4 2014 2014 20 2014 2014 2014

advertisement

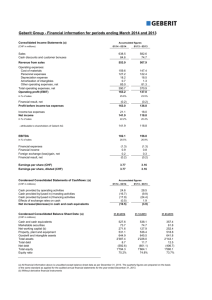

Schroder & Co Bank AG | Annual Report 2014 4 2014 2014 2014 2014 20 2014 2014 2014 2014 2014 4 2014 2014 2014 2014 20 2014 2014 2014 2014 2014 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 Content Chairman’s Statement 5 Balance Sheet 6 Off-Balance Sheet Transactions 7 Profit and Loss Account 8 1. Comments on Business Activities 10 2. Principal Accounting Policies and Valuation Principles 12 3. Information on the Balance Sheet 15 4. Information on Off-Balance Sheet Transactions 25 5. Information on the Profit and Loss Account 28 Report of the Statutory Auditor 29 Board and Senior Staff 30 Adresses32 3 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 Chairman’s Statement In 2014, Schroder & Co Bank AG achieved a good result, in The Board of Directors proposes to the General Meeting the part thanks to some non-recurring items. distribution of an ordinary dividend of CHF 7 million. It is also proposing that CHF 0.4 million be allocated to the general During the year, considerable progress was made by the legal reserve, CHF 10.5 million to other reserves and that new CEO in forming a new management team and adapting the profit remaining of CHF 10 290 be carried forward. As a our business model and services. result, the Bank’s reported equity capital after payment of the dividend will rise to CHF 127.7 million. The assets administered by the Bank increased significantly from CHF 36.2 billion to CHF 49 billion following the On behalf of the Board of Directors, I would again like to successful integration of Cazenove Capital Management’s express my thanks to all employees for their hard work and clients in the UK on 1 August 2014. commitment through the past year. Philip Mallinckrodt Chairman of the Board of Directors 5 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 Balance Sheet as of 31 December 2014 CHF Notes31.12.1431.12.13 Assets Liquid assets 909 585 517 551 592 831 Due from banks 866 348 711 992 898 001 Due from clients 3.1 169 578 525 204 787 440 Financial investments 3.2, 3.6 69 095 808 117 081 617 Participations 3.3 1 100 000 1 100 000 Fixed assets 3.4 62 040 162 036 Accrued income and prepaid expenses 13 349 441 15 850 055 Other assets 26 884 031 5 791 514 3.5 Total assets 2 056 004 073 1 889 263 494 Total due from Group entities and significant shareholders 12 803 391 140 647 Due to banks 27 913 349 19 021 512 Due to clients 1 828 997 744 1 675 881 749 Accrued expenses and deferred income 20 936 877 15 752 125 Liabilities and shareholders’ equity Other liabilities 3.5 12 266 217 8 908 699 Valuation adjustments and provisions 3.8 31 179 596 49 727 182 Share capital 3.9, 3.10 60 000 000 60 000 000 General legal reserve 3.10 28 700 000 28 700 000 Other reserves 3.10 28 100 000 28 100 000 Retained earnings brought forward 3 172 226 18 018 Net income 14 738 064 3 154 209 Total liabilities and shareholders’ equity 2 056 004 073 1 889 263 494 13 756 411 15 539 193 Total due to Group entities and significant shareholders 6 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 Off-Balance Sheet Transactions as of 31 December 2014 CHF Notes31.12.1431.12.13 Contingent liabilities 3.1, 4.1 15 381 519 21 251 052 Irrevocable commitments 3.1 2 848 000 2 984 000 Derivative instruments 4.2 – positive replacement values 25 680 036 5 200 325 – negative replacement values 9 314 718 5 533 473 – notional amounts 1 516 860 348 931 217 457 530 848 459 566 887 848 — 5 404 244 Fiduciary transactions 4.3 – Fiduciary placements with third parties – Fiduciary placements with Group entities – Fiduciary credits 7 2 881 295 2 578 622 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 Profit and Loss Account for the period from 1 Januar y to 31 December 2014 CHFNotes 2014 2013 a ) Revenues and expenses from ordinar y banking activities Results from interest activities – Interest and discount income 5 496 406 5 444 937 – Interest and discount income from financial investments 1 428 841 2 225 187 – Interest expenses (1 644 928) (1 187 259) Total 5 280 319 6 482 865 – Commission income on lending activities 464 036 401 634 – Commission income on securities and investment transactions 47 229 677 43 940 091 – Commission income on other services 1 021 069 1 166 521 – Commission expenses (10 648 455) (11 354 682) Total 38 066 327 34 153 564 5.1 7 414 273 4 835 628 – Income from administrative services provided by the Service Centre 30 079 402 19 161 576 – Other ordinary expenses (13 760) (1 353 800) Total 30 065 642 17 807 776 (50 699 949) (40 267 949) Results from commission and service fee activities Results from trading operations Other ordinary results Operating expenses – Personnel expenses 5.2 – Other operating expenses 5.3 (17 439 697) (19 509 938) Total (68 139 646) (59 777 887) Gross profit 12 686 915 3 501 946 8 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 CHFNotes 2014 2013 b ) Net income Gross profit 12 686 915 3 501 946 3.4 (99 996) (190 057) Valuation adjustments, provisions and losses (4 586 241) (17 915 935) Results before extraordinary items and taxes 8 000 678 (14 604 046) 11 525 244 18 343 295 Depreciation and write-offs of non-current assets Extraordinary income 5.4 Taxes (4 787 858) (585 040) Net income 14 738 064 3 154 209 14 738 064 3 154 209 c ) Allocation of retained earnings Net income Retained earnings brought forward 3 172 226 18 018 Total 17 910 290 3 172 227 Retained earnings at the end of the period 17 910 290 3 172 227 (7 000 000) — Allocation of retained earnings – Ordinary dividend – Allocation to general legal reserve (400 000)­­— – Allocation to other reserves (10 500 000) — Retained earnings carried forward 10 290 3 172 227 9 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 1. Comments on Business Activities General Risk management Schroder & Co Bank AG is a wholly-owned subsidiary of Risk Assessment Schroders plc, London. In addition to the head office in The Board of Directors re-assesses the Bank’s risks each Zurich the Bank has a branch office in Geneva. year (in particular with respect to credit, market, liquidity and operational risks). The effectiveness of the limit system The business activities of the Bank are described below. and the controls are also evaluated. The Organisation and There are no further business activities that would signifi- Management Regulations ensure that the Board of Directors cantly impact the Bank’s risk and income situation. is always adequately informed of the risk situation and that the authority for decisions in this area remains in the Board Fee and commission business of Directors’ responsibility. The Bank’s principal line of business is investment management for both domestic and foreign clients. Details on Risk Management The risk management procedures and the ongoing mo- Asset management, trustee, custodian and credit operations nitoring is delegated to committees. The Asset & Liability are the main contributors to commission and service fee Management Committee is responsible for monitoring revenues. market risk, interest rate risk and liquidity. This includes the selection and monitoring of banks, brokers and custodians. Banking activities In addition it monitors the adherence to the capital and large The Bank’s main balance sheet activities are the client-len- exposure regulations. ding business and interbank operations. The interest rate risks arising out of the balance sheet and Loans to clients are mainly granted on the basis of Lombard off-balance sheet positions are monitored and managed coverage. centrally. They are managed using calculations of the net present value effect on shareholders equity and the net Trading activities income effect under various interest rate assumptions. The Trading comprises mainly trading for the accounts of clients ability to meet obligations is monitored and ensured within in interest rate products, securities and foreign exchange, the framework defined in the bank law and by the Group. and to a limited extent proprietary trading. Operational risks are managed through internal organisation and control procedures. Internal audit regularly audits the in- Service Centre Zurich – Insourcing business ternal controls and issues reports to the Board of Directors. The Service Centre Zurich renders securities administration, funds transfer, accounting and IT services centrally. These The credit risks are subject to specific monitoring by the services are being offered to other Schroder Group Credit Committee and the Credit Department. Loan collate- companies (currently Schroder & Co. Limited, London, ral is valued at market value. The collateral rates are set forth Schroders (C.I.) Limited, Guernsey, Schroder & Co. (Asia) in predefined procedures. Limited, Singapore and Schroder Investment Management (Switzerland) AG), Zurich. These services are charged at market rates. 10 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 Outsourcing Staff The Bank has an outsourcing agreement with the company At the end of the business year the Bank had 179 full- and Biveroni Batschelet Partners AG (BBP) for running the inter- 28 part-time employees, for a total of 207 (or 199 full-time bank applications SIC, EuroSIC, Swift and Secom. BBP’s equivalent positions; previous year: 164). role is limited to providing electronic access to the abovementioned interbank services. Capital Adequacy Basel III Basel III CHF 1000 2014 2013 Adjusted eligible capital 118 872 – thereof for large exposure­­­— Remaining eligible capital 115 718 2 307 118 872 113 411 Total minimum capital requirement 44 735 48 088 – thereof for credit risk 30 555 36 623 – thereof for valuation adjustments 237 96 – thereof for non-counterparty related risks 5 13 – thereof for market risk 3 584 446 – thereof for operational risk 10 354 10 910 Capital requirement coverage ratio I 266 % 241% Capital requirement coverage ratio II 266 % 236 % 11 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 Basis of preparation Interest accrual is suspended if recovering interest is so unli- The accounts are prepared in accordance with the Swiss kely that an accrual no longer makes sense. Code of Obligations, the Swiss Federal Law Governing Banks and Savings Banks, including the implementing ordi- If an outstanding loan is classified as entirely or partially irre- nances, directives, and the Swiss Financial Market Supervi- coverable or if a renunciation of outstandings is granted, the sory Authority’s (FINMA) regulations and directives. outstanding loan is written off by debiting the respective loss provision. All transactions are recorded in the Bank’s books at the trade date and valued from that date for the profit and loss Troubled loans are reclassified as being of full value when account. Money market and foreign exchange transactions outstanding amounts of capital and interest are again paid are reported off-balance sheet until the settlement date. on time according to the conditions fixed by contract. From the settlement date, these transactions are included in the balance sheet. Securities and precious metals trading portfolio Actively traded positions which are either traded on a recog- Business risks are covered by adequate value adjustments nised stock exchange or for which a representative market and provisions. exists are valued at market value. Refinancing costs are charged against trading income. All other trading positions As allowed by Article 23a, paragraph 5 of the Swiss Banking are valued at the lower of cost or net realisable value. Ordinance, consolidated financial statements have not been prepared. Financial investments Securities held to generate income in the medium term are Detailed principles valued at the lower of cost or net realisable value. Realised The most important accounting policies and valuation prin- profits or losses from sales of these securities are included ciples are shown below. within “Results from the sale of financial investments”. Unrealised profits or losses are included within “Other ordinary Liquid assets, receivables from banks and liabilities income” or “Other ordinary expenses”. Debt securities to These items are stated in the balance sheet respectively at be held until maturity are valued at cost. Any premium or their nominal value or at cost less any individual valuation discount is amortized over the life of the security. Precious adjustments required for impaired assets. metals are valued at market value. Loans Participations Impaired loans, i. e. loans that are unlikely to be repaid by the Participations are stated at cost, less any impairment. debtor, are valued individually. A specific provision is made for the estimated shortfall against nominal value in capital Tangible fixed assets and interest. Off-balance sheet exposure, such as commit- Tangible fixed assets are valued at cost, less accumulated ments, guarantees or derivative instruments, are also taken depreciation. Depreciation is calculated using the straight- into consideration for this valuation. Loans are considered line method based on useful life. as impaired at the latest when the contractual payments for capital and/or interest are overdue for more than 90 days. 12 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 The recoverability is reconsidered each year. Should the Taxes useful life change or the value decrease upon reconsidering Current tax is generally tax on profit and recurs on an annual the recoverability, the remaining book value will be depre- basis. One-off or transaction taxes are not considered as ciated according to the revised plan, or an extraordinary de- current tax and are charged elsewhere in the profit and loss preciation can be made. In accordance with tax regulations, account. smaller items may be charged directly to the profit and loss account. Current tax on earnings is included as expense of the period in which the earnings are recognized. Tax liabilities are Useful life of the various fixed assets: shown under “Accrued expenses and deferred income”. Information technology (hardware and software): 3 years Cars: 4 years Derivative financial instruments Derivative financial instruments are used by the Bank for Foreign currencies asset and liability management and for securities and foreign Transactions in foreign currencies are translated at the exchange dealing. They are used both for proprietary trading mid exchange rates ruling at the daily balance sheet date. and for trading for the accounts of clients. Valuation is in Foreign exchange positions in the balance sheet are trans- accordance with the purposes for which they were originally lated at the closing exchange rates at the balance sheet date acquired. and taken to the profit and loss account. Forward foreign 1. Derivative trading positions exchange transactions are valued at the forward market rates ruling at the balance sheet date. The result of the These derivatives are marked to market. Positive and negative replacement values are included within “Other revaluation is taken to the profit and loss account. assets” or “Other liabilities”. Profits and losses are included within “Result from trading operations”. The main conversion rates applied are listed below: 2014 2. Derivative financial investments 2013 EUR 1.20241.2254 These derivatives are acquired by the Bank instead of GBP 1.54781.4724 direct investments. In accordance with the accounting USD 0.99360.8892 policy for financial investments, these positions are JPY 0.82890.8460 valued at the lower of cost or net realisable value. Any interest income components are included within “Interest and dividend income from financial investments”. Valuation adjustments and provisions Based on the principle of prudence, the Bank establishes Realised profits or losses are included within “Result from the sale of financial investments”. valuation adjustments and provisions within liabilities for contingent risks. The valuation adjustments and provisions 3. Derivatives for hedging purposes may contain undisclosed reserves. Derivative transactions concluded for hedging purposes are valued and booked on a basis consistent with the underlying transactions. 13 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 Liabilities to own pension plans The employees of Schroder & Co Bank AG benefit from two defined contribution pension plans. The “BVG Stiftung” grants a minimum of the benefits mandatory by law. The “Vorsorgestiftung” of Schroder & Co Bank AG grants benefits for that part of the salary above the limit of the BVG law. The employer’s contributions according to the defined contribution pension plans are included within “Personnel expenses”. 14 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 3. Information on the Balance Sheet 3.1 Schedule of collateral for loans and off-balance sheet transactions CHF 1000 Type of collateral Mortgage Other Without Total collateralcollateralcollateral Loans Due from clients — 164 814 4 765 169 579 Total 31.12.14 — 164 814 4 765 169 579 31.12.13 — 185 269 19 518 204 787 Contingent liabilities — 15 378 4 15 382 Irrevocable commitments — — — — Off-balance sheet transactions Irrevocable commitment to the Swiss Bankers’ and Securities Dealers’ Deposit Guarantee Association, Basel — — 2 848 2 848 Total 31.12.14 — 15 378 2 852 18 230 31.12.13 — 21 231 3004 24 235 Gross Estimated Net Specific amount collateralamount provision proceeds Impaired loans 31.12.14 211 3 208 208 31.12.13 36 273 17 162 19 111 19 111 3.2 Financial investments CHF 1000 Book Value Book Value Fair Value Fair Value 31.12.1431.12.1331.12.1431.12.13 Debt securities and rights – with the intention to hold to maturity 45 389 65 445 45 437 65 462 – at lower of costs or market — 30 012 — 30 012 Precious metals 23 707 21 625 23 707 21 625 Total 69 096 117 082 69 144 117 099 of which qualify as repos as defined in the liquidity rules 45 437 95 474 15 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 3.3 Participations CHF 1000 31.12.14 31.12.13 Without market value 1 100 1 100 Total 1 100 1 100 Additional information on significant participations Share Ownership Ownership Company Name Business activities capital propor tion propor tion Schroder Trust AG, Geneva Trust and offshore company administrationCHF 100 000 100% 100% 100% 100% Schroder Cayman BankBanking services and and Trust Company Ltd., trust and offshore Cayman Islands company administrationUSD 633 714 3.4 Assets and participations CHF 1000 31.12.13 31.12.14 Historical Accumulated Book value Additions Disposals Depreciation cost depreciation Book value Total majority participations 1 100 — 1 100 — — — 1 100 Other fixed assets 4 120 (3 814) 162 — — (100) 62 Total 5 220 (3 814) 1 262 — — (100) 1 162 Fire insurance value of other fixed assets 22 300 Liabilities: future operational lease commitments 17 619 16 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 3.5 Other assets and other liabilities CHF 1000 31.12.14 31.12.13 Other assets Other liabilities Other assets Other liabilities Replacement costs of derivative instruments 25 680 9 315 5 200 5 533 Indirect taxes and stock exchange fees 504 2 566 430 2 561 Other assets and liabilities 700 385 161 815 Total 26 884 12 266 5 791 8 909 3.6 Assets pledged or ceded to secure own liabilities and assets subject to ownership reservation CHF 1000 31.12.14 31.12.13 Assets pledged Effective liability (Book value) Own securities 37 259 There are no loans or pension transactions with securities. 17 ­16 230 Assets pledged (Book value) 49 034 Effective liability — S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 3.7 Pension plans CHF 1000 31.12.14 31.12.13 The liabilities due to own pension plans at the balance sheet date amounted to: 10 961 12 430 According to the pension fund regulations, the employer pays total contributions and benefits equivalent to 15% of the relevant salary whereas the employees contribute 5% of that salary. Pension plan free funds at the balance sheet date CHF 1000 31.12.13 31.12.12 Schroder & Co Bank AG BVG Stiftung (mandatory pension plan) 55 53 Schroder & Co Bank AG Vorsorgestiftung (non-mandatory pension plan) 4 3 In 2013 the level of the accounts of the individual plan members was TCHF 29 438. Contributions to pension funds / pension and related benefits expense CHF 1000 2014 2013 The Bank’s total contributions to both pension plans for the year amounted to: 4 695 3 932 6 697 5 647 The Bank’s total pension and related benefit expenses (including old age and survivors’ insurance, disability insurance, unemployment insurance and other mandatory contributions) for the year amounted to: 18 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 3.8 Valuation adjustments, provisions and reserves for general banking risks CHF 1000 Balance 31.12.13 Specific usage and reversals Change in Recoveries, New provisions Reversals Balance definition of overdue interest, charged to credited to31.12.14 purpose (re- exchange rate Profit & Loss Profit & Loss differencesstatementstatement classifications) Loan losses (credit and country risk) 19 111 (8 146) — 680 67 (11 504) 208 Other provisions 30 616 (2 849) — 23 3 182 — 30 972 and provisions 49 727 (10 995) — 703 3 249 (11 504) 31 180 31.12.13 31 513 (520) — 1 071 19 174 (1 511) 49 727 Valuation adjustments A provision is created when the Bank has a present obligation at the time of the establishment of the accounts as a result of a past event which is likely to result in an expected outflow of resources that can be reliably estimated. On 29 August 2013 the U.S. Department of Justice published its programme for the Swiss bank industry for which the Bank created provisions within Other Liabilities for a potential penalty and legal costs. The management of the Bank established this provision based on the principles contained in the DoJ programme and based on the on-going review of relevant accounts as at 31.12.2014 and increased the provision for legal costs. The change in loan losses is mainly due to provisions which are no longer necessary. 3.9 Capital structure and shareholders The share capital amounts to CHF 60 million and is split into 60 000 shares of CHF 1000 nominal value each. At 31 December 2014 all shares are held directly by Schroder Nederland Finance BV, Amsterdam. That company is ultimately wholly-owned by Schroders plc, London. On 5 March 2014, respectively on 6 March 2013 Schroders plc was notified pursuant to “FSA’s Disclosure and Transparency Rule 5.1.2 R” of the following interests of 3 % or more in the ordinary shares: 05.03.2014 06.03.2013 Shares Schroders plc Stake Vincitas Limited 60 724 609 26.87% Veritas Limited 36 795 041 Flavida Limited 60 951 886 Fervida Limited 40 188 706 Harris Associates L.P. 15 969 200 Shares Schroders plc Stake 60 724 609 26.87% 16.28 % 36 795 041 16.28 % 26.97% 60 951 886 26.97% 17.78 % 40 188 706 17.78 % 7.07% 15 969 200 7.07% Vincitas Limited and Veritas Limited held their interests as trustees of certain settlements made by members of the Schroder family. The interests of Flavida Limited and Fervida Limited include interests in voting rights in respect of all the shares in which Vincitas Limited and Veritas Limited are interested as trustees. 19 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 3.10 Statement of changes in shareholders’ equity (before profit distribution) CHF 1000 Total shareholders’ equity at the beginning of 2014 Paid-in share capital 60 000 General legal reserve 28 700 Other reserves 28 100 Reserves for general banking risks­— Retained earnings brought forward 3 172 Total shareholders’ equity at the beginning of 2014 119 972 Movements Net income 2014 14 738 Total shareholders’ equity at the end of 2014 134 710 Paid-in share capital 60 000 General legal reserve 28 700 Other reserves 28 100 Retained earnings carried forward 20 17 910 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 3.11 Maturity structure of working capital and liabilities CHF 1000 At sight Redeemable Maturities Total upon notice Up toFromFrom Beyond 3 months 3 to 12 12 months 5 years months to 5 years Assets Cash 909 586 Due from banks Due from clients Financial investments Total 31.12.14 31.12.13 — — — 133 904 — 535 581 196 864 14 66 559 63 057 38 948 — — 909 586 — — 866 349 1 000 — 169 578 69 096 23 707 — — 29 923 15 466 — 1 067 211 66 559 598 638 265 735 16 466 — 2 014 609 709 809 102 252 899 470 107 735 47 094 — 1 866 360 24 635 — 3 279 — — Liabilities Due to banks — 27 914 1 828 997 Due to clients 1 814 127 357 14 513 — — — Total 31.12.14 1 838 762 357 17 792 — — — 1 856 911 1 674 771 408 18 836 889 — — 1 694 904 31.12.13 3.12 Amounts due from and due to affiliated companies as well as loans and exposures to members of the Bank’s governing bodies CHF 1000 31.12.14 31.12.13 Due from affiliated companies 2 590 141 Due to affiliated companies 4 667 5 039 Loans and exposures to members of the Bank’s governing bodies 4 216 With related parties the Bank engages in securities and money market transactions and applies interest rates at conditions applicable to third parties. Members of the Board of Management and of the Board of Directors are granted the conditions and tariffs applicable to staff members of the Bank. 21 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 3.13 Assets and liabilities by domestic and foreign origin CHF 1000 31.12.14 31.12.13 Domestic ForeignDomestic Foreign Assets Cash 909 586 — 551 593 — Due from banks 405 917 460 432 314 940 677 958 Due from clients 24 911 144 668 39 540 165 247 Financial investments 54 436 14 660 83 351 33 730 Participations 100 1 000 100 1 000 Fixed assets 62 — 162 — Accrued income and prepaid expenses 12 830 519 15 314 536 Other assets 9 313 17 570 1 840 3 952 Total 1 417 155 638 849 1 006 840 882 423 Due to banks 717 27 197 9 19 012 Due to clients 313 766 1 515 231 279 475 1 396 407 Accrued expenses and deferred income 20 936 1 15 751 1 Other liabilities 6 870 5 396 6 409 2 500 Valuation adjustments and provisions 31 180 — 49 727 — Share capital 60 000 — 60 000 — General legal reserve 28 700 — 28 700 — Other reserves 28 100 — 28 100 — Retained earnings brought forward 3 172 — 18 — Liabilities and shareholders’ equity Net income 14 738 — 3 154 — Total 508 179 1 547 825 471 343 1 417 920 22 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 3.14 Assets by countries / country groups CHF 1000 31.12.14 31.12.13 Total in % Total in % Assets Europe – Germany 34 123 1.7% 38 516 2.0 % – United Kingdom 159 276 7.7% 209 650 11.1% – Switzerland 1 417 155 68.9 % 1 006 840 53.3 % – Rest of Europe 299 718 14.6 % 483 467 25.6 % Total Europe 1 910 272 92.9 % 1 738 473 92.0 % North America 6 060 0.3 % 15 265 0.8 % Asia 18 438 0.9 % 12 170 0.6 % Other countries 121 234 5.9 % 123 355 6.6 % Total 2 056 004 100.0 % 1 889 263 100.0 % 23 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 3.15 Assets by currencies CHF 1000 31.12.14 Currencies CHF EUR USDPrecious metals Other Total Assets Cash 908 606 758 105 — 117 909 586 Due from banks 50 865 152 708 530 813 21 555 110 407 866 348 Due from clients 64 005 54 512 35 281 — 15 782 169 580 Financial investments 30 729 14 660 — 23 707 — 69 096 Participations 1 100 — — — — 1 100 Fixed assets 62 — — — — 62 Accrued income and prepaid expenses 12 496 299 214 — 340 13 349 Other assets 26 568 11 304 — — 26 883 Total balance sheet assets 1 094 431 222 948 566 717 45 262 FX forward and FX option transactions 189 913 411 673 724 444 — Total assets 1 284 344 634 621 1 291 161 45 262 126 646 2 056 004 Assets deriving from FX spot, 190 831 1 516 861 317 477 3 572 865 Liabilities and shareholders’ equity Due to banks 1 285 213 12 198 — Due to clients 213 620 469 711 945 196 45 262 Accrued expenses and deferred income 20 932 — 4 — Other liabilities 11 976 — 290 Valuation adjustments and provisions 30 738 — — 14 218 27 914 155 208 1 828 997 2 20 938 — — 12 266 — 441 31 179 Share capital 60 000 — — — — 60 000 General legal reserve 28 700 — — — — 28 700 Other reserves 28 100 — — — — 28 100 Retained earnings brought forward 3 172 — — — — 3 172 — 14 738 Net income 14 738 — — — Total balance sheet liabilities 413 261 469 924 957 688 45 262 164 681 333 416 — 147 488 1 499 688 634 605 1 291 104 45 262 317 357 3 555 692 169 869 2 056 004 Liabilities deriving from FX spot, FX forward and FX option transactions 854 103 Total liabilities 1 267 364 Net position by currency 16 980 16 24 57 — 120 17 173 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 4. Information on Off-Balance Sheet Transactions 4.1 Contingent liabilities CHF 1000 31.12.14 31.12.13 Credit guarantees 15 382 Irrevocable commitments — 14 849 6 402 Total 15 382 21 251 4.2 Outstanding derivative instruments CHF 1000 Positive replacement values Negative replacement values Contract volume Foreign exchange / metal instruments Forward contracts 25 389 9 024 1 508 912 Options (OTC) 291 291 7 948 Total 31.12.14 25 680 31.12.13 5 200 9 315 1 516 860 5 533 931 217 The above outstanding derivative instruments are held for trading purposes. There are no netting agreements in place. Outstanding derivative instruments by counterparties CHF 1000 31.12.14 31.12.13 Banks Positive replacement values Negative Contract Positive replacement volume replacement values values 18 730 Non banks 6 950 Total 25 680 6 111 1 085 800 3 204 25 2 246 Negative replacement values Contract volume 2 722 623 890 431 060 2 954 2 811 307 327 9 315 1 516 860 5 200 5 533 931 217 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 4.3 Fiduciary transactions CHF 1000 31.12.14 31.12.13 Fiduciar y deposits Fiduciary deposits in CHF — 4 900 Fiduciary deposits in European currencies 357 041 306 311 Fiduciary deposits in USD 122 246 256 091 Fiduciary deposits in other currencies 51 561 4 990 Total 530 848 572 292 Fiduciar y credits Fiduciary credits in USD 2 881 2 579 Total 2 881 2 579 Effected fiduciary deposits placed with banks within the Schroder Group at the end of the year amounted to TCHF 0. 26 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 4.4 Funds under management CHF 1000 31.12.14 31.12.13 Private Banking Assets in own managed investment funds 10 288 9 959 Assets under discretionary management 1 535 333 1 555 393 Assets subject to other management 5 219 466 4 884 933 Total funds under management Private Banking (incl. double counting) 6 765 087 6 450 285 of which double counting 10 288 9 959 Total funds under management Private Banking (excl. double counting) 6 754 799 6 440 326 Total net inflow / outflow of assets (125 886) (110 302) The Bank does not hold any custody-only assets. Debit interest on current account overdrafts is treated as negative performance, while interest charged on Lombard loans is a cash outflow. The Bank calculates performance according to the direct method. 4.5 Funds administered by the Service Centre Zurich CHF 1000 31.12.14 31.12.13 Assets administered banking activities (cf 4.4.) 6 754 799 6 440 326 insourcing for Schroder Group companies 42 281 074 29 776 181 Total assets administered by the Service Centre Zurich 49 035 873 36 216 507 Assets administered in connection with the The Bank’s Service Centre Zurich renders administrative services to other Schroder Group companies in the areas of custody, operations and finance. For this insourcing business the Service Centre charges fees which are reflected in the profit and loss account under the position other ordinary income (see explanation about the Service Centre – insourcing business). Following the integration of the Cazenove Capital Holdings Ltd. clients on 1 August 2014, the administered assets increased significantly. 27 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 5. Information on the Profit and Loss Account 5.1 Results from trading operations CHF 1000 2014 2013 Foreign exchange 7 414 4 836 Total 7 414 4 836 5.2 Personnel expenses CHF 1000 2014 2013 Authorities, meeting compensations and fixed compensations 204 186 Salaries and extras 41 546 32 663 Social security contributions 2 002 1 715 Pension plan contributions 4 695 3 932 Other personnel expenses 2 253 1 772 Total 50 700 40 268 5.3 Operating expenses CHF 1000 2014 2013 Occupancy expenses 4 871 3 605 5 000 6 548 publication and advertising, audit, other costs 7 569 9 357 Total 17 440 19 510 Expenses for EDP, machinery, fixtures and fittings, vehicles and other equipment Other operating expenses including: Telephone, telex, postage, electronic information systems, legal and other consulting fees, stationery and printing, courier services, property insurance, travel and entertainment, 5.4 Extraordinary income The CHF 11.5 million of extraordinary income is due to the reversal of loan loss provisions which are no longer necessary. 28 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 Report of the Statutory Auditor As statutory auditor, we have audited the financial presentation of the financial statements. We believe that the statements of Schroder & Co Bank AG, which audit evidence we have obtained is sufficient and appropria- comprise the balance sheet, income statement and te to provide a basis for our audit opinion. notes, for the year ended 31 December 2014. Opinion Board of Directors’ responsibility In our opinion, the financial statements for the year ended The Board of Directors is responsible for the preparation of 31 December 2014 comply with Swiss law and the the financial statements in accordance with the requirements company’s articles of incorporation. of Swiss law and the company’s articles of incorporation. This responsibility includes designing, implementing and Report on other legal requirements maintaining an internal control system relevant to the pre- We confirm that we meet the legal requirements on licensing paration of financial statements that are free from material according to the Auditor Oversight Act (AOA) and indepen- misstatement, whether due to fraud or error. The Board of dence (article 728 CO and art. 11 AOA) and that there are no Directors is further responsible for selecting and applying circumstances incompatible with our independence. appropriate accounting policies and making accounting estimates that are reasonable in the circumstances. In accordance with article 728a paragraph 1 item 3 CO and Swiss Auditing Standard 890, we confirm that an internal Auditor’s responsibility control system exists which has been designed for the Our responsibility is to express an opinion on these financial preparation of financial statements according to the instruc- statements based on our audit. We conducted our audit in tions of the Board of Directors. accordance with Swiss law and Swiss Auditing Standards. Those standards require that we plan and perform the audit We further confirm that the proposed appropriation of availa- to obtain reasonable assurance whether the financial state- ble earnings complies with Swiss law and the company’s ments are free from material misstatement. articles of incorporation. We recommend that the financial statements submitted to you be approved. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the finan- PricewaterhouseCoopers AG cial statements. The procedures selected depend on the Thomas Romer, auditor’s judgement, including the assessment of the risks of Markus Meier, Audit expert, Auditor In Charge Audit expert material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the Zurich, 20 March 2014 auditor considers the internal control system relevant to the entity’s preparation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control system. An audit also includes evaluating the appropriateness of the accounting policies used and the reasonableness of accounting estimates made, as well as evaluating the overall 29 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 014 Board and Senior Staff (as of 1 April 2015) Board of Directors Executive Board Externe Revisionsstelle Philip Mallinckrodt Adrian Nösberger PricewaterhouseCoopers AG Zürich Chairman Chairman, Dr. François Bochud Marc Brodard Deputy Chairman Dr. Martin Eckert Jean-Claude Marchand Jean-Charles Roguet Markus Rütimann Chief Executive Officer Member, Head Private Clients Geneva David Dowse Member, Chief Financial Officer Oliver Oexl Member, Head Legal, Compliance and Risk Peter Thüring Member, Chief Operating Officer 30 Head Office Branch Office Subsidiary Companies Schroder & Co Bank AG Schroder & Co Banque SA Schroder Trust SA Central 2, 8001 Zürich 8, rue d’Italie, 1204 Genève 8, rue d’Italie, 1204 Genève Postfach, 8021 Zürich Case postale 3655, 1211 Genève 3 Case postale 3655, 1211 Genève 3 Tel +41 (0)22 818 41 11 Tel +41 (0)22 818 41 22 Fax +41 (0)22 818 41 12 Fax +41 (0)22 818 41 28 Service Centre Zürich Pfingstweidstrasse 60, 8005 Zürich Postfach 2222, 8031 Zürich Schroder Cayman Bank and Trust Company Limited Tel +41 (0)44 250 11 11 P. O. Box 1040, Harbour Centre Fax +41 (0)44 250 13 12 Grand Cayman KY1-1102, B.W.I. www.schroders.ch Tel +1 345 949 28 49 contact@schroders.ch Fax +1 345 949 54 09