Capital Development Update Minnesota State Colleges and Universities A new direction

Capital Development Update

A new direction

Greg Ewig, System Director, Capital Development

Minnesota State Colleges and Universities

The Minnesota State Colleges and Universities system is an Equal Opportunity employer and educator.

2

Agenda

Capital Development

Capital Budget Update

Future Capital Plans

Master Plan

CEMRS

FRRM

Web and Sharepoint

3

Capital Development Team and

Areas of Responsibilities

Capital Budget

HEAPR

Revenue Fund

Space Planning

Predesigns

Real Estate

Energy

Sustainability

System Office Property

Management

4

5

Programs Staff

Capital Budget Lisa Jansen

HEAPR

Revenue Fund

Space Planning

Predesigns

Real Estate

Energy

Sustainability

System Office Property

Management

Ken Oas

Heather Anderson

Lisa Jansen, Stacy Brown

Lisa Jansen

Betty Ewens

Ken Oas

Ken Oas

Dale Johnson

6

Transition Plan

Step One - consolidating several groups

Planning & programming,

Revenue fund,

Real estate and

System office property / office management

Step Two – Assessing team

Step Three – Stabilizing and building relationships

Step Four – Do the work

7

Capital Budget Updates

2013 Capital Budget

House - $108M ($58M Projects (all) and $50M HEAPR)

Governor - $89M ($54M Projects and $35M HEAPR)

Senate – waiting to hear

2014 Capital Budget

Dependent on outcome of 2013

Next steps: Leadership Council and Board consideration – May / June

2015/6 Capital Budget

Recognize / respond to yearly capital bonding bill

Process reengineering

8

2013 Capital Budget

Location of Projects

Major Projects

Initiatives

X

# of projects at a location

2

3

2

9

Master Planning

Board Policy 6.4

Presidential responsibility

Three main criteria

Current Facilities Assessment

Plans for modernization, renewal and improved sustainability

Record of space utilization

5 year update schedule

Published Master Plan Guidelines

Updated schedule available as white paper

Master Planning

Time horizon

20 year target

Emphasis on 5-10 year plans

Master Plan Guidelines

1. Summary

2. Existing Site Conditions

3. Existing Building Conditions

4. Proposed Framework for Site Development

5. Proposed Framework for Building Development

6. Capital Budget Incremental Improvement Program

7. Appendix – (Residential life plan, academic planning, municipal)

10

11

Master Planning Major Issues

1.

Inventory of Sq. Ft. and Percentage of Room Type

Classroom/Labs – 24 / 12 large/ 12 medium, 150,000 sq. ft., 25%

Offices – 50 offices/ 25 hard wall/ 25 cubicle 25,000 sq. ft. 12%

i.e. Student Support, Administrative, Mechanical, Circulation, Athletic

2.

Local jurisdiction and regional consultation

3.

Space utilization and CEMRS integration

4.

Security and responding to COPE surveys

5.

Integrating supplemental work – parking studies, residential life master plans, repair and replacement studies

12

CEMRS Integration

CEMRS stands for Classroom, Event Management and

Resource Scheduling

Schedule

Finishing 3 rd group of schools

Last group starting in May

Costs

Invoices went out last month for 2013 costs

Based on FYE to reimburse initial investment and ongoing licensing

FY2013-17 -- $4.00 per full year equivalent

FY2017 onward - target is $2.00 per full year equivalent (subject to enhancements, future technical support)

13

CEMRS Roll Out Schedule

Number of Schools per Group

5

9

8

Group 1 (June '12)

Group 2 (Nov '12)

Group 3 (Feb '13)

Group 4 (May '13)

15

14

CEMRS - Last Group – Start in May

Central Lakes

Dakota County Technical College

Fond du Lac Tribal & Community College

Minnesota State – Southeast Technical

Northland Community & Technical College

Hibbing Community College

Rainy River

Vermilion Community College

Pine Technical College

15

CEMRS Action Plan (System)

Goal – Efficient use of space (Chancellor/Board)

System report development ongoing under CEMRS

ISRS Cleanup of Room Types

Major criteria – Room, Event and Group Types

New Reporting Observations:

New utilization driven by Event types

Moving away from narrow view of just Room Types 110/210

Describe the room for what it is

Eventually review of academic, credit use AND non-credit use

16

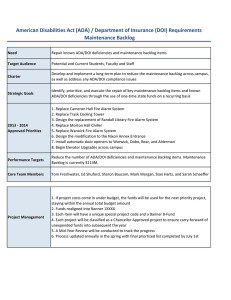

Facilities Renewal & Reinvestment

Model (FRRM)

Model - cost of current and future condition of buildings

Purpose – Planning and to support capital requests

Product – Backlogs, renewal and Facilities Condition Index

Timeline - FRRM Reports on a calendar year (December 31)

Translation - Look at current backlog to date

January – now – you know what’s dropped off

Now – December - Forecast to the end of 2013

For Example - HEAPR expected in 2013; but don’t remove until it’s appropriated

17

FRRM

Database open starting April 25 – June 25, 2013

Enter your backlog, renewal and any new buildings

Academic AND Revenue buildings

Training (April 25)

May schedule another training if necessary

18

Trendline for FRRM system backlog

Backlog in millions

720

705

700

684

680

660 654 654

640 632

Backlog

620

600

580

2008 2009 2010 2011 2012

Base year is 2005 for backlog calculation

Comparing 2005 Backlog With the 2012 Backlog

$1,400,000,000

$1,200,000,000

$1,000,000,000

$800,000,000

$600,000,000

$400,000,000

$200,000,000

$0

2005 Initial

Backlog

2006 Need 2007 Need 2008 Need 2009 Need 2010 Need 2011 Need 2012 Need Total Backlog if No

Investment

Inflation Difference Current

Backlog 2012

19

Showing the natural growth in backlog

Comparing 2005 Backlog With the 2012 Backlog

$1,400,000,000

$1,200,000,000

$1,000,000,000

$800,000,000

$600,000,000

$400,000,000

$200,000,000

$0

2005 Initial

Backlog

2006 Need 2007 Need 2008 Need 2009 Need 2010 Need 2011 Need 2012 Need Total Backlog if No

Investment

Inflation Difference Current

Backlog 2012

20

Scenario if no investment since 2005

Comparing 2005 Backlog With the 2012 Backlog

$1,400,000,000

$1,200,000,000

$1,000,000,000

$800,000,000

$600,000,000

$400,000,000

$200,000,000

$0

2005 Initial

Backlog

2006 Need 2007 Need 2008 Need 2009 Need 2010 Need 2011 Need 2012 Need Total Backlog if No

Investment

Inflation Difference Current

Backlog 2012

21

Scenario - No investment, add inflation

$1,400,000,000

$1,200,000,000

Comparing 2005 Backlog With the 2012 Backlog

$1.3B+ Backlog!

$1,000,000,000

$800,000,000

$600,000,000

$400,000,000

$200,000,000

Note on Inflation: Since these figures are based upon the 2005 analysis all the costs were based upon 2005 values. Therefore, inflation for each figure needs to be factored into the growth from

2005 to 2012. The actual inflation rate over the years was used for this chart to show what the projected backlog would have been based upon the 2005 analysis.

$0

2005 Initial

Backlog

2006 Need 2007 Need 2008 Need 2009 Need 2010 Need 2011 Need 2012 Need Total Backlog if No

Investment

Inflation Difference Current

Backlog 2012

22

Over $500M difference if no investment

Comparing 2005 Backlog With the 2012 Backlog

$1,400,000,000

$1,200,000,000

$1,000,000,000

$800,000,000

$600,000,000

$500M+

$400,000,000

$200,000,000

$0

2005 Initial

Backlog

2006 Need 2007 Need 2008 Need 2009 Need 2010 Need 2011 Need 2012 Need Total Backlog if No

Investment

Inflation Difference Current

Backlog 2012

23

Where we are today

Comparing 2005 Backlog With the 2012 Backlog

$1,400,000,000

$1,200,000,000

$1,000,000,000

$800,000,000

$600,000,000

$400,000,000

$200,000,000

$0

2005 Initial

Backlog

2006 Need 2007 Need 2008 Need 2009 Need 2010 Need 2011 Need 2012 Need Total Backlog if No

Investment

Inflation Difference Current

Backlog 2012

24

Predicting Future Capital Needs

Current Backlog and Annual Renewal Needs 2012-2022

$1,800,000,000

$1,600,000,000

$1,400,000,000

$1,200,000,000

$1,000,000,000

$800,000,000

$600,000,000

$400,000,000

$200,000,000

$0

$81,340,000

$90,617,000

$103,341,000

$79,431,000

$57,318,000

$72,882,000

$47,031,000

$84,937,000

$147,491,000

$1,554,134,000

$81,557,000

Current

FY10-11

Backlog

2013 Need 2014 Need 2015 Need 2016 Need 2017 Need 2018 Need 2019 Need 2020 Need 2021 Need 2022 Need Estimated

Backlog w/NO

Investment

Note: These projected figures are in 2012 constant dollars no inflation has been calculated for future costs 25

26

Facilities Renewal & Reinvestment

Model (FRRM)

Training

Thursday afternoon, 1-4:30 pm

Sightlines (formerly Pacific Partners)

Cover:

Creation of FRRM

System backlog

Comparison with other systems throughout the U.S.

Campus Backlog and renewals

Types of subsystems

Entering information on subsystems

27

Technology and Online Resources

Facilities Web Site

Capital Development

Planning

Real Estate

Revenue Fund

Capital Budget

Studies

Sharepoint sites

28

Capital Development:

Planning/Programming Section

Sharepoint Workplan

Active:

2014 Capital Budget Scoring (and future)

CEMRS

Enterprise Program Management System (EPMS)

Roll out

Master Planning

Revenue Fund Projects

Facilities Policies and Procedures

Public Safety and Compliance

29

30

New Site for updating Master Plans

31

Other Topics

Facilities Policies and Procedures re-engineering

Revenue Fund kick off for 2015 bond sale

Repair & Replacement Cost Accounting

Energy Consumption Data

Use of Bond Proceeds

Regional master planning

Master Plan guideline updates

Sustainability

Redevelopment Energy Grants

Guaranteed energy savings contracts

32

Thank you

Questions?

Greg Ewig, Director, Capital Development

651.201.1775

Gregory.ewig@so.mnscu.edu

33