Board of Trustees Committee of the Whole Meeting June 18, 2014 Budget Resolutions

advertisement

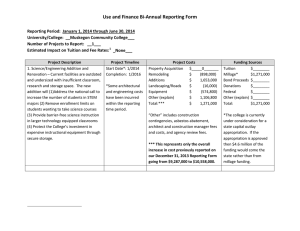

Board of Trustees Committee of the Whole Meeting June 18, 2014 Budget Resolutions For Consideration and Vote Final Amended 2013‐2014 Budget Initial 2014‐2015 Budget Millage Authorization (Operating, Debt) Tuition and Fee Recommendation beginning Winter 2015 FINAL FY13‐14 AMENDED BUDGET: GENERAL FUND Final FY13‐14 General Fund Budget REVENUES Overall upward amendment to revenue is $2.0 Million; 2.28% change from January 2014 amendment Transfers In Tuition, Grants, Property Taxes $350,000 Decrease from Reserves Up $400k State Aid $1.6 Million for the UAAL Rate Stabilization Payments Final FY13‐14 General Fund Budget EXPENDITURES Amended upward by $1.3 Million; 1.73% Salaries & Fringe Benefits $1.6 Million for the UAAL Rate Stabilization Payments Non‐ salary related expenses Savings in contracted services, materials & supplies, and utilities, increase in bad debt expense, equipment Final FY13‐14 General Fund Budget 13‐14 AMEND #1 13‐14 AMEND #2 $ 73,746,195 $ 73,313,454 $ 75,078,928 73,671,482 73,896,751 75,265,897 Excess (Deficit) Revenues Over Expenditures $ 74,712 $ (583,297) $ (186,969) Fund Balance – Beginning $ 6,506,447 $ 6,581,160 $ 6,581,160 Fund Balance – Ending $ 6,581,160 $ 5,997,863 $ 6,394,191 Fund Balance Percent* 8.92% SUMMARY 12‐13 ACTUAL Revenues Expenditures * Target = 5% ‐ 10% of expenditure budget 8.18% 8.52% Final FY13‐14 General Fund Budget NET RESULTS OF AMENDMENT: 6/30/2014 projected to end with ($187,000) reduction FUND BALANCE : $400,000 higher than the January Amended Budget Reserves as Required by Board Policy #3930 FUND Fund Name Requires 01 72 78 General Operating Maintenance & Reserve Replacement Fund Building & Site Fund 5‐10% of annual operating expenses 1‐3% of College depreciated assets or $3 M 1‐3% of College depreciated assets or $3 M 8.5% $1.6 million $1.8 million $1.4 million $1.2 million 13‐14 Amended Budget Reserve Amount Needed to Fully Fund Funding Sources State Aid 2014 ‐2015 Tuition Debt Property Taxes Operating THEN and NOW 1999‐2000 Tuition 32% 2013‐2014 Tuition 49% Taxes 26% State Aid 37% Other 5% State Funding $15,344,107 State Aid 21% Other 6% State Funding $15,306,817 Taxes 24% What if Tuition Covered State Aid Losses? Actual $167 $175 $175 $147 $129 $130 $133 $100 $100 2012‐2013 $103 2011‐2012 $94 2010‐2011 2005‐2006 $87 2009‐2010 2004‐2005 $85 2008‐2009 $71 $82 2007‐2008 $63 $80 2006‐2007 $61 $69 $76 2003‐2004 $73 2002‐2003 $61 $113 $120 2013‐2014 $115 $121 2001‐2002 $200 $180 $160 $140 $120 $100 $80 $60 $40 $20 $‐ Hypothetical Projected Property Tax Funding FYE 2010 through FYE 2016 Millions ($19.4 Million lost since 2009‐2010) $24 $22 $23.3 $20 $20.2 $18.9 $18 $17.7 $16 $17.2 $17.2 $17.5 2013‐2014 2014‐2015 2015‐2016 $14 $12 2009‐2010 2010‐2011 2011‐2012 2012‐2013 Enrollment and State and Local Funding per Fiscal Year Equated Students (FYES) Revenue per FYES $6,500 $5,500 $5,000 $4,500 2012‐2013 2011‐2012 2010‐2011 2009‐2010 2008‐2009 2007‐2008 2006‐2007 2005‐2006 2004‐2005 2003‐2004 2002‐2003 $4,000 2001‐2002 Funding $6,000 Percentage of Property Tax and State Aid of Total Funding 70% 65% 60% 63% 55% 60% 62% 60% 59% 58% 57% 56% 56% 50% 54% 51% 45% 47% 40% 44% 45% 45% 35% 6/2014 6/2013 6/2012 6/2011 6/2010 6/2009 6/2008 6/2007 6/2006 6/2005 6/2004 6/2003 6/2002 6/2001 6/2000 30% Based on 2012 – 2013 ACS Data Current Year Comparison of Millage Rates / Property Tax Declines with State Grouping 0.0% Grand Rapids Schoolcraft ‐0.3% ‐2.0% Property Taxes ‐3.0% Delta Wayne County ‐1.7% Kalamazoo Valley Mott Washtenaw Henry Ford 3.5 ‐0.7% ‐0.9% 3.0 ‐2.5% 2.5 ‐4.0% 2.0 ‐4.5% ‐5.0% ‐6.0% ‐4.6% 1.5 1.0 ‐7.0% ‐8.0% ‐7.7% ‐9.0% MCC is 3rd Highest Millage Rate, and has the Largest Property Tax Decline 0.5 ‐ Millage Rates ‐1.0% 4.0 $120 $100 $80 4th Lowest $60 $40 $20 Wayne County Grand Rapids Washtenaw Henry Ford Mott Schoolcraft Delta $‐ Kalamazoo Valley Millions Current Year Comparison of State Peer Group Total Revenue $60 $50 $40 $30 $20 8 7 6 5 4 3 2 1 Schoolcraft Delta Mott Grand Rapids Washtenaw Wayne County $‐ Kalamazoo Valley $10 Henry Ford Millions Current Year Comparison of State of Michigan Peer Group Property Tax Revenue Comparison of State of Michigan Peer Group Revenue Percentages Based on 2012 ‐ 2013 ACS Data 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 45% 41% 53% 21% Delta 17% Grand Rapids Henry Ford All Other 34% 38% 49% 45% 17% 13% 15% Schoolcraft Washtenaw Wayne County 31% 29% 22% 19% Kalamazoo Mott 11% 24% Tuition & Fees 51% 34% 26% Property Tax 47% 63% 32% State Aid Expenditure Reductions Energy Conservation Project Utility costs averaged 8.2% in 2003; now they are 3.1% Hold on vacant positions Average savings of $750K per year Change in timing of custodial shift Savings of approximately $170K per year Eliminating and restructuring food service Was losing approximately $100K per year Now generating $48K per year in revenues More Expenditure Reductions Utility Reduction Analyst Project Resulted in $720K savings between 2004‐2010 on Telecommunications/IT, Water & Waste Employee Contract Bargaining Employees agreed to pay freezes with incremental increases over 9 years at 1.35% Industry average is 2.8% Savings of $460K per year Course Section Efficiency Maximizing section seat count before adding new sections Discretionary budget cuts Average savings of $400K per year Even More Expenditure Reductions Reduction of ORP (optional retirement plan) costs Average annual savings of $400K Combining Deans position Fine Arts and Social Science combined saving $168K per year Outsourcing custodial and grounds work at sites Savings of approx. $350K per year Health Insurance changes to coverage and plans Savings $550K New print shop lease Savings of $200,000 per year New Auditors Savings of $60,580 over five years Tuition & Financial Aid Federal Aid $27,100,000 72% Other Aid Cash Paying Total aid comprises 78% of MCC’s total tuition revenue $8,300,000 22% $2,300,000 6% Millions Pell Awards $35 $30 $25 $20 $15 $10 $5 $0 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Academic Year Pell Award & Cost of Tuition (PUBLISHED 13‐14) MOTT COMMUNITY COLLEGE IN‐DISTRICT SAGINAW VALLEY STATE UNIVERSITY IN‐STATE Pell Awarded $5,730 $5,730 Tuitions & Fees $4,271 $7,985 $1,000 $1,000 $459 ‐ $3,255 (30 contact hours) Books & Supplies Difference Student receives remaining balance Student needs unmet Pell Distribution – 2013/2014 Approximately 7,282 Students AWARDED $ 22,570,894 EDUCATIONAL TUITION & FEES $ 17,655,767 2014/1 to 2014/4 ‐ Preliminary EDUCATIONAL BOOKS NON‐EDUCATIONAL $$ & SUPPLY CHARGES GIVEN TO STUDENTS $ 2,659,748 $ 2,255,379 THE AMERICAN OPPORTUNITY TAX CREDIT (AOTC) LL for Most EVERYONE ELS Available Financial Aid (Pell & American Opportunity Tax Credit) Pell American Opportunity Tax Credit (AOTC) “Pell for Most Everyone Else” Maximum Award $5,730 $2,500 Enrollment Sliding Scale up to full‐time At least Half Time Income Limits Expected Family Contribution Modified AGI < $80,000 Single < $160,000 MFJ Program of Study Degree or Certificate‐Accredited Institution Degree or Certificate‐Accredited Institution Can be used for Tuition, fees, books, equipment, supplies, leftover can be for living expenses Tuition, fees, books, equipment, supplies Length of Award 6 years 4 years Other Eligibility Not convicted of a felony drug offense Not convicted of a felony drug offense Tuition & Fee Recommendation Per Contact Hour 2013 CY RATE 2014 CY RATE In‐District Rate $ 122.50 $ 126.30 $ 3.80 Out of District Rate $ 177.96 $ 183.48 $ 5.52 Out of State Rate $ 253.54 $ 261.40 $ 7.86 $ 7.02 $ 7.24 $ 0.22 $ 122.50 $ 126.30 $ 3.80 $ 8.50 $ 8.76 $ 0.26 Institutional Technology Fee Student Services Fee Student Administrative Fee INCREASE Tuition & Fees: Local Comparison College Yearly Tuition & Fees Mott Community College $ 4,271 Saginaw Valley University $ 7,985 Eastern Michigan University $ 7,989 Baker College – Flint $ 8,280 University of Michigan – Flint $ 9,426 Oakland University $ 10,613 Ferris State University $ 10,950 Central Michigan University $ 11,220 Davenport University MCC’s annual cost is approximately 48% of that of the next most affordable college/university in our area Not Reported Michigan State University $ 12,862 University of Michigan – Ann Arbor $ 13,783 Kettering University $ 29,536 Cost is based on rates published from the Peterson’s Guide at www.petersons.com as of 6/11/2014. Relevant Board Policies 3100 BUDGET ADOPTION • Budget revisions will be brought forward for Board action as necessary, but not less than twice per year. 3920 FINANCIAL STABILITY & 3930 FISCAL RESERVES • The College will designate and set aside appropriate fund reserves to support plans for long‐term capital and operating commitments 5100 COMPENSATION PHILOSOPHY • The Board has determined based on long‐term budget projections, and other related budget data, that total compensation/ benefits should not exceed 77% of the total operating budget Strategic Plan 7‐0 Budget/Finance 7‐1 7‐2 7‐3 7‐4 Focus on controllable revenues and costs to sustain our current reputation and facilities and provide funding for strategic priorities Establish short and long‐term budget and finance priorities that provide a balanced approach to the needs of a learning organization with the flexibility to realign resources Implement a comprehensive strategy to address the long‐term deficit which enables us to continue to provide affordable high quality education Seek and cultivate alternative resources to supplement and/or increase existing revenue streams and funding sources Proposed FY14‐15 General Fund Budget REVENUES – KEY ASSUMPTIONS Tuition & State Aid $1.5 million in tuition & fees; $430,000 in State Aid Property Taxes Grants & Other unchanged ($100,000) decrease in transfers in Proposed FY14‐15 General Fund Budget EXPENDITURES – KEY ASSUMPTIONS Salaries & Fringe Benefits No across the board increases, minimal increase in health insurance (hard cap), and blended MPSERS rate Other Expenses Additional bad debt expense Initial FY14‐15 General Fund Budget 13‐14 AMEND #2 INITIAL 14‐15 Revenues 75,078,928 75,430,356 Expenditures 75,265,897 75,424,741 Excess (Deficit) Revenues Over Expenditures (186,969) 5,615 Fund Balance – Beginning 6,581,160 6,394,191 Fund Balance – Ending 6,394,191 6,399,806 Fund Balance Percent* 8.52% 8.45% * Target = 5% ‐ 10% of expenditure budget Proposed “Other Funds” FY14‐15 Budgets Main Point is Impact on Operating Budget à Designated Fund $2.7Million Revenue Budget Scholarships, Student Enrichment, Copy Machines, Paid Parking, Designated Technology Fee à Auxiliary Enterprise Fund $994,000 Budget $751,750 Net “Profit” Supplements General Fund Catering, Vending, Bookstore, Computer Lab Printing, Lapeer Campus Auxiliary Proposed “Other Funds” FY14‐15 Budgets Main Point is Impact on Operating Budget à Debt Retirement Fund Millage rate remains at 0.87 mill to meet debt obligations à Capital Funds repair, upgrade of buildings, equipment, technology & vehicles ($101 million in net value) Instructional Technology Fee = $1.55 Million per year $765,000 per year planned transfer from General Fund (minimum required annual expenses) Regional Technology Center Capital Funding Link to Mission and Strategic Plans MCC’s mission statement directs the college to… “maintain its campuses, state‐of‐the‐art equipment, and other physical resources that support quality higher education. The college will provide the appropriate services, programs, and facilities to help students reach their maximum potential.” Capital Asset Funding Current 10 year needs are approximately $85 million Taxable Values Declining Bond Millage passed in November 2013 ($50 M) Approx. $1.6 million in tech fees annually 7 – Year Forecast Key Assumptions – Revenue à Tuition and fee revenue increases at 1.0% each year à Property tax revenue remain flat for 1 year with slight à à à à increases (0.5‐1.0%) thereafter 0.6410 Mill Voted Operating Millage is renewed for 10 years starting with FY08‐09 State appropriations increase at 1% Other revenues increase by 2% each year Total revenue increases by an average of 1.4% 7 – Year Forecast Key Assumptions ‐ Expenses à Salaries and wages increase by 2.5% each year à Fringe benefits increase at a rate of 2.0% each year à Total expenses increase by avg. of 2.4% each year 7 – Year Forecast Projected General Fund Balance would be ($12.7) million at end of FY20‐21, if current trends continued (Revenue growth of 1.4% vs. expenditure growth of 2.4%) Based on an average projected gap of $823,000 per year to be filled with budget‐balancing solutions Short‐term savings and flexibility continues to be key Long‐term strategy of managing total compensation costs 7 Year Forecast at June 2014 AMENDED BUDGET 13‐14 REVENUES INITIAL BUDGET 14‐15 15‐16 16‐17 17‐18 18‐19 19‐20 20‐21 Tuition & Fees 36.6 38.2 38.6 38.9 39.3 39.7 40.1 40.5 Property Taxes 17.3 17.3 17.6 18.0 18.4 18.9 19.4 19.9 State Appropriations 16.9 15.7 15.9 16.1 16.2 16.4 16.5 16.7 4.2 4.2 4.3 4.3 4.4 4.5 4.6 4.7 75.1 75.4 76.4 77.3 78.4 79.5 80.7 81.8 0.5% 1.2% 1.3% 1.4% 1.4% 1.4% 1.4% All Others TOTAL REVENUE Revenue Increase (Decrease) EXPENDITURES Salaries 40.0 40.3 41.3 42.4 43.4 44.5 45.6 46.7 Fringe Benefits 18.6 17.6 18.0 18.3 18.7 19.1 19.4 19.8 All Others 16.7 17.5 18.0 18.5 19.1 19.6 20.1 20.7 75.3 75.4 77.3 79.2 81.2 83.1 85.2 87.3 0.1% 2.6% 2.4% 2.4% 2.4% 2.4% 2.5% (0.19) 0.06 (1.0) (1.9) (2.7) (3.6) (4.5) (5.5) 6.3 6.4 5.4 3.4 0.7 (2.9) (7.4) (12.9) TOTAL EXPENDITURES Expenditure Increase (Decrease) Surplus/(Deficit) Fund Balance Note: the forecast illustrates proforma data if current trends were to continue. The College is obligated to balance its budget each year and will take necessary steps to do so. Board of Trustees Committee of the Whole Meeting June 18, 2014 Questions or Comments? Larry Gawthrop, CFO (810) 762‐0525 larry.gawthrop@mcc.edu Details Provided with Board Resolutions 1.39 and 1.40