International Business Combinations, Goodwill, and Intangibles Session 11

advertisement

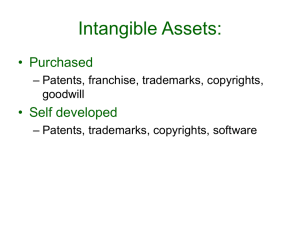

Matakuliah Tahun : F0142/Akuntansi Internasional : September 2006 Session 11 International Business Combinations, Goodwill, and Intangibles 1 Strategic Decision Point • How should we consolidate financial results? – Use 50% rule or some other method? – Example – Vodafone owns 47% of Verizon • Does percentage consolidation show exaggerated growth? • FASB and IASB are considering options in this area currently 2 Consolidated Financial Statements • Controversy exists on how results for MNEs should be reported • Current method – consolidation – Consolidated reports are useful to external users and management – Segment information is also presented – No treatment is given to differing areas of risk and return – Consolidated information varies from country to country • U.S. requires consolidated financial statements • German common practice – parent company statements and worldwide statements 3 Consolidation Methods • “Line-by-line” for approach • Proportionate ownership method – Considered appropriate for joint ventures • “One-line basis” - equity method – Investment amount is adjusted to reflect MNEs share of equity • More conservative method involving only dividends and receivables – Used in Australia and Sweden 4 Purchase versus Pooling-of-Interests Accounting • Purchase method (acquisition method) – Assets revalued at “fair-value” – Purchase price above fair value of net assets is goodwill – Acquired company contributes to earnings after consolidation – Investment recorded at market value 5 Purchase Accounting • Pooling-of-interests method (merger method) – Assets are not revalued – No goodwill – Precombination earnings are included – Investment recorded at nominal value 6 Pooling-of-Interests Accounting • What method is most appropriate? – Purchase method for situations where full ownership is transferred – Pooling-of-interests method is considered appropriate when a continuity of ownership through an exchange of shares exists • Pooling-of-interests method is used less often – Not allowed in the U.S. – FAS 144 – IASB requires purchase method 7 The Treatment of Nonconsolidated Subsidiaries • Equity Method – Reported earnings will be higher because MNE’s share of earnings is included instead of dividends – Used in Japan, U.K., and U.S. – Japanese keiretsu make comparability difficult • Cost Method – MNE’s share of dividends is included in reported earnings – Used in Australia, Sweden, and Switzerland 8 Corporate Group Share Ownership Patterns 9 Fair Value Adjustments • Fair value of assets acquired is determined using the current market value – U.S. and U.K. • Book value is retained even if greater than fair value in Japan and Switzerland – If there is no restatement and • FV>BV, earnings overstated and assets understated • FV<BV, earnings understated and assets overstated 10 Accounting for Goodwill • Most countries treat goodwill as an asset subject to systematic amortization – Maximum amortization periods of 5 to 40 years apply in some countries • U.S. and IASB treatment is an annual impairment test of goodwill • Some countries use immediate write-off method against reserves – Not permitted in U.S., Australia, Japan • Some countries retain goodwill as a permanent asset 11 International Accounting Standards • IFRS 3 on Business Combinations superceded IAS 22 in March 2004 – Pooling-of-interests method disallowed – Impairment testing for goodwill required • Some countries still adopt a flexible approach and permit immediate write-off of goodwill • Asset-with-amortization and immediate write-off methods are both supported by evidence • Enhanced transparency is likely more important than uniformity 12 Problems and Prospects • In practice, consolidated financial statements have not increased with demand – Italy, India • Consolidated accounts are still not required in some countries – India, Saudi Arabia • Problems exist relating to group identification and the various techniques of consolidation 13 Problems and Prospects • Different groups want different consolidation – Government and trade union – country level – Investors – worldwide level • International consolidation may not be relevant because of inflation, exchange rates, and political risk 14 Funds and Cash Flow Statements • “Funds” does not necessarily mean cash – Could also mean working capital • Provides insight into the financial performance, stability, and liquidity of MNEs • May be useless without additional disaggregated information – Example – location of sources and uses of funds • Fairly new statement in regards to regulation 15 Funds and Cash Flow Statements • Countries where statement is required – Brazil, Canada, Philippines, Australia, NZ – All countries adopting IFRS • Countries where statement is not required – Saudi Arabia, India • Many companies disclose voluntarily • IAS 7 permits companies to use the direct or indirect method (direct recommended) 16 Funds and Cash Flow Statements • Problems and Prospects – Regulation is highly flexible in this area – Some confusion about the purpose, presentation, and use of the statement • Confusion as to what “funds” are • Difficulty in comparing statements • Cash flow statement could be more useful than a funds statement internationally – Used in U.S. and U.K. and endorsed by the IASB 17 Joint Venture Accounting • Little is known about the control processes or performance measurement of joint ventures • Differences between current and former socialist economies and Western economies lead to potential problems • IAS 31 attempts to resolve issues from the venturer’s perspective 18 Joint Venture Accounting • Three types of joint ventures exist – Jointly controlled operations – Jointly controlled assets – Jointly controlled entities • IAS 31 requirements for venturers – Jointly controlled operations and assets – recognition based on share in operations or assets – Jointly controlled entities – two alternatives • Benchmark Treatment • Allowed Alternative Treatment 19 Goodwill and Intangibles • Major international importance • Academic research and cooperation between standard-setting agencies are needed in this area • Intangible Assets and the Balance Sheet – Balance sheet should show how well a company can meet its obligations – Should “relevance” or reliability” govern the value of intangible assets? 20 Goodwill and Intangibles • The Stock Market Perspective – If the market is efficient • The nature and treatment of intangible assets should be sufficiently disclosed to help users assess the treatment used – If the market is inefficient • Skepticism exists concerning analysts adjustments • Markets are affected by international and national political and economic factors – More disclosure means fairer stock prices 21 Goodwill • Only an issue when purchase method is used • Controversies – Should goodwill be included as an asset? – Should goodwill be amortized? • Accounting Methods – Asset without Amortization – Asset with Annual Impairment Testing – Asset with Systematic Amortization – Immediate Write-Off 22 Goodwill • Comparative National Practices – Insert Exhibit 8.3 – Conflict existed between U.S. and U.K. over benefits derived from immediate write-off • Problem magnified by increased merger activity • Conclusions – – – – Goodwill is not an asset under “separability” Goodwill meets the “reliability” criterion Goodwill meets the “relevance” criterion Accounting for goodwill should be flexible, but fully disclosed within competitive limits 23 Brands, Trademarks, Patents, and Related Intangibles • Should brands be capitalized? – Brand capitalization would • Restore equity • Enhance borrowing capacity • Facilitate takeovers without consultation with shareholders (U.K.) • Avoid undervaluation of firms 24 Brands, Trademarks, Patents, and Related Intangibles • Methods of Accounting – Asset without Amortization – Asset with Systematic Amortization – Immediate write-off • “Current Cost” approach – U.K. • Capitalization without amortization if no limit to useful life – France • Brands are identified as intangible assets in Australia, France, and the U.K. 25 Brands, Trademarks, Patents, and Related Intangibles • U.S. – combination of asset-withoutamortization method and asset-withsystematic-amortization method depending on estimate of useful life • IFRS requires recognition of intangible assets for consolidated statements • U.S. and Canada must write off internally developed intangibles immediately 26 Brands, Trademarks, Patents, and Related Intangibles • International Accounting Standards – IAS 38 • Intangible assets only recognized if future benefits will flow to the enterprise and cost of asset can be measured reliably • Systematic amortization required for finite lives • Impairment testing for assets with infinite lives 27 Brands, Trademarks, Patents, and Related Intangibles • Conclusions – Problems are linked with the goodwill issue – Brand names qualify as assets under “separability” – Measurement of intangibles may not be “reliable” – Value-oriented approach to brands and intangibles should be used 28 Research and Development • R & D expenditures include all costs related to the creation and development of new processes, techniques, applications, and products • Three categories of expenditure – Pure research – no specific aim or application – Applied research – applying research to an area of business interest – Development – work toward introduction or improvement of specific products or processes 29 Research and Development • Insert Exhibit 8.4 • Tendency towards conservative asset recognition and assessment of future benefits • Accounting Methods – Expense as incurred • Germany and U.S. (software exception in U.S.) – Capitalize Development Costs • Canada, India, U.K. – Capitalize all R&D Costs • Greece, Italy, Japan, Sweden – Multiple methods allowed • Brazil, Hong Kong, Spain, Thailand 30 Research and Development • International Accounting Standards – IAS 38 • Requires immediate write-off method for research expenditures • Development costs should be immediately written off unless project meets specific criteria – If project meets criteria, capitalize and amortize – Amortization periods are reviewed and recognition of impairment losses apply 31 Research and Development • Conclusions – R&D expenditure does not qualify under “separability” unless specific assets are developed – If assets are developed, expenditure meets the “relevance” criterion – If future benefits can be assessed, “reliability” criterion is met – R&D expenditures should be capitalized to the extent of development costs, subject to periodic review and disclosure within competitive limits 32