July 29, 2009 CHIEF FINANCIAL OFFICER MEMORANDUM NO. 01 (2009-2010) SUBJECT: AMERICAN

advertisement

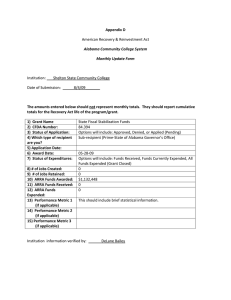

July 29, 2009 CHIEF FINANCIAL OFFICER MEMORANDUM NO. 01 (2009-2010) SUBJECT: AMERICAN RECOVERY AND REINVESTMENT ACT (ARRA) REQUIREMENTS The American Recovery and Reinvestment Act of 2009 (“ARRA”) has made billions of dollars available to the State of Florida. ARRA mandates special accountability and transparency requirements for the expenditure of all ARRA appropriations. In order to ensure that the State of Florida fully complies with the accountability requirements of ARRA, this memorandum establishes special requirements for recording ARRA receipts and the reporting of payments (regardless of amount) made from ARRA funds. All existing Department of Financial Services (DFS) payment processing requirements remain in effect. ARRA Funds Agency Representation Each Agency receiving or expending ARRA funds must represent in writing to the State of Florida Chief Financial Officer that internal controls and procedures are in place to ensure a proper accounting and reporting of ARRA funds. Agency Representation Letters must be signed by the agency head. DFS Division of Accounting and Auditing will send each agency a request for an Agency Representation Letter at the beginning of each state fiscal year. Signed representation letters must be submitted to the Division of Accounting and Auditing no later than September 1. ARRA Expenditure Requirements At the beginning of each fiscal year through the Agency Representation Letter referenced above, each agency will provide, for each ARRA award, the specific data elements used in FLAIR to separately account for the expenditures. The data elements may include, but are not limited to, special category, grant number, project number and/or other cost accumulator. If an agency receives additional ARRA awards during the fiscal year, the agency is responsible for providing the Bureau of Auditing the data elements in FLAIR to separately account for the expenditures before the first payment is made. In addition to the existing payment processing requirements, DFS may request documentation that substantiates any payment of ARRA funds to a vendor or subrecipient or information reported under Section 1512 of ARRA. This documentation may include, but not be limited to, the agreement/ contract, procurement documentation or price/cost analysis, invoices, reports evidencing receipt of goods or services, agreement/contract monitoring reports, or agency reports detailing disbursement transactions that support the amount of ARRA funds expended and reported quarterly. DFS may also request additional documentation that demonstrates Agency compliance with the following ARRA requirements. • Recipients and their subrecipients must maintain current registration in the primary registrant database for the U.S. Federal Government, Central Contractor Registration (CCR) at all times during which they have active federal awards funded with ARRA funds. • ARRA related agreements must include provisions (as applicable) addressing requirements necessary for compliance with ARRA, including but not limited to: ¾ ¾ ¾ ¾ Amount of ARRA funding 2 CFR 176, subpart A reporting requirements 2 CFR 176, subparts B and C requirements Additional sub-recipients reporting requirements contained in 2 CFR 176, subpart D. Accounting for ARRA Revenues As specified in Agency Addressed Memorandum (No. 18, 2008-2009), to account for ARRA revenues originally receipted from the Federal Government, the following revenue category has been established in FLAIR: 000750 Federal ARRA Grants All ARRA grant revenue must be recorded in FLAIR using this new revenue category for fiscal year ending June 30, 2009, and each fiscal year thereafter. Subsequent transfers of ARRA funds to another account code within the agency, or to another agency, should be coded with existing transfer categories. New categories will not be established for the transfer of ARRA funds to other funds/ agencies within the state entity. However, if an agency uses a Transaction Code 94 in FLAIR to transfer ARRA funds, the new 000750 category code should be used in the receiving account code. Schedule of Expenditures of Federal Awards (SEFA) Reporting Agencies are required to report ARRA expenditures separately on the 2008/2009 SEFA (and fiscal years thereafter). Further SEFA instructions are available on the following website: http://www.myfloridacfo.com/aadir/statewide_financial_reporting/financing.htm Recommendations Agencies should consider the following supplemental requirements to enhance accountability and transparency related to ARRA in addition to the above requirements. • • Agencies should consider issuing cost reimbursement agreements. Agencies should also consider issuing new agreements for ARRA funds rather than amending existing agreements to include ARRA funding. Questions regarding this memorandum may be directed to Cheri Greene at 850-413-5593, Cheri.Greene@myfloridacfo.com, or Jeff Cagle at 850-413-5504, Jeffrey.Cagle@myfloridacfo.com.