forum where short-sold securities are offered by the stockbrokers at a premium. B. A forum where scarce securities are sourced by dealers. C. A forum to enhance liquidity of quoted stocks. D. A forum where the management of a company acquires the shares from existing owner. 87. The measure of the magnitude and direction of the general price movement on the Stock Exchange is ____________ A. Stock indentation. B. Market price ratio. C. Share index. D. Stock market index. 88. NSE Article 15 requires stockbroking firms to maintain a liquidity margin of __________ of shareholders funds. A. 10% B. 15% C. 20% D. 25% 89. A stock is considered as Ex-Div, if __________ A. Buyers will be entitled to division of shares already declared by the company. B. Sellers will be entitled to division of shares already declared by the company. C. Sellers will not be entitled to dividend already declared by the company. D. Buyers will not be entitled to dividend already declared by the company. 90. In the event of oversubscription of a public offer, the company is allowed to appropriate only ___________ of the oversubscription. A. 10% B. 20% C. 25% D. 35% 91. A new investor just confirmed his “number” from a stockbroking firm as C36547AP. This number is most likely to be ___________ A. Investor’s account number with the stockbroking firm. B. CSCS Clearing House number. C. Investor’s SEC number. D. Investor’s CIS number. 92. The secondary market is best described by which of the following statements? A. Market in which subordinated shares are issued and resold. B. Market conducted solely by brokers. C. Market dominated by dealers. D. Market where outstanding shares of stock are resold. 93. Expenses incidental to or consequent upon an investigation ordered by the Council of the NSE shall be borne by the ____________ A. NSE B. SEC C. Dealing member. D. Investment and Securities Tribunal. 94. E-dividend ensures which of the following? 15 A. B. C. D. Increase in investors’ confidence in the market. Increases in capital gains in the market. Reduction in cases of dividend warrants lost in transit. (A) and (C) above. 95. The permissible daily price movement on the opening price for equity transactions on the NSE is ___________ A. 10% for all stocks traded above the price of N10 and 5% for those traded below N100 B. 5% for all stocks traded. C. 10% for all stocks traded. D. None of the above. 96. The ___________ of the Nigerian Stock Exchange have the power to take disciplinary action against its members for any violation of its rules. A. President. B. Dealers. C. Council. D. Quoted companies. 97. The NSE may impose the following sanctions against its erring members except? A. Incarceration. B. Expulsion. C. Imprisonment. D. (A) and (C) above. 98. According to SEC Rule 136, which of the following is the current minimum prescribed capital requirement in order to be licensed as a dealing member? A. N150 million. B. N1 billion. C. N70 million. D. N75 million. 99. The self regulatory association registered with the Securities and Exchange Commission to provide a platform for the OTC market is _________ A. Regional Exchange Market. B. Abuja Commodities Market. C. National Association of Securities Dealers. D. All of the above. 100. An order given to a broker/dealer which is to be filled in one day or cancelled immediately can be best describe as ___________ A. Fill or kill order. B. An all or none order. C. Immediately or cancel order. D. Whole or none order. Total = 100 marks 16