Schroder International Selection Fund Société d'Investissement à Capital Variable

Schroder International Selection Fund

Société d'Investissement à Capital Variable

5, rue Höhenhof, L-1736 Senningerberg

Grand Duchy of Luxembourg

Tel : (+352) 341 342 202 Fax : (+352) 341 342 342

IMPORTANT: This letter is important and requires your immediate attention. If you have any questions about the content of this letter, you should seek independent professional advice. The directors of Schroder International Selection Fund accept full responsibility for the accuracy of the information contained in this letter and confirm, having made all reasonable enquiries, that to the best of our knowledge and belief there are no other facts the omission of which would make any statement misleading.

31 August 2010

Dear Shareholder,

Schroder International Selection Fund – changes to distribution policy

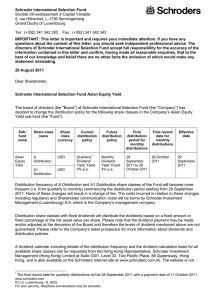

In response to business demand, the board of directors (the "Board") of Schroder International Selection

Fund (the "Company") has decided to change the distribution policy for a number of share classes in some of the Company's sub-funds as listed in the table below:

Sub-fund name

Asian

Equity

Yield

EURO

Bond

Share class name

Share class currency

Current distribution policy

Future distribution policy

First distribution period ended with new policy and the corresponding record date

Effective date

A Distribution

A1 Distribution USD

A Distribution

B Distribution

USD

EUR

EUR

Quarterly

Variable

Annual

Variable

Quarterly

Dividend

Yield: Fixed

4% p.a.

30 September 2010 with 29 September

2010 as record date

Semi-annual

Variable

30 June 2011 with record date to be scheduled in June

2011

30 September

2010

30 June 2011

EURO

Corporate

Bond

A Distribution EUR

A1 Distribution EUR

B Distribution EUR

Semi-annual

Variable

Monthly

Variable

Semi-annual

Dividend

Yield: Fixed

3% p.a.

31 December 2010 with 29 December

2010 as record date

31 December

2010

Semi-annual

Variable

1

The final annual dividend payment will be made for the December 2010 record date using the current distribution policy.

Thereafter distributions will be made semi-annually as set out in the table above. The record dates are provided in the dividend calendar.

2

The final monthly variable dividend payment will be made for the September 2010 record date using the current distribution policy. The following dividend payment will be for December 2010, for which a fixed dividend rate of 0.75% of the Net Asset Value per Share for the December 2010 record date will be applied. Thereafter distributions will be made semi-annually. The record dates are provided in the dividend calendar. www.schroders.lu

R.C.S. Luxembourg - B. 8202

For your security, telephone conversations may be recorded.

Page 2 of 2

Sub-fund name

Global

Corporate

Bond

Share class name

A Distribution

EUR Hedged

Share class currency

Current distribution policy

EUR Annual

Variable

Future distribution policy

Quarterly

Dividend

Yield:

Fixed 3% p.a.

First distribution period ended with new policy and the corresponding record date

Effective date

30 September 2010

with 29 September

2010 as record date

30 September

2010

US Dollar

Bond

A Distribution USD Quarterly

Variable

Quarterly

Dividend

Yield:

Fixed 3% p.a.

30 September 2010 with 29 September

2010 as record date

30 September

2010

None of these changes will result in a change of fee. The costs incurred in relation to these changes will be borne by Schroder Investment Management (Luxembourg) S.A. which is the Company’s management company. For distribution share classes with variable dividend changing to fixed dividend after the respective effective dates, the amount of dividend to be distributed under the new policy may be lower or higher than that distributed under the old policy.

Please note that the dividend payment may be made and/or adjusted at the discretion of the Board and therefore the levels of dividend mentioned above are not guaranteed.

Dividend Calculation

Distribution Share Classes based on Investment Income After Expenses

For distribution share classes with a variable amount paid out, the policy is to distribute substantially all the investment income for the distribution period after deduction of expenses.

Distribution Share Classes with Fixed Dividends

Distribution share classes will generally distribute all of the investment income after expenses unless the distribution policy is stated as a fixed amount or fixed percentage of the net asset value per share. Fixed distributions are calculated by:

1. taking the fixed dividend yield per annum and dividing it by the frequency of payment per annum

(i.e. for a quarterly period with a dividend yield per annum of 3% this would be 3% divided by 4 which equals 0.75% per quarter); and

2. applying the periodic fixed distribution rate (0.75% in the above example) to the net asset value per share as calculated for the record date for that distribution.

This may result in share classes with fixed distributions either paying out both income and capital in distribution payments, or not substantially distributing all the investment income which a share class has

3

The first distribution with new policy will be made for the September 2010 record date for the period starting from 1

January 2010 and ending 30 September 2010, for which a fixed dividend rate of 2.25% (0.75% x 3) of the Net Asset

Value per Share for the September 2010 record date will be applied. Such distribution may be paid out of capital and reduce the share class’ net asset value. Thereafter distributions will be made quarterly. The record dates are provided in the dividend calendar.

Page 3 of 3 earned after deduction of expenses. Any distributions involving a proportion of a share class’ capital will result in a reduction in the share class’ net assets value per share.

The Board will periodically review fixed dividend yield share classes and reserves the right to make changes to the amount of the dividend yield in which case the dividend calendar will be updated accordingly. For example if the investment income after expenses is higher than the target fixed distribution the Board may declare a higher amount to be distributed. Equally the Board may deem it is appropriate to declare a dividend lower than the target fixed distribution.

Relevant shareholders in Hong Kong will be informed of any change to the fixed amount or fixed percentage of the net asset value per share to be distributed.

Please refer to the Company's latest prospectus for more information about dividends and distribution policies.

A dividend calendar including details of the distribution frequency and the dividend calculation basis for all available share classes can be requested from the Hong Kong Representative, Schroder Investment

Management (Hong Kong) Limited at Suite 3301, Level 33, Two Pacific Place, 88 Queensway, Hong

Kong, and is also available on the www.schroders.lu website. The website is not authorized by the

Securities and Futures Commission in Hong Kong (“SFC”) and may contain information on funds which are not authorized by the SFC and may not be offered to the retail public in Hong Kong.

If you wish to redeem your holding in the above-mentioned share classes, any such redemption instruction will be executed free of charge. However, please note that some distributors, paying agents, correspondent banks or similar agents might charge you switching and / or transaction fees. A redemption might also affect your tax status. We therefore recommend you to seek independent professional advice in these matters.

If you would like more information, please contact your usual professional advisor or Schroders' Investor

Hotline on (+852) 2869 6968.

Yours faithfully,

Achim Kuessner

Director

Ketil Petersen

Director