Important Information:

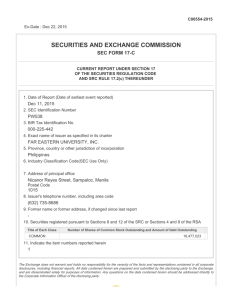

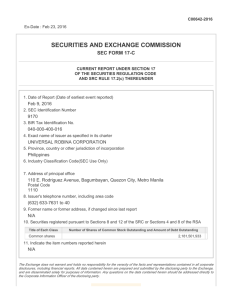

advertisement

Important Information: 1.The fund invests primarily in global equities and fixed income securities through the use of funds or derivatives. 2.For share classes with a general dividend policy, expenses will be paid out of capital rather than out of gross income. The amount of distributable income therefore increases and the amount so increased may be considered to be dividend paid out of capital. Share classes with a fixed dividend policy may pay out both income and capital in distributions. Where distributions are paid out of capital, this amounts to a return or withdrawal of part of your original investment or capital gains attributable to that and may result in an immediate decrease in the net asset value of shares. 3.The fund invests in debt securities which may be subject to interest rate, credit and counterparty risks. The fund may invest in unrated and noninvestment grade securities which are exposed to greater credit risks. 4.The fund may invest in mortgage related and other asset backed securities that may be subject to interest rate, credit, valuation and liquidity risks. 5.The fund’s active management of currency positions may result in losses if the strategy/technique is not successful. 6.The fund may use derivatives to meet its investment objective but does not intend to use derivatives extensively for investment purposes. Derivatives exposure may involve higher counterparty, liquidity and valuation risks. In adverse situations, the fund may suffer significant losses from their derivative usage for hedging. You should not make any investment decision solely based on this document. Please read the relevant offering document carefully for further fund details including risk factors. 29 April, 2016 Schroder ISF Global Multi-Asset Income Get on the Right Track with Global Income Opportunities The Schroder ISF Global Multi-Asset Income Fund offers you an investment choice to enjoy regular income* as well as growth, from a globally diversified portfolio that primarily invests in high income bonds and high dividend yielding equities. The fund will draw on the rich experience and proven expertise of our investment teams who will actively manage the fund to maximise yield and total potential returns in all seasons. Why invest in the Schroder ISF Global Multi-Asset Income Fund? Fixed payout of 5% p.a. (A Dis share class excluding AUD Hedged)* With the primary objective of maximising sustainable yield, the fund intends to make a fixed payout of 5% per annum*. The payout will primarily come from a portfolio of global high income bonds and high dividend yielding equities, selected for the quality and reliability of their income. Equity income investing is relatively attractive High dividend stocks are relatively more attractive than broad equity market High dividend stocks offer investors not only a higher yield, but also better valuation and quality relative to the broad equity market. The more stable earnings and cash-flows of high dividend stocks also provide investors with better investment opportunities. In addition, with interest rates remaining low, the demand for income is here to stay, providing long-term support for high dividend equity strategy over the medium to long-term. Characteristics Metric MSCI ACWI High Dividend Yield MSCI AC World Index Income Dividend Yield 4.1% 2.6% Valuation Price-to-earnings 19.2x 22.7x Quality Return on Equity 16.2% 15.6% Source: MSCI, FactSet, as of 30 April 2016. Enjoy the growth of alternative assets Flexibility to invest in alternative assets The fund can invest in alternative assets such as infrastructure, preferred securities, property, mortgage-backed securities (MBS), asset-backed securities (ABS) and municipal bonds. These assets ensure diversification and improve sustainability of the fund’s income, and offer potential growth for investors. Active asset allocation to maximise yield and total returns Mortgage-backed Securities (MBS) Preferred Securities Asset-backed Securities (ABS) Property Municipal Bonds A wide range of asset classes provide flexibility in asset allocation ﹪ 90 80 70 Global Bonds 20 – 90% 60 Allocation The current asset allocation range in global high income bonds (20 – 90%), global high dividend yielding equities (10 – 50%), alternative assets (0 – 10%) and cash (0 – 20%)1 gives the fund manager flexibility to achieve the fund’s objective of achieving yield and maximising total returns during different phases of the economic cycle. We also implement active downside risk management aiming to protect the fund’s value during volatile markets without sacrificing the income earned from the underlying assets. Infrastructure 50 40 30 20 Global Equities 10 – 50% 10 0 0 – 10% Equities Bonds Alternative Assets 0 – 20% Cash The exact asset allocation may deviate from the range mentioned above without prior notice to investors, please refer to the relevant offering document for details. 1 Schroder ISF Global Multi-Asset Income Fund Features Top Holdings – A Distribution share class offers a fixed payout* (for details refer to table below) – Capture growth potential through investment in high income bonds and high dividend yielding equities around the world – Enjoy the growth of alternative assets – Active asset allocation to manage risk Distribution Policy and Frequency Share Classes A A A A A A A A A Dis- USD Dis- HKD Dis- GBP Hedged Dis- AUD Hedged Dis- EUR Hedged Acc- USD Acc- HKD Acc- GBP Hedged Acc- EUR Hedged ISIN Code Bloomberg Ticker LU0757359954 LU0894486033 LU0910996080 LU0911024122 LU0757360960 LU0757359368 LU0894485498 LU0903425840 LU0757360457 SCHGMIA LX SCHAHKI LX SCGMAGD LX SCGMAUD LX SCGMAHI LX SCHGMAA LX SCHAHKA LX SCHAHAG LX SCGMAHA LX Distribution Distribution Policy Frequency Fixed, 5% p.a. Fixed, 5% p.a. Fixed, 5% p.a. Variable Fixed, 5% p.a. N/A N/A N/A N/A Monthly Monthly Monthly Monthly Quarterly N/A N/A N/A N/A Weights (%) UK Treasury 2% 22/07/2020 US Treasury Note 1% 15/09/2017 US Treasury Note 3.125% 15/08/2044 US Treasury Note 1.25% 29/02/2020 Schroder European Real Estate Investment Trust Plc US Treasury 3.5% 15/02/2018 GCP Infrastructure Investments Ltd US Treasury Note 1.375% 30/09/2018 US Treasury Note 2.375% 31/12/2020 US Treasury Note 1.75% 30/09/2019 Fund Performance Cumulative Performance (%) Fund YTD 3-mth 1Yr 3Yrs 5Yrs Since Launch 3.3 4.8 -5.8 -1.0 N/A 12.3 Annual Return (%) 2015 2014 2013 2012# Fund -6.9 2.8 5.8 7.4 Key Information Fund Objective To provide income and capital growth over the medium to longer term by investing primarily in global equities and global fixed income securities directly or indirectly through the use of investment funds or financial derivative instruments (including, but not limited to, futures, options and credit default swaps). Unit NAV (Class A Acc) USD 112.30 Hi / Lo (past 12 mths, Class A Acc) USD 119.64 / 105.69 Fund Manager Aymeric Forest & Iain Cunningham Launch Date 18/04/2012 Fund Size (Million) USD 4,753.94 Dividend Distribution Record* Share Classes A A A A A Dis Dis Dis Dis Dis - USD HKD GBP Hedged AUD Hedged EUR Hedged Distribution Per Share Price on Record Date Last Record Date 0.384097 2.888796 0.407105 0.477333 1.137815 92.18 693.31 97.71 87.32 91.03 27/04/2016 27/04/2016 27/04/2016 27/04/2016 30/03/2016 0.8 0.6 0.6 0.6 0.6 0.6 0.6 0.5 0.5 0.5 Initial Charge up to (Class A) 5% Upcoming Distribution Record Date of Distribution Share Classes 25/05/2016 29/06/2016 27/07/2016 Note: The distribution record date may subject to change. Geographical Breakdown Weights (%) North America Emerging Markets Europe UK Asia Pacific ex-Japan Japan Others 43.3 24.8 18.5 10.9 2.9 1.7 -2.1 Asset Type Weights (%) Equity US High Yield Government Bonds EM Local Currency EM USD Sovereign Bonds EUR High Yield Catastrophe Bonds US Investment Grade Bonds Others Cash & Income 32.5 17.4 10.1 9.7 9.3 5.0 2.9 2.3 8.3 2.5 Management Fee (Class A) 1.25% p.a. Dealing Frequency Daily Financial Year End 31/12 The Fund Offers an Investment Choice for Investors Who – wish to enjoy a fixed payout* and long-term potential of capital appreciation – look for active asset management that aims to maximise yield and total returns over an economic cycle – are positive on the potential growth around the world Note: Investors should consider your own investment objective and risk tolerance level and seek independent professional advice. Schroder International Selection Fund is referred to as Schroder ISF. * The monthly distribution is applicable to A class USD/HKD/GBP Hedged/AUD Hedged distribution units (in respect of AUD Hedged distribution units, there is neither a guarantee that such distributions will be made nor will there be a target level of distribution payout), the quarterly distribution is applicable to A class EUR Hedged distribution units. The manager will make distributions in respect of distribution units. The manager has the sole and absolute discretion to vary the rate and/or frequency of distributions, subject to one month’s prior notice to the relevant unitholders. Distribution yield is not indicative of the return of the fund. Distribution may be paid from capital of the fund. Investors should note that where the payment of distributions are paid out of capital, this represents and amounts to a return or withdrawal of part of the amount you originally invested or capital gains attributable to that and may result in an immediate decrease in the value of units. All fund information as at 29/04/2016, Source: Schroders. Fund performance based on Class A Acc; NAV-NAV in USD with net income re-invested. The fund size quoted includes all classes of the fund. # Performance is calculated from the fund’s since launch date 18/04/2012. Investment involves risks. Past performance is not indicative of future performance. Please refer to the relevant offering documents for fund details including risk factors. This material, including the website, is issued by Schroder Investment Management (Hong Kong) Limited and has not been reviewed by the SFC. Management Company: Schroder Investment Management (Luxembourg) S.A., 5, rue Höhenhof, L-1736 Senningerberg, Grand Duchy of Luxembourg Supervisory Authority: Commission de Surveillance du Secteur Financier, 110, route d’Arlon, L-2991 Luxembourg