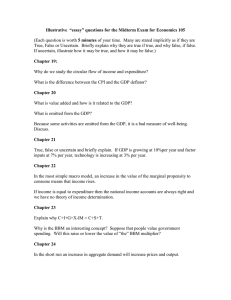

Chapter 22: National Income and Product Accounts National Income Accounting

advertisement

Chapter 22: National Income and Product Accounts National Income Accounting - - National Income Accounting is the whole process of measuring and recording various economic aggregates which give some indication of the economic health of the country over time Statistics Canada collects and publishes economic and social statistics. Total Output - The Gross Domestic Product is a fairly good measure of the country’s economic well-being. Flow Concept - GDP is a flow, it refers to the flow of output during the year. GDP is expressed in monetary terms - It is not based on the number of products but the value of all the products. Avoidance of double-counting - Double-Counting over estimates the value of total output. - Value Added is the output value minus the input value - Intermediate Products are the outputs of one industry used as inputs in another industry. - A Final Product is bought for final use, not for resale. Treatment of non-productive transactions - Non-productive transactions are excluded because they do not represent current production. - Government and private transfer payments do not represent payments for production - Government Transfer Payments are payments from the government to individuals like unemployment insurance. - Private Transfer Payments are transfers of purchasing power from one individual or group to another like a grant to a student. Treatment of used or second-hand goods - Second-hand sales do not represent current production. Measuring the Total Output - GDP can be measured either by the income method or the expenditure method. - The Income Approach measures the total income of those involved in production. - The Expenditure Approach measures the total amount spent of the total output. Total expenditure on the economy’s output = Total income earned in producing it The Income Approach - The income approach to measuring GDP involves adding up the various types of factor incomes. The factor incomes are: A. Wages, Salaries, and Supplementary Labor Income B. Corporation Profits before Taxes C. Interest and Miscellaneous Investment Income D. Accrued Net Income of Farm Operators from Farm Production E. Inventory Valuation Adjustment F. Indirect Taxes less Subsidies G. Capital Consumption Allowances - Net Domestic Income at Factor Cost is the total income earned by the factors of production. NDI = A + B + C + D + E + F + G Capital Consumption Allowance allows for the depreciation of capital during production. The Expenditure Approach - The expenditure approach adds the various groups that purchase the economy’s output in order to arrive at a GDP. The various groups are: A. Personal Expenditure on Consumer Goods and Services B. Government Current Expenditure on Goods and Services C. Business Inventories D. Exports of Goods and Services E. Imports of Goods and Services - Net Exports equals total exports minus total imports. Expenditure approach for GDP = A + B + C + (D – E) Gross Investment is the total expenditure on investment goods. Net Investment is gross investment minus depreciation Depreciation = Gross Investment – Net Investment Some Related Concepts - - The Gross National Product (GNP) is the value of all output produced by a country’s factors, regardless of where the factors are located. GNP = GDP + Net investment income from non-residents Net National Income at Factor Cost - Net National Income at Factor Cost is the total income earned by a country’s factors of production. Personal Income - Personal Income is income received by the owners of the factors of production. Personal Disposable Income - Personal Disposable Income is personal income minus personal taxes and personal transfers to the government. - Personal Saving is the part of disposable income not spent on consumer goods and services. Inflating and Deflating the GDP - A Base Year is a year chosen as a reference point in a comparison. Real GDP = (GDP divided by Price Index) X 100 Nominal Income is income expressed in current dollars. Real Income is expressed in constant dollars. Gross Domestic Product as a Measure of Economic Well-Being Size of the Population - Real GDP per capita is real GDP divided by the population. The Distribution of Income - Distribution of income may not be fair even when real GDP per capita is high. Non-Marketed Goods and Services - Many goods and services do not get counted in GDP because they are not sold. The Underground Economy - The Underground Economy is neither recorded by statisticians nor observed for tax purposes. A Better Measure of Economic Welfare - A Better Measure of Economic Well-Being can be obtained by making adjustments to GDP GDP + Non-Marketed Goods and Services + Underground Economy transactions – Environmental Damage = BMEW