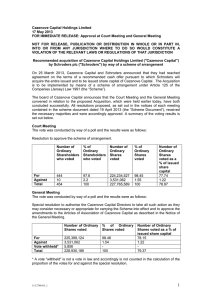

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. PART... THIS DOCUMENT COMPRISES AN EXPLANATORY STATEMENT IN COMPLIANCE WITH

advertisement