ESSAY: TELLING STORIES OF SHAREHOLDER SUPREMACY

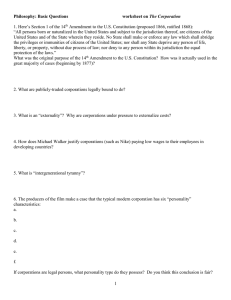

advertisement