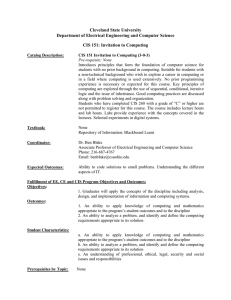

CIS March 2011 Exam Diet Examination Paper 2.4:

advertisement

CIS March 2011 Exam Diet Examination Paper 2.4: Ethics and Professional Standards Law relating to Securities and Investments Regulations of Securities and Corporate Finance Level 2 Ethics and Professional Standards (1 – 14) 1. John Bassey, FCS, a financial analyst, works in an Asian country where there are no securities laws or regulations. According to CIS Code and Standards, John Bassey: A. Must adhere to the standards as defined in a neighbouring country that has the strictest laws and regulations. B. Need not concern herself with ethics, codes and standards. C. Must adhere to the CIS Code and Standards. D. Must adhere to the standards as defined in a neighbouring country that has the least strict laws and regulations. 2. According to CIS Members’ Regulation and Code of Conduct (2005), a member or registered student shall, subject to the CIS Charter and regulations, be liable to disciplinary proceedings if: I. In the course of carrying out his professional duties or otherwise, has been guilty of misconduct. II. He has been disciplined by any other professional body recognized by statute or pursuant to some other disciplinary process. III. He is a sponsored individual in relation to a corporate body against which a disciplinary order has been made. A. B. C. D. I and II I and III II and III All of the above. 3. Island Wealth Ltd, a stockbroking firm in Victoria Island Lagos, just hired Danladi Bako, ACS, who had previously worked for another stockbroking firm for six years. When Danladi was with his former employer, he had in his laptop a list of clients and their contact information which he generated in the course of his duties. Upon resumption at Island Wealth, Danladi contacts his former clients using the list, since he knows them well and is certain that many will follow him to his new employer. Is Danladi in violation of the CIS Code and Standards? A. Danladi is not in violation of the Code and Standards because he generated the clients list on his own in his former employment, and has the right to use it. B. Danladi is not in violation of the code because he did not sign any non-compete agreement with his former employer. C. Danladi is in violation of the Code and Standards because clients’ records are the property of the firm and he could only use them with permission from his former employer. D. Danladi is in violation of the code because he resigned to work for a firm in competition with his former employer. 4. Which of the following is not a requirement for compliance with respect to responsibilities of CIS members to the Institute and the profession? A. Duty to adhere to laws, rules, regulations and the Institute’s Codes and Standards. B. Proper use of professional qualifications. C. Avoidance of acts of professional misconduct. D. Prohibition against unfair trading. 5. According to the CIS Code and Standards, which of the following actions is/are improper with regard to the use of non-public information? I. A CIS member in possession of material non-public information relating to issuer of financial instruments shall not trade on or communicate to others such information. II. If a CIS member acquires material non-public information directly from the issuer, he shall strive to encourage the issuer to make it public if he determines such public disclosure appropriate. III. A CIS member can use material non-public information in investment analysis, but shall not communicate such to third parties. A. B. C. D. II only III only I and II only II and III only 6. Jimoh Orlando, ACS is a research analyst with a brokerage firm. He decides to change his recommendation on the ordinary shares of PSM Ltd from “buy” to a “sell”. He faxes this change in investment advice to all his current customers. The next day, a new customer calls with a “buy” order for 500 shares of PSM Ltd. In order not to violate CIS Codes and Standards, what should Jimoh do? A. He may accept the order because he has complied with the standard on fair dealing with customers. B. He should advise the customer of the change in recommendation before accepting the order. C. He should delay executing the order until five days have elapsed after the communication of the change in recommendation. D. He may accept the order when the customer specifies in writing that he was notified of the change in the recommendation. 7. Sammy Adu, a CIS member took a bet with his colleague about the direction of the stock market in the foreseeable future. He was confident that, based on his analysis and projections, the stock market would record a minimum return of 30% in the next 12 months. According to the CIS Code and Standards, Sammy: A. Had violated the Code and Standards by taking a bet on the market. B. Had done nothing wrong since he took a bet with a professional colleague. C. Had not violated the code because there was no monetary reward associated with the bet. D. Had violated the code because his supervisor was not aware of the bet. 8. In the course of preparing an investment report, Tijanni, a CIS member, had copied and used in substantially the same form as the original, material that had been prepared by another person. Which of the following is correct? A. Tijanni, has violated the CIS Code and Standards for copying and using another person’s material. B. Tijanni, would have violated the CIS Code and Standards if he did not acknowledge and identify the name of the author, publisher or source of the material. C. Tijanni, had done nothing wrong as long as he did not make any commercial gain from the material. D. None of the above. 9. Tunde Oroyo, ACS, is a portfolio manager with an investment firm based in Lagos. One of his firm’s clients told Tunde that he would compensate him beyond his remuneration from the firm, based on the capital appreciation of his portfolio each year. What is the best course of action Tunde should take in this circumstance, in order not to violate CIS Code and Standards? A. Turn down the additional compensation because it will result in conflict of interest with other clients’ accounts. B. Receive permission from CIS for the compensation arrangement. C. Obtain written consent from, and disclose the amount to, his employer, customers and clients before accepting the compensation arrangement. D. Turn down the additional compensation because it would create undue pressure on him to achieve strong short-term performance results. 10. Sunkanmi Moses, ACS, is an analyst with a stockbroking firm. He analyses and prepares reports on WAGGO Plc, a company quoted on The Nigerian Stock Exchange. Extensive study has led Sunkanmi to rate WAGGO as a “hold” largely because of increasing competition in the industry. At a recent CIS conference, Moses discussed WAGGO’s prospect with two other analysts. Although the other analysts did not give reasons, both believed that WAGGO was about to experience rapid earnings growth. Immediately following the meeting, Sunkanmi issued a “buy” recommendation for WAGGO. Did Sunkanmi violate CIS Code and Standards? A. Yes, because he copied the opinions of others. B. Yes, because he did not seek approval of the change from his supervisor. C. Yes, because he did not have a reasonable and adequate basis for his recommendation. D. No, because he relied on information obtained from qualified professional colleagues 11. Roberts Kenny, ACS, Director of Operations, has had an ongoing battle with management about the adequacy of the firm’s compliance system. Recently, it has come to Robert’s attention that the firm’s compliance procedures are not being monitored or carefully followed. What should Kenny do? A. Resign unless the compliance system is strengthened and followed. B. Send his superior a memo outlining the problem. This will discharge his obligation under the CIS Code and Standards. C. Take no action, since his job is supervision and not policy making. D. Decline in writing to accept supervisory responsibility until reasonable compliance procedures are adopted. 12. Johnbull is a research analyst with a large stockbroking firm. He is in charge of writing investment reports and making recommendation to clients, on the conglomerates sector of the Nigerian Stock Exchange. He has been recommending the purchase of the stock of Global Alliance Limited because of their new lines of innovative businesses in several European countries. Shortly after his initial report on the company, Johnbull’s wife purchased N2 million worth of Global Alliance shares. He is about to write a follow-up report on Global Alliance. What is the most appropriate action Johnbull should take so as not to violate the Code and Standards? A. He should do nothing because he has not taken any action that contravenes the Code and Standards. B. He should tell his wife to sell the shares so as not to create conflict of interest. C. He should disclose his wife’s ownership of Global Alliance shares to his employer and in his follow-up report. D. He should disclose his wife’s ownership of Global Alliance shares to his supervisor and obtain written approval from him to go ahead and write-the follow up report. 13. Which of the following statements are true with respect to trading rules and practices as stipulated by the CIS Membership Regulation and Code of Conduct (2005)? I. A CIS member should not buy or sell securities in the secondary market for his own account except with the written consent of his employer. II. A CIS member should not buy or sell securities in the secondary market for the account of his spouse or children except with the written consent of his employer. III. A CIS member should not maintain a stockbroking account with other firms without prior written approval or disclosure of such account to his/her employers. IV. A CIS member is permitted to maintain a personal trading account only with his/her employer stockbroking firm. A. B. C. D. 14. I and II only I, and III only I, II and III only I, II, III and IV Bassey works for a stockbroking firm. Chukwu, a new client of the firm is meeting Bassey for the first time. Chukwu had obtained advisory and stockbroking services from another firm for several years. After discussing with Chukwu for a few minutes getting acquainted, Bassey explains to Chukwu that he had discovered a highly undervalued stock that offers large potential returns. He recommends that Chukwu purchase the stock. Bassey had violated the Code and Standards. What should he have done differently? A. He should have determined Chukwu’s needs, objectives and risk tolerance before making a recommendation for any type of security. B. He should have asked Chukwu his reasons for changing his stockbroking firm C. He should have given Chukwu more details about the stock, company and the industry the company operates in before making any recommendation. D. He should have convinced Chukwu that he had the requisite skill, knowledge and experience before making any recommendation. Law Relating to Securities and Investments (15 – 26) 15. A term which goes to the root of a contract and the breach of which entitles the other party to repudiate the contract is called: A. Express term B. Condition C. Warranty D. Exemption clause 16. Dongoyaro instructed Iba, his estate agent to sell one of his houses at Agodi Ibadan for N6 million. Iba was able to sell the house for N7 million. He paid N6 million to Dongoyaro, collected his commission and kept the extra N1 million for himself. Iba’s action can be regarded as a breach of: A. Religious duty B. Fiduciary duty C. Statutory duty D. Duty of care 17. A person may become a member of a company in which of the following ways? I. By subscribing to the Memorandum of Association. II. By allotment and registration. III. By payment for director’s qualification shares. IV. By personally signing all the incorporation documents. A. B. C. D. I, II and IV I, II and III II, III and IV All of the above. 18. Dodondara Plc declared dividends in 2009 but up till now, Omo-Oko a shareholder of the company has not been paid even though the company has his correct address. What type of debt does the dividend constitute against the company and within which period may Omo-Oko claim the dividends? A. Simple debt; 6 years. B. Accumulated debt; 12 years. C. Originating debt; 12 years. D. Specialty debt; 12 years. 19. Which of the following grounds can lead to the winding-up of a company by the Federal High Court? I. Ordinary resolution by the company. II. The company has a backlog of unpaid dividends to shareholders. III. Reduction of members below two. IV. Default in respect of holding of statutory meeting or delivering the statutory report. A. B. C. D. I and II only II and III only III and IV only II, III and IV only 20. Which of the following persons below the age of eighteen years can make a valid will? A. An educated minor. B. A minor in actual military service. C. A minor who is an orphan. D. A minor who has inherited a lot of property from his deceased father. 21. The minimum paid-up capital of a life insurance business under the Insurance Act 2003 (as amended) is: A. N1 billion. B. N2 billion. C. N5 billion. D. N10 billion. 22. An executor may perform which of the following acts of administration before Probate? I. II. III. IV. Collect all the assets of the deceased. Sell or transfer any security. Withdraw money from the account of the deceased. Receive payment of debts owe to the deceased. A. B. C. D. I and II only I and III only I and IV only I, II and IV only 23. Under the Investments and Securities Act 2007, which of the following persons is not liable to pay compensation for mis-statements contained in a Prospectus? A. A director of the company at the time of the issue of the prospectus. B. A creditor of the company at the time of the issue of the prospectus. C. A promoter of the company. D. A person who has authorized the issue of the prospectus. 24. One of the documents which must be submitted to the Securities and Exchange Commission with the application for approval of a merger is: A. Two years audited account of all the enterprises involved. B. Three years audited accounts of all the enterprises involved. C. Five years audited accounts of all the enterprises involved. D. Ten years audited accounts of all the enterprises involved. 25. What is the minimum contribution of an employee in the public service of the Federation and Federal Capital Territory under the Pension Reform Act 2004? A. Five and half percent. B. Seven and half percent. C. Ten and half percent. D. Twelve and half percent. 26. A company quoted on the Nigerian stock exchange would like to repurchase 40% of its share capital in the next one year through open market offer, using surpluses from its share premium account. Which of the following is a reason why the company cannot proceed, with reference to SEC Rule 109 on share buy-back? A. Share repurchase is not allowed in Nigeria. B. A company cannot repurchase up to 40% of its issued share capital in a year. C. Share repurchase cannot be done through open market offer. D. Surpluses from the share premium account cannot be utilized for share repurchase. Regulations of Securities and Corporate Finance (27 – 40) 27. Which of the following statements is incorrect in respect of the qualifications of a Chief Executive of a dealing member in line with NSE Article 154? A. He must be an authorized clerk of the Nigerian Stock Exchange. B. He must be duly registered by the Nigerian Stock Exchange. C. He must have core stockbroking experience of at least 5 years. D. He must have minimum of 10 years of cognate experience in the finance industry. 28. SEC Rule 3 clearly states sanctions for filing false or misleading papers, documents or information with the Securities and Exchange Commission pursuant to the provision of the Investment and Securities Act. Which of the following is correct regarding the sanction? A. A penalty of N5,000 B. A penalty of N10,000 C. A penalty of N100,000 D. A penalty of N100,000 in the first instance and N5,000 per day for every day the violation continues. 29. 30. SEC Rule 65 provides that the issuing house shall within 21 working days of approval of allotment, file with Securities and Exchange Commission a summary report containing which of the following information? I. II. III. IV. Problems arising generally from the conduct of the issue. Workability of the timetable adopted by the parties to the issue. Analysis of total cost incurred during the course of the offer. Details regarding the return of surplus monies. A. B. C. D. I and II only II and III only I, II and IV only I, II, III and IV According to SEC Rule 202, which of the following statements is/are true as to the mode of handling return monies by a Registrar? I. All return monies shall be paid by special crossed cheque. II. A subscriber can request in writing to be paid by open cheque. III. Return monies shall be returned by registered post or through a reputable courier service. A. B. C. D. I only III only I and III only I, II, and III 31. Which of the following is not a registration requirement for a receiving bank to an issue according to SEC Rule 33? A. A copy of Memorandum and Articles of Association of the applicant certified by the Corporate Affairs Commission. B. Fidelity Bond representing 20% of the paid-up capital of the bank. C. A copy of form C.O. 7 certified by the Corporate Affairs Commission. D. Evidence of compliance with the minimum paid-up capital as stipulated by the Central Bank of Nigeria. 32. Which of the following is/are incorrect as regards disclosure of interest in companies, in line with SEC Rule 112-114? I. A director of a public company shall disclose his interest in a stockbroking/dealing company engaged by a company to which he is a director. II. Stockbroking/dealing companies shall disclose their interest in public unquoted companies in offer documents as well as in their annual report and accounts. III. All public quoted companies shall disclose their interest in stockbroking/dealing companies in public offer documents as well as in their annual report and account. A. B. C. D. I only I and II only I and III only I, II and III 33. Which of the following are possible ways of achieving the objectives of good corporate governance? I. Identifying and penalizing corporate wrong doings. II. Appointing independent non-executive directors. III. Combining the role of Chairman and Chief Executive Officer. IV. Installation of strong protective structure for creditors. A. B. C. D. I and II only II and III only I, II and IV only I, II, III, and IV 34. NSE Article 15 requires dealing members to submit to the Exchange their financial statements within which period? A. 30 days of the end of the fiscal year. B. 45 days of the end of the fiscal year. C. 60 days of the end of the fiscal year. D. 90 days of the end of the fiscal year. 35. According to NSE Article 129, when a prima facie case of professional misconduct has been established against a dealing member, such a member shall: A. Be immediately suspended. B. Be referred to the investigation panel before any action is taken. C. Be admonished. D. Be immediately expelled. 36. Which of the following are prohibited practices as detailed in NSE Article 142? I. Disclosing customer’s information in a way that would harm the customer or any other party. II. Establishing fictitious accounts to execute some transaction. III. Commingling the firm’s cash account with that of customers IV. Opening of client’s account after observing the know-your-client procedure. A. B. C. D. 37. I and II only II and III only II and IV only I, II and III According to NSE Articles 2, 9 and 10, which of the following statements are correct? I. It is the duty of every dealing member to report any breach of the articles or rules and regulations by any other dealing member in writing to the Council of the Exchange. II. Any dealing member being aware of any breach on the part of another dealing member and failing to report the same shall receive a stern warning from the Council of the Exchange. III. No dealing member shall carry on business for a client who is in default to another dealing member. IV. No dealing member shall carry on any other business save that of dealing in securities and those activities which are ancillary thereto. A. B. C. D. I, II and III only I,III and IV only II, III and IV only I, II,III and IV 38. According to Investment and Securities Act, 2007, the Investment and securities Tribunal is empowered to exercise jurisdiction, to hear and determine any question of law or dispute between which of these parties? A. Between capital market operators. B. Between capital market operators and their clients. C. Between an investor and a securities exchange or capital trade point or clearing and settlement agency. D. All of the above. 39. Which of the following procedures are required before a state could issue bonds in Nigeria? 40. I. II. III. IV. State Executive Council resolution to issue the bond. Approval from the Federal Executive Council. State law to authorize borrowing from the capital market. An irrevocable standing payment order. A. B. C. D. I, I, I, I, II, and III only II and IV only III and IV only II, III and IV Which of the following documents is not required as part of the ‘Know Your Customer’ requirements for a corporate body as stipulated in NSE Article 102? A. Certificate of incorporation. B. Particulars of directors. C. Particulars of shareholding. D. None of the above Total = 40 marks Question 2 – Ethics and Professional Standards Give two examples of actions that would help ensure fair treatment of the clients of a stockbroking firm when a new investment recommendation is made, in line with the provisions of the Code and Standards on fair dealing with clients and prospective clients? (3 marks) Question 3 – Law Relating to Securities and Investments In his Will, Timothy left property on trust to Jamiu on behalf of certain beneficiaries. What are the three certainties required for the trust to be valid? (3 marks) Question 4 – Regulations of Securities and Corporate Finance Explain the following briefly: 4(a) One of your colleagues is facing CIS disciplinary tribunal for a trading abuse referred to as ‘‘front-running’’. Explain, and give a practical example to illustrate, this infraction. (2 marks) 4(b) Mention two practical ways by which the Investments and Securities Act 2007 makes provision for the protection of investors’ interests in the Nigerian capital market. (2 marks) Question 5 – Ethics and Professional Standards You are Head of Corporate Services and External Relations of a fast-growing bank quoted on the Nigerian Stock Exchange. Recently you met one of your old school mates, Dare Thompson, who is Head of Marketing of a small stockbroking firm. In your discussion, Dare intimated you with the quality of service his firm was capable of rendering to its clients, which he attributed to new ‘business strategies’ introduced by the Managing Director. He was keen on convincing the bank’s management to establish business relationship with his firm for the provision of stockbroking and related services. Dare said, ’’we are a one-stop financial supermarket, offering a wide range of services from stockbroking, investment advisory, portfolio management, funds management to banking services. We will help you “manage” your share value so that it would remain at a respectable level at all times. In fact, our investment recommendations to our clients on your company’s shares at any point in time would be based upon our discussions and agreement with your company”. Dare also offered to render some of the listed services to your bank personally at a rate lower than what his firm would charge, although this arrangement would be kept secret between him and the bank. At the end of your discussion, you exchanged call cards, and promised to get in touch with him for further discussions. You noticed that your friend’s call card reads: Dare Thompson, ACS; Head of Marketing. You are aware that Dare recently passed his CIS final paper just two months ago. Required: 5(a) You are worried about a number of ethical issues arising from your meeting and discussion with Dare. Identify any five contraventions of CIS Code of Ethics and Standards of Professional Conduct from the above. (7½ marks) 5(b) Discuss the provisions of the CIS Code of Ethics and Standards of Professional Conduct as regards the issues raised in question (5a). (10½ marks) Question 6 – Law Relating to Securities and Investments Clause 2 of the Memorandum of Association empowers Dodondawa Plc to appoint agents world-wide but Clause 5 of the Articles of Association provides that the directors must obtain the approval of the shareholders in general meeting before appointing a manufacturer’s representative for the company. However, the directors appointed Chief Dende, a friend of all the directors without approval. The company has become indebted to Chief Dende to the tune of N0.5 million as commission, but the shareholders in general meeting have refused to approve the payment on the ground that his appointment was made without their approval. Required: 6(a) Advise Chief Dende. (7 marks) 6(b1) Upon the death of Baba Ali, a very wealthy man, it became necessary to appoint a personal representative to administer his estate on behalf of his beneficiaries. Mention the two types of personal representatives that could be relevant in this case, and distinguish clearly between the two types of personal representatives. (4 marks) 6(b2) There is a category of trust regarded as charitable trust. Enumerate clearly the types of trusts that fall under this class. (3 marks) Question 7 – Regulations of Securities and Corporate Finance You are a management consultant, and have just been employed by a small firm of stockbrokers to advise them on their internal procedures. There is currently no department directly responsible for monitoring the internal processes of the firm. Their previous compliance officer, who worked part time was ‘‘encouraged to retire’’ several months ago and has not yet been replaced. In the meantime, a number of complaints have been received and the Managing Director is concerned about what these might reveal about the firm. Accordingly, you have been asked to look into the complaints and advise him whether they have any substance and, if so, the possible regulatory consequences for the firm. Upon investigation, you note a number of instances where the behaviour of advisers and brokers appear quite objectionable. Accordingly you report to the MD, highlighting the following issues: I. A broker had persuaded an advisory customer to buy more shares than she wanted, and when the customer objected, she was told that it was too late, as the transaction had already been undertaken. II. A number of customers had complained that they wait for up to two weeks to receive their contract notes from the firm. III. In advising a customer on a potential purchase of shares of a quoted company, a broker referred to a contract which the company had been awarded, details of which were not in public domain. IV. A broker had given guarantee of a minimum of 50% annual return on investment to several of his clients based on his experience in the last few years, although economic projections suggest that the expected returns cannot be more than 20%. Required: 7(a) From the above, advise the MD of your concerns, identifying any regulatory infractions (with reference to relevant SEC Rules, NSE Articles, CIS Code and Standards, e.t.c.) and suggest what type of penalties and sanctions the firm might face. (14 marks) 7(b) Briefly suggest to the MD some simple steps that might be taken to prevent a recurrence of these types of issues. (4 marks)