Document 14328157

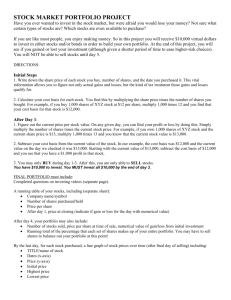

advertisement