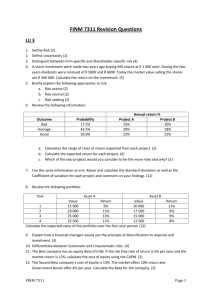

Level 1 QUESTIONS Examination Paper 1.2

advertisement

CHARTERED INSTITUTE OF STOCKBROKERS QUESTIONS Examination Paper 1.2 Corporate Finance Equity Valuation and Analysis Fixed Income Valuation and Analysis Professional Examination March 2014 Level 1 SECTION A: MULTI CHOICE QUESTIONS Corporate Finance (1 - 33) 1. The primary goal of financial management is ____________ A. To maximize the return. B. To minimize the risk. C. To maximize the wealth of owners. D. To maximize profit. 2. The computation of present value requires a/an ___________ A. Compounding rate. B. Discounting rate. C. Inflation rate. D. Deflation rate. 3. A company’s cost of equity is determined by ___________ A. The respective companies. B. The investment market. C. The government. D. Shareholders. 4. A company has a beta of 1.1. The market risk premium is 7% while the return on treasury bills is 6%. What is the company’s cost of equity? A. 13% B. 13.7% C. 14.2% D. 15.5% 5. Which of the following steps is not appropriate for improving the cash flow of a company? A. Reduce the period of credit granted to debtors. B. Reduce production cycle. C. Reduce the amount of credit taken from creditors. D. Reduce stock turnover periods. 6. A company’s weighted average cost of capital is ___________ A. The weighted average cost of equity shares and debentures. B. The weighted average cost of equity preference shares. C. The weighted average cost of all sources of long term funds. D. The weighted average cost of short term funds. 7. When a company uses increasing fixed cost for production, this influences what type of leverage? A. Operating leverage. B. Financial leverage. C. Variable cost leverage. D. Combined leverage. 8. Beta is a measure of _______________ A. Systematic risk. B. Simultaneous risk. C. Unsystematic risk. D. Global market risk. 9. A company has an EPS of 40 kobo. It has a P/E ratio of 10 times and a dividend payout ratio of 30% and a return on equity of 40%. What is the company’s growth rate using Gordon’s growth model? A. 28% B. 25% C. 23% D. 20% 10. Which of the following instruments is not currently traded on the Nigerian Stock Exchange? A. Ordinary shares. B. Bonds. C. Rights. D. None of the above. 11. Modigliani and Miller (without tax) concluded that ___________ A. There exists an optimal capital structure. B. There is no optimal capital structure in a firm as such. C. There exists 100% debt financial organizations. D. Minimum capital utilization exists. 12. Available capital funds are to be carefully allocated among competing projects by careful prioritization. This is called __________ A. Capital positioning. B. Capital structuring. C. Capital rationing. D. Capital budgeting. 13. A demerit of IRR method of capital investment appraisal is that it does not distinguish between _________ A. Lending & borrowing. B. Discounting & non-discounting. C. Cash flow & non-cash flow items. D. Inflow & out flow. 14. Factoring is an approach to managing _________ A. Payable. B. Receivables. C. Borrowings. D. Debts. 15. Which of the following is the most likely source of financing a small business? A. Bank loan. B. Leasing. C. Bonds. D. Proprietor’s personal savings. 16. A project has a NPV of (N420,000) when evaluated at a cost of capital of 15% but it produces a NPV of N1,200,000 when evaluated at a cost of capital of 8%. What is the project’s IRR? A. 7.23% B. 9.81% C. 12.61% D. 16.46% 17. A company has a cost of equity of 16.2%. The average return on the market is 12% while the risk free rate is 5%. What is the beta of the company? A. 1.6 B. 1.5 C. 1.4 D. 1.3 18. Fresh Company Limited is considering the expansion of its production plant in order to increase its productive capacity so as to meet the new demand requirement. The expansion is expected to cost three hundred million Naira (N300,000,000) and it is expected that as a result of the expansion, annual operating net cash flow would increase by forty five million Naira (N45,000,000). What is the project’s pay back period? A. 6 years and 7 months. B. 7 years and 7 months. C. 7 years and 6 months. D. 6 years and 10 months. 19. Fuels Nig. Ltd. is considering investing in a project that requires an initial investment of N3 million. The project would generate cash flow as follows: Year 1 2 3 Cash flow (N) 1,250,000 1,750,000 2,200,000 Using a cost of capital of 10%, what is the project’s NPV? A. N1,333,750 B. N1,136,250 C. N1,233,950 D. N1,652,200 20. Why are market values often used to compute the weighted average cost of capital? A. It is because securities are issued at market value and not at book value. B. It is simpler to calculate market values than to calculate book values. C. This is a very common mistake, especially because market values are much more volatile. D. This is in line with the goal of maximizing shareholders’ value. 21. ______________ is the distribution of the profits of a company among its shareholders. A. Shares. B. Interest. C. Dividend. D. Commission. 22. A firm may impose on itself internal capital rationing for the following reasons except ___________ A. To avoid dilution of ownership. B. To ensure efficient utilization of available funds. C. As a strategy to grow organically. D. To maximally utilize expansion potentials. 23. __________ costs are associated with monitoring management to ensure that it behaves properly. A. Agency. B. Behavioural. C. Bankruptcy. D. Managerial. 24. The Smith Co. has a N10 million bond issue outstanding with a coupon rate of 6 percent. The tax rate is 35 percent. What is the present value of the tax shield? A. N3.65 million. B. N3.50 million. C. N3.62 million. D. N3.53 million. 25. Which of the following is true about relevant cash flows? A. They are incremental. B. They are profit based. C. They are committed. D. They are sunk. 26. Dorsal Co. intends to make a bonus issue of ordinary share during the forthcoming year. Which one of the following will be affected as a result of the issue? A. Financial gearing. B. Total equity. C. Earnings per share. D. Liquidity. 27. The criterion which ranks projects according to the ratio of present value to initial investment is ___________ A. The internal rate of return. B. The profitability index. C. The net present value. D. The payback period. 28. What is the cost of equity given the rate of return on risk-free securities and market portfolio to be 9% and 14% respectively and beta factor as 0.8? A. 13% B. 27.4% C. 12% D. 18% 29. If the weighting of equity in total capital is 1/3, that of debt is 2/3, the return on equity is 15% that of debt is 10% and the corporate tax rate is 32%, what is the Weighted Average Cost of Capital (WACC)? A. 10.533% B. 7.533% C. 9.533% D. 11.350% 30. A N1,000 par value irredeemable bond selling for N500 in the market has a coupon rate of 15%. What is the required rate of return? A. 2% B. 20% C. 30% D. 50% 31. The method of raising equity capital from existing shareholders by offering them opportunity to buy securities on pro rata basis is referred to as __________ A. Public issue. B. Bonus issue. C. Private placement. D. Right issue. 32. Which of the following is not a source of long-term finance? A. Equity shares. B. Preference shares. C. Commercial papers. D. Reserves and surplus. 33. Which of the following is a feature of convertible bond? A. It is generally regarded as an hybrid between debt and equity. B. It is convertible into the equity of the issuer under agreed terms and conditions. C. It generally attracts far higher coupon rate than a non-convertible bond. D. (A) and (B) above. Equity Valuation and Analysis (34 - 67) 34. Which one of the following is true? A. The National Association of Securities Dealers’ (NASD) market is a Securities Exchange in Nigeria. B. The most important source of finance for companies comes from the selling of shares. C. The 'market capitalisation' of a company is the total value at market prices of the shares in issue for a company. D. (A) and (C) above. 35. Which of the following would cause an analyst to have concerns about a firm’s quality of earnings? A. The firm took a write off for a recently impaired asset. B. A firm’s sales declined 3% during the quarter. C. The gain on the sale of a plant was included in operating earnings. D. A firm books sales when orders are shipped. 36. Which of the following is not a disadvantage of raising money by the issue of ordinary share capital vis-à-vis other forms of capital? A. The existing shareholders may have their degree of control diluted if outsiders purchase the new shares. B. Dividends cannot be used to reduce taxable profits. C. The cost of issuing shares is usually higher than the cost of raising the same amount by obtaining loans. D. The capital amount has to be repaid on a date fixed at the time of the share sale. 37. Which of the following is false? A. A cumulative preference share has the characteristic that if dividends are missed in any year the right eventually to receive a dividend is carried forward. B. A participating preference share entitles the holder to take part in the management of the company on a day-to-day basis. C. A convertible preference share can be converted into ordinary shares at specific dates and on pre-set terms. D. A redeemable preference share is one that has a finite life, at the end of which the initial capital will be repaid. 38. A company __________ A. Is a separate legal entity that may buy, own, and sell property. B. Can be legally bound by a contract that is signed by only one stockholder. C. Is taxed on income at the corporate level, so that dividend distributions are not taxed at the shareholder level. D. Maximizes the company's value for the benefit of corporate management. 39. With regard to ordinary shares ownership _________ A. Amounts paid in by ordinary shareholders must eventually be paid back by the company. B. Dividends are guaranteed to ordinary shareholders. C. A shareholder is entitled to one vote for each share of ordinary share owned. D. Ordinary Shareholders are guaranteed a profitable return. 40. One thousand shares of N3 par value ordinary shares of Jensen Ltd are recently sold for N8 a share. This implies that _________ A. The market value has increased by N5 per share over the years. B. Paid-in capital has increased by N3,000 C. Paid-in capital has increased in excess of Par by N5,000 D. Total stockholders' equity has increased by N3,000 41. A stock has a required rate of return of 15 percent, a constant growth rate of 10 percent, and a dividend payout ratio of 45 percent. The stock’s price-earnings ratio should be __________ A. 3.0 times B. 4.5 times C. 11.0 times D. 9.9 times. 42. Total shareholder’s equity will increase if a company, __________ A. Issues preferred stock at par. B. Declares and distributes a two-for-one stock split. C. Declares and distributes a 50% stock dividend. D. Declares and pays a cash dividend. 43. AB plc has a current free cash flow to the firm of N40 per share. A growth of 2.5% is expected. If cost of equity is 15% and WACC is 12.5%, what is the current value per share? A. N400 B. N410 C. N320 D. N328 44. If the risk-free rate is 4 percent, the expected return on the stock market is 10 percent, and a firm’s beta is estimated at 1.1, the estimate of the firm’s return on equity will be ___________ A. 8.0% B. 9.2% C. 10.1% D. 10.6% 45. Which of the following statements is correct? A. Ordinary shareholders risk the loss of their investment. B. Ordinary shareholders bear the risk of no dividends. C. Preferred and common shareholders usually have the right to vote. D. (A) and (B) above. 46. Jones decorating shares are currently selling for N50 per share. Jones last paid a dividend of N2 and the growth in dividends and earnings is 10 percent. Based on this data, what is the required rate of return on Jones? A. 10.4% B. 14.0% C. 14.4% D. 10.0%. 47. What is the value of a preferred stock that pays a N4 fixed dividend forever if investors require an 8 percent rate of return? A. N32 B. N40 C. N50 D. N48 48. Regarding the dividend discount model (DDM), which of the following is false? A. The required return must be greater than the dividend growth rate. B. The calculated stock price is sensitive to the dividend growth rate. C. It is suitable to value high growth firms. D. It cannot be used for non-dividend paying firms. 49. Which of the following will increase the value of a stock, assuming all other factors are held the same? A. An increase in the dividend. B. A decrease in the growth rate. C. An increase in required rate of return. D. An increase in the difference between ke and g. 50. ACME Ltd is expected to earn N1.22 per share over the next year. A comparison of similar firms reveals an average P/E ratio of 12. Based on this comparison, what will be the value of an ACME share? A. N9.84 B. N10.17 C. N14.44 D. N14.64 51. A company cannot buy back ___________ A. Part of its ordinary shares. B. All of its shares. C. All of its redeemable preference shares. D. Part of its cumulative preference shares. 52. Medtronic Company has an expected ROE of 16%. The dividend growth rate will be ________ if the firm follows a policy of paying 70% of earnings in the form of dividends. A. 3.0% B. 6.0% C. 7.2% D. 4.8% 53. All A. B. C. D. of the following are analytical factors used in stock valuation except ________ Growth rates. Inflation rates. Firm cash flows. Ratio analysis. 54. High P/E ratios generally indicate that, all else equal, a company will tend to grow _____________ A. Slowly. B. Quickly. C. At the same rate as the market. D. None of the above. 55. Which of the following statements regarding the use of the Free Cash Flow to Equity (FCFE) model is false? The Free Cash Flow to Equity (FCFE) model __________ A. Is appropriate for firms that do not pay dividends. B. Is appropriate for firms that do not have positive earnings. C. Will only work for firms that have no debt. D. Involves forecasting several variables including capital expenditures. 56. The circuit breaker that is applied where stock prices in the market are rising is known as which of the following? A. Ceiling. B. Floor. C. Starter. D. Simulator. 57. All of the following steps are involved in estimating the earnings stream of a company except __________ A. Estimating corporate sales. B. Estimating corporate earnings before taxes. C. Estimating corporate liabilities and assets. D. Estimating corporate earnings after taxes. 58. The expected return on ordinary shares is composed of __________ A. Dividend yield. B. Capital appreciation. C. Capital appreciation minus the dividend yield. D. Both dividend yield and capital appreciation. 59. How much should you pay for a share of stock that offers a constant growth rate of 10%, requires a 16% rate of return, and is expected to sell for N50 one year from now? A. N42.00 B. N45.00 C. N45.45 D. N47.00 60. Why is it possible to ignore cash dividends that occur far into the future when using a dividend discount model? Those dividends __________ A. Will be paid to a different investor. B. Have an insignificant present value. C. Will not be paid by the firm. D. Ignore the tax consequences of future dividends. 61. The _______ is defined as the present value of all cash proceeds to the investor in the stock. A. Dividend payout ratio. B. Intrinsic value. C. Market capitalization rate. D. Plowback ratio. 62. Torque Limited is expected to pay a dividend of N1.00 in the upcoming year. Dividends are expected to grow at the rate of 6% per year. The risk-free rate of return is 5% and the expected return on the market portfolio is 13%. The stock of Torque Limited has a beta of 1.2 What is the return you should require on Torque's stock? A. 12.0% B. 14.6% C. 15.6% D. 20% 63. Which of the following investment vehicles provide(s) an inexperienced investor the benefit of professional management of his investment in the equities market? A. Growth fund. B. Income fund. C. Direct participation in equities. D. (A) and (B) above. 64. A firm’s stock has required return of 8 percent. The current stock price is N30 and the stock’s dividend yield is 5 percent. What dividend did the company just pay? A. N0.73 B. N1.46 C. N2.51 D. N2.92 65. AB plc is financed entirely by equity. If the asset beta is 1.2 and tax rate is 30%, what is the equity beta? A. 0.84 B. 1.71 C. 1.20 D. 4.00 66. A stock pays no dividend for the next 4 years. Dividend of N2 will be paid in year 5 and dividend will then grow at 2% p.a. indefinitely. If the required return is 7%, what is the intrinsic value of the stock? A. N30.52 B. N28.57 C. N40 D. N28.52 67. What is the sustainable earnings growth rate given the following information? Return on Equity Dividend payout ratio A. B. C. D. 20% 30% 6% 10% 14% 20% Fixed Income Valuation and Analysis (68 - 100) 68. The interest rate risk of a bond normally is ___________ A. Greater for shorter maturities. B. Lower for longer duration. C. Lower for higher coupons. D. All of the above. 69. The current yield on a bond is equal to ________ A. Annual interest divided by the current market price. B. The yield to maturity. C. Annual interest divided by the par value. D. The internal rate of return. 70. A firm with a low rating from the bond rating agencies would have __________ A. A low times interest earned ratio. B. A low debt to equity ratio. C. A low quick ratio. D. (A) and (C) above. 71. Ceteris paribus, the price and yield on a bond are _________ A. Positively related. B. Negatively related. C. Sometimes positively and sometimes negatively related. D. Not related. 72. Callable bonds ___________ A. Are called when interest rates decline appreciably. B. Have a call price that declines as time passes. C. Are called when interest rates increase appreciably. D. (A) and (B) above. 73. FGN bond due in one year has a yield of 6.2%; FGN bond due in 5 years has a yield of 6.7%. A bond issued by Mobil Ltd due in 5 years has a yield of 7.9%; a bond issued by Glo Ltd due in one year has a yield of 7.2%. The default risk premiums on the bonds issued by Glo Ltd and Mobil Ltd respectively are ___________ A. 1.0% and 1.2% B. 0.5% and .7% C. 1.2% and 1.0% D. 0.7% and 0.5% 74. A zero-coupon bond has a yield to maturity of 9% and a par value of N1,000. If the bond matures in 8 years, the bond should sell for a price of _______ today. A. N422.41 B. N501.87 C. N513.16 D. N483.49 75. The bond indenture includes ___________ A. The coupon rate of the bond. B. The par value of the bond. C. The maturity date of the bond. D. All of the above. 76. The process of retiring high-coupon debt and issuing new bonds at a lower coupon to reduce interest payments is called ___________ A. Deferral. B. Reissue. C. Repurchase. D. Refunding. 77. Which of the following statements is not correct in respect of bonds? A. Bond cash flows are predictable. B. Bond holders have priority over other stakeholders in the payment of returns (interest) and principal in the case of bankruptcy. C. The principal invested in a bond is guaranteed against loss. D. Bond holders do not have voting rights in a company. 78. All A. B. C. D. other things equal, which of the following has the shortest duration? A 30 year bond with a 10% coupon. A 20 year bond with a 9% coupon. A 20 year bond with a 7% coupon. A 10 year zero coupon bond. 79. A pension fund must pay out N1 million next year, N2 million the following year and then N3 million the year after that. If the discount rate is 8% what is the duration of this set of payments? A. 2.00 years. B. 2.15 years. C. 2.29 years. D. 2.53 years. 80. All A. B. C. D. else equal, bond price volatility is greater for __________ Higher coupon rates. Lower coupon rates. Shorter maturity. Lower default risk. 81. A portfolio manager believes interest rates will drop and decides to sell short duration bonds and buy long duration bonds. This is an example of __________ swap. A. A pure yield pick-up. B. A rate anticipation. C. A substitution. D. An inter-market spread. 82. Banks and other financial institutions can best manage interest rate risk by ____________ A. Maximizing the duration of assets and minimizing the duration of liabilities. B. Minimizing the duration of assets and maximizing the duration of liabilities. C. Matching the durations of their assets and liabilities. D. Matching the maturities of their assets and liabilities. 83. A bond with annual coupon payments has the following characteristics: Coupon Rate 8% Yield-to-Maturity Macaulay Duration 10% 9 What is the bond’s modified duration (in years)? A. 8.18 B. 8.33 C. 9.78 D. 10.00 84. Immunization of coupon paying bonds is not a passive strategy because of which of the following? I. The portfolio must be rebalanced every time interest rates change. II. The portfolio must be rebalanced over time even if interest rates don't change. III. Coupon payments cannot be guaranteed. A. B. C. D. I only. I and II only. II only. All of the above. 85. You own a bond that has a duration of 6 years. Interest rates are currently 7% but you believe the CBN is about to increase interest rates by 25 basis points. Your predicted price change on this bond is __________ A. +1.40% B. -1.40% C. -2.51% D. +2.51% 86. The market risk of an AAA rated preferred stock relative to an AAA rated bond is ___________ A. Lower. B. Higher. C. Equal. D. Unknown. 87. The rating of ABC Limited’s bonds has just been reviewed from BB+ to BB by Global Ratings Ltd. All other things being equal, what would most likely happen to the market price of ABC Limited bonds? The market price will __________ A. Rise. B. Fall. C. Remain the same. D. Be pegged. 88. Revenue bonds __________ A. Rely on the general earning power of the firm for the bond's safety. B. Are backed by the general assets of the issuing firm. C. Are considered quite risky to the investor compared to other bonds. D. (B) and (C) above. 89. Debt securities are often called fixed-income securities because __________ A. The government fixes the maximum rate that can be paid on bonds. B. They are held predominantly by older people who are living on fixed incomes. C. They pay a fixed amount at maturity. D. They promise either a fixed stream of income or a stream of income determined by a specific formula. 90. A zero-coupon bond is one that __________ A. Effectively has a zero percent coupon rate. B. Pays interest to the investor based on the general level of interest rates, rather than at a specified coupon rate. C. Pays interest to the investor without requiring the actual coupon to be mailed to the corporation. D. Is issued by state governments because they don't have to pay interest. 91. The _____ is known as the term structure of interest rates. A. Inflation premium. B. Interest rate risk premium. C. Relationship between short and long-term interest rates. D. Zero coupon bond yield curve. 92. According to the market segmentation theory, an upward sloping yield curve is most likely due to ___________ A. Investor expectations that short-term interest rates will fall in the future. B. Different levels of supply and demand for short-term and long-term funds. C. An increasing yield premium required by investors for bearing interest rate risk. D. None of the above. 93. Which of the following equations is correct in respect of bond pricing? A. Full bond price = Quoted price + Accrued interest. B. Full bond price = Quoted price - Accrued interest. C. Full bond price = Quoted price. D. Full bond price = Clean price. 94. The ________ is used to calculate the present value of a bond. A. Nominal yield. B. Current yield. C. Yield to maturity. D. Yield to call. 95. Of A. B. C. D. the following four investments, ________ is considered the least risky. Treasury bills. Corporate bonds. Treasury bonds. Commercial paper. 96. The _________ gives the number of shares for which each convertible bond can be exchanged. A. Conversion ratio. B. Current ratio. C. P/E ratio. D. Conversion premium. 97. A __________ bond is a bond where the bondholder has the right to cash in the bond before maturity at a specified price after a specific date. A. Callable. B. Coupon. C. Puttable D. Treasury. 98. If a bond’s issuer is required to retire a specified portion of the issue each year, the bond most likely __________ A. Is callable. B. Is a step-up tone. C. Has a sinking fund provision. D. Is puttable. 99. One reason why the duration of a portfolio of bonds does not properly reflect that portfolio’s yield curve risk is the duration measure ___________ A. Assumes all yield change by the same amount. B. Assumes all the bonds have the same discount rate. C. Ignores differences in coupon rates across the bonds. D. None of the above. 100. Your neighbour is bragging that the coupon payment on the bonds he bought five years ago have increased in each of the last three years. You know he must own ___________ A. A zero coupon bond. B. A convertible bond. C. A put bond. D. A step-up bond. Total = 100 marks