Market Outlook Opportunities & Challenges Birla Sun Life Asset Management Company Limited

Market Outlook

Opportunities & Challenges

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013

Agenda

•

Indian Markets

•

2013: Where we got lost

•

2014-15 : Winds of change- The way ahead

•

India Inc.: On the path to recovery

•

Budget view

•

Valuations and Expectations

•

Market Outlook

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013 2

Policy inertia impacted investments & growth

GDP Growth slowed down amid external and internal factors

12

11

10

9

8

7

6

5

4

3

India Quarterly GDP Growth, %yoy

Persistent high inflation resulted in high rates, input costs

16%

15%

14%

13%

12%

11%

10%

9%

8%

%yoy CPI Food Inflation

CPI

9.7%

8.6%

Industrial Production – flat for the last ~2.5 years now

20%

15%

YoY%

YoY% 3MMA

10%

5%

0%

-5%

-10%

Mar-

07

Mar-

08

Mar-

09

Mar-

10

Mar-

11

Mar-

12

Mar-

13

Mar-

14

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013

Increasing interest rates have hit margins, investments

12%

11%

10%

9%

8%

7%

6%

5%

4%

3%

Reverse Repo Rate

91-Day T-Bill Yield

Repo Rate

Source: Morgan Stanley Research

3

India 2015 & beyond : The way ahead

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013 4

Pillar of future growth

Key drivers:

1.

Politics – stable, strong Government, after 30 years

2.

Investment cycle: policy push + cyclical upswing

3.

Inflation and interest rates to cool down

4.

Current Account and Currency have stabilized

5.

Budget View

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013 5

1: Politics: Stable, Strong……after 30 years

450

400

350

300

250

200

150

100

50

0

404

143

161

Why is a stable Government so important?

Most number of seats won by any party

244

Majority needed - 272

182 180

145

206

282

35

30

25

20

15

10

5

0 months

Average time taken for Environment

Clearance

1984 1989 1991 1996 1998 1999 2004 2009 2014

20 (% YoY real GDP)

15

10

5

0

(5)

(10)

Gujarat All-India

Gujarat average GSDP growth

FY03-FY12: 10.3%

India average GDP growth

FY03-FY12: 7.9%

12%

10%

8%

6%

4%

2%

0%

GDP Growth : Pvt. + Public Consumption, Net Exports and others

GDP Growth attributed to GFCF change

FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 E

Source: CLSA, BSLAMC

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013 6

Politics: Stable, Strong……after 30 years

Priorities of the new regime

1.

Reduce Inflation - Release food stock, Restructure APMC laws

2.

Improve Governance, decision-making

3.

Job creation by stimulating manufacturing investments - liberalize

FDI limits and law, create industrial clusters

4.

Reforms in mining, power sectors and land acquisition

5.

PSU reforms Holding company structure

6.

Accelerate infrastructure creation

• Dedicated Freight Corridor, 100 new cities, River-linking, Road and

Rail Diamond Quadrilateral, National Gas Grid, Strengthen Power

Grid, High Speed Rail, Alternate Energy

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013 7

Investment cycle: Policy push + Cyclical upswing

As bad as it gets: USD 130 billion projects stalled

9,000

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

0

(Rsbn)

Quarterly Investments added during the quarter

Private Sector Government

90,000

80,000

70,000

60,000

50,000

40,000

30,000

20,000

10,000

-

Projects Under

Implementation

Growth YoY %

10,000

8,000

6,000

4,000

2,000

-

Projects Stalled

Growth YoY %

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013

200%

150%

100%

50%

0%

-50%

• Investment cycle suffered a virtual collapse.

Corporate sentiments were impaired due to lack of clear road map, slowing GDP growth and elevated cost of capital.

• Projects worth INR 8,000 bn got stalled – due to Fuel linkages /EC/FC/Regulatory

Clearances, creating a large back log of capital work in progress.

• Better policy framework and governance to revive investments.

8

60%

50%

40%

30%

20%

10%

0%

-10%

-20%

Investment cycle: The opportunity

120,000

100,000

80,000

60,000

40,000

20,000

-

Rs. Crs

MRTS projects under development 2013-2017

So urc e: Ed el weis s

Mass Rapid Transit System

109,600

16000

14000

12000

10000

National Highway Projects Pipeline &

Execution

Cummulative Projects Under Execution (km)

2 yr rolling execution (km)

8000

6000

4000

2000

0

FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13

So urce: NHAI

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013

10,000

9,000

8,000

7,000

6,000

5,000

4,000

Railway Track addition in Kms.

Dedicated Freight Corridor

Feeder routes

5,500

The DFC impact

3,000

2,000

3,300

Trunk routes

1,000

0

-1,000

661

193 244

-133 -5 -54

742

-41

486

140

470 500

Source: Barclays

• FDI in critical sectors like defense, media

• Policy for labor-intensive sectors like textiles and construction are likely

9

New Government Report Card

• ‘Minimum Government, Maximum Governance’ on its way a) Abolished several Group of Ministers (GoM) and Empowered GoM (EGoM) b) Downsized the cabinet c) Emphasized time-bound and transparent decision-making and sharply increased the accountability of bureaucrats and ministers alike.

• Kick-starting the investment cycle a) Government promised to achieve 25km/day of road construction in FY15 b) Issues with 3 critical railway links for coal transportation

– stuck for a long time on various issues – are being resolved with at least one project now on track.

• Inflation Control: The road is long

• Measures to address inflation in the short term

•

Exhorting states to delist trade of fruits and vegetables through the Agriculture

Produce Market Committees (APMCs)- so farmers can sell directly

• The budget also promised a restructuring of the Food Corporation of India

(FCI)

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013 10

Inflation and Rates to cool down further

12%

10%

8%

6%

4%

2%

0%

-2%

WPI Core WPI 12.00%

11.00%

10.00%

9.00%

8.00%

7.00%

6.00%

5.00%

CPI

Core CPI

-4%

• Both the inflation matrix have registered a sharp decline in the month of June. Favorable base effects will continue to provide lower inflation prints till November.

• More importantly the momentum of Core inflation in case of both wholesale and retail has been trending down vs. its historical average.

• Going forward we expect inflation to atleast achieve RBI glide path thus creating a headroom for monetary easing eventually.

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013

Source: Bloomberg, BSLAMC

11

55.0

50.0

45.0

40.0

70.0

65.0

60.0

IIP and PMI pick up .. Early signs of recovery

PMI Manufacturing

PMI Services

IIP

25.0%

20.0%

15.0%

10.0%

5.0%

0.0%

-5.0%

-10.0%

•

•

• Industrial activity has shown green shoots since the beginning if the fiscal. High frequency data such as automobile sales freight traffic etc. has also registered positive growth rates.

The PMI for both manufacturing and services is back to expansionary mode. The business expectation index also hits at revival continuation.

The nascent sign of recovery in PMI and IIP reflect a cyclical upturn in GDP growth rate.

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013 12

50,000

45,000

40,000

35,000

30,000

25,000

20,000

15,000

10,000

5,000

-

Current Account and Currency have stabilized

Policy responses have worked..

Imports, 3mma

Exports, 3mma

14%

12%

10%

8%

6%

4%

2%

0%

-2%

-4%

-6%

-8%

Current Account

Capital Account

• Dramatic reduction seen in India’s trade deficit due to falling imports and rising imports

• Gold imports are down 70%. Non Oil, Non Gold imports also down. Current account deficit for quarter ended March 14 is the lowest in 4 years

• Indian Rupee is amongst the best performing in the past 9 months

130

125

120

115

110

105

100

95

90

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013

Indian Rupee

Brazilian Real

S. African Rand

Indo Rupiah

% of GDP, quarterly annualised

Source: Bloomberg, BSLAMC

13

Budget The guiding post

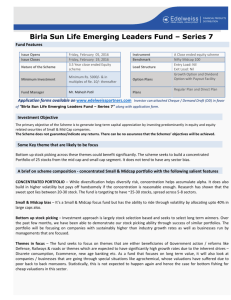

Budget Overview 2014-15

GDP growth estimated between 5.4 - 5.9% as per the economic survey

Fiscal deficit budgeted at 4.1 % of GDP- and fiscal path 3.6% in FY16 and

3% in FY17.

Current account deficit expected at 2.1% of GDP

Revenue deficit projected at 2.9% of GDP

Net market borrowing to be Rs. 4.6 lakh crores

Road Map expected

Market expected clarity on Road map for GST & reforms for Subsidy rationalization.

Lack of clarity on the application of GAAR created uncertainty for a host of entities.

Source: Bloomberg, BSLAMC

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013 14

Budget Math and Our View

FY14 Deficit

The fiscal deficit for FY14 was finally pegged at 4.5% of GDP v/s budget estimates of 4.8% of GDP

Sharp cut in planned expenditure key reason (10.8% growth vs BE of

29.4%)

Revenues were running below budget estimates due to slowdown in economic activity and shortfall in divestment receipts

FY15 budget math: More realistic

The fiscal arithmetic is based on nominal GDP growth of 13.4%, total revenues rising 15.6% and expenditure rising 12.9%

GDP growth assumption moderately optimistic, expect receipts targets to be met on account of non-tax revenues

Higher expenditure budgeted for an investment starved economy

Upside risks to fiscal deficit unlikely

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013 15

Budget Key Sector announcements

Sector

Infrastructure

Capital Goods

Capital Goods

Banking

Banking and

Insurance

Power Utilities

Impact

Positive for all Road developers/ Asset

Owners

Positive for T&D companies

Announcements

NHAI allocation, Plan to construct 8000Km road,

Increase in planned Expenditure, REIT

New Feeder separation scheme

Positive for all

Industrial companies

Positive for entire sector

Positive for Infra-

Finance

Positive for insurance companies

Investment allowance of 15% for investments made above Rs250mn as compared to Rs1bn earlier for a period of 3 years.

Govt. to oversee that all power companies to get adequate coal supply

Banks to be permitted to raise long term funds for lending to infrastructure sector

Proposed to increase foreign ownership limit in the insurance sector from 26% to 49% through the FIPB route

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013

Source: Bloomberg, BSLAMC

16

India Inc: On the path to recovery

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013 17

We expect cyclical bottom in GDP growth rates

12%

BoP

Crisis

10%

8%

6%

4%

2%

0%

South

East

Asian

Crisis

Dot.Com

Bust & 9/11

Global

Financial

Crisis

GDP Growth

Rate

Avg ('91-'13) =

6.63%

Since ‘91 India’s growth has averaged 6.6%. We believe GDP growth has bottomed out in 2014

Source: Bloomberg, BSLAMC

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013 18

Sales and Margins – Slow Recovery has begun

Sales growth for

SENSEX Companies

20

27

34

23 21 20

16

22

33 30 32

22

37 36 38

44

31 30

6

19

32

28

22

18

23

26

23 25

19 17

11

8 6

2

13 14 14

-5

-11

-6

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4QE

FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14E

25 26 25

30

37

34 33 34

28 28

30

28

EBITDA Margin (%) for

SENSEX Companies

26 26 26

24 25 24 24 23 25 24 24 24 25 25 25

22 22 23 21 22 21 20 21 21 21 21 22 22

1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4QE

FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14E

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013

Source: MOFSL, BSLAMC

19

90%

85%

80%

75%

70%

65%

60%

55%

50%

Profitability at cyclical lows .. Margins and Interest costs are key drivers of profits

Aggregate Interest to EBITDA Total asset turnover ratio

60%

50%

40%

30%

20%

10%

0%

7%

6%

5%

4%

3%

2%

1%

0%

Corporate Profits (% of GDP) Profit to GDP halved

26

SENSEX ROE (%)

24.2

22

15 Year Average 19.0%

18

14

10

16.2

Source: Bloomberg, BSLAMC, IIFL & MOSL

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013 20

Consensus expectations are still low

1900

1750

1600

1450

1300

1277

1150

1000

Apr2010 Oct2010

FY12

FY13

FY14

FY15E

FY16E

1483

Apr2011

1497

1129

Apr2012

1684

1287

1806

1834

1576

1352

Oct2011 Oct2012 Apr2013 Oct2013 Apr2014

• Over the last four years we have seen an earning decline cycle. In FY12,FY13, FY14 we say sharp cuts in Sensex earnings estimates.

• From Dec 2013 we saw consensus earning revision towards the positive side.

• Historically, analyst estimates for earning growth tends to lag in accelerating GDP growth environment,. Over the course of next few years we expect upwards revision in estimates

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013

Source: Morgan Stanley Research

21

Markets at all time High.. Where are

Valuations

Sensex PE (x)

35000

24.04

Mutiple de-rating

25000

20686

15000

5000

26.00

25246

23.00

20.00

15.82 17.00

14.00

11.00

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013 22

27

22

17

12

7

Market valuations are still reasonable

SENSEX P/E (x)

15 Year Average is 15.1x

2.5

1.5

0.5

4.5

3.5

SENSEX P/B (x)

15 Year Average 2.6x

160%

140%

120%

100%

80%

60%

40%

20%

0%

India Market Cap to GDP

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013

• Valuations are slightly above the Long term averages of 15.1x. Currently Sensex trades at

15.8x 1 Year forward PE.

• Even as indices are trading near all-time high levels, valuation parameters are comfortably below the 2008 highs.

• The current PE are on moderate earnings growth estimates. As earning upgrades cycle sets in on visibility in reform process, valuations will provide further comfort.

Source: Morgan Stanley Research

23

6.0

5.0

4.0

3.0

2.0

1.0

0.0

Opportunities in valuation gaps, cyclical more headroom..

Defensives vs Sensex P/B Cyclicals vs Sensex P/B

FMCG-Sensex P/B +2 SD -2 SD Average

4.0

3.0

2.5

2.0

1.5

1.0

0.5

0.0

Cap Goods-Sensex P/B +2 SD -2 SD Average

1.3

3.0

2.5

2.0

1.5

1.0

0.5

0.0

Pharma-Sensex P/B +2 SD -2 SD Average

1.7

1.2

1.0

0.8

0.6

0.4

0.2

Metals-Sensex P/B +2 SD -2 SD Average

0.5

Cyclical sectors trading below their LT average levels makes a compelling case for mean reversion as outlook improves.

Source: MOFSL, BSLAMC

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013 24

Sensex Historical Earnings Growth

FY93-96: 45%

CAGR

129 181 of

FY93-FY14: 14% CAGR

FY08-14:

8% CAGR

FY96-03: 1% CAGR

250 266 291 278 280

FY03-08: 25% CAGR

718

833 820 834

1,024

1,123 1,184

450 523

216 236 272

348

FY14-16E: 16%

CAGR

1,802

1,525

1,338

Sensex PE (x) growth and

PE Re-rating

17.65

19.38

Sensex CAGR -1%

Sensex CAGR 39%

17.651

Sensex CAGR -1%

26

20

15.8 14

8

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013

Source: MOFSL, BSLAMC

25

Outlook

Equity markets have rallied on decisive election outcome leading to hopes of improving pace and quality of economic recovery.

• A pro-reform government coupled with decisive leadership will accelerate the reforms and growth process.

• The depressed corporate profitability will improve over the next 3 to 5 of years as the economy sees a cyclical uptick, clocking CAGR of 18% - driven by higher revenues, operating leverage and interest costs savings.

• Even post the sharp run up- Sensex trades at 1year forward PE of 16.8x. Earning upgrades cycle on visibility in reform process will provide further support to market and valuations.

•

We expect cyclical recovery in economy with average GDP growth of 6% over the next

5years with exit GDP of 7.5 to 8%. - equity returns will be driven both by earning growth and valuation re-rating providing investor a good investment opportunity.

• In the current scenario, equity investments provide a compelling case over other asset classes. Indian investors should increase their equity allocations and benefit from

Indian growth story.

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013 26

Thank You

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013 27

Disclaimers

Internal views, estimates, opinions of BSLAMC expressed herein may or may not materialize. These views, estimates, opinions alone are not sufficient and should not be used for the development or implementation of an investment strategy.

The portfolio of the scheme is subject to changes within the provisions of the Scheme Information Document(SID) of the scheme. Please refer to the SID for asset allocation, investment strategy and scheme specific risk factors. Forward looking statements are based on internal views and assumptions and subject to known and unknown risks and uncertainties which could materially impact or differ the actual results or performance from those expressed or implied under those statements.

This document is strictly confidential and meant for private circulation only and should not at any point of time be construed to be an invitation to the public for subscribing to the units of Birla Sun Life Mutual Fund. Please note that this is not an advertisement. The document is solely for the information and understanding of intended recipients only. If you are not the intended recipient, you are hereby notified that any use, distribution, reproduction or any action taken or omitted to be taken in reliance upon the same is prohibited and may be unlawful. Views expressed herein should not be construed as investment advice to any party and are not necessarily those of Birla Sun Life Asset Management Company Ltd.(BSLAMC) or any of their officers, employees, personnel, directors and BSLAMC and its officers, employees, personnel, directors do not accept responsibility for the editorial content. Wherever possible, all the figures and data given are dated, and the same may or may not be relevant at a future date. Further the opinions expressed and facts referred to in this document are subject to change without notice and BSLAMC is under no obligation to update the same. While utmost care has been exercised, BSLAMC or any of its officers, employees, personnel, directors make no representation or warranty, express or implied, as to the accuracy, completeness or reliability of the content and hereby disclaim any liability with regard to the same.

Recipients of this material should exercise due care and read the scheme information document (including if necessary, obtaining the advice of tax/legal/accounting/financial/other professional(s) prior to taking of any decision, acting or omitting to act. Further, the recipient shall not copy/circulate contents of this document, in part or in whole, or in any other manner whatsoever without prior and explicit approval of BSLAMC.

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013

28

Statutory Details & Risk Factors

Statutory Details: Constitution: Birla Sun Life Mutual Fund (BSLMF) has been set up as a Trust under the Indian

Trusts Act, 1882. Sponsors: Aditya Birla Financial Services Private Limited and Sun Life (India) AMC Investments Inc.

(liability restricted to seed corpus of 1 Lac). Trustee: Birla Sun Life Trustee Company Pvt. Ltd. Investment Manager:

Birla Sun Life Asset Management Company Ltd.

Risk Factors: Mutual Funds and securities investments are subject to market risks and there can be no assurance or guarantee that the objectives of the Scheme will be achieved. As with any investment in securities, the NAV of the Units issued under the Scheme may go up or down depending on the various factors and forces affecting capital markets and money markets. Past performance of the Sponsor / Investment

Manager / Mutual Fund does not indicate the future performance of the Schemes and may not necessarily provide a basis of comparison with other investments. The names of the Schemes do not, in any manner, indicate either the quality of the Schemes or their future prospects or returns. Unitholders in the schemes are not being offered any guaranteed/assured returns. Investors should read the Statement of Additional Information / Scheme Information

Document/ Key Information Memorandum available at Investor Service Centers and with distributors carefully before investing.

The Material provided in this communication cannot be reproduced or quoted anywhere without express permission from Birla Sun Life Asset Management Company Ltd.

Birla Sun Life Asset Management Company Limited

Copyright Aditya Birla Nuvo Limited 2013

29