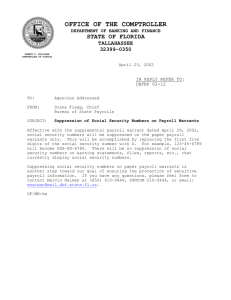

OFFICE OF THE COMPTROLLER STATE OF FLORIDA TALLAHASSEE

advertisement