A mixed month of good and bad news;

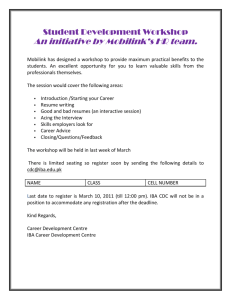

advertisement

A mixed month of good and bad news; Asiamoney. London: Mar 2004. pg. 1 http://proquest.umi.com/pqdweb?did=608155501&sid=22&Fmt=3&clientId=68814&RQT =309&VName=PQD Abstract (Document Summary) Borrowing or selling, it's mostly been good news for Asia's sovereigns. Governments in the region are setting new benchmarks in the global debt capital markets. At the same time, the equity markets are encouraging a swathe of privatization issues. A series of benchmark bond issues that emerged in February said much about how investors perceive some of the lower-rated sovereign credits in the region. The news was excellent for Pakistan, outstanding for Indonesia and rather miserable for the Philippines. As Pakistan priced its 5-year deal, the Philippines March 2009 bond was trading to yield at 7.15%, about 40 bps outside the lesser-rated Pakistan. China is, of course, continuing its mammoth sell-down programme, while India - the only other country with more than a billion people - in February suddenly announced plans to sell about US$3.2 billion of government-owned stock by March 31. Full Text (2936 words) Copyright Euromoney Institutional Investor PLC Mar 2004 Borrowing or selling, it's mostly been good news for Asia's sovereigns. Governments in the region are setting new benchmarks in the global debt capital markets. At the same time, the equity markets are encouraging a swathe of privatization issues. So, is it good news all round? Well, not quite A series of benchmark bond issues that emerged in February said much about how investors perceive some of the lower-rated sovereign credits in the region. The news was excellent for Pakistan, outstanding for Indonesia and rather miserable for the Philippines. While the Philippines was engaged in its somewhat contentious old for new' bond exchange last month, Pakistan courtesy of leads ABN Amro, Deutsche Bank and JPMorgan sold US$500 million of five-year bonds at 370 bps over Treasuries. Even with continued assassination attempts on president Musharraf, ongoing troubles in Afghanistan and fallout from the nuclear scandals, the B2/B-rated credit priced well inside the Ba2/BB-rated Philippines, which continues to wallow in the mud of investor perception. As Pakistan priced its five-year deal, the Philippines March 2009 bond was trading to yield at 7.15%, about 40 bps outside the lesser-rated Pakistan. That differential is certainly not merited by the relative ratings, even given the view that the Philippines might slip a notch before long. However, the sad reality is that the country has become marginalized in investors' minds, both in the debt and equity markets. The Philippines has earned an unenviable reputation for consistently disappointing its people and investors, at home and abroad. Last month, it concluded a contentious US$1.3 billion deal to exchange old bonds for new. Global co-ordinator JPMorgan and joint bookrunners Citigroup and Deutsche Bank arranged the deal, which was essentially the repackaging of nine different outstanding bonds into a single new issue. But the new Philippines' 10-year global, priced to yield 8.465% or 490bps over Treasuries, slipped as the inevitable flow of disturbing news came out of the country. The latest was in the form of demonstrations related to the selection and approval of presidential candidates prior to the May elections. If the Pakistan finance officials were pleased with the rapturous response to their country's rare benchmark issue; their counterparts in Indonesia were set to be even more delighted. Indonesia is the most directly comparable credit in the region, being the world's largest Muslim country by population, with Pakistan second largest. Indonesia was due to price its US$500 million to US$1 billion global on March 4, following a bookbuild conducted by Deutsche Bank and JPMorgan. It is the country's first overseas deal since 1996 and as soon as the market heard of the deal on February 23, the buzz was of pricing well inside the Pakistan benchmark, despite the identical B2/B rating. That is another bitter blow for the Philippines, as there was every indication that Indonesia's 10-year bonds were likely to price a whopping 2% or more tighter than the Philippines' January 2014 issue, again despite the latter being rated several notches higher. The Philippines is also likely to be notable by its absence from the privatization festival that is about to hit the Asia-Pacific markets. With the global equity markets continuing to enjoy such positive momentum and with most countries in the region producing outstanding economic growth numbers, regional governments are quite appropriately preparing a feast of state sales. China is, of course, continuing its mammoth sell-down programme, while India the only other country with more than a billion people in February suddenly announced plans to sell about US$3.2 billion of government-owned stock by March 31. With domestic liquidity running high and interest rates at historic lows, foreign investors will be hard-pressed to pick up stock in these sales. The predominantly domestic sales should find plenty of buyers at home, as evidenced by the one-day sell-out on February 19 of stock in Indian Petrochemicals, India's second-largest chemicals company. Perhaps only the state's 10%, or roughly US$2.5 billion, stake in Oil Natural Gas, the number one oil exploration company, will be partly sold offshore. Thailand is altogether a different proposition. While domestic liquidity runs high, the institutional market at home is relatively thin. Hence the arrangers of the Airports of Thailand IPO, which was set to be completed in late February, were targeting about 40% of the offer to long equity buyers overseas. am ---The Shinsei IPO and a ready Japan By Pauline Loong REBIRTH IS THE literal translation of the Japanese word Shinsei. And it is perhaps apt that the biggest IPO to come out of Japan in recent years is from the bank with a name that evokes sentiments such as reawakening, renewal, rekindling, revival and resurgence synonyms for rebirth listed in the Thesaurus. The February 19 listing of Shinsei Bank and the stock's 52% surge on its Tokyo Stock Exchange debut says as much about the mood in Japan these days as about the evident quality of the bank that has risen, Phoenix-like, from the ashes of the failed Long Term Credit Bank of Japan (LTCB). The three joint leads Citigroup, Morgan Stanley and Nomura had been swamped with US$51 billion in orders for the US$2.3 billion offer. In the same week as Shinsei listed, the government released figures showing that real growth had raced ahead to 7% in the last quarter of 2003. The mood in Tokyo these days is effusive, though still cautious. Dresdner Kleinwort Benson strategist Peter Tasker notes in a February 3 report that "the Japanese stock market is either extremely cheap or extremely expensive, depending what you want to look at". Relative to cashflow, book value, nominal GDP and economy-wide pre-tax earnings, Japanese stocks are as cheap as they have been in decades, says Tasker. But on the metrics that are closest to shareholders' hearts, EPS and dividend yield, the values still look far from compelling. The opposite is true of Shinsei after the first day's trading. After the 52% jump, the stock was valued at more than 2.3 times book value. There is plenty of E in the PS, but the multiple leapt from a fair 16.4 times on listing to 25 times less than eight hours later. Most investors that the company met on the global roadshow saw the stock as a gateway to Japan's recovery, evidence of which was cropping up almost weekly. They voted with their cheque books that the cleaned-up balance sheet and a focused management could help the stock outperform. They were right, it soared in less than a day. What next? Some analysts say that the stock went too far, too fast. Within days of the exuberant debut, it slipped back from its lofty heights. But the first day's excesses were through no fault of the leads. The deal is generally seen to have been priced on the button. Some analysts say that Shinsei is now likely to be forgotten until its next set of results proves that it is indeed outperforming the wider economy; that its stock deserves more the rating of an investment bank than that of a polished-up corporate bank. For Ripplewood and friends who took over the failed LTCB from the state in 2000, the deal is a remarkable coup. After day one of listing, the consortium's remaining 66% stake was worth the equivalent of about US$6.75 billion. And for those detractors among the opposition party politicians who have tried to stir anti-gaijin sentiment, let it be remembered that the state also holds a stake in Shinsei worth about US$5.3 billion through its mandatory convertible preference shares. am ---Cash-heavy Fubon bids for IBA By Dominic Jones Fubon Financial Holding has announced a firm bid offer to acquire a controlling interest in Hong Kong-based International Bank of Asia (IBA). The offer, which would see the Taiwan firm purchasing Arab Banking Corp's 55% stake in the Hong Kong lender, is valued at HK$4.3 billion (approximately US$553 million) and would also involve a special dividend of HK$0.26 per share. Some reports indicate Fubon is bidding for IBA in order to take advantage of the Closer Economic Partnership Arrangement (CEPA) recently signed between Hong Kong and China. "The CEPA relaxes requirements for Hong Kong banks aiming to open branch offices on the mainland and could provide a back door for Taiwanese banks who are currently barred from having full banking operations [there]," says Franklin Yao at Primasia Securities. But according to Raymond Heung, banking analyst at CLSA in Taipei, this is unlikely to be the main rationale. "IBA could be a bridgehead, but under the CEPA, IBA would still need two years before it can start offering banking services in the mainland," he says. The more powerful rationale is immediate. At Fubon's bid price, IBA is simply a good buy. "The total cost for Fubon is 1.22 times price to book value, which is an attractive valuation for the acquirer," says Heung. "Just from an asset trading perspective, the deal is a good one for Fubon." The deal also makes sense for the Taiwanese financial group because it has considerable excess capital, which it needs to deploy. "Fubon hasn't been able to absorb this excess through a share buy-back scheme as Taiwanese accounting regulations hinder this strategy," Heung notes. Fubon plans to pay cash for the IBA transaction. Because of its surplus funds, Heung also believes the IBA deal won't stretch Fubon's balance sheet even if Fubon is successful in its other potential acquisition, of domestic competitor Sinopac Bank. In any case, the Sinopac deal looks less probable than the IBA bid. "Fubon is bidding against a rival Taiwanese financial holding company, Chinatrust, and it isn't submitting a particularly aggressive offer. The chances of it winning the bid are not that great," says Yao. am ---Taj hotels CB fully booked By Mark Johnson Indian companies are perennially noticeable by their absence in the global capital markets, belying the country's size. That partly explains why a US$150 million convertible bond issue for the owner of the famous Taj Hotel was greeted with such exuberance, as investors placed orders for more than 20 times the bonds on offer. The issue from The Indian Hotels Company was the largest convertible bond (CB) from India since 1997. "The buoyant Asian equity-linked market has been reaching fever pitch in the past few months," reports Udhay Furtado, vice-president at Citigroup's Asia ECM team. "This deal gave investors a recognizable brand name, a well-respected company and welcome portfolio diversification from North Asian issues." The company is part of the Tata Group and owns the famous Taj brand name. Although only a modest-sized deal in today's Asian context, competition for the mandate was intense, with the company finally selecting a powerful triumvirate of Citigroup, Merrill Lynch and Morgan Stanley to manage the sale. Indian regulators demand a five-year maturity for convertible bonds, with no puts. That is partly why the company ended up paying a yield of 3.15%. That might seem steep when Taiwanese issuers are obtaining sub-zero cost of funds, but the issuer should more fairly be compared with companies in other regional markets. A direct comparison emerged in mid-February, when Shangri-La Hotels, listed in Hong Kong and Malaysia, raised US$200 million with a CB that yields 2.75%. Moreover, many Indian deals in the past have required credit enhancement, whereas Taj was a standalone transaction. Even so, buyers from across the globe tried to book into the deal, which resulted in a pricing inside of the marketed range. Pramit Jhaveri, head of Citigroup's India investment bank, comments: "Citigroup's second CB offering since the successful Tata Motors deal in 2003 has demonstrated the robustness of investor demand for Indian blue chips. We now anticipate that other Indian companies will follow the lead set by this issuer, as the terms on offer in the market today are compelling." am ---Merrill party with NAB's threesome By Rob Oldnall Merrill Lynch in late January launched three simultaneous secondary share sales on behalf of National Australia Bank. "This was a first for the Australian market, and showed the capacity of the Australian and international markets to take large blocks of stock within a few hours," says Kevin Skelton, country head at Merrill Lynch in Sydney. "Our local and global distribution is critical when we are required to sell US$763 million of stock on an underwritten basis." NAB concurrently disposed of 7.7% of St George Bank, 2.3% of AMP Ltd and 1.4% of HHG, the UK investment manager listed late last year as part of the AMP demerger. Australia's largest bank by market value said the disposals were part of its strategy to focus on core businesses in Australia, New Zealand and the UK. Some in the market took a more sceptical view that the bank wanted to realize profits on the stakes to take attention off the losses it has racked up due to unauthorized foreign exchange trading. However, the placements propelled NAB shares A$0.95 to A$30.40 as the market warmed to the idea of NAB stepping back from jumbo takeover targets, particularly the long-time suspects St. George and AMP. The bank sold strategic stakes held in St. George Bank, AMP Limited and HHG plc, taking gross proceeds of A$993.2 million (approximately US$767.09 million) from the sales and a profit of A$322 million, on which it will not pay any tax thanks to substantial capital losses relating to the sale of HomeSide, its US home mortgage business, last year. The accelerated global bookbuild for all three stocks was the second big coup of the year for Merrill in Australia. The giant US investment bank has been struggling to punch its weight down under in recent years, but had earlier in January won a prestigious bought deal from General Motors to sell A$1.2 billion of News Corp preference shares. Aside from its willingness to underwrite prices for all three of NAB's disposals, the fact that Merrill had worked for NAB in first securing the St. George stake no doubt helped it win this latest jumbo deal. Merrill had conducted Australia's first-ever reverse bookbuild to acquire 14 million shares for NAB at A$13.50 in January 2000. "We have a history of innovative ECM transactions in Australia, and this deal is directly in that tradition," says Skelton. "We had no doubts that we could execute all three trades simultaneously and at tight discounts. For example, more than 100 buyers from across the globe came into the St. George book, with an ideal mixture of fundamental, index and momentum buyers." The deal was also a disappointment for JBWere Goldman Sachs, as the Australian portion of that new partnership has long enjoyed a strong relationship with NAB. In August 2003 NAB launched a failed raid on AMP, in which both Citigroup and JB Were were involved. That sortie failed to capture the 15% stake NAB was thought to be seeking. The fallout from NAB's forex losses and the stuttering takeover forays of recent years meant something had to give. Shortly after the trio of disposals, CEO Frank Cicutto stepped down. am ---Elsewhere in the market Koram bank take over Citigroup has agreed to buy KorAm Bank in the biggest acquisition by an overseas investor in South Korea. The US bank is paying 3.18 trillion won (US$2.7 billion) in cash, the equivalent of 15,500 won a share, which is a 6.7% premium to the average price in February. But KorAm shares fell 5.1 per cent soon after the announcement, reflecting disappointment with the offer price and the time it took for the purchase to be completed. amIndia lifts foreign cap The Indian government's decision to raise foreign direct investment (FDI) levels in the banking sector changes the picture for foreign suitors. The government has approved a hike in FDI from 49% to 74% but voting rights of foreign entities will not exceed 10%. Wholly owned subsidiaries regulated by the Indian financial regulator are permitted to hold 100% equity. Up until now, private banks were allowed 49% FDI and an additional 49% via foreign institutional investment (FII), taking the total ceiling to 98%. "With the recent amendment, the government has allowed 74% FDI and capped FII holdings at 49% within the overall foreign investment ceiling of 74%," says Ajay Parmar, head of equity research at broking firm Joindre Capital Services Limited. "There is a reduction in the total foreign stake allowed in private banks." Analysts feel that with only limited voting rights, investing banks will find it difficult to impose their brand and business culture. They expect a preference for the 100% equity route in future acquisitions. Inorganic growth will also depend on factors such as distribution, customer mix and core competency. HSBC, Standard Chartered, ABN Amro and Citibank, which have focused on corporate and merchant banking, are expected to increase their private-sector holdings with a view to boosting retail portfolios. "With treasury profits dipping, retail banking will be the key focus in the next five to seven years," says Jitendra Jain, associate vice-president and head treasury of Government of Maharastra Development Bank, Sicom. amXinao Gas placement Privately owned Chinese piped-gas distributor Xinao Gas has raised about HK$468 million (US$60 million) through the placing and subscription of 122 million existing shares and new shares in February. The placing price of HK$3.84 per share represented a discount of 7.2% to its average closing price over the 10 trading days before pricing. The placing agent of the Hong Kong-listed company is HSBC. Xinao Gas chairman Wang Yusuo says: "The placement has got good feedback with three times subscription, mainly from professional and institutional investors in Asia, the United States and Europe." The placing represents just over 14% of the enlarged issued capital. Proceeds will fund the company's long-term development plans. am