The Path to the Crisis of 2008: Jean-Paul Rodrigue Theo Notteboom

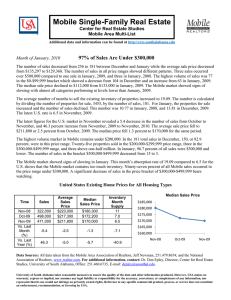

advertisement

The Path to the Crisis of 2008: Beware of Future Expectations Jean-Paul Rodrigue Department of Global Studies & Geography, Hofstra University Theo Notteboom ITMMA - University of Antwerp and Antwerp Maritime Academy Terminal Operators Conference - Europe Valencia (Spain), June 8-10 2010 The Crisis is Over: Long Live the Crisis • Many unfounded assumptions behind the recovery: - Randomness and uniqueness. The cause (debt) is the solution (more debt) The soundness of economic theory (Keynesianism). “Appropriate” response from central banks and governments. - No unintended consequences of moral hazard. • Recession: - Clear the stupidity out of the system. - We have been very stupid (depression?). The First Crisis of Globalization: Reaping the Consequences of Misallocations Production CAUSES Monetary system (fractional reserve banking, fiat currencies) Distribution SYMPTOMS Debt, asset inflation CONSEQUENCES Misallocations (bubbles) Consumption Business Cycles: The Trend that Time Forgot Demand Transfer of future demand into the present. Supply Misallocations because of distorted expectations about the future. Asset price distortions. Credit-Driven Boom Peak Credit-Driven Bust Trough Expansion Recession Expansion Depression Blowing Bubbles and Compounding Distortions: From Technology to Commodities 500.0 450.0 400.0 NASDAQ (Jan 1998=100) 350.0 TOL (Jan 2003=100) 300.0 BDI (Jan 2006=100) 250.0 200.0 150.0 100.0 50.0 0.0 Jan-98 Tech / Stock Bubble Jan-99 Jan-00 Jan-01 Commodities / Trade Bubble Housing Bubble Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Globalization 2000-2008: A Bubble? 14 2 13 Seaborne Trade (billions of tons of goods loaded) - Left Axis 12 Exports of Goods (trillions of current $US) - Left Axis 11 Ratio Exports / Seaborne Trade - Right Axis 10 1.8 1.6 1.4 9 8 7 6 1.2 1 0.8 5 4 0.6 3 0.4 2 1 0 0.2 0 Changes in the Value World’s Merchandise Trade, Production and GDP, 1950-2009 (in %) 25.00 20.00 15.00 10.00 5.00 0.00 -5.00 Recession Total Merchandise Trade -10.00 World GDP World Merchandise Production -15.00 A Paradigm Shift in Neomercantilism? Monthly Value of Exports or Imports, Selected Traders, 2006-2010 (Jan 2006=100) 225 China (Exports) Japan (Exports) Korea (Exports) Germany (Exports) Canada (Exports) USA (Imports) UK (Imports) 200 175 150 125 100 75 Jan-10 Nov-09 Sep-09 Jul-09 May-09 Mar-09 Jan-09 Nov-08 Sep-08 Jul-08 May-08 Mar-08 Jan-08 Nov-07 Sep-07 Jul-07 May-07 Mar-07 Jan-07 Nov-06 Sep-06 Jul-06 May-06 Mar-06 Jan-06 50 0 May-10 Jan-10 Sep-09 Housing Bubble May-09 Jan-09 Sep-08 May-08 Jan-08 Sep-07 May-07 Jan-07 Sep-06 May-06 Jan-06 Sep-05 May-05 Jan-05 Sep-04 May-04 Jan-04 Sep-03 May-03 Jan-03 6,000 Sep-02 May-02 Jan-02 Sep-01 May-01 Jan-01 Sep-00 May-00 Jan-00 Keeping Doing the Same Thing? Baltic Dry Index, Monthly Value, 2000-2010 12,000 Commodities Bubble 10,000 8,000 -92% 4,000 2,000 Which Bubble? 150 140 130 120 Jan-05 Mar-05 May-05 Jul-05 Sep-09 Nov-05 Jan-06 Mar-06 May-06 Jul-06 Sep-06 Nov-06 Jan-07 Mar-07 May-07 Jul-07 Sep-07 Nov-07 Jan-08 Mar-08 May-08 Jul-08 Sep-08 Nov-08 Jan-09 Mar-09 May-09 Jul-09 Sep-09 Nov-09 Jan-10 Mar-10 Container Traffic Recovery Around the Corner? Monthly Total Container Traffic at Selected Ports (Jan 2005=100) Los Angeles New York Busan Hong Kong Algeciras 110 100 90 80 70 60 15 -15 10 -20 5 -25 0 -30 Jan-10 Jan-09 Jan-08 Jan-07 Jan-06 Jan-05 Jan-04 Jan-03 Jan-02 Jan-01 Jan-00 Jan-99 Jan-98 Jan-97 Jan-96 Jan-95 Jan-94 Jan-93 Jan-92 Jan-91 Jan-90 Jan-89 Jan-88 20 Jan-87 Jan-86 Jan-85 Monthly Trade between China and the United States, Billions of USD (19852010) 35 5 30 0 25 -5 Exports Imports -10 Balance Jan-10 Jul-09 Jan-09 Jul-08 Jan-08 Jul-07 Jan-07 Jul-06 Jan-06 Jul-05 Jan-05 Jul-04 Jan-04 Jul-03 Jan-03 Jul-02 Jan-02 Jul-01 Jan-01 Jul-00 Jan-00 Jul-99 Jan-99 Jul-98 Jan-98 Jul-97 350,000 Jan-97 400,000 Jul-96 Jan-96 Jul-95 Jan-95 Monthly Container Traffic at the Port of Los Angeles, 1995-2010 450,000 Out Loaded In Loaded In Empty Out Empty 300,000 250,000 200,000 150,000 100,000 50,000 0 American Foreign Trade by Maritime Containers, 2008 (in TEUs): The Trade Fundamentals Importers Whirlpool JC Penney Nike Red Bull Samsung Jarden General Electric Ashley Furniture Ikea Heineken Chiquita Philips LG Group Lowe's Costco Wholsale Dole Food Sears Holding Home Depot Target Wal-Mart Exporters Newport Chinternational Sims Metal Management CGB Enterprises Denison JC Horizon ExxonMobil Delong BASF Archer Daniels Midland Cedarwood-Young Meadwestvaco Procter & Gamble Potential Industries Dupont Dow Chemical International Paper Koch Industries Cargill Weyerhaeuser America Chung Nam 0 200,000 400,000 600,000 800,000 0 200,000 400,000 600,000 800,000 Value Propositions behind the Interest of Equity Firms in Transport Terminals Diversification (Risk mitigation value) Sectorial and geographical asset diversification. Mitigate risks linked with a specific regional or national market. Asset (Intrinsic value) Source of income (Operational value) Terminals occupy premium locations (waterfront). Globalization made terminal assets more valuable. Traffic growth linked with valuation. Same amount of land generates a higher income. Terminals as fairly liquid assets. Income (rent) linked with the traffic volume. Constant revenue stream with limited, or predictable, seasonality. Traffic growth expectations result in income growth expectations. Port and Maritime Industry Finance: Who is Leveraging Whom? Investors Financial Markets Brokers Corporations Money Markets Commercial Banks Private Investors Capital Markets Mortgage Banks Investments Managers Equity Markets Merchant Banks Private Placement Finance Houses •Insurance Companies •Pension Funds •Banks •Trust Funds •Finance Houses Leasing Companies Shipping Companies Port Operators Earnings Reviewing Assumptions: The Impacts of “Financialization” Physical assets seen as financial assets. Disconnection Rent-seeking strategies From market knowledge Focus on shortterm results Asset inflation High amortization Expectations of quick capital amortization. Expectations about future growth and the corresponding volumes. From long-term business cycles From outcome of actions Lack of accountability From local/ regional dynamics Lack of regional embeddedness Loss of embeddedness Assets perceived simply from their expected level of return. Lower contestability Perceived liquidity. Capacity to quickly enter and exit the market. Dumb Money at Work? Date 2005 Early 2006 Mid 2006 Mid 2006 End 2006 Transaction DP World takes over CSX World Terminals PSA acquires a 20% stake in HPH DP World acquires P&O Ports Goldman Sachs Consortium acquires ABP AIG acquires P&O Ports North America Price compared to EBITD 14 times 17 times 19 times 14.5 times 24 times Early 2007 Ontario Teachers’ Pension Fund acquires OOIL Terminals RREEF acquires Maher Terminals 23.5 times Mid 2007 25 times EBITDA = Earnings Before Interest, Taxes, Depreciation and Amortization World Container Traffic and Throughput, 1980-2008. Reaching Peak Growth? World Traffic World Throughput Full Containers Transshipment Empty Containers 500 Million TEU 400 Niche markets Maturity Massive diffusion Network complexities Peak Growth 300 Network development Productivity multipliers 200 100 Acceleration New (niche) services Productivity gains Adoption 0 1980 1985 1990 1995 2000 2005 2010 Fallacies of Forecasting: 2020 Throughput Forecast, Selected Large Ports, Linear and CAG Scenario Port / Traffic 2007, M TEU R2 / CAG (1998-2007) Traffic 2020 (Linear Scenario) / CAG Traffic 2020 (CAG 1998-2007 Scenario) New York / 5.3 0.996 / +7.9% 9.6 M TEU / +4.7% 14.2 M TEU Savannah / 2.6 0.968 / +13.5% 4.9 M TEU / +5.1% 13.6 M TEU Los Angeles / 8.3 0.966 / +9.5% 16.6 M TEU / +5.4% 27.1 M TEU Antwerp / 8.2 0.974 / +9.6% 14.5 M TEU / +4.5% 26.9 M TEU Algeciras / 3.4 0.961 / +6.5% 6.0 M TEU / +4.4% 7.7 M TEU Busan /13.3 0.983 / +8.4% 24.3 M TEU / +4.8% 38.1 M TEU Shanghai / 26.1 0.948 / +23.9% 56.5 M TEU / +6.1% 423.8 M TEU From under estimating to over estimating trends Linearity prevalent in growth trends (1998-2007) Compound annual growth common in forecasts Non-contestability assumption If you build it they will come… Terminal Operators; Well Positioned or Overextended? Then: Dynamics oriented towards expansion. Now: Rationalization, performance improvements and the search for niche markets. Container Terminal Portfolio of the four Main Global Terminal Operators, 2009 Container Terminal Portfolio of Other Global Terminal Operators, 2009 Conclusion: Beware of Future Expectations • Intense phase of capital accumulation in the shipping and port sectors. • Some of the growth expectations based on unsubstantiated assumptions. • “Financialization” transformed the industry and expanded misallocations. • What could be some specific consequences on the maritime industry?