Schroders Infrastructure Finance Monthly Newsletter – April 2016

advertisement

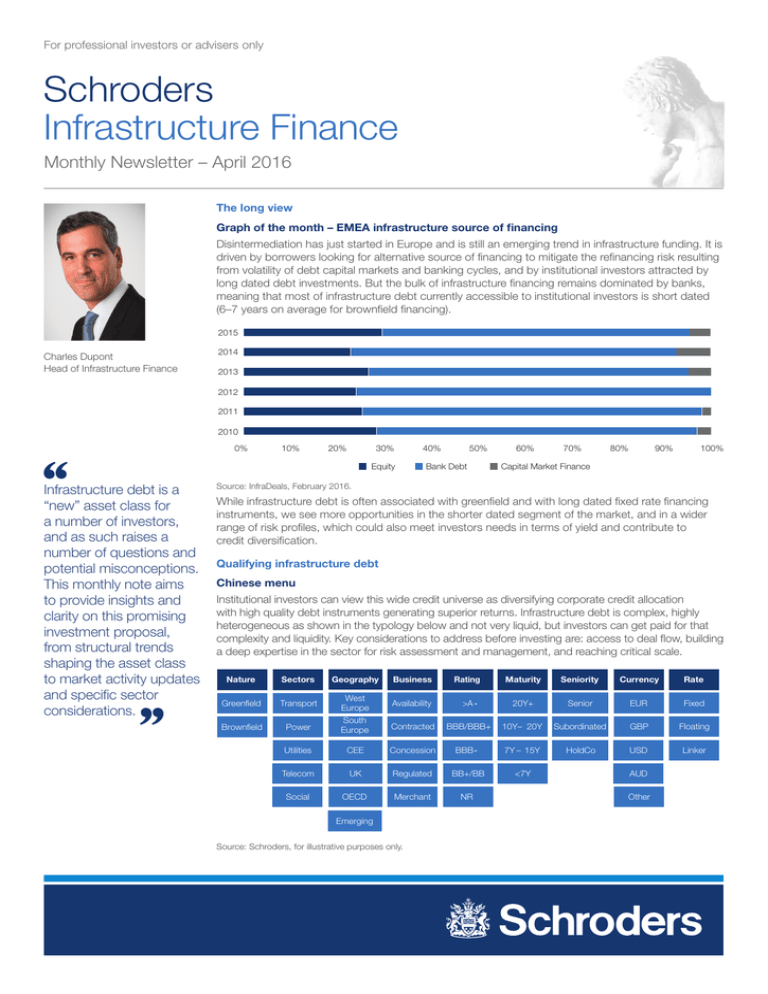

For professional investors or advisers only Schroders Infrastructure Finance Monthly Newsletter – April 2016 The long view Graph of the month – EMEA infrastructure source of financing Disintermediation has just started in Europe and is still an emerging trend in infrastructure funding. It is driven by borrowers looking for alternative source of financing to mitigate the refinancing risk resulting from volatility of debt capital markets and banking cycles, and by institutional investors attracted by long dated debt investments. But the bulk of infrastructure financing remains dominated by banks, meaning that most of infrastructure debt currently accessible to institutional investors is short dated (6–7 years on average for brownfield financing). 2015 Charles Dupont Head of Infrastructure Finance 2014 2013 2012 2011 2010 0% 10% 20% 30% 40% Equity Infrastructure debt is a “new” asset class for a number of investors, and as such raises a number of questions and potential misconceptions. This monthly note aims to provide insights and clarity on this promising investment proposal, from structural trends shaping the asset class to market activity updates and specific sector considerations. 50% Bank Debt 60% 70% 80% 90% 100% Capital Market Finance Source: InfraDeals, February 2016. While infrastructure debt is often associated with greenfield and with long dated fixed rate financing instruments, we see more opportunities in the shorter dated segment of the market, and in a wider range of risk profiles, which could also meet investors needs in terms of yield and contribute to credit diversification. Qualifying infrastructure debt Chinese menu Institutional investors can view this wide credit universe as diversifying corporate credit allocation with high quality debt instruments generating superior returns. Infrastructure debt is complex, highly heterogeneous as shown in the typology below and not very liquid, but investors can get paid for that complexity and liquidity. Key considerations to address before investing are: access to deal flow, building a deep expertise in the sector for risk assessment and management, and reaching critical scale. Nature Sectors Geography Business Greenfield Transport West Europe Availability Brownfield Power South Europe Utilities Maturity Seniority Currency Rate >A - 20Y+ Senior EUR Fixed Contracted BBB/BBB+ 10Y– 20Y Subordinated GBP Floating CEE Concession BBB - 7Y – 15Y HoldCo USD Linker Telecom UK Regulated BB+/BB <7Y Social OECD Merchant NR Emerging Source: Schroders, for illustrative purposes only. Rating AUD Other Infrastructure Finance Infrastructure Finance Market trends Political support to energy transition – a tailwind In 2015, 563 deals closed in Europe with a value of USD156.06bn, including USD84bn via bank debt and USD9.36bn via capital markets1. In the current market environment with a relatively flat spread curve and increasing interest rate risk in the long term, we believe that the acquisition of bank loans by institutional investors, being structured as floating rates and short dated, may offer an attractive relative value to other loans and corporate credit. After a very slow start in 2016, the EUR IG corporate primary market gained momentum towards the end of the quarter. Markets have regained their risk appetite following action by central banks, a firming in commodity prices and evidence that the tail risks of a US recession and of a China hard landing are not materialising. The infrastructure (private) debt market has remained active throughout the period. A number of landmark deals have been announced: acquisition financing for London City Airport, the Belwind offshore windfarm refinancing in Belgium by banks and institutional investors, or the Caruna distribution network in Finland through a private placement process. The energy sector should continue to offer a number of investment opportunities in Europe, thanks to the strong political support to the energy transition. In brief Sector updates – risks and rewards are not created equal –– Renewables: Last year for the first time, renewables accounted for a majority of new electricitygenerated capacity added around the world, according to a recent United Nations report2 (53% of the 253GW added, vs. 16% for coal). Adapting, upgrading, interconnecting transportation and distribution networks and R&D on energy storage are critical throughout developed to emerging markets, to adapt power systems to the changing energy mix. An interesting investment theme. –– US toll roads: Texas lawmakers explore ending toll roads in the background of the bankruptcy of the SH130 section3. The US has rarely explored the private funding option for transportation, compared to Europe. It seems like the few attempts have not been compelling and a number of politicians are now requesting the nationalisation of these toll road companies, with a similar claim as is often heard in Europe that toll roads are “privatising profits, but nationalising losses”. Political risk. –– Gas: ConocoPhillips is said to be planning the closure of the Lincolnshire gas pipeline, which is amongst the 15 big gas networks in the UK section of the North Sea, and the Theddlethorpe gas terminal4. At least 10 oil fields are said to be dependent on this pipeline, a number of them are having ceased production in the context of falling oil prices. Industrial equipment vs. infrastructure asset. –– Water: the abolition of water charges in Ireland has entered the political debate in the context of forming a new government5. The charge has been introduced two years ago to comply with European law policy. Reversely in the UK, the regulation applicable to water companies has been further anchored last year for a 6th period of 5 years, giving always more visibility to investors on authorised cost of capital, operational and capital expenditure allowances (totex), allowed outperformance and incentive regime, taxation and asset depreciation levels. Local is crucial. Source: 1 InfraDeals 2015 Trend report, 2 Global trends in Renewable Investment 2016, UNEP, 3 wfaa.com, 31/04/2016, 4 ibtimes.co.uk, 29/03/2016, thetimes.co.uk 29/03/2016, 5 Irish independent 1/03/2016. Important Information: This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. No responsibility can be accepted for errors of fact or opinion. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results, prices of shares and the income from them may fall as well as rise and investors may not get back the amount originally invested. Schroders has expressed its own views in this document and these may change. Issued by Schroder Investment Management Limited, 31, Gresham Street, EC2V 7QA, who is authorised and regulated by the Financial Conduct Authority. For your security, communications may be taped or monitored. Infrastructure debt is exposed to the following risk factors: illiquidity risk, interest rates risk, default risk, early reimbursement risk. w48791