Working Paper SHOULD WE TAX INTERNALITIES LIKE EXTERNALITIES? Donald B. Marron November 2015

advertisement

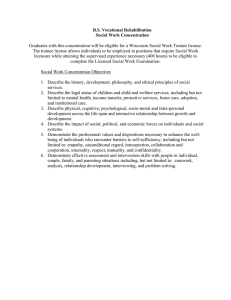

Working Paper SHOULD WE TAX INTERNALITIES LIKE EXTERNALITIES? Donald B. Marron November 2015 ABSTRACT Economists often recommend taxes to address externalities. Does the same logic apply to internalities? It depends. If the goal is efficiency, the answer is yes. Efficient taxes reflect any harms consumers overlook, whether to others or themselves. Internalities pose a special challenge, however: distinguishing costs consumers recognize from those they overlook. If the goal is maximizing social welfare, considering both equity and efficiency, the answer is yes but with caution. Internality taxes fall most heavily on consumers who overlook future costs, a group that tends to have lower incomes. Internality taxes thus raise more distributional concerns that do externality taxes. The answer is no if the goal is improving the well-being of people who consume harmful products. Such paternalism generally implies lower taxes than do efficiency or welfare maximization. In fact, the optimal paternalistic tax is often no tax. Internality taxes are most likely to improve the welfare of affected consumers when demand is highly responsive to prices, overlooked costs are large, and a large fraction of revenues is rebated to those paying the tax. Donald B. Marron is director of economic policy initiatives and Institute fellow at the Urban Institute (dmarron@urban.org). I thank Chas Cadwell, William Congdon, William Gale, Maeve Gearing, Elizabeth Peters, and Eric Toder for helpful comments; John Iselin and Lydia Austin for excellent research assistance; Michael Marazzi and Joanna Teitelbaum for editorial assistance; and the Laura and John Arnold Foundation for funding this work. The findings and conclusions in this paper are solely the responsibility of the author and do not necessarily reflect positions or policies of the Urban-Brookings Tax Policy Center, the Urban Institute, or their funders. 1. INTRODUCTION Governments often use taxes to discourage consumption of products believed harmful, including alcohol, tobacco, junk food, indoor tanning, and marijuana.1 Policymakers justify these taxes as a way to reduce health risks to individuals who consume these products and to lower any spillover costs imposed on others. Drinking excessive alcohol, for example, may cause liver disease and injuries and expose third parties to risks from drunk driving and violence. Eating unhealthy foods may similarly cause diabetes, cardiovascular problems, and other ailments, lowering an individual’s quality of life and increasing costs for everyone in the same health insurance pool. Economists have long studied how targeted taxes might improve social welfare when consumption imposes costs on third parties (Pigou 1920). A newer, behavioral literature applies similar reasoning to situations in which consumers do not fully perceive costs they themselves bear (Allcott, Mullainathan, and Taubinsky 2014; Gruber and Kőszegi 2004; Haavio and Kotakorpi 2011; O’Donoghue and Rabin 2006). Building on that work, this paper examines whether traditional arguments for taxing externalities (overlooked harms to others) also apply to taxing internalities (overlooked harms to one’s self). To do so, the paper uses a framework that combines simple optimal tax theory with insights from behavioral economics. That framework allows us to evaluate how internality taxes affect efficiency, equity, and the welfare of affected consumers. From an efficiency perspective, the conceptual case for internality taxes is identical to that for externality taxes. In both instances, people overlook some costs and thus consume too much. Taxes can act as a proxy for those costs, whether external or internal, and thus reduce consumption to a more efficient level. That theoretical equivalence comes with a practical challenge, however. When addressing internalities, the relevant cost, and thus the appropriate tax, is the portion of internal costs that consumers overlook—not their total amount. If eating french fries imposes one dollar of internal costs per serving from increased health risks and consumers already limit consumption by recognizing costs equivalent to 40 cents, the efficient tax would be 60 cents per serving, the cost that is still overlooked, not the full dollar. The efficiency perspective sails a middle course between two other frameworks often applied to internality concerns. In the public health literature, analysts often make no distinction between health risks that are knowingly accepted and those that are overlooked. In that 1 For example, the 2010 health reform in the United States included an excise tax on indoor tanning services; Alaska, Colorado, Oregon, and Washington tax marijuana; Denmark briefly taxed fat; Berkeley, California taxes sugar-sweetened beverages; and Mexico taxes sugary drinks and junk food. 1 6. DISCUSSION perspective, taxes are a way to reduce all internal harms from consumption, not just the ones that people fail to recognize. At the other extreme, a libertarian perspective draws a sharp contrast between externalities, which involve harm to third parties, and internalities, which do not. Externalities can justify a tax that takes the place of property rights, tort laws, or other mechanisms for defending third parties. Internalities raise no third-party concerns and thus are not an appropriate basis for taxation or other regulation.2 Although the efficiency rationale implies a 60-cent tax on fries in the example above, the public health view could imply a tax of a dollar or more, and the libertarian view implies no tax at all. From an equity perspective, the theoretical case for internality taxes also appears identical to that for externality taxes. But that seeming equivalence also comes with a caveat. Equity concerns are likely to be more severe with internality taxes because of the way they target consumers. Internality taxes systematically fall on consumers who overlook future costs, a group that tends to have lower incomes than do consumers who recognize those costs. To reduce their negative distributional effects, optimal tax rates on internalities will be correspondingly lower, or the government will have to do more to offset tax burdens by rebating the revenues. The parallel between externality and internality taxes disappears when the focus shifts from society as a whole to the welfare of affected consumers. Policymakers and advocates often characterize internality taxes as a way to help people who will regret their consumption choices. Unless revenues are perfectly rebated to the consumers who pay them, however, internality taxes have offsetting effects. Consumers may have fewer regrets about unhealthy choices but will have less disposable income. A tax that appears optimal from an efficiency or equity perspective can thus reduce the welfare of affected consumers rather than increase it. A consumer with inelastic demand for a harmful good, for example, may pay the new tax while still bearing most internal costs. If the purpose of internality taxation is to help people who overconsume harmful products, taxes will often be lower than the efficient or welfaremaximizing level and may well be zero. Policymakers are understandably concerned about the personal and public costs of poor nutrition, smoking, substance abuse, and other harms from certain products. Taxes can discourage their consumption. But the case for taxing internalities is weaker than for taxing externalities. Internality taxes are harder to calibrate because the relevant magnitude is the portion of internal harm overlooked, not the total harm created. Internality taxes raise more equity concerns because overlooking future costs correlates with lower incomes. Internality taxes that make sense from a social perspective look less attractive to the consumers they are intended to help. Indeed, the optimal paternalistic tax is often no tax. Internality taxes are most 2 Cornell (2015) discusses other reasons why people oppose internality taxes and other paternalistic policies. Of particular note is his argument that paternalistic policies are perceived as insults to affected consumers. 2 6. DISCUSSION likely to improve the welfare of affected people when their demand is highly responsive to prices, overlooked internal costs are large, and a large fraction of revenues are rebated to them. The paper develops these findings as follows. Section 2 presents a simple model of consumer choice in which there are externalities and internalities. Using that model, section 3 demonstrates the equivalence of externality and internality taxation for maximizing efficiency and highlights the importance of distinguishing internal costs consumers recognize from those they overlook. Section 4 shows that the equivalence of externality and internality taxes persists when we add equity concerns. Digging deeper, however, we find that internality taxes raise greater equity concerns because they systematically fall on consumers who overlook future costs. Section 5 demonstrates that internality taxes motivated by concern for affected consumers are generally lower than those motivated by efficiency and are often zero. Summarizing those results, section 6 concludes that taxing internalities sometimes makes sense, but is less compelling than taxing externalities. An appendix then presents mathematical derivations. 3 2. CONSUMER CHOICE WITH EXTERNALITIES AND INTERNALITIES To compare taxes on externalities and internalities, we consider a model in which consumers allocate spending across two goods, x and z. Consumption of x may create internal and external costs; z represents spending on all other goods and services. Assuming additive separability among the utility from consumption, internal harms, and external harms, the consumer’s experienced utility is3 𝑈𝐸 = 𝑈(𝑥, 𝑧) − 𝐼(𝑥) − 𝐸(𝑥⃗), (1) where U(x, z) is the utility from consuming goods x and z, I(x) is any harm the consumer bears from consuming good x, and 𝐸(𝑥⃗) is any harm that the consumer bears because of all consumers buying x, represented as x⃗⃗ = (x1 , … , xn ), where n is the number of consumers.4 U might include the enjoyment the consumer gets from smoking cigarettes, for example, with I being any consequent health damage and E any risks from secondhand smoke.5 Consumers may lack information about the negative consequences I, may be inattentive, may have limited self-control, or may otherwise systematically underrecognize potential personal harms from consuming x. In addition, they do not account for any contribution they make to external costs.6 The consumer’s choice utility—the utility they maximize when deciding how much to consume—thus differs from their experienced utility: 𝑈𝐶 = 𝑈(𝑥, 𝑧) − (1 − 𝜃)𝐼(𝑥), (2) where 𝜃 is the fraction of internal harms the consumer fails to consider when making the consumption choice. If 𝜃 = 0, the consumer is fully rational and fully informed, and their choice utility matches their experienced utility excluding the externality. If 𝜃 > 0, the consumer does not fully account for potential harms and may make choices that are suboptimal in terms of their 3 Kahneman, Wakker, and Sarin (1997) provide an early discussion of the distinction between experienced and choice utility. 4 For notational simplicity, this model allows consumers to impose an externality on themselves in addition to any internal costs. For example, eating unhealthy foods might reduce future utility (captured in I) and increase the cost of health insurance (captured in E). In addition, the model presumes that the goods and services in z generate no internalities or externalities. In reality, governments should also consider the products that consumers purchase when they substitute away from a taxed good. Consumers may switch to other products that also pose health risks or may turn to black markets that generate externalities. 5 The distinction between direct utility U and internal harm I is not uniquely defined in the consumer’s experienced utility; different U and I could represent the same utility. That imprecision is resolved with the distinction between harms that may be overlooked by the consumer, and thus are in I, and those that are always fully recognized, which appear in U. 6 Some consumers do attempt to account for externalities, such as by buying products perceived as environmentally friendly even if they cost more. The model could be extended to account for this dimension of consumer heterogeneity, with an additional parameter tracking how much of the externality they voluntarily internalize. 4 6. DISCUSSION eventual experience. The consumer does not consider external harms in deciding how much to consume. This framing of the consumer choice captures the essence of externality and internality issues while abstracting from the details of why consumers may make consumption decisions they regret. Behavioral challenges often arise when consumers make choices in one period but do not experience some effects until later. Decisions about saving versus spending and about whether to consume enjoyable-but-unhealthy food and drinks are two examples. Both rational and behavioral models thus often explicitly model intertemporal choice.7 Such modeling can add useful context about purchasing decisions, particularly when consumption in one period changes preferences in a future period, but is not necessary for comparing the fundamental rationales for externality and internality taxes.8 More generally, behavioral analyses often specify a particular manner in which consumer choices deviate from traditional rationality. Analyses of “sin” taxes, for example, often suppose consumers engage in quasi-hyperbolic discounting (Laibson 1997) and thus underweight future harms when making current decisions (Gruber and Kőszegi 2004; Haavio and Kotakorpi 2011; O’Donoghue and Rabin 2006). This paper takes a reduced-form approach that is agnostic about whether such present bias or other mechanisms (e.g., limited attention or lack of information) cause consumers to deviate from conventional rationality.9 Good x is produced in a constant-cost, competitive industry and sold at a producer price equal to marginal and average cost, c. If the government levies a corrective tax t, the consumer price is c + t.10 The consumer has income y and receives a lump sum rebate r from the revenue collected through any corrective taxes.11 The rebate may depend on the consumer’s age, income, location, and other attributes, but not on his or her purchases of x. Given those conditions, the consumer’s budget constraint is 7 See, for example, Becker and Murphy (1988), Gruber and Kőszegi (2004), Haavio and Kotakorpi (2011), and O’Donoghue and Rabin (2006). 8 For that reason, previous models often simplify to single-period optimizations (Haavio and Kotakorpi 2011; O’Donoghue and Rabin 2006). 9 Mullainathan, Schwartzstein, and Congdon (2012) provide a comprehensive analysis of reduced-form approaches to behavioral analysis. 10 The model thus considers exact pass-through of the tax into price and abstracts from issues that arise when consumers can switch easily to other jurisdictions (Cawley and Frisvold 2015) or producers have market power. We also assume the tax is as salient as the regular price (Chetty, Looney, and Croft 2009). 11 For simplicity, we treat the rebate as a direct cash transfer or tax reduction; in practice, revenue could also be recycled through public provision of such goods as subsidized health care. The model can be generalized to that case with the additional complication of tracking the utility consumers get from the publicly provided good. 5 6. DISCUSSION 𝑧 = 𝑦 + 𝑟 − (𝑐 + 𝑡)𝑥. (3) When deciding how much x to consume, the consumer maximizes their choice utility. Taking the budget constraint into account, the first-order condition for their purchases is 𝑈𝑥′ (𝑥) − 𝑚(𝑐 + 𝑡) − (1 − 𝜃)𝐼′(𝑥) = 0, (4) where 𝑚 = 𝑈𝑧′ is the consumer’s marginal utility of money. The choice of x has no effect on the consumer’s income or rebate, so y and r do not appear. The consumer ignores any externality they create and, if 𝜃 > 0, some of the internal costs they bear. This relationship implicitly determines the consumer’s demand for x as a function of price, which is downward sloping under usual conditions.12 If we set 𝜃 = 0, the expression similarly determines what the consumer’s demand would be if they accounted for all internal costs and thus behaved fully rationally. 12 Here and throughout, we focus on solutions that satisfy conditions for an interior solution and yield downward-sloping demand. In this instance, a sufficient condition is 𝑈𝑥′ > 0, 𝑈𝑧′ > 0, 𝐼𝑥′ > 0, 𝑈x′′ ≤ 0, 𝑈𝑧′′ ≤ 0, 𝐼𝑖′′ ≥ 0. 6 3. EFFICIENCY The efficient tax rate maximizes consumer welfare, measured as consumer surplus from good x using their actual demand plus the tax revenues minus any external and overlooked internal costs. IDENTICAL CONSUMERS If consumers are identical, it is straightforward to show that the efficient tax is 𝑡𝑒 = 𝑛𝐸 ′ 𝑚 + 𝜃𝐼 ′ 𝑚 . (5) (For this and later derivations, see the appendix.) As usual in optimal tax analyses, the tax rate is endogenous; I’, E’, and m may all depend on t . With that in mind, the efficient tax rate has a natural interpretation. The tax equals any marginal external costs (the E’ experienced by each of the n members of society) plus any overlooked, marginal internal costs (θI’). External and internal costs are converted into monetary terms by the marginal utility of money (m).13 e In this setting, the answer to the title question is yes. On efficiency grounds, we should tax internalities like externalities. The efficient tax reflects any costs, whether external or internal, that the consumer overlooks when deciding how much to consume. Taxing externalities this way is one of the most famous results in public finance. The more recent insight is that the same result applies to internalities. This theoretical equivalence poses a practical challenge, however. An optimal internality tax does not equal the full marginal harm that consumers experience from the harmful good. Instead, it equals the portion of that harm they do not already incorporate in their decisionmaking. Many consumers are aware that alcohol, tobacco, sugary beverages, indoor tanning, skydiving, and other goods and activities may harm their health. Many restrict their consumption accordingly. In considering whether and how much to tax to discourage consumption further, policymakers should calibrate how much untaxed consumption deviates from informed, selfcontrolled choice. 13 This analysis implicitly presumes, as do previous ones, that the degree to which consumers overlook internal costs is unaffected by the tax policy. An area for future research is exploring in what cases that assumption is wrong. Taxes might signal concern or social disapproval for a product and thus reduce consumption more than the price alone would suggest (Brockwell 2014). Consumers might become less vigilant in their consumption, thinking the government is already handling it. Or the financial effect of the tax and rebate combination may alter consumer’s ability to exercise self-control, as in the scarcity hypothesis of Mani et al. (2013). 7 6. DISCUSSION To illustrate, suppose people bear one dollar of long term health costs for each serving of french fries they eat. If people completely overlook those costs, the efficient tax would be a dollar. But that is an extreme case. In reality, people are often aware that there are long-term health costs, and they may incorporate some portion in their decisions. For example, they might manage to incorporate the equivalent of 40 cents per serving when deciding to order fries, leaving 60 cents unrecognized (i.e., 𝜃 = 0.6). The efficient tax would thus be 60 cents per serving, the cost that is still overlooked, not the full dollar. Estimates of internal harms are thus a starting point for calibrating internality taxes, but are not sufficient; we also need to know what fraction are overlooked. Unfortunately, 𝜃 is difficult to measure.14 The efficiency equivalence of internality and externality taxes can also be shown in a simple graphical analysis (figure 1). Let D be demand for good x and let supply S be flat at c, the private cost of production, and let m, the marginal utility of money, be one. If consumers fully accounted for internal costs and suppliers fully accounted for external costs, demand would instead be Drational and supply would be Ssocial. Consumers consume too much because they ignore external costs and some internal costs. To reduce consumption to its efficient level requires a tax that reflects both of those overlooked costs. Figure 1. An efficient tax reflects externalities and internalities. Firms produce the good at cost c and overlook external costs (𝑛𝐸′). Consumers overlook some internal costs; if they recognized all internal costs, demand would shift down by 𝜃𝐼′. Absent any tax, the market clears at A and quantity x. To maximize efficiency, consumption should decline to x*, corresponding to point B. The efficient tax, equal to the externality and internality (𝑛𝐸 ′ + 𝜃𝐼′), does this by moving consumer choice to A’. 14 Measurement is difficult for at least two reasons. First, analysts need to distinguish internal costs consumers recognize from those they overlook. Second, analysts must account for individual differences in valuing internal costs. A rational individual with a high rate of time preference, for example, may consume more of an unhealthy product that an otherwise identical person with a lower rate of time preference. 8 6. DISCUSSION HETEROGENEOUS CONSUMERS An efficiency-maximizing government should thus tax externalities like internalities when consumers are identical. The next question is whether that result persists when we recognize that consumers differ in their tastes, income, price responsiveness, adherence to rational choice, the harms they face from internalities, and the externalities they create. In a first-best world, the government can levy individually customized taxes. In that case, the analysis follows exactly as above but with n different tax rates. As long as consumers respond to price, the first-best policy involves taxes equal to the marginal external and internal harms that each person creates 𝑡𝑖𝑒 = ′ ∑𝑗 𝐸𝑗𝑖 𝑚𝑗 + 𝜃𝑖 𝐼𝑖′ 𝑚𝑖 (6) , where mi is the marginal utility of money of the ith individual. The individual’s own marginal utility of money is used in valuing the internality; those of affected individuals are used in valuing the externality. This first-best analysis provides a useful conceptual benchmark, but is not practically relevant. Governments rarely if ever can tailor taxes to individuals. Of more practical relevance, therefore, is the efficient tax when all consumers face the same tax rate: 𝑡 𝑒 = ∑𝑖 𝛼𝑖 𝑡𝑖𝑒 = ∑𝑖 𝛼𝑖 ( ′ ∑𝑗 𝐸𝑗𝑖 𝑚𝑗 + 𝜃𝑖 𝐼𝑖′ 𝑚𝑖 ), (7) where 𝛼𝑖 is consumer i’s share of the marginal demand response; 𝛼𝑖 = 𝑥𝑖′ / ∑𝑗 𝑥𝑗′ , and ∑𝑖 𝛼𝑖 = 1. The efficient tax is a weighted average of external and overlooked internal harms, with the weights reflecting consumers’ marginal demand responses.15 Consumers who respond greatly to the tax get more weight than consumers who respond little. The efficient tax treats internalities and externalities identically, so the answer to the title question is again yes. If the goal is maximizing efficiency, we should tax internalities like externalities. 16 15 Diamond (1973) first noted that the weighting should be based on marginal demand responses. 16 Expression (7) implies that the efficient tax depends on how internal harms, external harms, rationality, and demand responsiveness covary with one another. Some covariances weaken the case for corrective taxation (e.g., if those most likely to create harms are least responsive to prices); others strengthen it (e.g., when deviations from rationality yield greater consumption of a harmful good and greater marginal harms). 9 4. EQUITY Analyses of corrective taxes often focus solely on efficiency. That makes sense if policymakers have the opportunity and inclination to pursue distributional goals through other policies. Indeed, a classic finding is that an unconstrained government should set externality taxes at their efficient level and address equity concerns separately (Kaplow 2004). Recognizing distributional goals thus does not alter the equivalence between externality and internality taxes. As long as the government addresses equity concerns through other policies, corrective taxes should address overlooked external and internal costs identically. In reality, governments fail to do so. It therefore remains valuable to examine how equity considerations may affect corrective tax rates and whether effects differ for externalities and internalities. To do so, consider a utilitarian government that maximizes overall experienced utility, measured as the sum of the experienced utilities of individual consumers, subject to limits on how it rebates the resultant revenue. The government seeks a tax policy that balances the welfare gains and losses of raising the price of good x and the welfare effects of redistribution. The government thus trades off equity and efficiency in selecting an optimal tax. To formalize this trade-off, let 𝛽𝒊 be the fraction of revenues given to each consumer under a rebate rule, with∑𝒊 𝛽𝒊 = 1. The welfare-maximizing tax rate is 𝑡 ∗ = ∑𝑖 𝛼𝑖 ( ′ ∑𝑗 𝐸𝑗𝑖 ̃ 𝑚 + Corrective 𝜃𝑖 𝐼𝑖′ ̃ 𝑚 ) + ∑𝑖 𝑚𝑖 (𝑥𝑖 −𝛽𝑖 𝑋) ̃ 𝑋′ 𝑚 , (8) Redistributive where 𝑋 = ∑𝑗 𝑥𝑗 is total consumption of good x. The government translates individual utilities into monetary terms using a weighted average of the marginal utilities of money, with the weights determined by the rebate rule, 𝑚 ̃ = ∑𝑖 𝛽𝑖 𝑚𝑖 . The first term captures the corrective effects of the tax; it is the optimal tax rate if taxes and rebates do not systematically redistribute across people with different marginal utilities of money. For example, it is the optimal tax rate if rebates exactly offset each consumer’s tax burden at their optimal consumption (as assumed, for example, by Pogue and Sgontz [1989]). More generally, the purely corrective tax rate is optimal if any resultant redistribution does not raise or lower social welfare. The second term captures the welfare effects of systematically redistributing income. It depends on how the marginal utility of money covaries with the net of taxes paid and rebates received. We expect people with lower incomes to have a higher marginal utility of money and 10 6. DISCUSSION vice versa. We can therefore measure the degree of regressivity in a tax and rebate combination as (9) 𝑅 = 𝐶𝑜𝑣(𝑚𝑖 , 𝑥𝑖 − 𝛽𝑖 𝑋). Individuals pay taxes based on their purchases xi and receive rebates based on their rebate share multiplied by overall purchases, 𝛽𝑖 𝑋. If the tax and rebate combination is regressive, the difference between purchases and the rebate base will positively covary with the marginal utility of money. In other words, if the tax and rebate combination is regressive, R > 0. If the policy is progressive, R < 0, and R = 0 if there is no systematic redistribution. After some arithmetic (again, see the appendix), we can express the optimal tax as 𝑅 𝑡 ∗ = 𝑡 𝑐 − (𝑐 + 𝑡 𝑐 ) 𝑚̃𝑥̅ 𝜂+𝑅, (10) where 𝑡 𝑐 is the optimal corrective tax with no systematic redistribution (the first term in equation [8]), 𝑥̅ is mean consumption of good x, and η is the price elasticity of demand for x expressed as a positive number. The importance of distributional effects depends on the elasticity of demand. If consumers are highly responsive to the tax (i.e., if η is large), distributional effects are relatively unimportant. In that case, the primary effect of the tax is changing consumption choices, and the optimal tax rate is close to its purely corrective level. If consumers are not very responsive (i.e., if η is small), however, distributional effects loom large. In that case, the primary effect of the tax is redistributing income, and the optimal tax rate can deviate sharply from its purely corrective level. Indeed, if the demand elasticity is sufficiently small and the tax-rebate combination is regressive, the optimal tax may actually be a subsidy. The optimal tax will be lower than the purely corrective tax whenever the tax and rebate combination is regressive. In such cases, policymakers should forgo some corrective benefits to reduce the net burden on low-income consumers. The reverse is also true, with one nuance. If the tax and rebate combination is progressive, policymakers should favor a tax level that raises more revenue and thus accomplishes more redistribution. The optimal tax rate should thus be higher than the purely corrective tax if tax rates are on the upward-sloping portion of the Laffer curve and lower if they are on the downward-sloping part. This analysis applies equally to externalities and internalities, which appear directly only in the purely corrective component of the optimal tax. As with efficiency, it thus appears that internalities should be taxed like internalities even when policymakers have equity concerns. 11 6. DISCUSSION That equivalence comes with a caveat, however. Internalities may raise more practical distributional concerns even though they appear identical to externalities in the basic theory. This difference arises because externality taxes target consumers to the extent they harm others; internality taxes target consumers to the extent they unintentionally harm themselves. Both types of taxes fall on consumers based on their tastes, incomes, and product characteristics. But internality taxes add another dimension, falling particularly on consumers who may later regret their consumption decisions. To see this formally, we can disaggregate consumer purchases into the amount a consumer would purchase if fully rational and informed, 𝑥𝑖𝑟 , and the excess amount they actually purchase, 𝑥𝑖𝑒 (𝜃𝑖 ), which depends on the fraction of internal costs they overlook. Actual purchases by an individual are thus 𝑥𝑖 = 𝑥𝑖𝑟 + 𝑥𝑖𝑒 (𝜃𝑖 ), (11) and actual overall purchases are 𝑋 = 𝑋𝑟 + 𝑋𝑒 . (12) The regressivity term can then be decomposed into rational and excess components 𝑅 = 𝐶𝑜𝑣(𝑚𝑖 , 𝑥𝑖 − 𝛽𝑖 𝑋) = 𝐶𝑜𝑣(𝑚𝑖 , 𝑥𝑖𝑟 − 𝛽𝑖 𝑋 𝑟 ) + 𝐶𝑜𝑣(𝑚𝑖 , 𝑥𝑖𝑒 − 𝛽𝑖 𝑋 𝑒 ). (13) The first term measures how the marginal utility of money covaries with the redistribution that would occur if consumers all behaved rationally; it applies identically to externalities and internalities. The second term, which applies only for internalities, measures that covariance for consumers’ excess consumption. Many consumers overlook some costs when making purchasing decisions. A growing body of research suggests, however, that such behavior may be more common among people with low incomes. Poverty interferes with cognitive performance and can lead people to act impulsively and overlook future costs (Haushofer and Fehr 2013; Mani et al. 2013; Spears 2011). Causality may also run the other way: Having limited self-control leads to lower incomes, worse health, and greater substance dependence (Moffitt et al. 2011). For those reasons, we may expect that people with low incomes are more likely to have high 𝜃’s and excess consumption of harmful goods and vice versa.17 17 Smoking provides suggestive evidence of this. In the United States, smoking is almost twice as common among people living in poverty as among those at higher income levels (29 percent compared with 16 percent in 2013, respectively; Jamal et al. 2014). Some instances may run in the other direction, however. For example, there is evidence that people with low incomes make better financial decisions in certain contexts, so mistakes are more common among people with high incomes (Shah, Shafir, and Mullainathan 2015). 12 6. DISCUSSION All else equal, we should thus expect internality taxes to be more regressive than externality taxes. Optimal internality taxes will thus be lower relative to unrecognized harms than are optimal externality taxes, or the government will have to select a rebate rule that does more to address distributional harms. Those conclusions depend heavily on the “all else equal” condition. If we have good data on consumer incomes and consumption choices, we can observe the degree of regressivity directly for both externalities and internalities. The point here is that in the absence of such information, internality taxes should raise greater distributional concerns than do externality taxes. 13 5. PATERNALISM Thus far, we have focused on the traditional concerns of optimal tax theory, efficiency and equity. But policies to reduce internalities are often couched in terms of paternalism, a desire to help consumers who make decisions they may later regret. In that framing, the parallel between internality and externality taxes disappears.18 To illustrate, suppose the good creates internalities but not externalities and there are two types of consumers, those who purchase the harmful good and those who do not; within each group, consumers are identical. In this setting, the efficient tax equals the marginal internality, 𝑡 𝑒 = 𝜃𝐼 ′ 𝑚 , where m is the marginal utility of money for consumers who purchase x. What tax rate would x-consumers prefer? From a fully-informed, fully-controlled perspective, they would appreciate how a tax would curb excess consumption. But they would worry about the balance between the taxes they pay and rebates they receive. These consumers thus face a trade-off between reduced harm and a higher net tax burden. To analyze that trade-off, suppose each x-consumer receives a rebate equal to a fraction 𝛾 of taxes they pay. The consumer’s preferred tax rate is 𝑡𝑝 = 𝜃𝐼 ′ 𝑚 1−𝛾 1 (1 − 1−𝛾+𝛾𝜖 (1 − 𝜖 + 𝜙)), (14) where 𝜖 is the consumer’s price elasticity of demand for x, expressed as a positive number, 𝜃𝐼 ′ and 𝜙 = ( 𝑚 )/𝑐 is the size of the internality relative to the monetary cost of the product. If rebates fully offset tax payments (𝛾 = 1), x-consumers favor the efficient tax rate. They make better purchasing decisions without bearing any net new tax burden. If rebates only partly offset tax payments (𝛾 < 1), however, x-consumers typically prefer a tax rate lower than the efficient one. That happens whenever 1 𝜖 < 1 + 𝜙. (15) If consumers are not very responsive to price (low 𝜖) or the internality is small relative to the production cost of the product (low 𝜙), concerns about the burden of a tax loom large 18 In principle, there is a parallel concept for externalities: asking whether an externality tax increases the joint welfare of the buyers and sellers involved in the externality, rather than for society overall. 14 6. DISCUSSION compared to the benefits of reduced harm. Consumers thus prefer a tax rate lower than the efficient level. This happens, for example, when demand for good x is inelastic. This is important for policy because demands for unhealthy products, including cigarettes, alcohol, and fast food, often have elasticities less than 1 (Gruber and Kőszegi 2004; Nelson 2013; O’Donoghue and Rabin 2006; Powell et al. 2013). In fact, x-consumers often prefer to not be taxed at all. That happens whenever 𝜖< 1−𝛾 𝜙 . (16) Consumers do not benefit from being taxed if their purchases are not very responsive to price (low 𝜖), the internality is sufficiently small (low 𝜙), rebates are a relatively small share of tax payments (low 𝛾), or a combination of the three. In such cases, x-consumers would be harmed by a tax and prefer to be subsidized.19 Figure 2 illustrates how a consumer’s preferred tax rate varies with the elasticity, the rebate, and the internality. The first panel shows a “moderate” case in which overlooked internal costs are half the cost of producing the product. This case is moderate compared to previous analyses that consider larger internalities; O’Donoghue and Rabin (2006), for example, consider ratios of 2 and 10. This case is large, however, compared to many externalities, including climate change.20 For this internality and for elasticities from 0 to 2, consumers prefer a tax below the efficient tax. In fact, consumers prefer no tax for half of the rebate-elasticity combinations illustrated, including those that may be most realistic (low fractions of revenue rebated to xconsumers and inelastic demand). The second panel shows a large internality with overlooked internal costs twice the cost of the product. Taxes are more promising in this case because the internality is larger. Consumers still prefer no tax if their elasticity and rebate are sufficiently small, but that range is narrower. They prefer a tax less than the efficient level as long as the elasticity is less than 1.5. At higher elasticities, they prefer a tax above the efficient level because it reduces both internal costs and revenues diverted to other taxpayers. The third panel shows an enormous internality with overlooked internal costs 10 times the cost of the product. This case approximates what Gruber and Kőszegi (2004) estimate as the internal costs of smoking. Taxes are particularly promising in this case because the internality is so large. Even if they receive no rebates, consumers benefit from a tax as long as their elasticity is 19 This condition can also be viewed as identifying when an internality tax would be a Pareto improvement. If x-consumers prefer a positive tax, both they and non-consumers will be better off (Kotakorpi 2008; O’Donoghue and Rabin 2006). 20 The United States government estimates that properly pricing climate change externalities would add about 15 percent to the price of gasoline and about 25 percent to the price of electricity (see Marron, Toder, and Austin [2015] and references therein), lower than the 50 percent “moderate” case considered here. 15 6. DISCUSSION at least 0.1. At even moderate levels of elasticity, the optimal paternalistic tax is several multiples of the cost of the product.21 Figure 2. The optimal paternalistic tax depends on the internality, elasticity, and rebates. Contour lines show the ratio of the optimal tax from the consumer’s perspective to that from an efficiency perspective. If the ratio is below 0, the consumer is harmed by a tax and prefers a subsidy. If the ratio is between 0 and 1, the consumer benefits from a tax, but below the efficient level. If the ratio is above 1, the consumer prefers a tax above the efficient level. a. Moderate Internality (𝜙 =0.5) b. Large Internality (𝜙 = 2) c. Enormous Internality (𝜙 = 10) 21 Consistent with this analysis, Gruber and Mullainathan (2005) find evidence that cigarette taxes make smokers happier. 16 6. DISCUSSION As these examples illustrate, concern about the well-being of affected consumers eliminates any direct parallel between internality and externality taxes. The efficiency rationale behind externality taxes would calibrate the tax rate solely to the amount of the internality. But a paternalistic approach also accounts for the elasticity of demand and the degree to which revenues are returned to affected consumers. All else equal, those consumers are most likely to favor internality taxes when internalities are large, elasticities are high, and the government rebates a large fraction of revenue to them. 17 6. DISCUSSION Externalities and internalities arise when consumers do not fully account for the costs of their purchases. In principle, well-crafted taxes can reduce that problem by ensuring that a cost consumers do consider, price, reflects any otherwise-overlooked external and internal costs. On both efficiency and equity grounds, that logic implies that we should tax internalities like externalities.That conclusion weakens, however, under further scrutiny. Internality taxes are more difficult to calibrate than externality taxes. To levy an efficient externality tax, policymakers face one fundamental measurement challenge: identifying the spillover harm. To levy an efficient internality tax, however, policymakers face two challenges: identifying the harm that consumers impose on themselves and determining how much of that harm they overlook rather than recognize. Distinguishing recognized costs from overlooked ones is difficult. Some people eat french fries knowing the health risks; others overlook them. Internality taxes raise greater equity concerns than externality taxes because they target consumers who place too little weight on long-term costs. Most people make that mistake, but a growing literature shows that it is more likely for people with low incomes. Poverty makes it more difficult to assess future effects, for example, and limited self-control can lead people to have lower incomes. Consumption of goods that create internalities may thus skew toward people with lower incomes. That increases equity concerns about internality taxes and increases the importance of the government returning revenues to targeted consumers. Finally, the parallel between internality and externality taxes disappears if policy is motivated by paternalism. Traditional conceptions of efficiency and equity trade off the wellbeing of different people. In particular, they allow for “optimal” internality taxes that leave consumers of the harmful product worse off. That happens whenever those consumers pay more in net new taxes (taxes less rebates) than they benefit from improved consumption decisions. Requiring that targeted consumers benefit significantly constrains potential internality policies. Unless the government rebates most revenues to targeted consumers, the optimal paternalistic tax will generally be lower than the efficient or welfare-maximizing level and, indeed, will often be zero. This is particularly likely if consumption of a harmful good is concentrated among a relatively small fraction of the population. Internality taxes are thus less compelling than externality taxes. That does not mean policymakers should never use them. Smoking is so harmful and so clearly a source of regret that taxes can improve smokers’ well-being. But smoking is an exceptional case. For smaller internalities, analysts and policymakers should recognize that taxes impose costs on affected consumers and that people who overlook future costs in one part of their life may well face 18 6. DISCUSSION financial challenges as well. Policies that do not create the same financial burdens as taxes, such as nudges, information provision, and some regulations, are thus more attractive for addressing internalities than for otherwise comparable externalities. 19 APPENDIX: DERIVATIONS EFFICIENCY The government maximizes overall surplus defined as the surplus of consumers based on their actual demands, the revenue the government collects, and any external and overlooked internal costs, valued using the marginal utility of money of the people bearing those costs: 𝑆𝑢𝑟𝑝𝑙𝑢𝑠 = ∑𝑖 𝐶𝑆𝑖 (𝑥𝑖 ) − 𝐸𝑖 (𝑥⃗) 𝑚𝑖 − 𝜃𝑖 𝐼𝑖 (𝑥𝑖 ) 𝑚𝑖 + 𝑡𝑥𝑖 , (A1) where CSi is consumer i’s surplus. Maximizing over t yields the first-order condition ∑𝑖 −𝑥𝑖 − ∑𝑗 ′ ′ 𝐸𝑗𝑖 𝑥𝑖 𝑚𝑗 − 𝜃𝑖 𝐼𝑖′ 𝑥𝑖′ 𝑚𝑖 +𝑥𝑖 + 𝑡𝑥𝑖′ = 0. (A2) As long as consumers respond to the tax (𝑥𝑖′ < 0), this rearranges to give the efficient tax in equation (7). If consumers are identical, it simplifies to equation (5). EQUITY The government maximizes the sum of consumer’s experienced utility: SWF = ∑𝑖 𝑈𝐸𝑖 = ∑𝑖 𝑈𝑖 (𝑥𝑖 , 𝑦𝑖 + 𝑟𝑖 − (𝑐 + 𝑡)𝑥𝑖 ) − 𝐸𝑖 (𝑥⃗) − 𝐼𝑖 (𝑥𝑖 ). (A3) Maximizing over t yields the first-order condition ∑𝑖 𝑥𝑖′ (𝑈𝑥′ − (𝑐 + 𝑡)𝑚𝑖 − ∑𝑗 𝐸𝑗𝑖′ − 𝐼𝑖′ ) + (𝑟𝑖′ − 𝑥𝑖 )𝑚𝑖 = 0. (A4) Substituting in the consumer’s first-order condition (4) and rearranging yields the fundamental tradeoff the government faces ∑𝑖 𝑚𝑖 (𝑟𝑖′ − 𝑥𝑖 ) = ∑𝑖 𝑥𝑖′ (∑𝑗 𝐸𝑗𝑖′ + 𝜃𝑖 𝐼𝑖′ ). (A5) The government balances the marginal welfare costs of raising the price of good x and reallocating revenue (the left side of the equation) and the marginal welfare gains of reducing external and unrecognized internal costs (the right side). Let 𝛽𝑖 be the fraction of revenues rebated to consumer i, with ∑𝑖 𝛽𝑖 = 1. Each consumer receives 𝑟𝑖 = 𝛽𝑖 𝑡𝑋, where 𝑋 = ∑𝑗 𝑥𝑗 is total consumption. It follows that 𝑟𝑖′ = 𝛽𝑖 𝑋 + 𝛽𝑖 𝑡𝑋 ′ . 20 6. DISCUSSION Putting the rebate expressions into (A5) and rearranging yields the welfare-maximizing tax rate (8). The second term in equation (8) can be expressed in terms of our regressivity measure, R, which equals the covariance between the marginal utility of money and the net tax burden from the tax and rebate combination 𝑅 = 𝐶𝑜𝑣(𝑚𝑖 , 𝑥𝑖 − 𝛽𝑖 𝑋) = ∑𝑖 𝑚𝑖 (𝑥𝑖 −𝛽𝑖 𝑋) 𝑛 . (A6) ′ Define 𝜂 = −𝑋 (𝑡+𝑐) to be the price elasticity of demand defined as a positive number. Some 𝑋 tedious arithmetic then yields (10). PATERNALISM If asked to choose a preferred tax rate, a forward-looking, fully-informed consumer would maximize their experienced utility, 𝑈(𝑥, 𝑦 + 𝛾𝑡𝑥 − (𝑐 + 𝑡)𝑥) − 𝐼(𝑥)). Their first-order condition for choosing t is 𝑈𝑥′ 𝑥 ′ + 𝑚(𝛾𝑥 + 𝛾𝑡𝑥 ′ − (𝑐 + 𝑡)𝑥 ′ − 𝑥) − 𝐼′𝑥′ = 0. (A7) The consumer would recognize, however, that their actual purchasing decisions will not be forward looking. They thus expect the choice of x will satisfy the first-order condition for maximizing choice utility, equation (4). Combining the two expressions and rearranging yields 1 𝜃𝐼 ′ 𝑡𝑝 = 𝛾 𝑚 + 1−𝛾 𝑥 𝛾 𝑥′ (A8) From the consumer’s perspective, the optimal tax rate is a weighted average that balances the benefit of reducing excess consumption of the harmful good (the first term) and the cost of paying more in tax than they receive as a rebate (the second term). Substituting in the price elasticity of demand and rearranging yields the optimal paternalistic tax, equation (14). 21 REFERENCES Allcott, Hunt, Sendil Mullainathan, and Dmitry Taubinsky. 2014. “Energy Policy with Externalities and Internalities.” Journal of Public Economics 112: 72–88. Becker, Gary S., and Kevin M. Murphy. 1988. “A Theory of Rational Addiction.” Journal of Political Economy 96 (4): 675–700. Brockwell, Erik. 2014. “Signaling through Taxing America’s Sin: A Panel Data Study.” Working Paper 2014:4. Umeå, Sweden: Umeå University. Cawley, John, and David Frisvold. 2015. “The Incidence of Taxes on Sugar-Sweetened Beverages: The Case of Berkeley, California.” Working Paper No. 21465. Cambridge, MA: National Bureau of Economic Research. Chetty, Raj, Adam Looney, and Kory Kroft. 2009. “Salience and Taxation: Theory and Evidence.” American Economic Review 99 (4): 1145–77. Cornell, Nicolas. 2015. "A Third Theory of Paternalism." Michigan Law Review 114(2): 1295–336. Diamond, Peter A. 1973. “Consumption Externalities and Imperfect Corrective Pricing.” Bell Journal of Economics and Management Science 4 (2): 526. doi: 10.2307/3003052. Gruber, Jonathan, and Botond Kőszegi. 2004. “Tax Incidence When Individuals Are TimeInconsistent: The Case of Cigarette Excise Taxes.” Journal of Public Economics 88 (9–10): 1959–87. Gruber, Jonathan, and Sendhil Mullainathan. 2005. “Do Cigarette Taxes Make Smokers Happier?” B.E. Journal of Economic Analysis & Policy 5 (1): 1–45. Haavio, Markus, and Kaisa Kotakorpi. 2011. “The Political Economy of Sin Taxes.” European Economic Review 55 (4): 575–94. Haushofer, Johannes, and Ernst Fehr. 2014. “On the Psychology of Poverty.” Science 344 (6186): 862–67. Jamal, Ahmed, Israel T. Agaku, Erin O’Connor, Brian A. King, John B. Kenemer, and Linda Neff. 2014. “Current Cigarette Smoking Among Adults—United States, 2005-2013.” Morbidity and Mortality Weekly Report 63 (47): 1108–12. Kahneman, Daniel, Peter P. Wakker, and Rakesh Sarin. 1997. “Back to Bentham? Explorations of Experienced Utility.” Quarterly Journal of Economics 112 (2): 375–406. 22 Kaplow, Louis. 2004. “On the (Ir)Relevance of Distribution and Labor Supply Distortion to Government Policy.” Journal of Economic Perspectives 18 (4): 59–75. Kotakorpi, Kaisa. 2008. “The Incidence of Sin Taxes.” Economics Letters 98 (1): 95–99. Laibson, David. 1997. “Golden Eggs and Hyperbolic Discounting.” Quarterly Journal of Economics 112 (2): 443–77. Mani, Anandi, Sendhil Mullainathan, Eldar Shafir, and Jiaying Zhao. 2013. “Poverty Impedes Cognitive Function.” Science 341 (6149): 976–80. Marron, Donald B., Eric Toder, and Lydia Austin. 2015. Taxing Carbon: What, Why, and How. Washington, DC: Urban Institute. Moffitt, Terrie E., Louise Arseneaul, Daniel Belsky, Nigel Dickson, Robert J. Hancox, HonaLee Harrington, Renate Houts, Richie Poulton, Brent W. Roberts, Stephen Ross, Malcolm R. Sears, W. Murray Thomson, and Avshalom Casp. 2011. “A Gradient of Childhood Self-Control Predicts Health, Wealth, and Public Safety.” Proceedings of the National Academy of Sciences 108(7): 2693– 98. Mullainathan, Sendhil, Joshua Schwartzstein, and William J. Congdon. 2012. “A Reduced-Form Approach to Behavioral Public Finance.” Annual Review of Economics 4: 511–40. Nelson, Jon. 2013. “Meta-analysis of Alcohol Price and Income Elasticities with Corrections for Publication Bias.” Health Economics Review 3 (17). O’Donoghue, Ted, and Matthew Rabin. 2006. “Optimal Sin Taxes.” Journal of Public Economics 90 (10–11): 1825–49. Pigou, Arthur C. 1920. The Economics of Welfare. London: Macmillan and Co. Pogue, Thomas F., and Larry G. Sgontz. 1989. “Taxing to Control Social Costs: The Case of Alcohol.” The American Economic Review 79 (1): 235–43. Powell, Lisa M., Jamie F. Chriqui, Tamkeen Khan, Roy Wada, and Frank J. Chaloupka. 2013. “Assessing the Potential Effectiveness of Food and Beverage Taxes and Subsidies for Improving Public Health: A Systematic Review of Prices, Demand, and Body Weight Outcomes.” Obesity Review 14(2): 110-128. Shah, Anuj K., Eldar Shafir, and Sendhil Mullainathan. 2015. “Scarcity Frames Value.” Psychological Science 26 (4): 402–12. Spears, Dean. 2011. “Economic Decision-Making in Poverty Depletes Behavioral Control.” B.E. Journal of Economic Analysis and Policy 11 (1). 23 The Tax Policy Center is a joint venture of the Urban Institute and Brookings Institution. For more information, visit taxpolicycenter.org or email info@taxpolicycenter.org Copyright © 2015. Urban Institute. Permission is granted for reproduction of this file, with attribution to the UrbanBrookings Tax Policy Center.