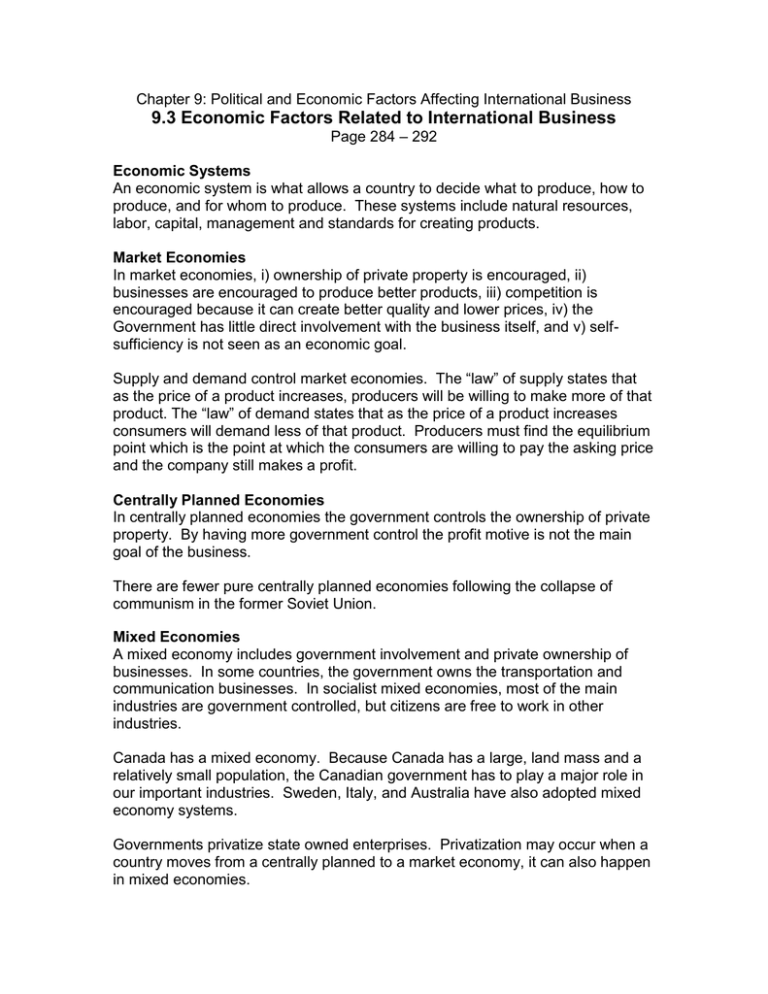

9.3 Economic Factors Related to International Business

advertisement

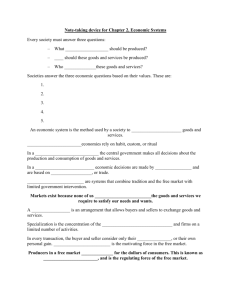

Chapter 9: Political and Economic Factors Affecting International Business 9.3 Economic Factors Related to International Business Page 284 – 292 Economic Systems An economic system is what allows a country to decide what to produce, how to produce, and for whom to produce. These systems include natural resources, labor, capital, management and standards for creating products. Market Economies In market economies, i) ownership of private property is encouraged, ii) businesses are encouraged to produce better products, iii) competition is encouraged because it can create better quality and lower prices, iv) the Government has little direct involvement with the business itself, and v) selfsufficiency is not seen as an economic goal. Supply and demand control market economies. The “law” of supply states that as the price of a product increases, producers will be willing to make more of that product. The “law” of demand states that as the price of a product increases consumers will demand less of that product. Producers must find the equilibrium point which is the point at which the consumers are willing to pay the asking price and the company still makes a profit. Centrally Planned Economies In centrally planned economies the government controls the ownership of private property. By having more government control the profit motive is not the main goal of the business. There are fewer pure centrally planned economies following the collapse of communism in the former Soviet Union. Mixed Economies A mixed economy includes government involvement and private ownership of businesses. In some countries, the government owns the transportation and communication businesses. In socialist mixed economies, most of the main industries are government controlled, but citizens are free to work in other industries. Canada has a mixed economy. Because Canada has a large, land mass and a relatively small population, the Canadian government has to play a major role in our important industries. Sweden, Italy, and Australia have also adopted mixed economy systems. Governments privatize state owned enterprises. Privatization may occur when a country moves from a centrally planned to a market economy, it can also happen in mixed economies. As a countries economic system matures, it tends to move towards a market system. When a centrally planned economy shifts to a market economy, the price of some products rise, there is more competition, and there may be greater unemployment. Global Economic Systems Since no nation can be completely self sufficient, they must trade with others (interdependence). Economic growth increases economic stability and brings the nation confidence as well as the ability to invest in the future. The global economy reflects the total amount of interdependent economic activity around the globe. In the past, the government would set rules on economic policies, but now the world is becoming one big market and trade barriers are beginning to slack. Global economy provides countries with more jobs and a higher standard of living. Countries use different strategies such as clustering (joining together in their industries) to get into the new economic order. Business Cycles Business cycles are patterned movements in the economy measured by the growth of production and industries. There are 4 phases*: 1) Depression (slowest economy), 2) Recovery (improving economy), 3) Prosperity (good economy), and 4) Recession (economy begins to slow) *See pg 288 for full explanations The World Economic Freedom Index Businesses must be aware of the economic freedom rating (A measure of prosperity that relates to economic growth, per capita income, and material wealth, calculated according to the level of market and trade freedoms a country has) “The Economic Freedom of the World” measures the following factors: -size of government -international exchange -Monetary policy and price stability -economy structure & use of markets -freedom to use alternative currencies -freedom of exchange in capital & financial markets -legal structure and property rights *See pg 289 for current and past global economic freedom ratings Canada’s Global Entrepreneurs In 2000, 1 in 16 Canadian adults tried to start a business (In this year Canada was ranked 6th of 21 countries for entrepreneurial activity). In most of Europe, employers provide good benefits. It makes people not want to risk entrepreneurial activity. Encouraging new business ventures also requires an environment with minimal paper work and applications. Around-the-Clock World Markets Stock exchanges are discussing the creation of a global market. Ordinary investors will be able to buy and trade stocks without being restricted by hours and listings of their home market. This new market is referred to as the global equity market. Equity is something that has worth, such as a home or stocks. Ten exchanges in three time zones are considering the set up: -Toronto, New York, Mexico, and Sao Paolo, Brazil in the Americas -Australia, Tokyo, and Hong Kong in the Asia-Pacific region -Euronext, the combined Paris, Amsterdam, and, Brussels exchange in Europe (one of the issues to be resolved is that not all stocks are listed on each of these markets). Even without around-the-clock trading, financial markets and national economies are interdependent. Uncertainty in any of the world stock exchanges reverberates through other economies. Common Currency The Euro attempts to balance each economy with greater price stability, harmonized long-term interest rates, more stable national currencies, and a commitment to control national budget deficits and public debt. The benefit of the Euro is that it simplifies transactions, reduces exchange risks, and strengthens European companies’ trading within and outside the EU. Some people have suggested a common currency between the USA and Canada; referred to as dollarization. Some effects would be a closer link between the two economies. Canada has already adopted the US dollar as a second currency. More and more Canadian companies have listed themselves in the US stock exchange. A single currency might ultimately hand Canada’s monetary policy to the US. It will take time to decide if a common currency would provide easier trade and travel.