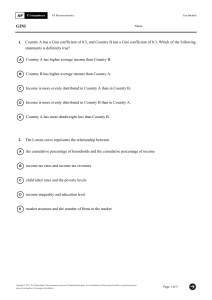

Problem Set 7 Problem 1

advertisement

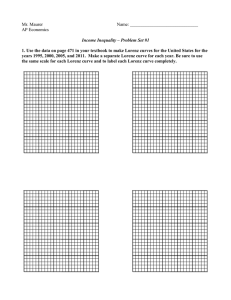

Problem Set 7 Problem 1 a. The median voter belongs to group M. If society members of income M support the tax then low-income, L, members support the tax as well, (they pay less taxes and enjoy the same benefits), and therefore the majority supports the tax. If society members of income M object the tax then highincome, H, members object the tax as well, (they pay more taxes and enjoy the same benefits), and therefore the majority objects the tax. The median voter support the tax rate of τ if M ≤ (1 − τ ) M + τ θ H +M +L H +M +L ↔M ≤θ 3 3 . b. For θ = 1 the condition turns to be about the ratio between median income and average income. Problem 2 Ability of individual i is αi , and income xi is given by xi = a + bαi where a, b > 0. αi is uniformly distributed in the unit interval. The cumulative distribution of wealth, F (x) = P (xi < x) = P (a + bαi < x) = P (αi < 0 (x − a)/b F (x) = 1 x<a x ∈ [a, a + b] x>a+b The density function f (x) : 0 1/b f (x) = o x<a x ∈ [a, a + b] x>a+b 33 x−a ) b Total income of all individuals with ability αi < α, for α ∈ [0, 1] (noting that f (αi ) = 1 for all α ∈ [0, 1]): ∫ α f (αi )x(αi )dαi 0 ∫ α = [a + bαi ]dαi = aα + bα2 /2 0 For α = 1, (total income in the economy): a + b/2 therefore the Lorenz curve is, L(α) = aα + bα2 /2 , f or α ∈ [0, 1] a + b/2 the area under the Lorenz curve is ∫ 1 ∫ 1 aα + bα2 /2 L(α)dα = dα a + b/2 0 0 1 a b = α2 + α3 2a + b 6a + 3b 0 3a + b = 6a + 3b the Gini index is 1−2 3a + b b = 6a + 3b 3(2a + b) hence: for a = 0 Gini = 1/3 for a > 0 Gini is increasing with b. d. The income of i after taxation ( ) ( ) b i i x̃ = (1 − τ ) x + θτ x̄; x̄ = a + , xi = a + bαi 2 denote x b the income such that x̃i = xi (1 − τ ) xi + θτ x̄ = xi 34 ) ( b x b = θx̄ = θ a + 2 ( ) θ a + 2b − a (θ − 1)a θ F (b x) = = + b b 2 e. For θ < 1, F (b x) = 0 ←→ b ≤ 2a(1 − θ)/θ → for low levels of inequality the support is zero. dF (b x)/db > 0, x) = θ/2 lim F (b b→∞ inequality increases support for taxation For θ > 1, F (b x) = 1 ←→ b ≤ 2a(θ − 1)/ (2 − θ) → for low levels of inequality the support is unanimus. dF (b x)/db < 0, lim F (b x) = θ/2 b→∞ inequality reducess support for taxation f. θ < 1 ⇒ with growth of b F (b x) grows ⇒ τ grows ⇒ bad for the economy θ > 1 ⇒ with growth of b F (b x) gets lower ⇒ τ gets lower ⇒ bad for the economy problem 3 a. Find the tax rate that maximizes output Y = K α h1−α = [(1 − τ )λb]α [τ λb](1−α)γ = (1 − τ )α τ (1−α)γ λbα+(1−α)γ max(1 − τ )α τ (1−α)γ λbα+(1−α)γ τ → τ∗ = (1 − α) γ α + (1 − α) γ 35 b. Find the optimal tax rate from the viewpoint of the workers dY wh = h = (1 − α) K α h1−α = (1 − α) Y dh → ∗ τ = arg max wh c. Find the optimal tax rate from the viewpoint of the capitalists dY R(1 − τ )b = (1 − τ )b = αY dK → ∗ τ = arg max R(1 − τ )b d. Explain your findings. In particular, without any further calculations, explain which parts of your conclusions depend on the specific human capital production function and on the specific output production function, and what is the importance of the assumption that capitalists do not get educated and do not work. 36