Session Plan Chapter Ten:

advertisement

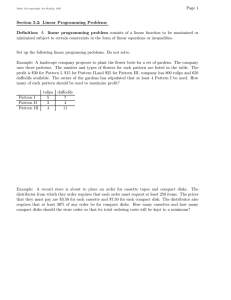

Session Plan Chapter Ten: – – – Short Discussion on warehouse and self-storage properties Review Industrial Case Studies Review of questions from any of the case studies Warehouse Properties These are structures designed and used for storage of wares, goods, and merchandise. The ceiling clearance for a warehouse is very important – – The higher that items can be stored the better Bulk warehouses have higher ceilings (24’ height) than service warehouses (18’ height) The less specialized the design and the less risk in operation, the more likely to be investment property Types of Warehouses Bulk/Distribution Warehouse – – Service Warehouse – – Lower ceiling heights than bulk More office space typically than bulk Flex – Pre-engineered metal primarily Higher ceiling heights as previously mentioned Mix of office and warehouse space (20/80 split) Self-Storage Office/Warehouses Have much better “curb appeal” than bulk warehouses – Usually multi-tenant facilities, with office space ranging from 25-50% of the total space – And thus higher rent per square foot Bulk warehouse usually has single tenant Warehouse ceiling clearance is lower than for bulk & service warehouses Importance of Location Should have easy access to major arteries Proximity to rail road and airport is desirable Bulk warehouses are often located in an industrial park Bulk warehouses need wide streets that provide easy access for large trucks Parking availability is less important than for the other primary property types – Although need more for office warehouses Projecting Demand for Industrial Space Demand: from firms moving into an area, relocations within an area, & expansion of existing facilities – – – Project current # and productivity of workers Project future industrial employment by industry Then can obtain output per sq. ft. of floor space Future land requirements: projected area required per worker (industrial density) x expected industrial employment for each use Trends show increase in output per square foot of floor space Diversity of Income Many warehouses are single tenant facilities Any prudent investor would want to find out about the financial health of the tenant before either purchasing the property or signing the tenant for a long-term lease Investors should request copies of environmental reports to see if facilities contained any “at-risk” manufacturing in the past Self-Storage Facilities Also known as Mini-Storage These are simply constructed properties that may have climate control in some of the units, and may have keyless entry Anyone use self-storage facilities? Who are the primary users of this type of space? Self-Storage Customers Students – In-transition adults – Moving, down-sizing, up-sizing houses Small business owners – Store personal items during summer breaks Pharmaceutical representatives Military personnel – During large deployments, occupancy rates soar Projecting Demand for Storage Space Estimate average rentable sq ft of storage per person vs. current population in primary market area Then compare to existing supply in the market Is Self-Storage Recession Proof? Some investors believe that this is true – Thought pattern is that people always need storage space and if economy is doing bad, people will attempt to reduce the size of their homes and store their belongings when unemployed This has not proven to be the case – – Many large cities have an over-supply of this type of space and occupancy levels have suffered Nothing in real estate is immune to the business cycle “Ayatollah of Climate Controllah” One of my all-time favorite ads outside a selfstorage facility Portable On Demand Self Storage (PODS) is the latest fad – You have probably seen these in your neighbors’ driveways These can be good investments due to the low cost of construction (for the basic units) and the high concentration of income per square foot Storage Auctions! Been around since late 1970’s Lease agreement allows for lien if bill is left unpaid – Auctions begin typically after unit is 90-120 days in arrears Helps prove property is not recession-proof Storage Auction Impact on Owner – Typically not recovering full amount owed Debt recovery vs. a profit opportunity Any profit must be returned to original owner of unit contents Problems with Self Storage Obtaining supply and demand for these units is tough Not as easy to glean future demand levels from demographic information as in apartments Most commercial banks have a hard time approving loans for “start-up” projects – Want to see a track record of performance first Very Fragmented Market Self-Storage industry does have a few major players, but for the most part has thousands of small owners throughout the country The few larger players have much deeper pockets than the typical investor, and they have the ability to temporarily lower their prices to drive out better located, smaller rivals, to increase their market share. End of Session