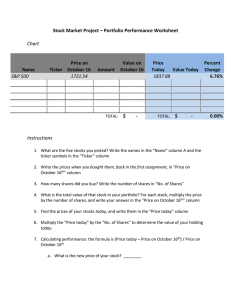

instructions

advertisement

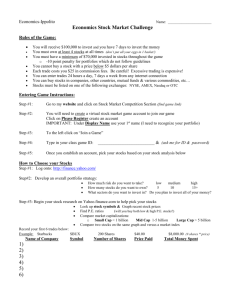

STOCK MARKET PORTFOLIO PROJECT Have you ever wanted to invest in the stock market, but were afraid you would lose your money? Not sure what certain types of stocks are? Which stocks are even available to purchase? If you are like most people, you enjoy making money. So in this project you will receive $10,000 virtual dollars to invest in either stocks and/or bonds in order to build your own portfolio. At the end of this project, you will see if you gained or lost your investment (although given a shorter period of time to ease higher-risk choices). You will NOT be able to sell stocks until day 5. DIRECTIONS: Initial Steps 1. Write down the share price of each stock you buy, number of shares, and the date you purchased it. This vital information allows you to figure not only actual gains and losses, but the kind of tax treatment those gains and losses qualify for. 2. Calculate your cost basis for each stock. You find this by multiplying the share price times the number of shares you bought. For example, if you buy 1,000 shares of XYZ stock at $12 per share, multiply 1,000 times 12 and you find that your cost basis for that stock is $12,000. After Day 1: 1. Figure out the current price per stock value. On any given day, you can find your profit or loss by doing this. Simply multiply the number of shares times the current stock price. For example, if you own 1,000 shares of XYZ stock and the current share price is $13, multiply 1,000 times 13 and you know that the current stock value is $13,000. 2. Subtract your cost basis from the current value of the stock. In our example, the cost basis was $12,000 and the current value on the day we checked it was $13,000. Starting with the current value of $13,000, subtract the cost basis of $12,000 and you see that you have a $1,000 profit in that stock. 3. You may only BUY during day 1-3. After this, you are only able to SELL stocks. You have $10,000 to invest. You MUST invest all $10,000 by the end of day 3. FINAL PORTFOLIO must include: Completed questions on investing videos (separate page). A running table of your stocks, including (separate sheet): Company name/symbol Number of shares purchased/held Price per share After day 1, price at closing (indicate if gain or loss for the day with numerical value) After day 4, your portfolio may also include: Number of stocks sold, price per share at time of sale, numerical value of gain/loss from initial investment Running total of the percentage that each set of shares makes up of your entire portfolio. You may have to sell shares to balance out your portfolio at this point! By the last day, for each stock purchased, a line graph of stock prices over time (after final day of selling) including: TITLE/name of stock Dates (x-axis) Price (y-axis) Initial price Highest price Lowest price