An Economic Analysis of the Great Depression: Lessons for Today

advertisement

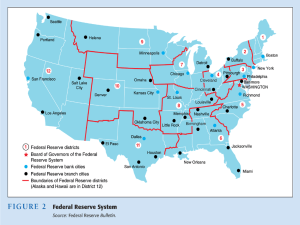

An Economic Analysis of the Great Depression: Lessons for Today Council for Economic Education March 21, 2009 Mark C. Schug, Ph.D. University of Wisconsin-Milwaukee Whatdunnit? The Great Depression Mystery Focus: Understanding Economics in U.S. History Lesson 30 Whatdunnit? In the 1920s, jobs were plentiful and the economy was growing and the standard of living was rising. Between 1920 and 1929 homeownership doubled. Most home-owning families enjoyed amenities such as electric lights and flush toilets. 60% of all households had cars, up from 26%. More teenagers were attending high school. Whatdunnit? By 1933… One fourth of the labor forces was unemployed. Families were losing their homes and many were going hungry. Adolescents who should be in school were riding around the country in freight cars, looking for jobs. Whatdunit? What happened? • The United states possessed the same productive resources in the 1930s as it had in the 1920s. • Great factories and productive machinery were still present. • Workers had the same skills and were willing to work just as hard. • How could life have become so miserable for so many in such a short period of time? 1920s Prosperity of the 1920s was based largely on purchases of homes and cars. Toward the end of the decade sales began to decline. End of the 1920s Machinery workers stand. Car sales people stand. Auto workers stand. Steel workers stand. Construction workers stand. Furniture sellers stand. Furniture workers stand. Clothing sellers stand. Restaurant workers stand. Grocery workers stand. 1929 Normally, people start buying again as automobiles wear out and incomes improve. Expansion Begins Again Machinery workers sit. Car sales people sit. Auto workers sit. Steel workers sit. Construction workers sit. Furniture sellers sit. Furniture workers sit. Clothing sellers sit. Restaurant and grocery workers sit. Grocery workers sit. What Are the Alleged Causes of the Great Depression? The Stock Market Crash of October 29, 1929. Excessive borrowing to purchase stocks and consumer goods. Overproduction of goods and services High tariffs which prevented imports and hurt exports. Low farm prices and low wages, leading to an uneven distribution of income. Why did a mild recession in 1929 become the Great Depression of the 1930s? A Hint Its mainly about money, banks, and the Federal Reserve System How is Money Created? Banks are not just businesses. Hint: Banks Create Money 100% Reserves Assets Reserves Loans Liabilities $100.00 Deposits $100.00 Hint: Banks Create Money Bank 1: 10% Reserves Assets Liabilities Reserves $10.00 Loans $90.00 Deposits $100.00 Hint: Banks Create Money Bank 2: 10% Reserves Assets Liabilities Reserves $9.00 Loans $81.00 Deposits $90.00 The Fed The Federal Reserve System was created in 1913. The Fed has 4 parts Board of Governors (Washington D.C.) Federal Open Market Committee (FOMC) Reserve Banks (12 members) Member Banks Conducting Monetary Policy Inflation: Enemy Number 1 The Federal Reserve System has 3 tools to control inflation: 1. Sets reserve requirements for banks. Raise reserve requirement = reduce money supply Lower reserve requirement = increase money supply Conducting Monetary Policy 2. Manages the Federal Open Market Committee (FOMC). The FOMC sets a target rate for the Federal Funds rate. This is the rate for loans made from bank to bank. This is almost always what the media is referring to when it says the Federal Reserve "changing interest rates". To increase the money supply, the Fed instructs the Open Market Desk at the New York Fed to buy bonds to try and hit the target rate. To decrease the money supply, the Fed instructs the Open Market Desk at the New York Fed to sell bonds. Conducting Monetary Policy 3. Sets the discount rate for members who borrow money from the Fed. Banks can borrow funds to keep up their required reserves is by taking a loan from the Fed Reserve at the discount window. The discount rate is usually higher than the federal funds rate. Raise discount rate = reduce money supply Lower discount rate = increase money supply Visual 30.2 Number of U.S. Banks Closing Temporarily or Permanently, 1920-1933 Year Number of Bank Closings 1920 168 1921 505 1922 367 1923 646 1924 775 1925 618 1926 976 1927 669 1928 499 1929 659 1930 1352 1931 2294 1932 1456 1933 4004 Visual 30.3 Money in Circulation Year Money in Circulation* 1929 $26.2 1930 $25.1 1931 $23.5 1932 $20.2 1933 $19.2 *Currency plus bank deposits, in billions of dollars. Why Did the Fed Fail to Act? 1. 2. 3. The Board of Governors believed that many banks were unsound. They wished to protect the value of the dollar by keeping interest rates high. They wished to protect the nation against inflation which they thought was the main problem. “We Did It.” In 2002, at Milton Friedman’s 90th birthday Ben Bernanke, then Federal Reserve Board Governor, said: “ I would like to say to Milton and Anna: Regarding the Great Depression, you were right, we did it. We’re very sorry. But thanks to you, we won’t do it again.” The Crash of 08 After 24 Consecutive Quarters of Growth… The Cliff And then we went off the cliff. 19 87 19 88 19 89 19 90 19 91 19 92 19 93 19 94 19 95 19 96 19 97 19 98 19 99 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 House Price Change 20.0% 15.0% 10.0% 5.0% 0.0% -5.0% -10.0% -15.0% -20.0% 19 79 19 80 19 81 19 82 19 84 19 85 19 86 19 87 19 89 19 90 19 91 19 92 19 94 19 95 19 96 19 97 19 99 20 00 20 01 20 02 20 04 20 05 20 06 20 07 Default Rate 6% 5% 4% 3% 2% 1% 0% Foreclosure Rate 1.4% 1.2% 1.0% 0.8% 0.6% 0.4% 0.2% 0.0% 79 980 981 982 984 985 986 987 989 990 991 992 994 995 996 997 999 000 001 002 004 005 006 007 9 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 2 2 2 2 2 2 2 Doubling of Household Debt as a Share of Income 140% 120% 100% 80% 60% 40% 20% 53 955 958 960 963 965 968 970 973 975 978 980 983 985 988 990 993 995 998 000 003 005 008 9 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 2 2 2 2 Consumption Causes of the Crash of 08? The likely suspects: The erosion of government regulations of conventional lending standards. The Fed’s manipulation of interest rates during 2002-2006. Causes of the Crash of 08? An SEC Rule change adopted in April 2004 led to highly leveraged lending practices by investment banks and their quick demise when default rates increased. Doubling of the Debt/Income Ratio of Households since the mid-1980s. Is It 1929 All Over Again? Primary causes of the Great Depression were: Poor monetary policy Poor fiscal Policy Reduced money supply High interest rates Failure of Fed to act Tax increase to balance the budget Increasing protectionism Smoot-Hawley tariff Banks Are Not Lending Today, the problem is not liquidity per se. Many banks are holding Mortgage Backed Securities (MBS) and other bad paper. Who do you trust? So far … Actions taken so far have been mainly aimed at increasing liquidity and spending rather than getting rid of bad assets. What are the Characteristics of Money? Medium of exchange Standard of value Store of value What is Money? M1 Currency Checking accounts (63%) M2: add in Savings accounts CDs Money market accounts Jobs of the Fed Services to Banks Check clearing Loans to member banks Services to Government Federal checkbook Federal deposits Supervise members banks Conduct monetary policy Managing the nation’s money supply. Auction Distribute 10 “dollars” in envelops to the class. Ask them to count the money but do not stress the amount they have. Auction off one or two items (T-shirts?), recording the prices. Figure the average price. Distribute 20 “dollars” to the class. Auction off one or two more items, recording the prices. Figure the average price. Explain the price change according to the amount of money in circulation. Activity 30.3 What Would You Have Done? 1. The world financial system that emerged after World War I was based upon the gold standard. The United States and Great Britain guaranteed that they would exchange their currencies for gold at a fixed rate ($20.67) for an ounce of gold. Other major countries agreed to exchange their currencies for gold, dollars or pounds. In 1927, several countries, most notably Germany and Austria, experienced serious bank runs. To stabilize their currencies, they exchanged their dollars and pounds for gold. The United States experienced a serious loss of gold To encourage foreign investors to buy American investments, the Federal Reserve Banks raised interest rates. If you were an American business owner planning to build a new factory or buy new equipment, what would you have done after interest rates were increased? Activity 30.3 What Would You Have Done? 2. The Federal Reserve lowered interest rates after a time, but in 1930 and 1931, when the American economy had already taken a downturn, more bank runs occurred in many countries, and again gold flowed out of the United States. To keep gold in the United States, the Federal Reserve Banks again raised interest rates. What was the result? Activity 30.3 What Would You Have Done? 3. Now imagine that you are an American citizen with a bank account. You read the newspapers. You see that banks are collapsing in other countries and that the rate of bank failures in the United States has risen. What might you do? Activity 30.3 What Would You Have Done? 4. In 1932 Congress creates the Reconstruction Finance Corporation (RFC), which lends money to businesses that are in trouble, including banks. The law requires that the names of banks receiving loans from the RFC must be published. You read in the newspaper that the bank in which your money is deposited is receiving help from the RFC. What are you likely to do? Overview Overview of Focus: Understanding Economics in U.S. History Demonstration of Lesson 30: Causes of the Great Depression Implications for today Today’s Stock Market Report Paper stocks were stationary. Fluorescent tubing dimmed in light trading. Knives were up sharply. Elevators rose, while escalators continued their slow decline. Mining equipment hit rock bottom. Diapers remain unchanged. Today’s Stock Market Report Coca Cola fizzled. Caterpillar stock inched up a bit. Balloon prices were inflated. Scott Tissue touched a new bottom. And batteries exploded in an attempt to recharge the market... Table of Contents Unit 1 Three World Meet Unit 2: Colonization and Settlement Unit 3: Revolution and the New Nation Unit 4: Expansion and Reform Unit 5: Civil War and Reconstruction Table of Contents Unit 6: The Development of the Industrial United States Unit 7: The Emergence of Modern America Unit 8: The Great Depression and World War II Unit 9: Postwar United States Unit 10: Contemporary United States Federal Reserve Banks New York Boston Philadelphia Richmond Atlanta Cleveland Minneapolis Chicago St. Louis Kansas City Dallas San Francisco Job Number One for the FED Conduct monetary policy Managing the nation’s money supply.