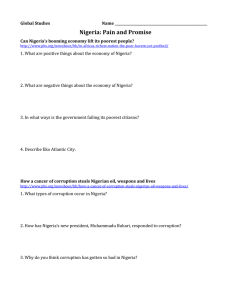

A SURVEY OF PROBLEMS ASSOCIATED WITH UNDERDEVELOPED ECONOMIES A CASE STUDY OF NIGERIA

advertisement