Global Economic & Trade Outlook: Economic Cycles and Maritime Shipping

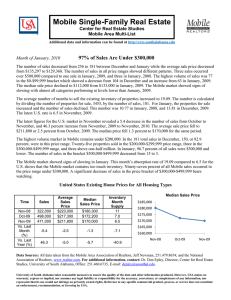

advertisement

IX Caribbean Shipping Executives Conference, Willemstad (Curacao), May 17-19 2010 Global Economic & Trade Outlook: Economic Cycles and Maritime Shipping Jean-Paul Rodrigue Associate Professor, Dept. of Global Studies & Geography, Hofstra University, New York, USA The Crisis is over … if you Believe in the Following… ■ ■ ■ ■ That the crisis was a random blip (“hoocoodanode”?) That debt is wealth (we are now VERY wealthy) That deficits do not matter (no risk of confiscation) That economists understand economics (no comment…) ■ That central banks and governments know what they are doing (blowing bubbles…) ■ That no significant commercial and sovereign default are in the pipeline (no more moral hazard) ■ That the excess capacity in shipping has been cleared (there is huge latent demand…) The First Crisis of Globalization: Reaping the Consequences of Misallocations CAUSES Monetary system (fractional reserve banking, fiat currencies) SYMPTOMS Debt, asset inflation Consumption Transactions and investments. Difficulty of clearing international trade transactions. Undue drop in freight volumes. Macroeconomic Storm CONSEQUENCES Misallocations (bubbles) Production Credit Storm Distribution Decline in aggregate demand. Clearing excess capacity. Business Cycles: The Trend that Time Forgot Demand Transfer of future demand into the present. Supply Misallocations because of distorted expectations about the future. Asset price distortions. Credit-Driven Boom Higher prices in spite of a low demand! Peak Credit-Driven Bust Trough Expansion Recession Expansion Depression Blowing Bubbles and Compounding Distortions: From Technology to Commodities 500.0 450.0 400.0 NASDAQ (Jan 1998=100) 350.0 TOL (Jan 2003=100) 300.0 BDI (Jan 2006=100) 250.0 200.0 150.0 100.0 50.0 0.0 Jan-98 Tech / Stock Bubble Jan-99 Jan-00 Commodities / Trade Bubble Housing Bubble Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Globalization 2000-2008: A Bubble? 14 2 13 Seaborne Trade (billions of tons of goods loaded) - Left Axis 12 Exports of Goods (trillions of current $US) - Left Axis 11 Ratio Exports / Seaborne Trade - Right Axis 10 1.8 1.6 1.4 9 8 7 6 1.2 1 0.8 5 4 0.6 3 0.4 2 1 0 0.2 0 Changes in the Value World’s Merchandise Trade, Production and GDP, 1950-2009 (in %) 25.00 20.00 15.00 10.00 5.00 0.00 -5.00 Recession Total Merchandise Trade -10.00 World GDP World Merchandise Production -15.00 A Paradigm Shift in Neomercantilism? Monthly Value of Exports or Imports, Selected Traders, 2006-2010 (Jan 2006=100) 225 China (Exports) Japan (Exports) Korea (Exports) Germany (Exports) Canada (Exports) USA (Imports) UK (Imports) 200 175 150 125 100 75 Jan-10 Nov-09 Sep-09 Jul-09 May-09 Mar-09 Jan-09 Nov-08 Sep-08 Jul-08 May-08 Mar-08 Jan-08 Nov-07 Sep-07 Jul-07 May-07 Mar-07 Jan-07 Nov-06 Sep-06 Jul-06 May-06 Mar-06 Jan-06 50 A Paradigm Shift in the World’s Largest Trade Relation? Monthly Trade between China and the United States, Billions of USD (1985-2010) 35 5 30 0 Exports 25 -5 Imports Balance 20 -10 Jan-10 Jan-09 Jan-08 Jan-07 Jan-06 Jan-05 Jan-04 Jan-03 Jan-02 Jan-01 Jan-00 Jan-99 Jan-98 Jan-97 Jan-96 Jan-95 Jan-94 Jan-93 Jan-92 -30 Jan-91 0 Jan-90 -25 Jan-89 5 Jan-88 -20 Jan-87 10 Jan-86 -15 Jan-85 15 6,000 0 Jan-00 May-00 Sep-00 Jan-01 May-01 Sep-01 Jan-02 May-02 Sep-02 Jan-03 May-03 Sep-03 Jan-04 May-04 Sep-04 Jan-05 May-05 Sep-05 Jan-06 May-06 Sep-06 Jan-07 May-07 Sep-07 Jan-08 May-08 Sep-08 Jan-09 May-09 Sep-09 Jan-10 May-10 Keeping Doing the Same Thing? Baltic Dry Index, Monthly Value, 2000-2010 12,000 10,000 8,000 -92% 4,000 2,000 150 140 130 120 60 Jan-05 Mar-05 May-05 Jul-05 Sep-09 Nov-05 Jan-06 Mar-06 May-06 Jul-06 Sep-06 Nov-06 Jan-07 Mar-07 May-07 Jul-07 Sep-07 Nov-07 Jan-08 Mar-08 May-08 Jul-08 Sep-08 Nov-08 Jan-09 Mar-09 May-09 Jul-09 Sep-09 Nov-09 Jan-10 Mar-10 Paradigm Shift or “V” Shaped Recession? Monthly Total Container Traffic at Selected Ports (Jan 2005=100) Los Angeles New York Busan Hong Kong Algeciras 110 100 90 80 70 400,000 350,000 Jan-95 Jul-95 Jan-96 Jul-96 Jan-97 Jul-97 Jan-98 Jul-98 Jan-99 Jul-99 Jan-00 Jul-00 Jan-01 Jul-01 Jan-02 Jul-02 Jan-03 Jul-03 Jan-04 Jul-04 Jan-05 Jul-05 Jan-06 Jul-06 Jan-07 Jul-07 Jan-08 Jul-08 Jan-09 Jul-09 Jan-10 Monthly Container Traffic at the Port of Los Angeles, 1995-2010 450,000 Out Loaded In Loaded In Empty Out Empty 300,000 250,000 200,000 150,000 100,000 50,000 0 Factors behind the Interest of Equity Firms in Transport Terminals Asset (Intrinsic value) Terminals occupy premium locations (waterfront) that cannot be substituted. Globalization made terminal assets more valuable. Traffic growth linked with valuation. Same amount of land generates a higher income. Terminals as fairly liquid assets. Source of income (Operational value) Income (rent) linked with the traffic volume they handle. Constant revenue stream with limited, or predictable, seasonality. Traffic growth expectations result in income growth expectations. Diversification (Risk mitigation value) Sectoral and geographical asset diversification. Terminals at different locations help mitigate risks linked with a specific regional or national market. Port and Maritime Industry Finance: Who is Leveraging Whom? Investors Financial Markets Brokers Corporations Money Markets Commercial Banks Private Investors Capital Markets Mortgage Banks Investments Managers Equity Markets Merchant Banks Private Placement Finance Houses •Insurance Companies •Pension Funds •Banks •Trust Funds •Finance Houses Leasing Companies Shipping Companies Port Operators Earnings Reviewing Assumptions: The Impacts of “Financialization” Disconnection Financial sector less aware of the operational and strategic reality. Physical assets are seen and managed strictly as financial assets. Rent seeking strategies Assets are less perceived as they are (port terminals) but simply from their potential (or expected) level of return. Chasing return without understanding well the fundamentals. Low contestability of entry and exit Perceived liquidity. Capacity to enter and exit the terminal market on a short notice. Herd behavior. High amortization Expectations that capital investment will be quickly amortized. Expectations about future growth and the corresponding volumes. Segments of the maritime and terminal operation industries have been subjugated by very smart people lacking wisdom. The financial sector has recently provided ample evidence about the amount of damage very smart people can do when hubris, obfuscation and fraud replace common sense and realistic perspectives. Dumb Money at Work? Date Transaction 2005 DP World takes over CSX World Terminals Early 2006 PSA acquires a 20% stake in HPH Mid 2006 DP World acquires P&O Ports Mid 2006 Goldman Sachs Consortium acquires ABP End 2006 AIG acquires P&O Ports North America Early 2007 Ontario Teachers’ Pension Fund acquires OOIL Terminals Mid 2007 RREEF acquires Maher Terminals Price compared to EBITD 14 times 17 times 19 times 14.5 times 24 times 23.5 times 25 times EBITDA = Earnings Before Interest, Taxes, Depreciation and Amortization The Double Squeeze on Ports and Maritime Shipping “Cruel” Overcapacity New terminals coming online New ships coming online (+ cancellations) Contestability for gateways Contestability for hubs Rebalancing Lower profitability Less pressures on terminal resources Less financial appeal World Container Traffic and Throughput, 1980-2008. Reaching Peak Growth? 500 Million TEU 400 World Traffic World Throughput Full Containers Transshipment Empty Containers 300 200 100 0 1980 1985 1990 1995 2000 2005 2010 Fallacies of Forecasting: 2020 Throughput Forecast, Selected Large Ports, Linear and CAG Scenario Port / Traffic 2007, M TEU R2 / CAG (19982007) Traffic 2020 (Linear Scenario) / CAG Traffic 2020 (CAG 1998-2007 Scenario) New York / 5.3 0.996 / +7.9% 9.6 M TEU / +4.7% 14.2 M TEU Savannah / 2.6 0.968 / +13.5% 4.9 M TEU / +5.1% 13.6 M TEU Los Angeles / 8.3 0.966 / +9.5% 16.6 M TEU / +5.4% 27.1 M TEU Antwerp / 8.2 0.974 / +9.6% 14.5 M TEU / +4.5% 26.9 M TEU Algeciras / 3.4 0.961 / +6.5% 6.0 M TEU / +4.4% 7.7 M TEU Busan /13.3 0.983 / +8.4% 24.3 M TEU / +4.8% 38.1 M TEU Shanghai / 26.1 0.948 / +23.9% 56.5 M TEU / +6.1% 423.8 M TEU From under estimating to over estimating trends Linearity prevalent in growth trends (1998-2007) Compound annual growth common in forecasts Non-contestability assumption Terminal Operators; Well Positioned or Overextended? Liner Shipping Connectivity Index and Container Port Throughput Container Terminal Portfolio of the four Main Global Terminal Operators, 2009 Container Terminal Portfolio of Other Global Terminal Operators, 2009 The Caribbean System: The Transshipment Triangle and the Panama Canal Funnel Lower aggregate demand. The “curse” of economies of scale. Response from West Coast ports. Response from railways (East vs. West). New gateways (Canada: CN, Mexico: KCS). Costs (fuel prices and Panama Canal toll rates). Competition from Suez and the Mediterranean. Regionalization of production. Diffusion Cycles in Containerization: Towards Maturity Niche markets Massive diffusion Network complexities Peak Growth Network development Productivity multipliers New (niche) services Productivity gains Adoption Acceleration Maturity Containerization Growth Factors: Which Opportunities are Left? A Derived / Organic (A) Economic and income growth. Globalization (outsourcing and global sourcing). Fragmentation of production and consumption. Substitution (B) Functional and geographical diffusion. New niches (commodities and cold chain) Capture of bulk and break-bulk markets. Incidental (C) Trade imbalances. Repositioning of empty containers. Induced (D) Transshipment (hub, relay and interlining). B C D Keeping Track of the Big Picture: Emerging Global Maritime Freight Transport System The “Calm” after the Storm: A Paradigm Shift for Maritime Container Trade and Ports 1) Risk Allocation Desire to allocate greater risks onto private sector in PPPs: • Requires clear policy goals and stable regulation. • Moral hazard risks will continue to be tested. More demanding capital markets and less access to (cheap) credit: • Focus on performance to meet financial metrics. • New projects more critically assessed. Greater consideration of cost recovery of port infrastructure investment: • From the deal / financial structure to quality of the asset. 2) Reviewing False The assumption that larger players have more information Asymmetries than smaller players: • The larger players appear to have lost the most. The “Calm” after the Storm: A Paradigm Shift for Maritime Container Trade and Ports 3) Growth Story: Time for realism Abandoning the compound annual growth paradigm: • Port traffic assumptions likely to be less backward looking. • Stronger cyclical effects than perhaps first assumed. Greater attention on market fundamentals: • Globalization or regionalization? 4) Barriers to Paying attention to competition drivers: Entry: Competition • Growth may no longer mitigate competitiveness as it did matters previously. • Transshipment is a particularly vulnerable segment. 5) Amortization: Modest times Volume & pricing assumptions more modest: • Longer amortization periods. • PPP rent sharing more probable.