D’Artagnan Capital Fund Annual Performance Report Williams College of Business

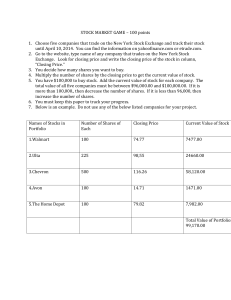

advertisement