Advanced Port Economics Seminar, University of Antwerp, Institute of

advertisement

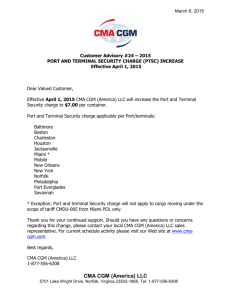

Advanced Port Economics Seminar, University of Antwerp, Institute of Transport and Maritime Management, December 17 2012 Ports, Inland Ports and Logistics Zones: Governance Issues Jean-Paul Rodrigue Professor Dept. of Global Studies & Geography Hofstra University New York, USA 1- Terminals and Governance 2- The Financing of Intermodal Terminals 3- Global Terminal Operators 4- Challenges to Terminal governance Terminals and Governance Technical and Policy Changes Transport Terminal Governance Intermodal Transportation: Emerging Paradoxes Growth Geographical and functional diffusion of containerization. Massive investments. Maturity Rationalisation (corridors and sites). Revolution New standards, practices and technologies. Increasing returns. Deregulation Consolidation (maritime, rail and trucking). Emergence of large operators. Evolution Incremental changes. Decreasing returns. Governance PPP. Supply chain control. Added-valuecapture. Foreland / Hinterland: An Ongoing Integration Through Containerization Maritime Shipping • Economies of scale • Setting of maritime networks • Port terminals Inland Transportation • Rail and fluvial shuttles • Intermodal terminals • Corridors (landbridges) Intermodal Logistics • Continuity and capacity • Inland ports / logistics zones Shift in Public Transport Policy Perspective Conventional Emerging Independent Modes Intermodal Systems Local Economies Regional / Global Economies Independent Jurisdictions (“turf wars”) Coalitions / Consensus Publicly Funded Public / Private partnerships Users (public subsidy) Customers (revenue generation) Build (infrastructure provision) Manage (optimization of existing resources) Plan (regulations; political signals) Market (deregulations; price signals) Commodity Chains and Added Value High Fabrication Added value R&D Low Marketing Branding Design Concept Sales / Service Distribution Manufacturing Commodity chain Logistics Why Governance of Intermodal Terminals Matters? ■ “The exercise of authority and institutional resources to manage activities in society and the economy. It concerns the public as well as the private sectors, but tends to apply differently depending if public or private interests are at stake.” ■ Terminal assets: • • • • Capital intensive. Consume land use. Have externalities (noise, emissions). Have many stakeholders (port authority, terminal operators, rail operators, trucking companies, etc.). Transport Terminal Governance PPP Ownership (Mostly public) Operations (Increasingly private) • Focused on compliance and revenue generation. • Challenge of rent seeking behavior. • Usage of concessions. • High productivity levels. • Generation of externalities. The Main Activities of Landlord Port Authorities Traffic Management Vessel traffic management (fast turnaround, security, reliability). Management of inbound and outbound inland traffic. Partnership with barge, rail and truck operators for inland distribution. Area Management Develop transport infrastructures. Provide space for port related activities (expansion or reconversion). Rationalize the land use. Customer Management Attract new customers. Retain existing customers (satisfaction). Find new added value activities. Stakeholder Management Influence regulation. Relations with local, regional and national public agencies. Public and Private Roles in Port Management Ownership Public service port Tool port Landlord port Corporatized port Public Responsibility Private service Private Responsibility port Port admin. Nautical management Port infrastructure Superstructure Cargo handling Pilotage Towage & Mooring Dredging Freight Cluster Governance Scale and scope Recognition of the city as a hub / terminal. Multimodal and intermodal. Across jurisdictions. Actors Recognition of the stakes of various private and public actors. Different forms of ownership and jurisdiction. Decision taking Consensus and ad hoc. Public-private partnerships. “Coopetition”. Policy Able to influence and articulate incentives (zoning, public investments, regulations). Information technologies Freight community system; coordination and integration of information systems. Labor Foster training and research needs. Main Governance Models for Inland Ports Model Characteristics Implications Single Ownership A public or a private actor entirely responsible for development and operations. Single vision and conformity to a specific role. Help combine public planning of infrastructures with private operational expertise. Public (local) interests represented. Public ownership and private operations (a form of PPP). Long term concession agreements. Potential lack of flexibility in view to changes (single mandate). Potential conflicts with surrounding communities. Public – Private Partnership Landlord Model Tendency to prioritize public interests over private interests. Managerial flexibility between the owner, the site manager and the operators. Most of the risk assumed by private operators. The Financing of Intermodal Terminals Private Participation and Public Divesture Privatization and Financing Models Public / Private Partnerships Main Causes of Public Divesture in the Transport Sector Fiscal Problems (we’re broke) High Operating Costs (we have few incentives) Crosssubsidies (profits are spent elsewhere) Equalization (everyone must have their fair share) Lifespan of Main Transport Assets Port Railway Airport Bridge Highway Jet plane Containership Container Average Lifespan Car Optimum Lifespan 0 20 40 60 80 Years 100 120 140 160 Risk Transfer and Private Sector Involvement in PublicPrivate Partnerships Concession D-B-F-M-Operate PPP Models Degree of Private Sector Risk Privatization Design-Build-Finance-Maintain Build-Finance Operation & Maintenance Design - Build Degree of Private Sector Involvement Conditions for Port Privatization Bidding process Open and transparent bidding process. Infrastructures Capacity and quality of port infrastructure as well as for hinterland access. Regulations Safety and labor conditions. Retrenchment and retraining of labor. Port authority Landlord model with clear role. Customs Efficient and transparent procedures. Privatization and Financing Models Sale or concession agreement Divesture part of a political agenda (budget relief). Public sector is forced to sell or lease some of its infrastructures. Infrastructure is transferred on a freehold basis. Requirement; used for its initial purpose. Long term lease (50 – 75 years). Requirement that the concessionaire maintains, upgrade and build infrastructure and equipment. Concession for new project Tap new sources of capital outside conventional public funding. Fiscal restraints. Experiment with privatization. Getting the latest technical and managerial expertise for the infrastructure project. Management contract Ownership remains public. Management given to a private operator. Through a bidding process. Popular in the terminal operation business (maritime and rail). Efficiency improvements. Value Propositions behind the Interest of Equity Firms in Transport Terminals Sectoral and geographical asset diversification. Mitigate risks linked with a specific regional or national market. Diversification (Risk mitigation value) Asset (Intrinsic value) Terminals occupy premium locations (waterfront). Globalization made terminal assets more valuable. Traffic growth linked with valuation. Same amount of land generates a higher income. Terminals as fairly liquid assets. Source of income (Operational value) Income (rent) linked with the traffic volume. Constant revenue stream with limited, or predictable, seasonality. Traffic growth expectations result in income growth expectations. Port and Maritime Industry Finance Investors Financial Markets Brokers Corporations Money Markets Commercial Banks Private Investors Capital Markets Mortgage Banks Investments Managers Equity Markets Merchant Banks Private Placement Finance Houses •Insurance Companies •Pension Funds •Banks •Trust Funds •Finance Houses Leasing Companies Shipping Companies Port Operators Earnings The Prediction of Future Outcomes Forecasting Scenarios Speculations 5 years 10 years New Project Time Global Terminal Operators Global Port Terminal Portfolios Port Operator Strategies Added Value Strategies Control of Global Container Terminals 900 800 700 Million TEU 600 Public Sector 500 Private Sector 400 Global Operators 300 200 100 0 1996 2003 2010 Typology of Global Port Operators Stevedores Maritime Shipping Companies Financial Holdings Horizontal integration Vertical integration Portfolio diversification Port operations is the core business; Investment in container terminals for expansion and diversification. Maritime shipping is the main business; Investment in container terminals as a support function. Financial assets management is the main business; Investment in container terminals for valuation and revenue generation. Expansion through direct investment. Expansion through direct investment or through parent companies. Expansion through acquisitions, mergers and reorganization of assets. PSA (Public), HHLA (Public), Eurogate (Private), HPH (Private), ICTSI (Private), SSA (Private). APM (Private), COSCO (Public), MSC (Private), APL (Private), Hanjin (Private), Evergreen (Private). DPW (Sovereign Wealth Fund), Ports America (AIG; Fund), RREEF (Deutsche Bank; Fund), Macquarie Infrastructure (Fund), Morgan Stanley Infrastructure (Fund). Vertical and Horizontal Integration in Port Development Horizontal Integration Vertical Integration Maritime Services Inland Port Port Intermediate hub Port Holding Maritime Shipping Port Terminal Operations Port Services Inland Services Terminal Port Rail / Barge Distribution Center Inland Modes and Terminals Commodity Chain Distribution Centers Top Twelve Global Container Terminal Operators in EquityBased Throughput Evergreen 7.0 SSA Marine 7.5 Modern Terminals 8.0 Ports America 8.1 China Merchants 8.9 MSC 9.9 COSCO 13.6 SPIG 19.5 APM Terminals 31.6 DPW 32.6 Hutchison Port Holdings 36.0 PSA 51.3 0 10 20 30 40 Million TEUs (2010) 50 60 Number of Terminals and Total Hectares Controlled by the Twelve Largest Port Holdings CMA-CGM 412 Terminals ICTSI 466 14 Hanjin 559 16 Cosco Pacific 686 Shanghai International Port Group 734 SSA Marine 13 14 10 939 Ports America 20 1,270 Eurogate 11 1,646 APM Terminals 9 2,038 Dubai Ports World 42 2,347 Port of Singapore Authority 50 2,604 Hutchison Port Holdings 3,248 0 38 47 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 Hectares (2010) Container Terminal Surface of the World's Major Port Holdings, 2010 Container Terminals of the Four Major Port Holdings, 2010 Portfolio by Equity-Based Capacity of Main Global Terminal Operators, 2010 APMT HPH DPW PSA Regional Share in the Terminal Portfolio of the Twelve Largest Global Terminal Operators (Hectares, 2010) CMA-CGM ICTSI Hanjin Cosco Pacific Africa Shanghai International… Australia North America SSA Marine South America / Caribbean Ports America Pacific Asia Eurogate South Asia / Middle East APM Terminals Mediterranean Dubai Ports World Europe Atlantic Port of Singapore… Hutchison Port Holdings 0% 20% 40% 60% 80% 100% Inter-firm Relationships in the Three Main Container Ports of the Rhine-Scheldt Delta, 2010 HUTCHISON PORT HOLDINGS PSA 20% Majority shareholding 100% Minority Shareholding (4) ECT MSC ANTWERP 50% NYK 100% 100% 50% Delta Terminal Waal- and Eemhaven Euromax phase 1 Rotterdam World Gateway (Maasvlakte 2) Operational by 2013 CYKH Alliance 50% 50% 60% 30% 10% APM Terminal Maasvlakte Terminal 1 (Maasvlakte 2) Operational by 2014 ROTTERDAM PSA HNN 100% 100% New World Alliance 100% DP World ZIM Line (1) 42.5% 10% MSC Home terminal 50% North Sea Terminal 100% Europe Terminal 50% Deurganck Terminal Antwerp International Terminal (AIT) DP World Delwaidedock Shipping Line (Global) Terminal Operator Antwerp Gateway (3) Terminal Cosco Pacific 20% CMA-CGM (2) 10% 35% 65% CHZ APM Terminals (AP Moller Group) 100% Albert II-dock north (under construction) Shanghai International Port Group (SIPG) 25% PORT Financial Holding 75% APM Terminal ZEEBRUGGE Inter-firm Relationships in the Three Main Container Ports of North America, 2010 APL 100% Global Gateway South Ontario Teachers' Pension Plan NYK 100% Yusen Terminals 100% 100% TraPac Los Angeles Berth 136 Mitsui OSK 100% APM Terminals Pier 400 Evergreen 50% Evergreen Terminal 50% Yangming 40% West Basin Container Terminal 60% 100% 100% Deutsche Bank RREEF LONG BEACH Global Terminal and Container Services APM Terminals Port Elizabeth Terminal C60 100% Maher Terminals 100% Maher Terminal Ports America 100% Port Newark Container Terminal MSC 50% Terminal A OOIL 100% Long Beach Container Terminal K-Lines 100% Pier G Berth 50% 100% 100% California United Terminals Cosco Pacific 51% Pacific Container Terminal 49% Hanjin 60% Total Terminals International 40% Shipping Line APM Terminals (AP Moller Group) New York Container Terminal LOS ANGELES Hyundai Global Container Terminals Terminal Operator Stevedoring Services of America NEW YORK AIG Highstar Capital Macquarie Infrastructure Terminal PORT Financial Holding Inter-firm Relationships in the Main Container Ports of the Pearl River Delta, 2010 GUANGZHOU APM Terminals (AP Moller Group) 20% China Shipping Group 40% 50% ZHUHAI Zhuhai International Container Terminals Guangzhou South China Oceangate Container Terminal Nansha Container Terminal Guangzhou Huangpu Xinsha Terminal 25% HUTCHISON PORT HOLDINGS 70% Da Chan Bay Terminal One 35% Shekou Container Terminals 80% Chiwan Container Terminal 75% 49% PSA 10% Moderns Terminals COSCO-HIT Terminal 10% Hong Kong International Terminals 20% 100% Shenzhen Municipal Government China Merchants Holdings International 67% Asia Port Services DP World 66% DP World Hong Kong 55% Asia Container Terminals HONG KONG SHENZHEN Shipping Line Guangzhou Port Group 33% Yantian International Container Terminals 20% 49% Dongguan Container Terminal 30% Modern Terminals 60% 50% Shenzhen Yantian Port Group 65% 41% Cosco Pacific Nanhai International Container Terminals Guangzhou Huangpu Xingang Terminal 50% 39% Terminal Operator Terminal PORT Financial Holding 33% The Strategies of Port Operators Profitability Increase the profitability of terminal assets; (better equipment, information systems and management). Port management is very lucrative. Financial Assets Large financial assets and the capacity to tap global financial markets. Terminals as equity generating returns. Managerial Expertise Experience in the management of containerized operations. IT and compliance with a variety of procedures. Gateway Access Establishing hinterland access. Creation of a “stronghold”. Provides a stable flow of containerized shipments. Development of related inland logistics activities. Leverage Negotiate with maritime shippers and inland freight transport companies favorable conditions. Some are subdiaries of maritime shipping companies. Traffic Capture Capture and maintain traffic for their terminals. Global Perspective Comprehensive view of the state of the industry. Anticipate developments and opportunities. Challenges to Terminal Governance Changes in the Role of Port Authorities Security of Global Supply Chains A Volatile Global Trade Context Governance Changes in Port Authorities: Competing over the Hinterland Conventional Port Authority • Planning and management of port area. • Provision of infrastructures. • Planning framework. • Enforcement of rules and regulations. • Cargo handling. • Nautical services (pilotage, towage, dredging). Expanded Port Authority Port Community System Exporter Foreland Importer Hinterland Risks in Global Supply Chains RISKS Supply Risks Demand Risks Operational Risks FACTORS Environmental Geopolitical Economic Technological Natural disasters Political instability Trade restrictions Demand shocks ICT disruptions Terrorism Corruption Theft and illicit trade Piracy Border delays Currency fluctuations Energy shortages Extreme weather Pandemic Probability High (>30%) Average (15-30%) Low (<15%) Price volatility Infrastructure failures Mitigation Uncontrollable Influenceable Controllable Thefts by Type of Cargo and Location, United States, 2010 Thefts (899 Incidents) 5% 1% 3% Locations (497) 6% 11% 5% 1% 7% 29% 9% 10% 8% 25% 4% 7% 5% 21% 20% 23% Truck Stops Public Access Parking Alcohol Auto / Parts Roasides Building / Industrial Clothing / Shoes Unsecured Terminals / Lots Consumer Care Products Electronics Secured Parking Food / Beverages Home / Garden Fictitious Pickup Miscellaneous Pharmaceuticals Driver Theft Tobacco Other Maritime Security Initiatives Implemented by The United States or the European Union Initiative Type Year Description Automated Targeting System (ATS) Cargo screening 1999 Weighted model applied to inbound cargo manifests to assign risk factors. Customs-Trade Partnership Against Terrorism (C-TPAT) Certification 2001 Transferring some of the Customs responsibilities to importers and exporters to reinforce overall security levels. Benefits include reduced likelihood that containers of participating firms will be examined. Container Security Initiative (CSI) Cargo tracking and screening 2002 Increasing security related to ocean going containers by targeting and screening high risk containers bound for the US before they are loaded. Megaports initiative Cargo tracking and screening 2003 Installation of radiation detection equipment in key foreign ports. Reducing the illicit trafficking of nuclear and other radiological materials. 24 hour rule Advance cargo information 2003 Implementing the cargo-related information at least 24 hours before a container is loaded aboard the vessel at the last foreign port. Standards to Secure and Facilitate Global Trade (SAFE) Certification 2005 Implementing C-TPAT and CSI security practices with foreign trade partners. EU Authorized Economic Operator (AEO) Certification 2008 Identifying reliable traders and providing them with trade facilitation measures. Importer Security Filling and Additional Carrier Requirements (ISF, 10+2) Advance cargo information 2009 Implementing the collection of cargo-related information by requiring information from both the importer (10 information elements) and the carrier (2 information elements) to be transmitted at least 24 hours before the goods are loaded. EU Pre-arrival and Predeparture Advance cargo information 2009 Advance information on goods brought into, or exported from the Customs territory of the EU (perimeter). 100% scanning Cargo screening 2012? Non-intrusive inspection of 100% of all inbound cargo containers. Global Maritime Piracy, 2008-2009 Jan-70 Jan-71 Jan-72 Jan-73 Jan-74 Jan-75 Jan-76 Jan-77 Jan-78 Jan-79 Jan-80 Jan-81 Jan-82 Jan-83 Jan-84 Jan-85 Jan-86 Jan-87 Jan-88 Jan-89 Jan-90 Jan-91 Jan-92 Jan-93 Jan-94 Jan-95 Jan-96 Jan-97 Jan-98 Jan-99 Jan-00 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 West Texas Intermediate, Monthly Nominal Spot Oil Price (1970-2012) 140 120 100 80 60 40 20 0 China: The Largest Bubble in History? Share of the World Commodity Consumption, China and United States, c2009/10 Cattle Oil GDP (PPP) Wheat Population Soybeans Chickens Rice Nickel Aluminum Zinc Copper Lead Steel Coal Pork Eggs Cement Iron Ore 6.1% 6.8% 10.4% 21.7% 13.6% 19.7% 16.6% 4.9% Rebalancing in demand 19.7% 4.5% 24.9% 19.9% 25.2% 11.3% China 30.2% 0.9% United States 31.9% 10.1% 34.6% 8.7% 38.2% 1.8% 39.5% 9.1% 42.1% 13.7% 45.8% 4.8% 46.9% 15.2% 49.6% 8.4% 53.6% 7.8% 53.6% 2.1% 54.4% 1.9% 0% 10% 20% 30% 40% 50% 60% 70% Jan-85 Jan-86 Jan-87 Jan-88 Jan-89 Jan-90 Jan-91 Jan-92 Jan-93 Jan-94 Jan-95 Jan-96 Jan-97 Jan-98 Jan-99 Jan-00 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Baltic Dry Index, Monthly Value, 1985-2012 12,000 10,000 8,000 6,000 4,000 2,000 0 Conclusion: Terminal Governance in a New Global Economic Setting ■ Terminal Operators and Port Authorities • New public / private partnerships. • Shifting balance of power (global vs. local). ■ Finding value to capture • New forms of distribution and integration with transport terminals. ■ Finding capital to finance • Governance as a risk mitigation strategy. ■ Governance of global freight distribution • Governance of foreland, hinterland and supply chains. • Strategies and policies a reflection of the scale and scope of global supply chains.