Management of Computer System Performance Chapter 5

advertisement

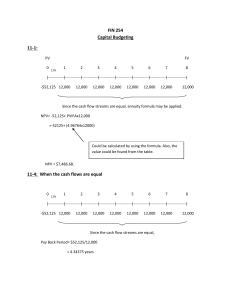

Management of Computer System Performance Chapter 5 Identification of IT Cost Identification of IT Cost Agenda Analytical approaches to Cost Benefit Analysis. Objective: Students should be able: to identify the costs related to IT implementation. 2 Identification of IT Costs It costs are usually divided into two elements; Direct and Indirect costs. Specific allocations are a function of Accounting Practices and may differ. Direct Costs-Labor, Materials, Facilities, Services and Supervision Indirect Costs-Administration, Fringe, G&A, Sr. Management. Etc. 3 Identification of IT Costs Labor Designers - Site Layout/Color Coordination Text/Content Editors Site Programmers - HTML, DHTML, JAVA, JavaScript, CGI, Perl, C, C++, Visual Basic System Administrators for the Servers System Administrators for the BackOffice Environment. Material Network Infrastructure - Routers, Hubs, Bridges and Gateways Network Computers - Servers and Workstations Software - Development Tools, (new and upgrades), Application S/W, Server S/W, Security S/W 4 Identification of IT Costs Facilities You have to have Office Space to put your workers, the cost may be allocated directly to your project (depending of size, etc.). Make sure that those costs are allocated from day one. A nine month of accumulated facility charges against your budget in month ten can inflict crippling damage Services Telecomm services / Bandwidth or Internet Connections. System support costs (maintenance contracts) Supervision Mid Level Management is responsible for their departments actions. They will participate at some level. Coordination with department managers across many 5 departments is key to controlling costs. Identification of IT Costs Licenses Shrink Wrap - Perpetual, usually one user or one PC only. Shrink Wrap Server Limits the number of “Clients” on the System. Limits the number of other servers it can interface with. Limits its role as a server (Primary /domain/Print) System (Midrange) - Perpetual or annual, depending on the provider and OEM. One system only. Maintenance is Extra. May limit the number of concurrent users. May limit the number of applications running on it. May require S/W OEM installation. 6 Identification of IT Costs Site Licenses Usually for a fixed geographic location. Set (NTE) number of users (ex.: 20,000) Usually perpetual. Maintenance is extra (includes patches). Upgrades are extra. Seat Licenses Same as site less geographic restrictions. System (MVS) - Annual, one System. Usually monitored by CPU Serial Numbers. Maintenance and annual renewal are extra. May shut down the system if renewal expires. May require S/W OEM installation. 7 Identification of IT Costs Indirect Costs - Administration, Fringe, G&A, Sr. Management. Etc. These are usually outside of your control, however, items to look for in budget roll ups include; Purchasing Labor Charge backs Hiring Cost Charge Backs G&A Changes 8 Identification of IT Costs System Licenses, the new model The servers are configured with the capability to record usage. Pricing becomes a function of the base price of the application plus individual time. Budget Component Swags for a Business to consumer POS Operation [12 Months] H/W = 3%, S/W = 4%, Design (Excluding Coding) = 26%, Development and Integration = 29%, Maintenance = 38% Marketing/Advertising (POS) 10x 9 Identification of IT Costs IT changes when associated with Business Process Re-engineering almost always cause some impacts on staffing. These vary from erosion of performance to layoffs and morale impacts. These types of changes can be very detrimental to an organization during the change process and should be recognized as elements for mitigation. These are negative costs associated with IT change and should be recognized as such. 10 Review Financial Concepts Reviewed Future value (FV) - refers to the amount of money to which an investment will grow over a finite period of time at a given interest rate. Future value is the cash value of an investment at a particular time in the future dependent on interest or other methods of return. Present Value (PV) - The current value of one or more future cash payments, discounted at some appropriate interest rate. 11 Review Financial Concepts Reviewed Net Present Value (NPV) - The present value of an investment's future net cash flows minus the initial investment. If positive, the investment should be made (unless an even better investment exists), otherwise it should not. Cash Flow - A measure of a company's financial health. Equals cash receipts minus cash payments over a given period of time; or equivalently, net profit plus amounts charged off for depreciation, depletion, and amortization. 12 Review Financial Concepts Reviewed Rate of Return - The annual return on an investment, expressed as a percentage of the total amount invested. Internal Rate of Return (IRR) - The rate of return that would make the present value of future cash flows plus the final market value of an investment or business opportunity equal the current market price of the investment or opportunity. 13 Project Valuation The key component to any IT project valuation is to calculate ROI. The key concepts to this calculation are The project’s Present Value (PV) and Net Present Value (NPV), The time value of money (TVM), The project’s internal rate of return (IRR). These formulas are interrelated and used to measure a project’s value to the corporation as compared to other opportunity costs. Comparisons require consistent measurement. 14 PV (Present Value) Present Value is referred to as a calculation of discounted cash flow. Example: $1 received in one year is actually worth $1/(1+r) today where r is called the discount rate and is the annual rate of return one could expect on a similar investment. if r is 10%, a dollar received in one year is worth $1/1.1 = 91 cents today. cash received two years from now should be discounted by (1 + r )2, so that the dollar received two years in the future is worth $1/(1.1)2 = 83 cents today. 15 PV (Present Value) A series of cash flows C1, C2, C3…Cn received in time periods 1, 2, 3…n, then the value of these cash flows today is calculated from the discounted sum PV = CF1 (1 + r)1 + CF2 (1 + r)2 + CF3 (1 + r)3 +…+ CFn (1 + r)n Where n is the number of time periods and PV is called the Present Value of the cash flows. Discounting a series of cash flows is mathematically equivalent to weighting cash received in the near term more than cash received further in the future. 16 NPV (Net Present Value) NPV is defined in Business Finance by Pierson & Bird as: "the difference between the present value of the net cash inflows generated by a project and the initial outlay". Net Present Value (NPV) The calculation of the discounted projected cash flows of the investment less the initial cash invested [ CF1 (1 + r)1 + CF2 (1 + r)2 + CF3 +…+ (1 + r)3 CFn ] – I =NPV (1 + r)n Legend 1. Cash Flow (CF)- The net cash flow for each year that the NPV is to be applied. 2. Discount Rate (r) - The discount rate or investment yield rate for the organization. The interest rate used in discounting future cash flows; also called the "capitalization rate." 3. Duration (n) - the total number of years for which the calculation is to be applied. 4. I = The initial investment. 17 How is NPV used? When making investment decisions, strive to invest in positive NPV projects. If the NPV of a project is negative, this means that the initial investment is greater than the present value of the expected cash flows. Investments in projects with negative NPVs should not be made, since they do not add value to the firm and actually extract value. 18 The Discount Rate PV and NPV depend upon the discount rate (r). CF1 ……….. (1 + r)1 “r” is derived from used for investments in a specific industry is defined by the expected return of the combined debt and equity of the firm for a given industry. “r” may be calculated from the Capital Asset Pricing Model (CAPM) and is averaged and weighted using the Weighted Average Cost of Capital (WACC). 19 Capital Asset Pricing Model This formula is designed to identify the correct value for “r” at current and future times. “r” will change over time so do NOT fall into that trap. r = Krf + B ( Km - Krf) r = The Required Rate of Return, (or just the rate of return). Krf = The Risk Free Rate (the rate of return on a "risk free investment", such as U.S. Government Treasury Bonds) B = Beta (Risk Tolerance where B>1 indicates a Risk Taker or if B<1, indicates a Risk Averse position). The Beta for a firm is usually determined by the CFO or Board Km = The expected return on the overall investment. 20 WACC WACC=An average representing the expected return on all of a company's investments. Each source of capital, such as stocks, bonds, and other debt, is weighted in the calculation according to its prominence in the company's capital structure. Included in the WACC calculation are all capital sources including: common stock, preferred stock, bonds, and any other long term debt. Note: As this implies, alternative invests, such as those made in the market are considered opportunity costs. They are a legitimate alternative to investing in IT projects. If they can generate better returns than IT Projects, as managers, where should they invest their money. As an IT person, that’s not what I want to hear but as a Manager, that is the correct answer. 21 WACC WACC is calculated by multiplying the cost of each capital component by its proportional weighting and then summing: WACC= E/V x Re + D/V x Rd x (1-Tc) Where: Re = cost of equity Rd = cost of debt E = the market value of the firm's equity D = the market value of the firm's debt V=E+D E/V = percentage of financing that is equity D/V = percentage of financing that is debt Tc = the corporate tax rate 22 IRR The IRR is the compounded annual rate of return the project is expected to generate. It is related to the NPV. The IRR is the discount rate at which the NPV of the project is zero. That is, the IRR is the average discount rate where the cash benefits and costs exactly cancel. Identifies the minimum revenues to offset costs. 23 Internal Rate of Return (IRR) Internal Rate of Return (IRR) The calculation of the discount rate that will make the present value of the projected cash flows equal to the investment. The IRR formula is as follows: NPV = C0 + (A1 – C1) + (A2 – C2) + (A3 - C3) + … + (An – Cn) (1 + IRR) (1 + IRR)2 (1 + IRR)3 (1 + IRR)n =0 Where A1, A2, A3…An are the positive cash benefits and C0, C1, C2, C3…Cn are the costs of the project in each time period 0, 1, 2, 3, …, n. 24 How is IRR used? IRR is greater than the project discount rate, or WACC, you should consider accepting the project - this is equivalent to a positive NPV project. When the IRR is less than the WACC the project should be rejected, since investing elsewhere could produce a higher rate of return. 25 The Period for the Analysis The analysis time period should match the system’s life cycle (the projected duration of its use). The system life cycle includes the following stages/phases: Requirements gathering stage of the project. The planning stage which would include: Design and development The execution or implementation stage and, Operation and maintenance 26 System Life Cycle explained A system life cycle ends when the system is terminated or is replaced by a system that has significant differences in processing, operational capabilities, resource requirements, or system outputs. Significant differences is a very subject term, and some organizations may feel that a 10% change is significant, while others may that the change must be over 30% to be significant. Consider that the Cobol Mainframe should already be history…but it is still in use in many companies. 27 Payback Period Payback Period The calculation of the number of years that are required for the discounted projected cash flows to equal the initial investment. The Payback Period formula is as follows: Payback Period = Initial Investment (NPV of Savings / N Years) 28 Return on Investment (ROI) Return on Investment (ROI) The calculation evaluates the discounted projected cash flows derived from the savings generated by the project divided by the initial investment. There are several formulas that provide this information: The initial ROI for Savings formula is as follows: ROI = Project Outputs - Project Inputs x 100% Project Inputs 29 ROI (Return on Investment) ROI is as an income model is shown as follows: or you can use the Dupont formula: ROI = Income/Investment ROI = (Income/Sales) * (Sales/Investment) or include interest costs: ROI = (Income + Interest)/Sales * (Sales/Investments) 30 Summary Know and understand PV, NPV, IRR. Understand the concept of CAPM and WACC Understand how they interrelate Assume these are exam questions. 31 Homework Read “Cigna’s Problems”. This is downloadable from the http://www.TheEBusinessSite.com Be prepared to discuss each concept. 32