CHARTERED INSTITUTE OF STOCKBROKERS ANSWERS Examination Paper 2.3

advertisement

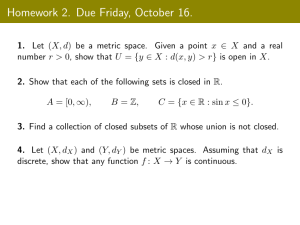

CHARTERED INSTITUTE OF STOCKBROKERS ANSWERS Examination Paper 2.3 Derivative Valuation and Analysis Portfolio Management Commodity Trading and Futures Professional Examination September 2013 Level 2 SECTION A: MULTI CHOICE QUESTIONS 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 D C C B A D D A D C C A A A B A B C D A 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 A B D D B A D B A D D B A D D C B A B B 2 SECTION B: SHORT ANSWER QUESTIONS Question 2 – Derivative Valuation and Analysis 2(a): As share price rises, call option value rises. Q 2(b): As exercise price rises, call option value falls. Q 2(c): As interest rate rises, call option value rises. Question 3 – Portfolio Management I. The investor benefits from the expertise of professional managers. II. Transactions costs are lower. III. A mutual fund achieves diversification that an individual small investor may not easily achieve. IV. Greater transparency through regular reporting of fund position. Question 4 – Commodity Trading and Futures This is a situation where an investor takes a long position in a futures contract in order to hedge against future price volatility. A long hedge is beneficial to a company that knows it has to purchase an asset in future and wants to lock in the purchase price. For example, assume it is January and a flour miller needs 100 tonnes of corn to produce corn flour and fulfill a contract in May. In January, the flour, miller would take a long position in May futures to lock in the price. SECTION C: ESSAY TYPE, CALCULATION AND/OR CASE STUDY QUESTIONS Question 5 – Derivative Valuation and Analysis 5(a): Price of Put option using Put Call Parity. Po= Co – So + Ke-rT = 2.42 – 60 + 60e0.005 x 0.25 = 2.42 – 60 + 59.925 = N2.345 3 Q5(b): At maturity, the value of the call is: C=S-K TT = (Ps – K) – CP = 65 – 60 = N5 Initial cost was C = N2.42 Total profit = 200 (5 – 2.42) = N516.00 5(c): Delta measures the sensitivity of an option price to a small movement in the price of the underlying asset. Delta can be obtained by taking the partial derivative of the BlackScholes formula with respect to the stock price. d1 = ln (S/K) + (r + ᵟ √T ᵟ 2 /2)T d1 = ln (60/60) + (0.5% + (0.2)2/2)0.25 0.2 √0.25 = 0.0625 N(d1) = 0.5249 Hence, the delta of call option = 0.5249 Similarly, the delta of the put option is: -N(-d1) = - [1 – N(d1)] = - [1 – 0.5249] = - 0.4751 The delta of a call is a positive number whereas the delta of a put option is a negative number, because the put value moves in the opposite direction of the underlying market. Also, since the option is at the money, the delta of a call option approaches +0.5 and that of a put option approaches -0.5 as also seen in the above calculated values. 4 Q5(d): Rho measures the sensitivity of an option price to a small change in the interest rate. For any increase in interest rate, the price of the call option would increase. Question 6 – Portfolio Management 6(a): The profit from the contract with the fast-food chain with respect to future cocoa prices can be represented as a function of the future cacao price P c: Profit = N520m – (N300m + 200 · Pc) = 220 - 200 · P c (where Pc is the cocoa price per metric) N Profit or loss (‘000) $ Profit/loss 140,000 1400000 120,000 1200000 1000000 100,000 800000 80,000 600000 60,000 400000 40,000 200000 CocoaPrice, price, metric $NCacao perper metric ton ton (‘000) 20,000 0 0 -200000 0 -20,000 -400000 -40,000 -60,000 -600000 -80,000 200 20 400 40 600 60 800 80 1000 100 1200 1400 140 1600 160 -800000 Purchasing one five-month cacao futures contract the chocolate producer locks in the cacao costs for 10 metric tons. This contract can be viewed as a loss if the market price of cacao in 5 months will be lower than N100,000 per metric ton. The hedge is not perfect, because the producer locks in the costs for only 10 tons out of 2,000 needed for production. The profit and loss on the purchase of one futures contract is illustrated below: 5 N Profit or$ Profit/loss loss (‘000) 5000 50,000 4000 40,000 3000 30,000 2000 20,000 1000 10,000 00 200 400 600 -10,000 -1000 0 20 40 60 80 -20,000 -2000 80 -30,000 -3000 -40,000 -4000 -50,000 -5000 -60,000 -6000 N Cocoa price, per metric ton (‘000) $ Cacao Price, per metric ton 800 1000 100 1200 120 1400 140 1600 160 It is obvious, that if the market price is equal to N100,000 per metric ton, the profit from the futures contract is zero. Q6(b): To make a perfect hedge, the chocolate producing company has to buy 200 futures contracts, because the production requires 2,000 metric tons of cocoa, and each futures contract is for 10 metric tons only. In this case the profit/loss line will look as follows: N$ Profit or loss Profit/loss 1200000 1000000 800000 600000 400000 N Cocoa price, per metric ton (‘000) 200000 $ Cacao Price, per metric ton 0 -200000 0 200 400 600 800 1000 1200 1400 1600 -400000 -600000 -800000 -1000000 Analytically the profit/loss line can be described as: Profit = N520m – N300m – 200 futures contract · 10 metric tons/contract x N100,000 per metric tons = N520m – N300m – 200m = N20m as initially planned. Q6(c): The benefits of hedging are that the costs for the cocoa are fixed. There is no chance to pass the change in prices on Mr Biggs in case prices for cocoa suddenly rise. On the other hand, if the prices decrease, the chocolate producer will still be obliged to purchase cacao at N100,000, as fixed by the futures contract. In case its competitors do not hedge, they will make more profit. It is important to note, that hedging mainly aims at providing insurance against downside risk, but not about a strategy to derive profit. 6 Q6(d): There is a number of different strategies to benefit. I. Long Butterfly: A long butterfly consists of buying 2 call options, one with a strike price XL, lower than $1,000 and one with a strike price XH, higher than $1,000. Then one writes 2 calls with an intermediate strike price $1,000. This results in a payoff pattern as shown below: $ Profit or loss N Profit or loss XL XH 1,000 Stock price at expiration II. Short Straddle. This is a combination of a short put and a short call, with the same strike price. $ Profit or loss N Profit or loss 1,000 Stock price at expiration III. Short Strangle. Short strangle is similar to a short straddle, but the strike price of the short call (XH) should be higher than that of the short put (XL), and the forecasted price of $1,000 being in between. $ Profit or loss N Profit or loss XL 1,000 XH Stock price at expiration (any 2 strategies for 2 marks each) Q6(e): (2 marks) The chocolate producing company’s main activity is not speculation. If the assistant’s forecast is not true, the company will be subject to huge losses, because short positions on options involve unlimited risk. The only strategy among the three mentioned above, that limited the downside risk is the long butterfly. If cacao price rises dramatically, the 7 chocolate producing company will suffer considerable losses not only due to the loss on option contracts, but also due to the sharp increase of production costs of the main activity. (2 marks) stock and expiration date”. Question 7 – Commodity Trading and Futures 7(a): Profit or Loss 0 Stock Price at Expiration The strategy is an option strategy used to simulate the payoff of a long stock position. It is an unlimited profit, unlimited risk strategy that is taken when the option trader is bullish on the underlying security but seeks a low cost alternative to purchasing the stock outright. Q7(b1): This is an illegal and unethical practice of a Stockbroker trading an equity, taking advantage of advance knowledge of pending orders from his customers. Q7(b2): This is an arbitrage strategy employed when the market price of the futures contract is overpriced relative to its theoretical price. The investor executes it by borrowing at the market free rate to buy the asset and by taking a short position in the futures contract. At maturity, the asset is solid under the terms of the futures contract, the loan is repaid, and a net profit can be realized. Q7(b3): This is a settlement method used in some commodities trade whereby upon expiry or exercise, the seller of the financial investment does not deliver the actual. Q7(b4): This is the maximum number of contracts a trader (especially speculators) may hold. Some exchanges may establish position limits as part of their rules. This is to prevent one firm, individuals or related group of individuals from establishing a dominant and potentially destabilizing position in a market. The limit prevents the creation of a position in which a manipulation of the market can take place. Position limits are particularly useful in the market with limited liquidity. 8