Business Finance Notes: Financial Management & Accounting

advertisement

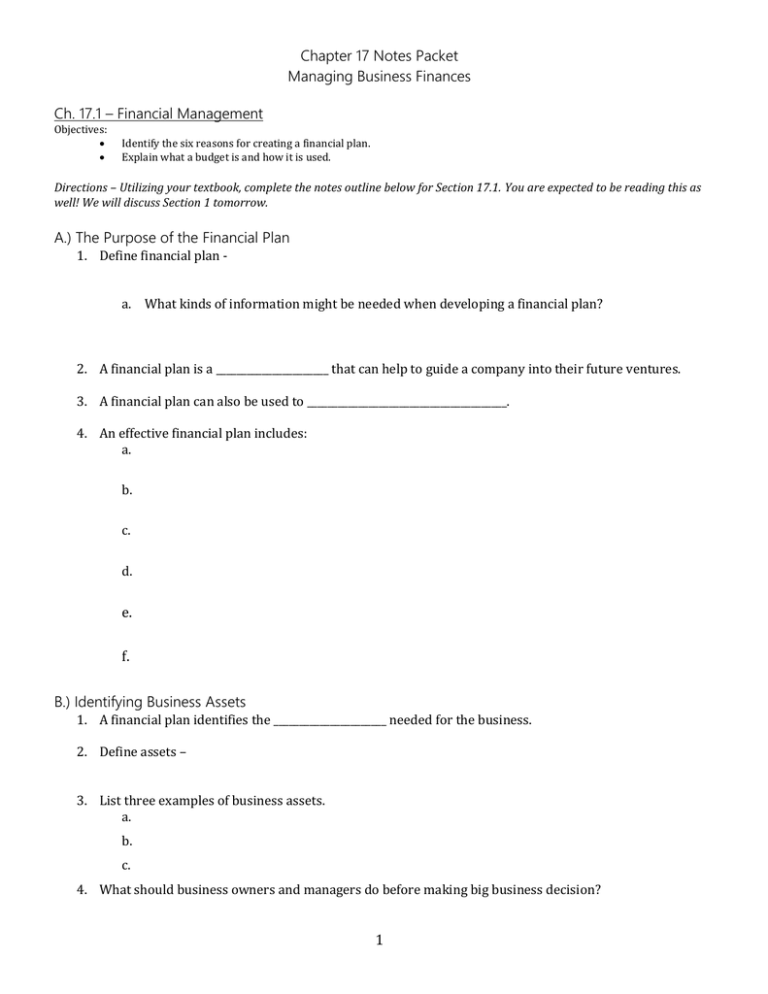

Chapter 17 Notes Packet Managing Business Finances Ch. 17.1 – Financial Management Objectives: Identify the six reasons for creating a financial plan. Explain what a budget is and how it is used. Directions – Utilizing your textbook, complete the notes outline below for Section 17.1. You are expected to be reading this as well! We will discuss Section 1 tomorrow. A.) The Purpose of the Financial Plan 1. Define financial plan a. What kinds of information might be needed when developing a financial plan? 2. A financial plan is a ______________________ that can help to guide a company into their future ventures. 3. A financial plan can also be used to _______________________________________. 4. An effective financial plan includes: a. b. c. d. e. f. B.) Identifying Business Assets 1. A financial plan identifies the ______________________ needed for the business. 2. Define assets – 3. List three examples of business assets. a. b. c. 4. What should business owners and managers do before making big business decision? 1 C.) Determining Needed Capital 1. What does a financial plan estimate? 2. ___________________ is the money that is supplied by investors, banks, or owners of a business. 3. Define start-up capital – a. List three common sources of start-up capital for entrepreneurs. i. ii. iii. D.) Describing Start-Up and Operating Expenses 1. Explain the reason for a new business to need a large amount of start-up capital. 2. Define operating expenses 3. What are some expenses of a new business venture? E.) Describe Financial Records Management 1. What does a financial record explain and describe? 2. Develop and list two questions a person might ask to help a business owner decide who should maintain financial records. F.) Forecasting Future Finances 1. Define financial forecasts 2. The forecast should consider: a. 3. A financial forecast might show: a. 4. It is best to remember to keep financial estimates for income ___________ and estimates for expenses ____________ . 2 G.) Describing Growth Financing 1. Every company needs to _____________ in order to remain ____________________. 2. Planned growth can be _____________________. 3. Unplanned growth can be __________________. 4. The financial plan should explain: a. H.) Budgets 1. Financial statements indicate the financial __________________ of a firm in a _______________________. 2. Define budget – 3. Budgeting helps business owners _________________ how much _______________ the business will need. 4. What do business owners do to avoid financial problems? 5. There are three main types of budgets (write the name and describe each one): a. ______________________ b. ______________________ c. ______________________ - Ch. 17.1 - Review Questions 1. In general, what is the purpose of the financial plan? 2. What does an effective financial plan do? 3. Why do business owners use a budget? 4. When big companies create financial statements, they often shorten large numbers by omitting zeroes and adding a caption such as “all numbers in billions.” Another way is to use scientific notation. What is 55 billion (55,000,000,000) expressed in scientific notation? 3 Ch. 17.2 – Accounting Objectives: Explain the purpose of accounting. Describe how property rights are measured. Define the three components of the accounting equation. Describe the three main financial statements used by businesses. Directions – Utilizing your textbook, complete the notes outline below for Section 17.2. You are also expected to read this section and be prepared to discuss the contents on Thursday. A.) Accounting for Business 1. Explain why operating a business costs money (be specific). 2. Define accounting – 3. Explain the role of an accountant. 4. An _____________ is a review of accounting records and procedures. 5. The biggest accounting firms are known as ____________________. 6. What is considered to be the “language of business”? 7. Everyone involved in a __________________ should understand some of the basics of ____________________. B.) Rules for Accountants 1. All accountants use the same set of rules, called _________________________________________________________________________________(GAAP). 2. These rules provide a way to ________________________ financial information to others. 3. ________________________________ are summarized information about the financial status of a business. C.) Property Ownership and Control 1. The right to own property is basic to a __________________________________. 2. Define property – 3. Businesses _____________ and _________________ property. 4. In accounting, property and financial claims are measured in _____________________. D.) Financial Claims in Accounting 4 1. Define current assets – 2. Define accounts receivable – 3. Define fixed assets – 4. Define equity – 5. When people or businesses buy property and agree to pay for it later they are both buying on __________. 6. The business or person selling the property is called a _____________. 7. Define liabilities – 8. Define accounts payable – 9. Define owner’s equity – E.) The Accounting Equation 1. The __________________________________________ is expressed as: a. ___________________ = _________________________ + _________________________ 2. Both sides must always be ________________. 3. For example, if a company’s assets are worth $100,000 and the liabilities against those assets are $40,000, then the owner has $60,000 in rights to the assets that the business possesses. 4. If a company’s assets are worth $120,000 and the liabilities against those assets are $70,000, then what is the owner’s equity in the business? Show your work. F.) Financial Statements 1. The financial system is designed to generate financial ________________ and _____________. 2. Define financial statements – 3. A(n) _____________________________ is the period of time reflected by an accounting report. 4. Define income statement – a. Describe the purpose of the income statement. 5. Define balance sheet – a. Describe the purpose of the balance sheet. 6. Define cash flows – a. What is the statement of cash flows? 5 Ch. 17.2 – Essential Question 1. How does accounting help a business? 6